Lease-Up Concessions Common in Top Development Markets

The U.S. apartment market has added nearly 1 million new units since 2015. Annual completion volumes have remained higher than at any other point in more than three decades. The flood of new units to the market has grown existing stock 5.6%, increasing options for prospective renters and creating a more competitive leasing environment. It’s no surprise, then, that rent concessions designed to entice renters are commonplace at lease-up properties.

Nationally, the share of apartments offering rent discounts remains relatively low by historical standards. That’s largely due to a shift away from the practice in recent years in business models for stabilized properties. However, lease-up properties operate slightly differently than stabilized properties. The goal of many lease-up properties is to fill as many units as quickly as possible, so sizable concessions are not as rare for lease-up properties as they are for stabilized properties.

Filling units quickly can be more challenging in markets seeing a lot of supply. Indeed, among the top 15 markets for new supply this cycle, the average giveaway is sizable. These markets have received roughly half of all new supply delivered in the U.S. since 2010. In total, their inventory has grown roughly 11%. As of March 2018, the average rent discount among lease-up properties in these 15 markets totaled roughly 7% – about three weeks free.

In general, the 15 high-development markets seeing the largest lease-up giveaways also have seen apartment completions more concentrated geographically. Atlanta tops the list, with concessions of 9.1% in March – more than one month free. There, apartment development has been highly concentrated in a handful of historically high-performing submarkets in the urban core and northern suburbs. Likewise, construction has been focused downtown and in affluent northern suburbs of Dallas, where rent concessions averaged 7.9% in March.

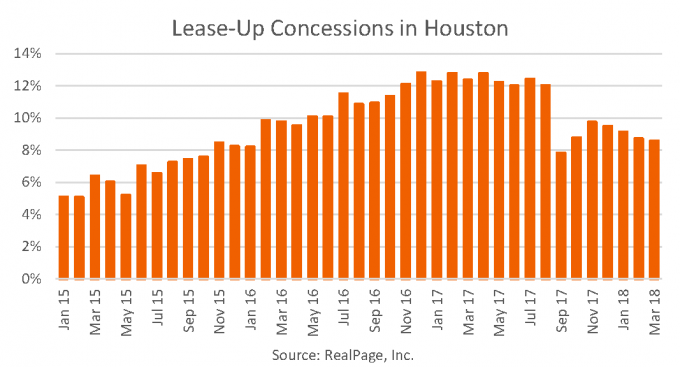

In both of those markets, concessions have generally increased in value as the high-supply cycle has worn on. In Houston, however, the 8.6% concession in March is down from the 12.8% peak in December 2016. Like Atlanta and Dallas, new supply has been concentrated in a handful of areas in Houston – namely, the urban core and Energy Corridor to the west. But Houston has grappled with demand shortages stemming from weakness in the energy industry, on which the metro’s economy is so dependent. A steep drop-off in concessions was seen following Hurricane Harvey in late August 2017, as displaced residents turned to apartments for temporary housing. In total, the average lease-up concession value plunged 420 basis points from August to September of last year.

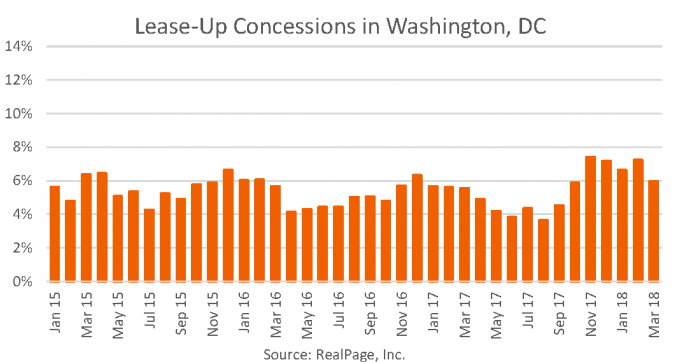

On the other hand, high-development markets seeing the smallest rent discounts offered by operators of lease-up properties are those in which development is more spread out geographically. In Boston, concessions have generally eased has construction activity has spread out from the urban core. The Massachusetts market recorded an average 5.0% discount in March. In Washington, DC, development has remained dispersed geographically throughout the cycle. In turn, concessions averaged 6.0% in the nation’s capital metro in March.

If higher concession values are driven by increased competition stemming from higher levels of new supply, then the gulf between stabilized and lease-up concessions signals that competitive pressures are currently concentrated among new properties. The bulk of new properties are high-priced, luxury product, and indeed, Class A properties continue to underperform on the pricing side at the national level. Annual increases in effective monthly rents at luxury product have trailed middle market and lower-tier product since early 2016. In the year-ending 1st quarter 2018, Class A rent growth measured 2.3%, trailing the 2.8% increase in Class B units and the 2.6% increase in Class C product.