As Expenses Surge, Operators Focus on Cost Controls for 2023

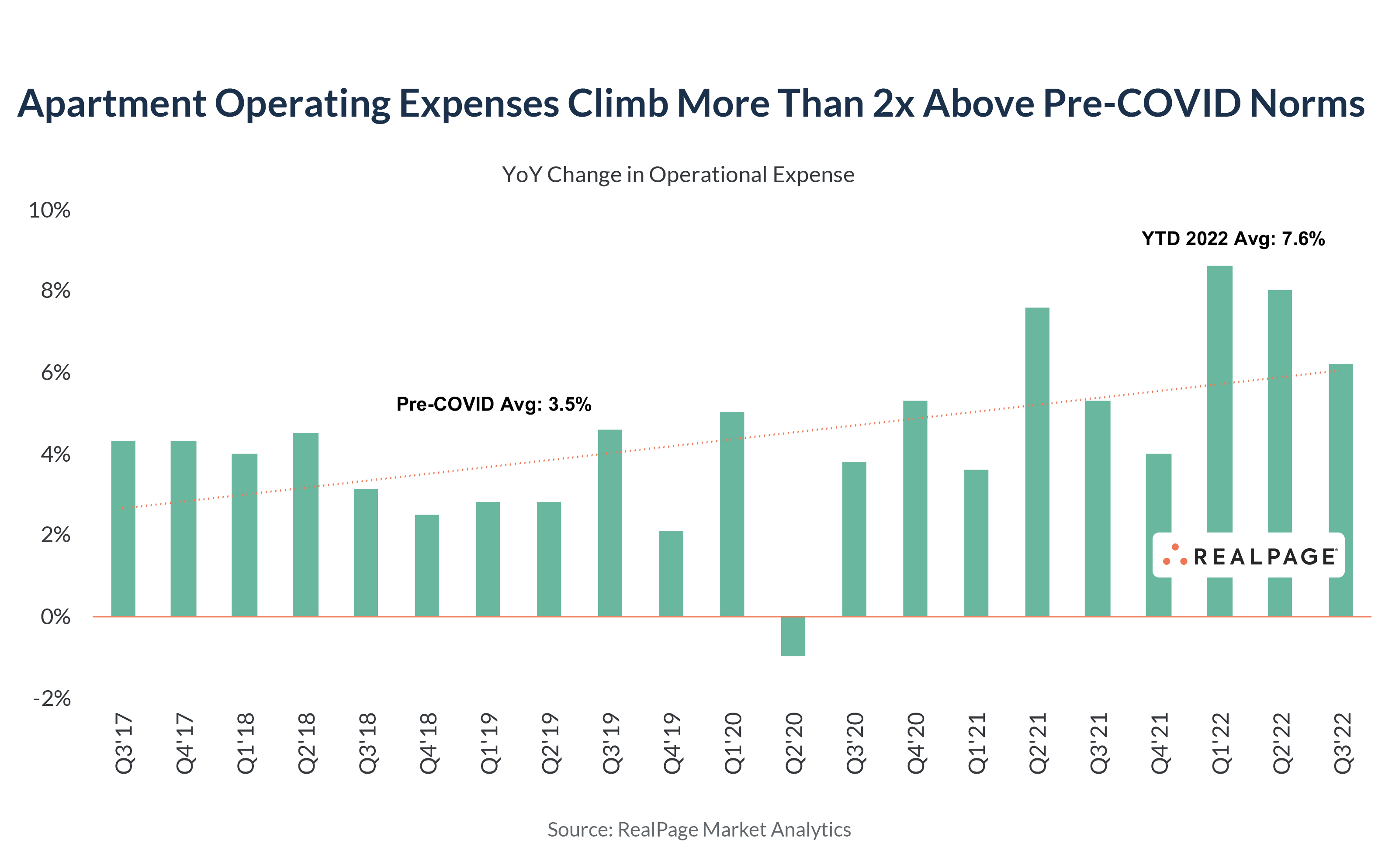

In more than a decade of meeting with rental housing owners and managers during budgeting season, I can’t recall any serious discussions around expenses prior to COVID-19. No one ever asked about it. Everyone pretty much just assumed 3%-4% expense growth.

But that’s changed dramatically in the last couple years. Now it’s a major topic of conversation as operators wrestle with the key theme for the market going forward: how to drive more efficiencies without sacrificing performance or resident satisfaction. That was less of a focus when apartments saw massive demand and big rent growth, but market conditions have cooled dramatically in 2022 – which heightens the focus on expense control for 2023 budgets.

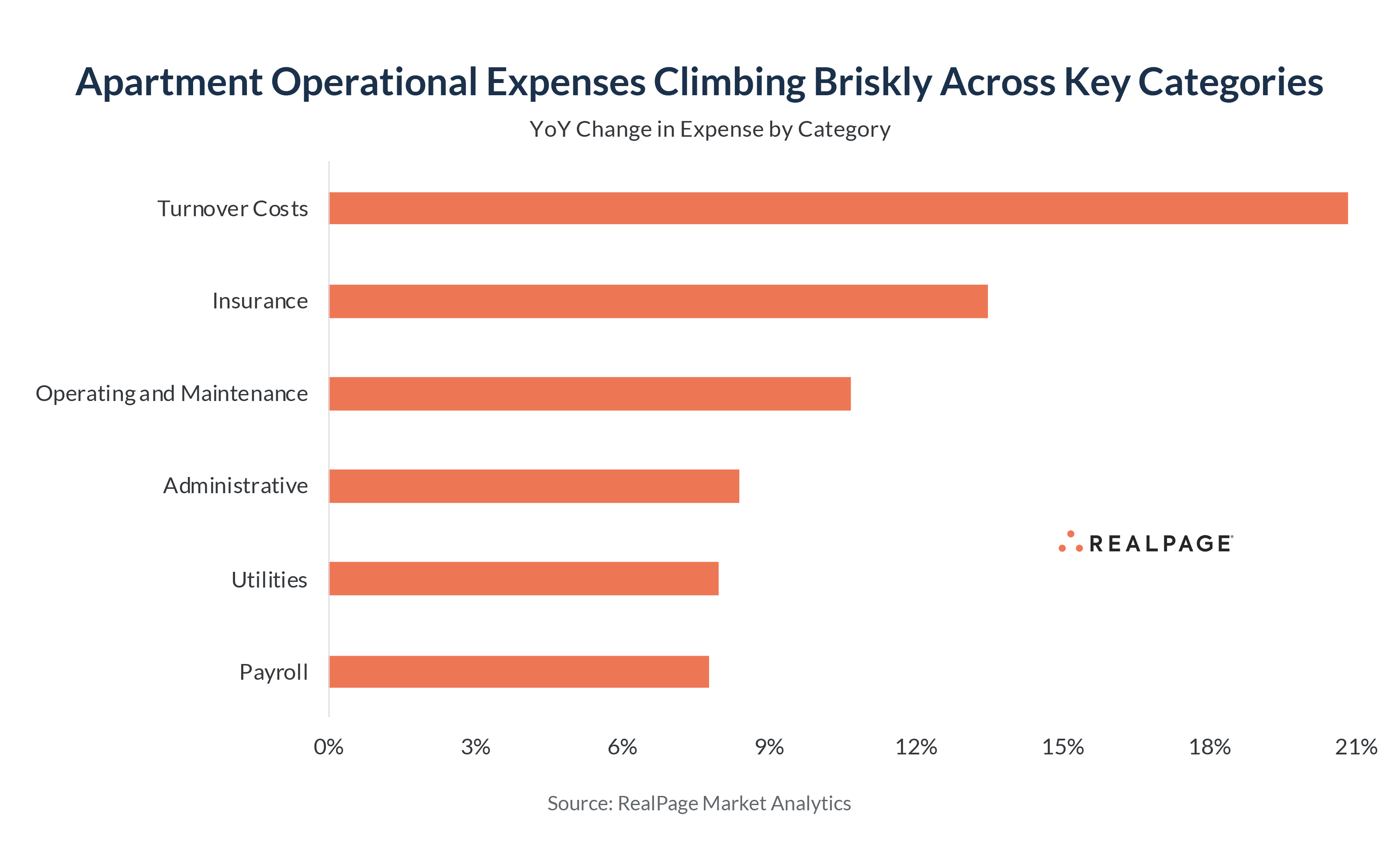

Here are six big areas where we’re seeing outsized expense growth: turnover costs, insurance, operating/maintenance, administrative, utilities and payroll. Insurance, utilities and payroll will be the bigger-ticket items for most – and you can add rising property taxes in there as well for many states.

Some of these expense categories could see some moderation as (hopefully) inflation cools.

But some will not – notably property insurance, which will likely go up much more in 2023 (especially in places like Florida and Texas) as insurance companies push up rates and some are reportedly exiting certain states altogether. And unlike most other expense categories, insurance isn’t one where operators can find creative efficiencies.

Payroll will be an interesting one to watch as the labor market remains tight (for now). Many operators are driving toward centralization – pushing back-office tasks offsite or automating them. That helps reduce the number of people needed on site. But those remaining on site (focusing on higher-value, high-touch tasks) are commanding significantly higher salaries.

Turnover costs are an interesting one, too. Turnover has been exceptionally low, which mutes the impact of rising costs for materials (paint, carpet, etc.) and labor. Higher costs here will provide another reason for property managers to focus on keeping turnover low in 2023. Retaining residents in good standing already takes on heavier importance in a slow-demand environment, and costs add another variable.

And on utilities: Rising costs here are driving increased focus on emerging sustainability tech, which now extends from utility management into even smart waste management – which is super fascinating. It’s tremendous to see how sustainability initiatives today not only help the environment but have advanced to the degree that they’re reducing operational expense, too.