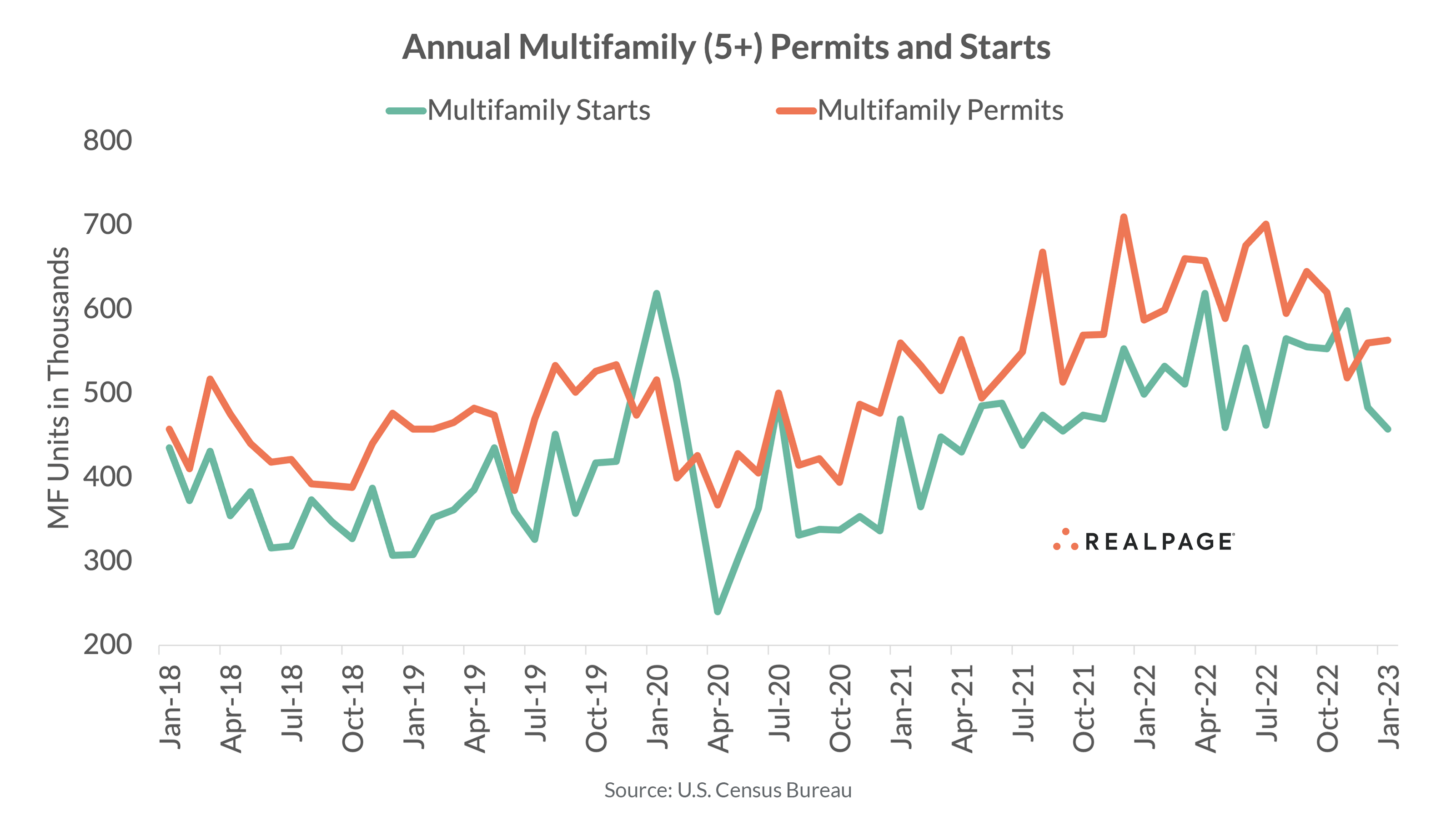

The seasonally adjusted annualized rates for multifamily permitting and starts continue to moderate, according to the U.S. Census Bureau’s monthly report.

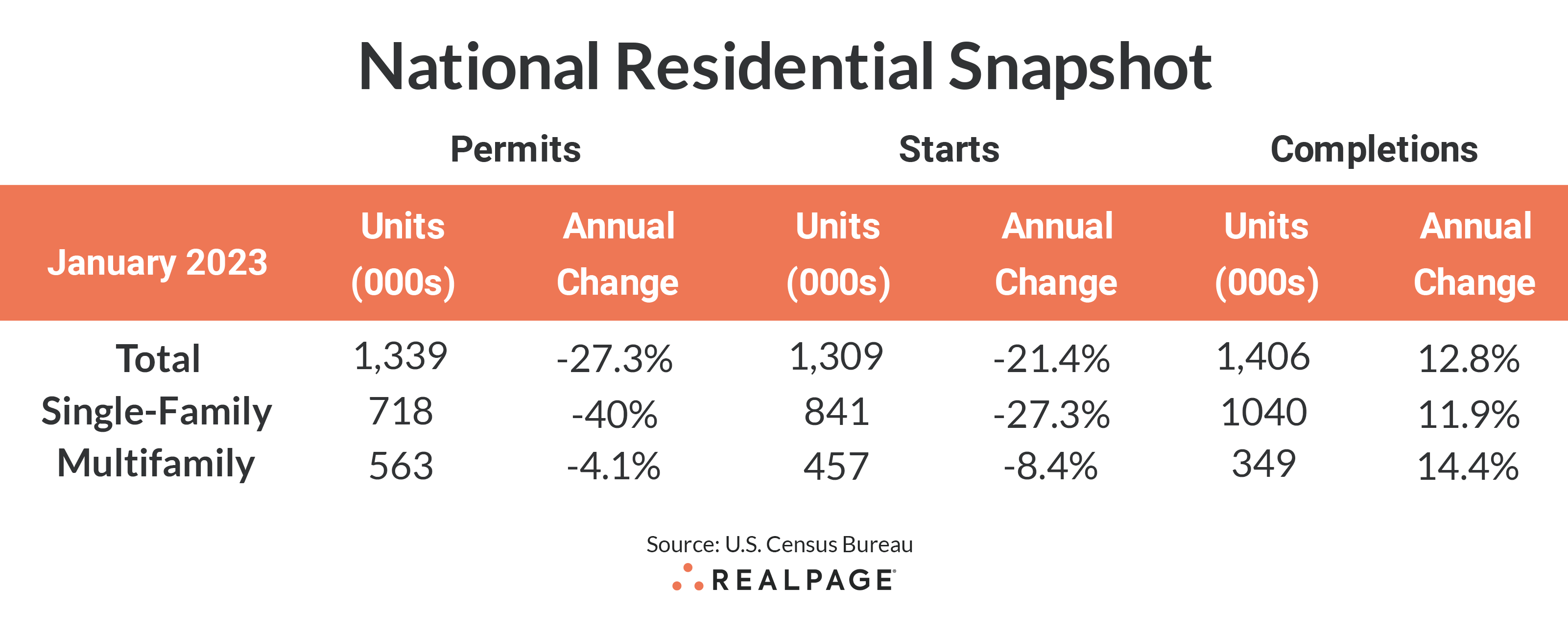

The annualized rate of multifamily permitting was essentially flat in January compared to December (up just 0.5% to 563,000 units) while multifamily starts fell 5.4% from last month to 457,000 units. Year-over-year, permitting was down 4.1%, while starts were down 8.4%.

Higher financing hurdles, greater regulatory costs, and delays or difficulties securing supplies and labor are eroding developer confidence – according to a recent survey by the National Association of Home Builders.

Single-family permitting declined for the 11th consecutive month, from an annualized rate of 1.2 million homes in February of this year to just 718,000 units in January. That was the lowest non pandemic affected annualized single-family permitting rate since September 2015. Year-over-year, single family permitting is down 40%.

The annualized rate for single-family starts has also slowed, decreasing 4.3% from December to 841,000 units, and that was down from last year’s pace by 27.3%. Single-family starts have fallen below one million units for the seventh consecutive month.

Multifamily completions were down about 9% from December to 349,000 units but that is more than 14% greater than last January’s seasonally weak figure. Single-family completions ticked up 4.4% in January with the annual rate reaching 1.04 million units, up almost 12% for the year.

The number of multifamily units authorized but not started increased 5.5% for the month to 154,000 units jumping 26.2% from one year ago. The ratio of multifamily units not started to annualized permits is more than 27%, up from about 20% at the beginning of 2022. Single-family units authorized but not started fell to 132,000 units, down 11.4% from last year.

Despite slowing permitting, starts and construction delays, the number of multifamily units under construction (932,000 units) currently exceeds that of single-family (752,000 units) and is up 24.3% from last January.

Compared to one year ago, the annual rate for multifamily permitting was up only in the Census’ South region (up 20.7% to 320,000 units). The West region saw a decline of 14.6% from last year to 136,000 units and the Midwest fell 26.9% to 72,000 units. The Northeast region dropped almost 45% from last January (down 44.5% to 37,000 units). Compared to the previous month, permitting was down in two regions, with the South and Midwest regions showing solid increases from December.

Multifamily starts were up in half of the four regions, with a strong increase in the West (23.8% to 170,000 units) and a respectable 5% increase in the Northeast to 57,000 units. Starts in the South were down 18.5% (to 208,000 units) and were down significantly in the Midwest region (down 58.5% to just 21,000 units. Compared to December’s SAAR, starts were down in all regions except the West.

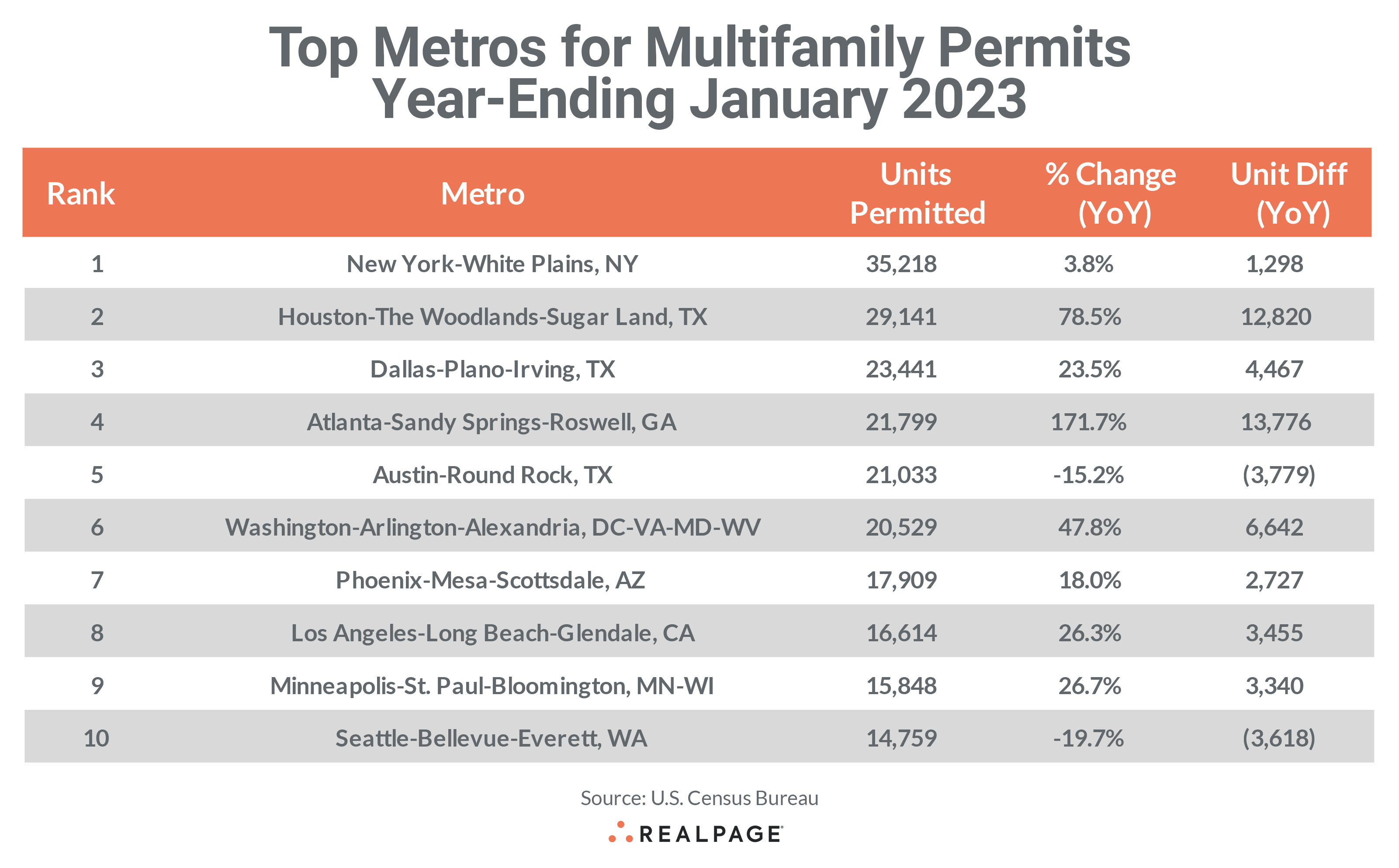

Metro-Level Multifamily Permitting

All of the top 10 markets from December’s list returned in January with only the first three remaining in order. New York continues to lead the nation in multifamily permitting, totaling 35,218 units through January, up by almost 1,300 units from last year but about 1,500 fewer than in December.

Houston returned at #2 with 29,141 units permitted, an increase of 12,820 units from last year and the second-highest annual increase after Atlanta. Dallas retained the #3 spot with 23,441 units permitted in the past 12 months, and like New York, had a year-over-year gain, but a decline from December. Atlanta continues to climb the top 10 list with an annual increase of 13,776 units, moving into the #4 spot with 21,799 units permitted and displacing Austin and Washington, DC down one spot each.

Multifamily permitting continues to slow in the still hot Austin market, dipping almost 3,800 units for the year to 21,033 units total, while Washington, DC jumped 6,642 units from last January to permit a total of 20,529 units for the year.

Phoenix remained in the #7 spot on the top 10 permitting list with 17,909 units permitted, about 2,700 more than last year. Los Angeles also remained in the same spot as last month at #8 with 16,614 units permitted, virtually unchanged from December but up 3,455 units for the year. Minneapolis-St. Paul and Seattle switched places at #9 and #10, with Minneapolis increasing their annal permitting by 3,340 units to 15,848 units, while Seattle slowed by 3,618 units to total 14,759 units through the 12-months ending January 2023.

Despite a national trend of slowing multifamily permitting, eight of the top 10 multifamily permitting markets increased their annual totals from the year before and they were generally large increases, ranging from a low of 1,298 units in New York to 13,776 additional units in Atlanta. Six of the top 10 markets increased multifamily permitting by at least 3,300 units over last year’s pace. Of the top 10 markets, only Austin and Seattle had decreases from last year.

Other large markets outside of the top 10 that saw significant year-over-year increases in annual multifamily permitting in the year-ending January were Tampa (+8,263 units), San Antonio (+4,288 units), Richmond (+3,248 units) and Raleigh/Durham (+2,769 units).

Smaller markets with big increases include Cape Coral-Fort Myers, FL (+2,713 units), Deltona-Daytona Beach-Ormond Beach, FL (+2,515 units), Sioux Falls, SD (+1,971 units), Akron, OH (+1,647 units), Crestview-Fort Walton Beach-Destin, FL (+1,435 units), Lincoln, NE (+1,388 units), Salem, OR (+1,266 units) and Worcester MA (+1,252 units).

Significant slowing in annual multifamily permitting occurred in Philadelphia (-19,591 units), Nashville (-13,054 units), Charlotte (-2,958 units), Salt Lake City (-2,076 units), Denver (-2,000 units), Oakland (-1,831 units) and Fort Lauderdale (-1,501 units).

The annual total of multifamily permits issued in the top 10 metros – 216,291 – was about 24% more than the 175,163 issued in the previous 12 months. The total number of permits issued in the top 10 metros was almost equal to the number of permits issued for the #11 through #41 ranked metros.

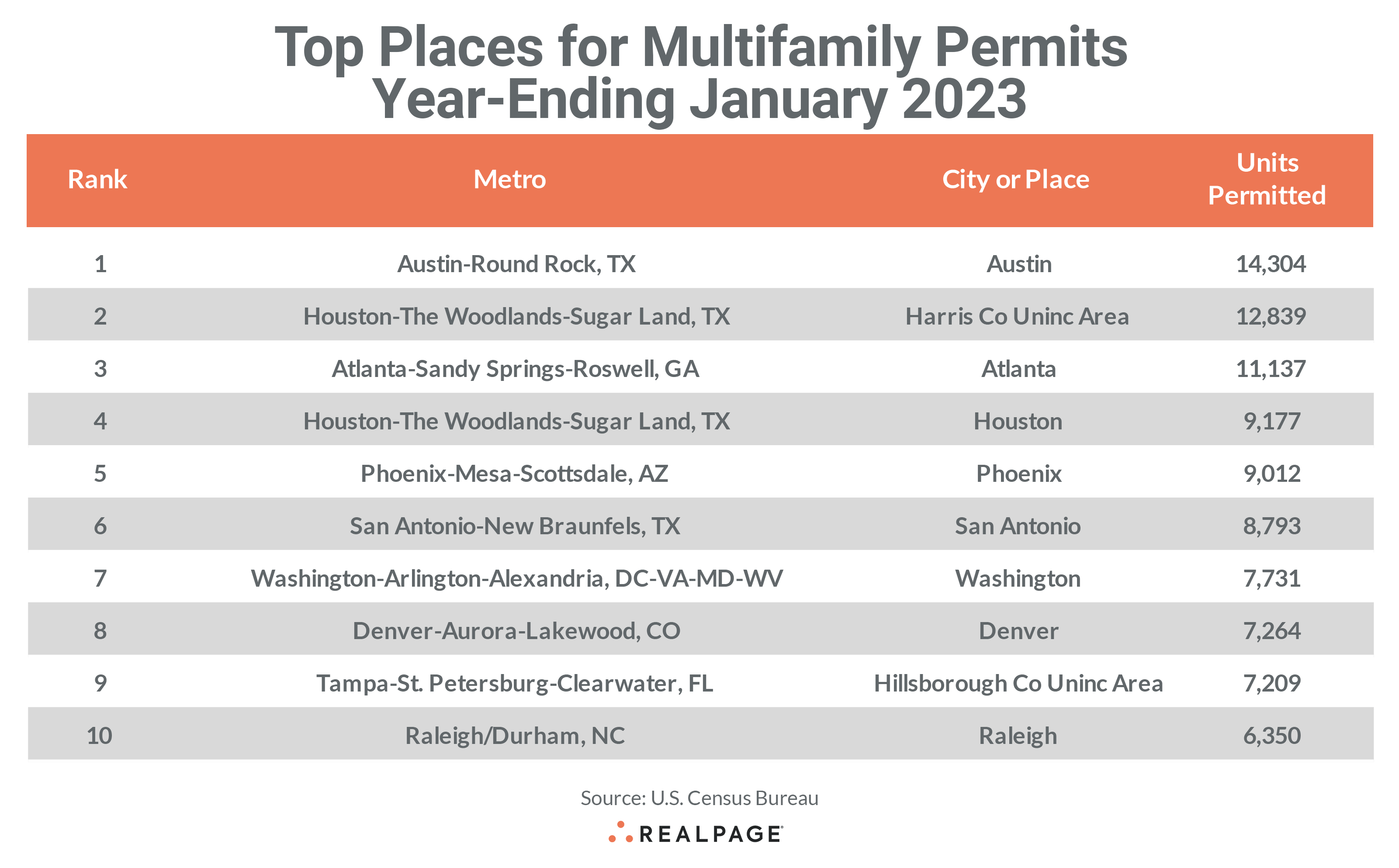

Below the metro level, all of last month’s top 10 permit-issuing places returned to this month’s list with five remaining in the same place and several others changing places. The list of top individual permitting places (cities, towns, boroughs, and unincorporated counties) generally include the principal city of some of the most active metro areas.

The city of Austin remained in the top spot with a permitting total of 14,304 units. The unincorporated portion of Houston’s Harris County remained at #2 with 12,839 units permitted, while the city of Atlanta was close behind with 11,137 units permitted for the year.

The city of Houston moved up two spots to #4 with 9,177 units permitted and the cities of Phoenix and San Antonio slipped one spot each but permitted 9,012 units and 8,793 units, respectively. The city of Washington (District of Columbia) moved up two spots to #7 with 7,731 units permitted, surpassing Denver at the #8 spot with 7,264 units permitted for the year.

Unincorporated Hillsborough County (Tampa) moved down two spots to #9 with 7,209 units permitted and the city of Raleigh retained the #10 spot, permitting 6,350 units. The cities of Austin, Phoenix, San Antonio, and Raleigh were the only top 10 permitting places on January’s list to see a decline in permitting from December’s annual total.