Here are 4 Implications of Loss-to-Lease Dropping Below Long-Term Average

Here’s a critical indicator that renewal lease rents will cool off significantly in coming months and lead to a) more favorable deals for renters, b) more renter turnover, and c) challenges for value-add investors dependent on large rent trade-outs.

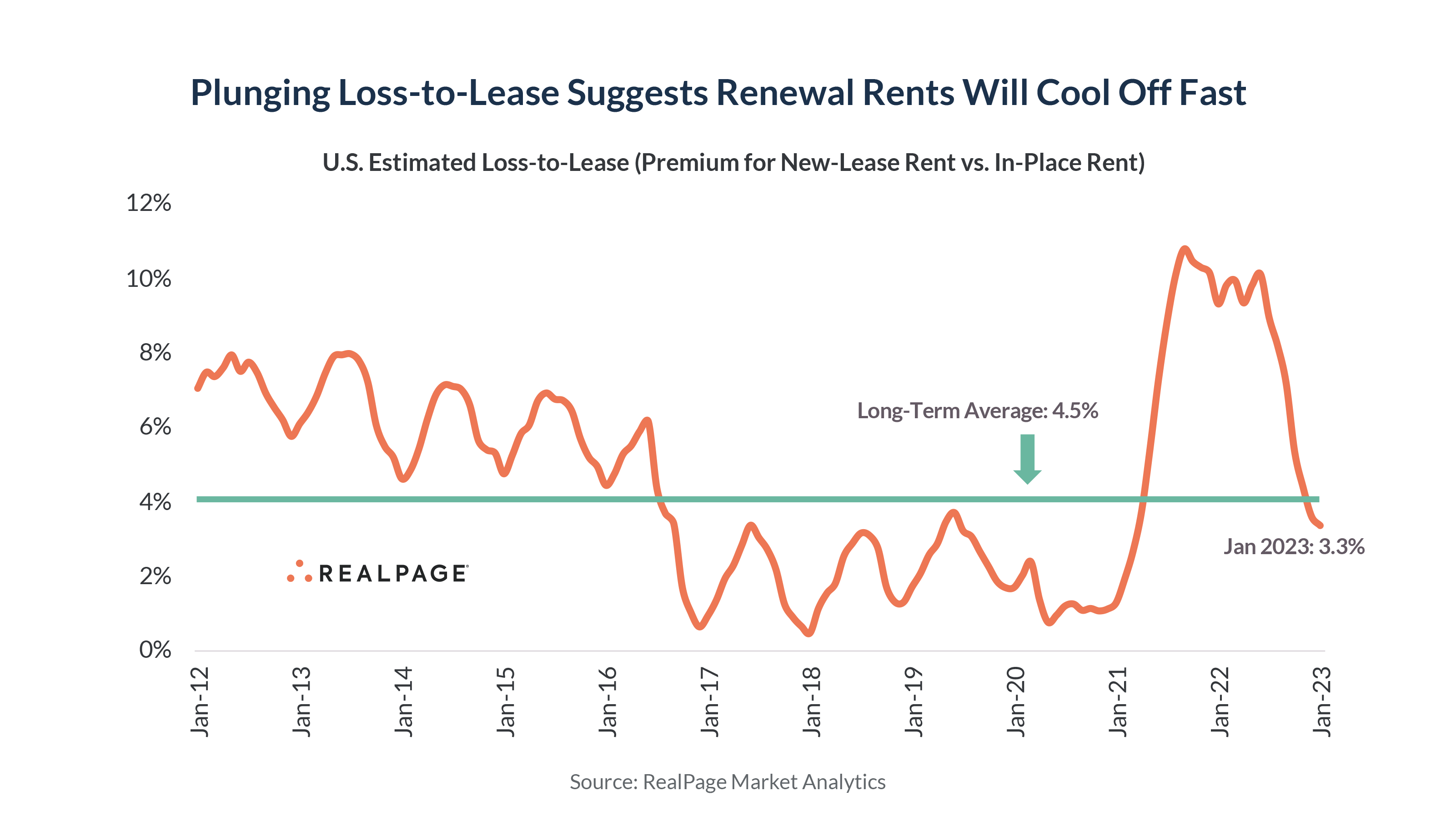

“Loss-to-lease” – the discount an average in-place renter pays versus today’s market rent for new renters. As a general rule of thumb: The larger the loss to lease, the larger the renewal increase. We saw large renewal rent hikes throughout 2022 as operators tried to bring renewal leases closer to market.

But renewals are a lagging indicator often priced 60-120 days in advance, and loss-to-lease tends to be the leading indicator. By that measure, much has changed since June 2022 when loss-to-lease measured 10.1%. Leasing traffic cooled way down, and that led to four straight month-over-month rent cuts (for new leases) followed by a flat number in January.

New lease rent cuts coupled with continued renewal rent growth leads to loss-to-lease compression. As a result, loss-to-lease has plunged down just as fast as it soared upward in 2021. Loss-to-lease as of January measured 3.3%, below the long-term norm of 4.5%.

And with it, renewal rent trade-out has cooled from 11.2% in June 2022 to 8.2% in January 2023. Look for deeper deceleration through the remainder of 2023.

It’s critical to acknowledge there is almost always some loss to lease because there’s usually a discount for renewals relative to new leases, as operators often incentivize renewals in order to reduce turnover costs, reward good residents, and protect occupancy. A widespread “gain to lease” scenario is unlikely (although we may see it in pockets) as we’d have what’s called “inverted rents” – incentivizing renters to move from one unit to another at the same apartment property.

Here are four possible implications:

1. Renewal offer letters will be priced more conservatively

Renters renewing their leases today are doing so usually based on terms agreed to 2-3 months ago, when loss-to-lease was still above average. But renewal offer letters going out now are likely much more conservative, as property managers are intently focused right now on retention and occupancy – especially given rising vacancy and the uncertain new-lease demand outlook.

2. Renter turnover with accelerate

Historically, renter turnover is higher when loss-to-lease is lower. Why? Because when turnover plunged in 2021-2022, most renters saw their best deal was to stay put. Most were still likely getting a sizable discount relative to a new renter.

In a low loss-to-lease scenario, that discount is much smaller – and when renters study their options, they are more likely to see attractively priced alternatives this year than they would have in 2021-2022. That’s directly tied to more rental availability, as well, with rising vacancy plus a big spike in newly built supply.

This scenario is already playing out, with retention falling from the highest January on record in 2022 (56.7%) to a more typical 51.6% in January 2023.

3. Operators will prioritize occupancy and retention

Most operators will adapt – and even eagerly adopt – lower-priced renewals to focus on occupancy and cashflow in 2023. Not only are operators grappling with more turnover and more competition, but they’re also facing much higher turnover costs. Higher costs for labor and maintenance combined with more units turning over is a tough equation. Retention takes on heightened importance in 2023.

Every lease is different, and it’s always critical to look at each one individually. But there could be cases where property managers pursue flat renewals or even renewal rent discounts in order to protect occupancy. That might be especially true among recent lease-ups competing with another wave of nearby new supply competition. In those cases, it could be difficult to simply burn off a concession when a property next door is offering deep concessions.

4. Some value-add deals could see challenges

Most multifamily owners and managers will see margin compression, but should remain in very solid financial shape. However, value-add investors could be in a tougher spot, particularly those with short-term investment windows facing a triple whammy of below-pro forma rent trade-outs plus above-pro forma interest rates and operational expenses. That could lead to isolated pockets of distress sales.