Insurance Solutions

Protect your community, safeguard residents and streamline operations with a full range of insurance and security deposit solutions.

Peace of mind for you and your residents

No two properties — or residents — are alike. That’s why RealPage® Insurance and Deposit Alternatives are customizable. You tailor the solutions to fit your community, property and resident needs. Custom offerings include renters insurance, master insurance and security deposit alternative programs.

RealPage Insurance specializes in structuring, forming and managing resident insurance and deposit alternative programs for multifamily and single-family property owners and operators.

With our unmatched expertise, integrated capabilities, customizable solutions and customer insights, we can offer you innovative protection options that mitigate risk and enhance revenue.

Insurance solutions with measurable results

4M rental units rely on RealPage Insurance Solutions

20+ years of insurance experience

Improve your bottom line and reduce bad debt

RealCoverage Insurance

Reduce exposure and provide a customizable, seamless resident experience with RealCoverage

Elevate your insurance program with RealCoverage – the solution that provides the most robust coverage while removing the burden of insurance program management.

- Comprehensive Coverage: Significantly reduce exposure to inferior policies by increasing resident adoption with your preferred insurance vendor and get better coverage by complimenting traditional renters insurance with a master policy program

- Hassle-free resident experience: Customizable coverage and payment options. Provide your residents with comprehensive coverage that meets lease requirements and offers convenient pay with rent options.

- Streamline operations: Leverage technology and integrations to increase productivity and automate resident communication. Eliminate the need to collect, verify, and manage insurance certificates and automate third party policy cancellation tracking and notification.

- Improve your bottom line: RealCoverage can generate additional income through marketing fees and help mitigate the expenses associated with managing insurance.

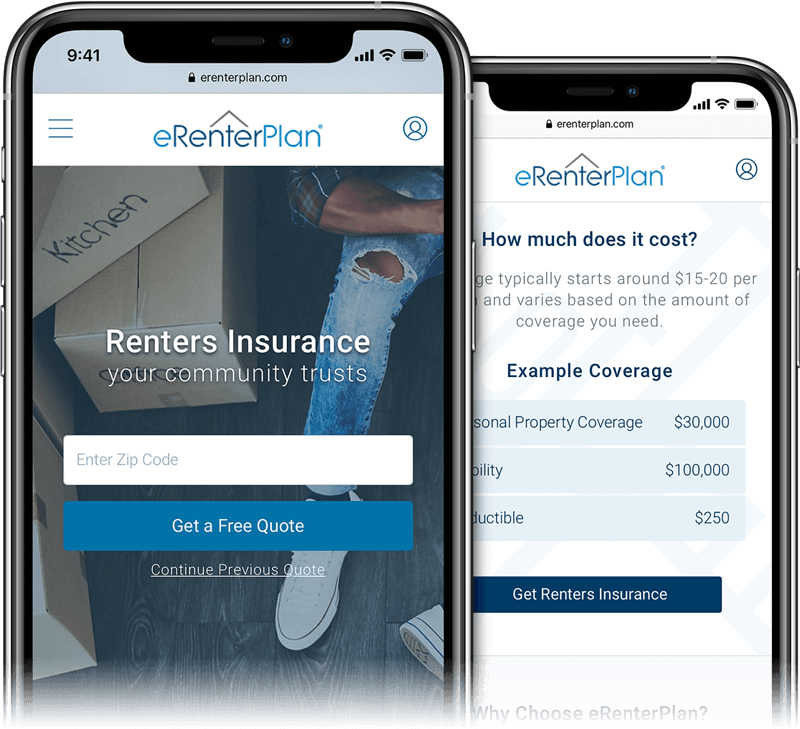

eRenterPlan + RenterProtection

eRenterPlan offers residents affordable, comprehensive coverage, while optional RenterProtection provides gap coverage for vacant units or uninsured residents.

The combination of both provides you with a comprehensive renters insurance program, including:

-

For residents: same-day, customizable coverage

-

For owners: asset protection and insurance savings

-

For property managers: improve your bottom line via marketing fees or commissions

- Automated gap coverage for uninsured residents

Mandating renters insurance for residents has become commonplace (84% of communities require it*). Using eRenterPlan and RenterProtection has proven to increase compliance by as much as 41%**.

Read more about eRenterPlan

Discover key insurance risks challenging the multifamily housing market: rising costs, administrative overload, resident experience and the impact on financial performance. Recognizing these overlooked factors can save your bottom line.

AssetProtect

An affordable alternative to resident insurance that protects rental assets, AssetProtect also helps you create a valuable new revenue stream:

- For residents: easy and convenient liability insurance option that is added to the residents rent ledger and includes personal contents insurance options

- For owners: mitigates risk of accidental, resident-caused damage by insuring up to 100% of occupied building units under one master insurance policy

- For property managers: mitigate the expenses associated with managing insurance

Policy Validator

Remove the burden of site staff reviewing and monitoring insurance policies with Policy Validator, and let your site staff focus on attracting and retaining residents.

- For residents: option to upload their own third party policies

- For owners: minimize risk exposure by ensuring residents insurance meets the minimum requirements

- For property managers: leverage RealPage Insurance experts to validate and manage third party insurance policies and automate resident communications for out of compliance and renewing residents

- Available when combined with one of our insurance solutions and gap coverage

DepositIQ

Offer your residents the option of purchasing a one-time, nonrefundable surety bond to guarantee lease obligations. Providing a low-cost alternative to traditional security deposits can attract more residents.

- Residents qualify through your existing screening process, offering them an alternative to the traditional security deposit

- Property is still covered up to the bond amount

- Residents remain responsible for any loss of rent or damage, but is able to move in at a much lower cost

Read more about Deposit Alternatives

Best in Class. Easiest to Use.

RealPage Insurance solutions represent the best the industry has to offer—and you can access it all in one place.

Fully Integrated

The only solution that allows you to view compliance data from a single, familiar platform. Integrates with key leasing and resident solutions such as Online Leasing, ActiveBuilding® and the On-Site platform.

Affordable Rates

Competitive rates—no premium increases for filing claims. Avoids cost to owners and improve your bottom line.

Created for Renters

RealPage Resident Insurance was developed specifically for the multifamily industry. It’s affordable and customizable insurance that benefits both you and your residents.

Covers the Uninsured

RenterProtection gap insurance can further reduce risk to solve the issue of uninsured residents by placing a property policy on the lease requirement.

Start protecting your properties, safeguarding residents and streamline operations.

Stay Informed

webcast

How Covered Are You, Really? Understanding Resident & Deposit Insurance

article

Comprehensive Renters Insurance is a Must, Not an Option

video

Customers Share Benefits Of Requiring Renters Insurance

video

Reduce Liability and Risk with LeasingDesk Renter’s Insurance

testimonial

RealPage Understands Business Needs

*according to an NMHC 2013 survey

**from a 2013 18-month study by RealPage Consumer Marketing

RealPage insurance services are offered through our wholly-owned insurance agency subsidiaries.