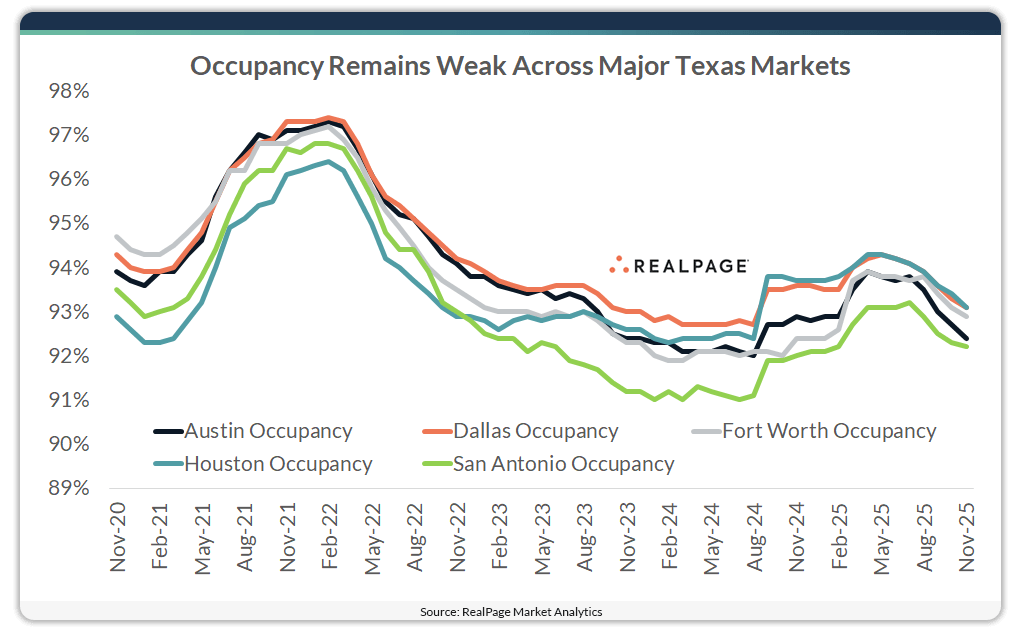

While apartment demand across the five largest apartment markets in Texas has been sizable, elevated delivery volumes have weighed down occupancy. Low occupancy – landing the major Texas markets in the bottom 10 among the nation’s 50 largest apartment markets – has led to continued rent cuts.

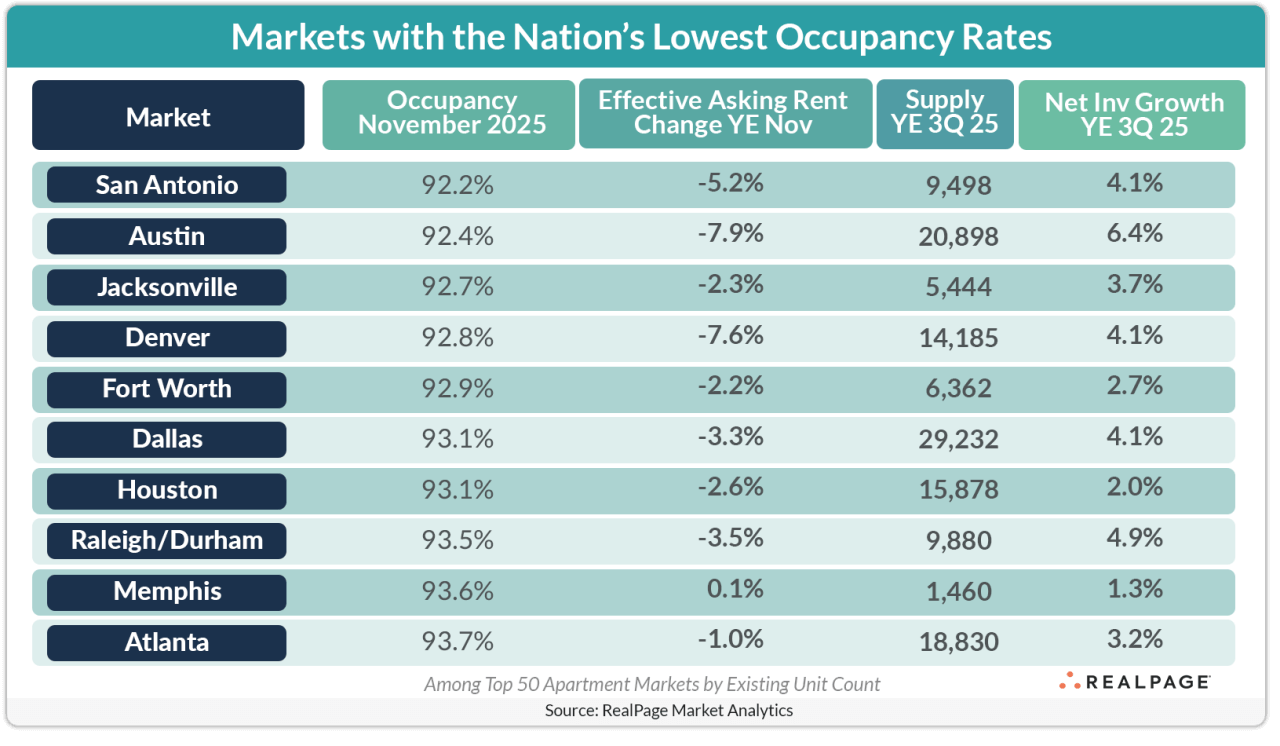

San Antonio recorded the nation’s weakest occupancy rate in November at 92.2%, followed by Austin at 92.4%. Fort Worth had the fifth-lowest rate nationally at 92.9%, while Dallas and Houston had the nation’s sixth-weakest reading, both at 93.1%.

While San Antonio had the nation’s weakest occupancy, the rate actually improved during the year-ending November, rising 20 basis points (bps). Fort Worth’s occupancy rate was also up for the year, climbing 50 bps.

The other three major Texas markets – Dallas, Fort Worth and Houston – recorded some of the nation’s steepest occupancy declines over the past year, with rates dropping 50 bps to 70 bps and landing among the nation’s bottom 10 performers for annual occupancy change.

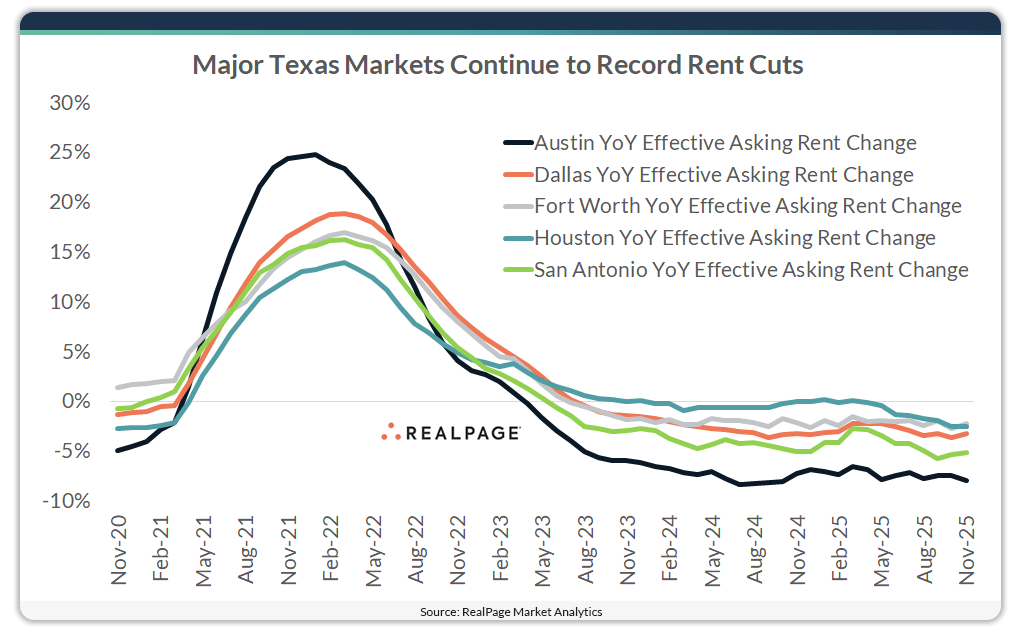

In an effort to preserve occupancy, operators in large Texas markets have resorted to rent cuts. In fact, all five of the major markets in Texas had some of the deepest rent cuts in the nation, landing among the bottom 15 performers, with Austin recording the nation’s steepest drop of 7.9%.

San Antonio recorded a rent cut of 5.2% during the year-ending November, the fourth-deepest reduction among the nation’s 50 largest markets. Meanwhile, Dallas posted a 3.3% price decline over the past year, the eighth steepest nationally, followed by Houston with the nation’s 12th deepest cut of 2.6% and Fort Worth’s 2.2% reduction, which was the 15th steepest nationally.