Real estate investments are broken into four quadrants: public, private, debt, and equity. Few market participants look to all four quadrants for data points. Investment shops tend to specialize in one or two quadrants, and real estate researchers tend to view the real estate universe in a similar light. The purpose of this piece is to explore the market selection process through the eyes of public equity. Specifically, MPF Research will identify which metros are more influenced by equity REITs and attempt to read between the lines regarding strategy.

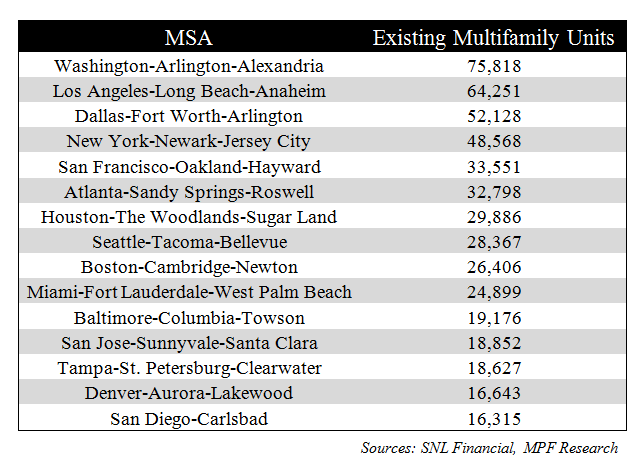

The chart below illustrates top markets for REIT ownership by unit count as of year-end 2014. For clarification, each of the top 15 markets are ranked based on their number of existing units either partially or fully owned by REITs, excluding the construction pipeline. Per the chart, if you substitute Seattle for Chicago, all six of the so-called Sexy Six markets are represented. This is not surprising given that the six are gateway cities, which are magnets for Millennials and where residents have a higher propensity to rent. Second, Sun Belt metros are also prominent, which makes sense given historical patterns of population and employment growth.

But where is new money going? In 2014, the top metro areas for multifamily acquisitions look very similar to the chart above – but with a slight shift towards secondary markets. For example, metros like Oklahoma City, Louisville, and Memphis cracked into the top 10 list, indicating an increased risk appetite as investors pursue yield strategies.

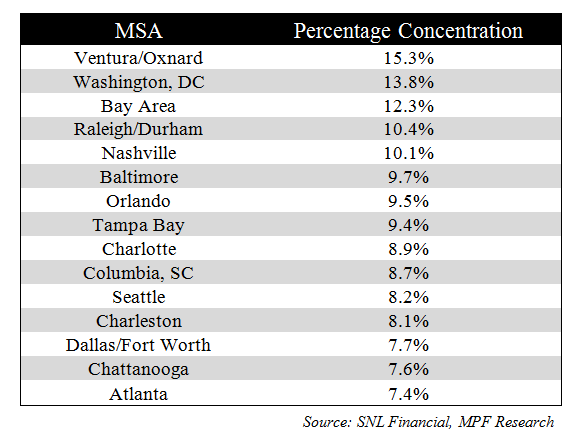

Let’s view the same information on a relative basis. The chart below ranks the 15 most active metros for REIT ownership relative to the metro’s total inventory base. In a previous blog post, “What Does the Construction Date Reveal About the Stock?” MPF Research grouped our surveyed units into two broad categories to illustrate a metro’s concentration of newer units, built since 1990, and of older units. We found that many South and Southeastern metros had a higher concentration of newer product, which appears to be influencing REIT behavior. For example, markets like Raleigh/Durham, Nashville, Orlando, Tampa Bay, Charlotte and Dallas/Fort Worth, which feature larger stocks of newer properties, all maintain a sizable REIT presence. Finally, REIT management focuses on market concentration to provide a leg up on pricing power and cost reduction synergies. Case in point, REITs own more than 10% of the estimated apartment stock in five areas: Ventura/Oxnard, Washington, D.C., Bay Area, Raleigh/Durham and Nashville.

In conclusion, the REIT strategy appears to be typical of most institutional investors. Sexy Six markets are common due to lower affordability in single-family homes, favorable long-term income growth prospects and liquidity. REITs are inclined to invest in metros with healthy levels of population and employment growth that contain newer units built to institutional quality. However, moving forward, it will be interesting to see if REITs stick to the tried and true playbook of market selection. Or could a shift occur toward more secondary and tertiary markets where the potential to shift the competitive landscape is easier to achieve?

(Image Source: Shutterstock)