Apartment Leasing Traffic Ticks Up as Cooling Rents Incentivize Relocations

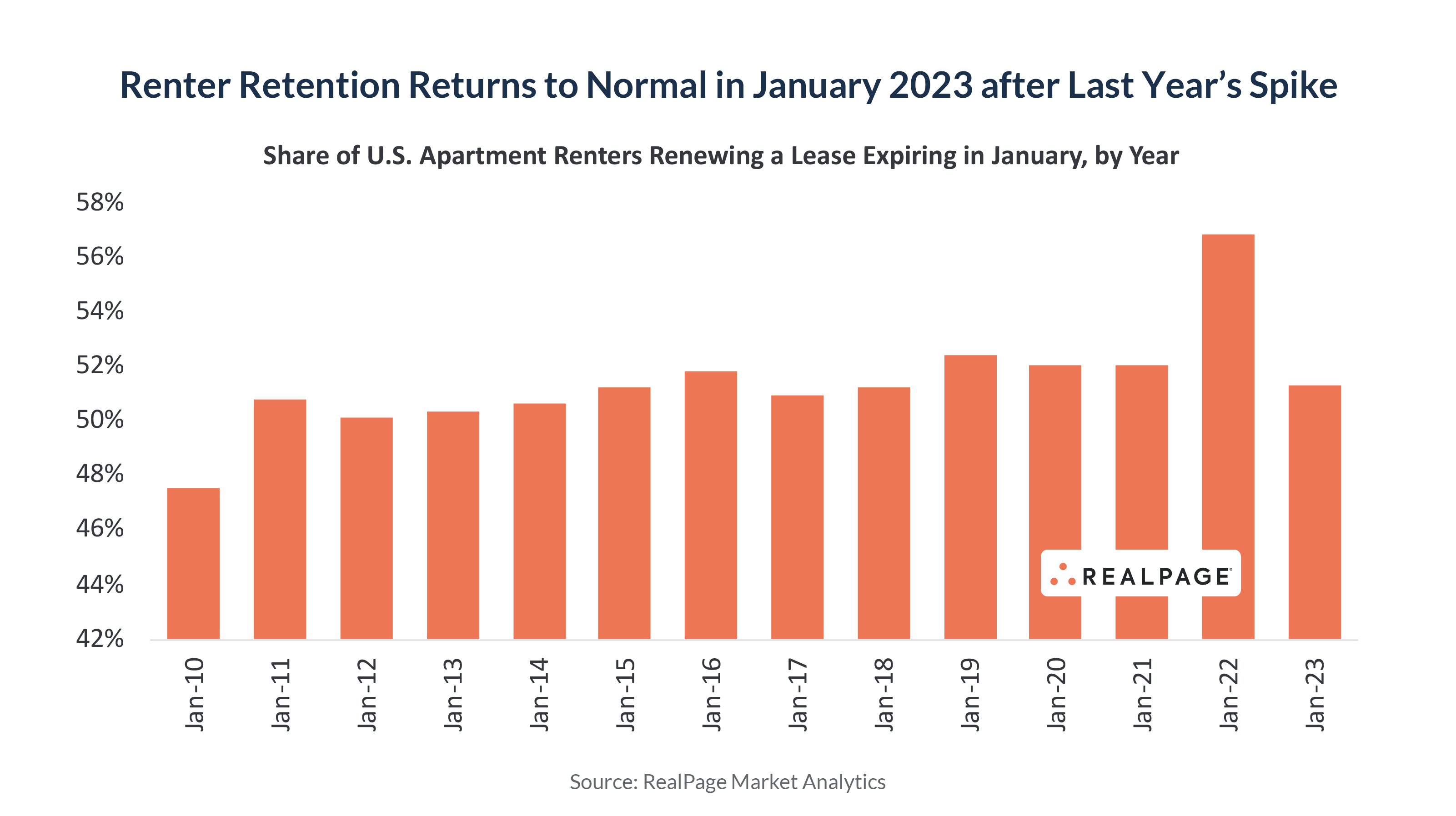

Apartment leasing is showing signs of improvement, but at least some of it appears to stem from musical chairs. Renter retention – which skyrocketed in the last couple years – plunged 5.5 percentage points year-over-year back to a more seasonally normal rate of 51.3% in January 2023. Retention rates will likely further drop in coming months as a big wave of new apartment supply plus cooling rents incentivize turnover.

Why are retention rates dropping off? In the simplest of terms: It’s supply (more of it) and demand (less of it). As a result, there’s more availability and therefore rents are cooling. In turn, renters facing lease renewals suddenly have a lot more options – often attractively priced as apartment operators push hard to keep occupancy elevated.

Here’s a more detailed explanation:

Retention first soared during the 2020 lockdowns, briefly dropped back to normal in the second half of 2020, and then shot up again throughout 2021-2022.

Interestingly, renters renewed leases most frequently when rent growth was at peak levels – as it was often cheaper to renew than relocate, plus ultra-low vacancies meant there were few attractive alternatives (in any housing type, not just apartments).

After a record surge in new-lease demand in 2021, leasing traffic stalled out in 2022 despite strong job growth and strong income growth. Demand for all types of housing essentially froze up due to low consumer confidence. People were waiting it out, even if they were secure in jobs, and renters already in place continued to renew at high frequency.

The lack of front-door leasing plus growing new supply levels led to occupancy rates falling from a record high of 97.6% in February 2022 to 94.8% as of January 2023. While that’s a very normal and healthy rate historically, it’s also the lowest since 2018. That prompted four straight months of unusually large new lease rent cuts (month-over-month) and a flat rent number for January (a period where we typically see modest growth).

And as a result of rising availability and cooling rents, renters now have a lot more options. Unlike in 2021 and 2022, renters facing lease renewals are seeing more attractively priced alternatives. That encourages relocations.

The drop-off in retention will undoubtedly prompt some to wonder how affordability is playing a role. But in the market-rate apartment market specifically, the data suggests that isn’t a primary factor – not yet anyway. Rent collections improved about 50 basis points (bps) year-over-year and they’re back around pre-COVID levels. Additionally, household incomes among new lease signers (many of whom we know were relocating from other apartments) jumped 6% YoY, 100 bps above new lease rent growth.

Furthermore, there are signs that cooling inflation – including rents – is prompting more people to consider moving beyond relocations from other apartments. Property managers are reporting improved leasing traffic, and the number of days vacant between leases shrunk from a decade-high of 33 in December to 31 in January – which was the largest drop on record for that time of year.

What Does This Mean for the Months Ahead?

The buzz among apartment operators right now is that they’re laser focused on protecting occupancy rates. That means a heavy focus on keeping current renters and luring in new renters. Occupancy equals cashflow, and therefore protecting occupancy is critical in a time when new-lease demand is uncertain and new supply is plentiful.

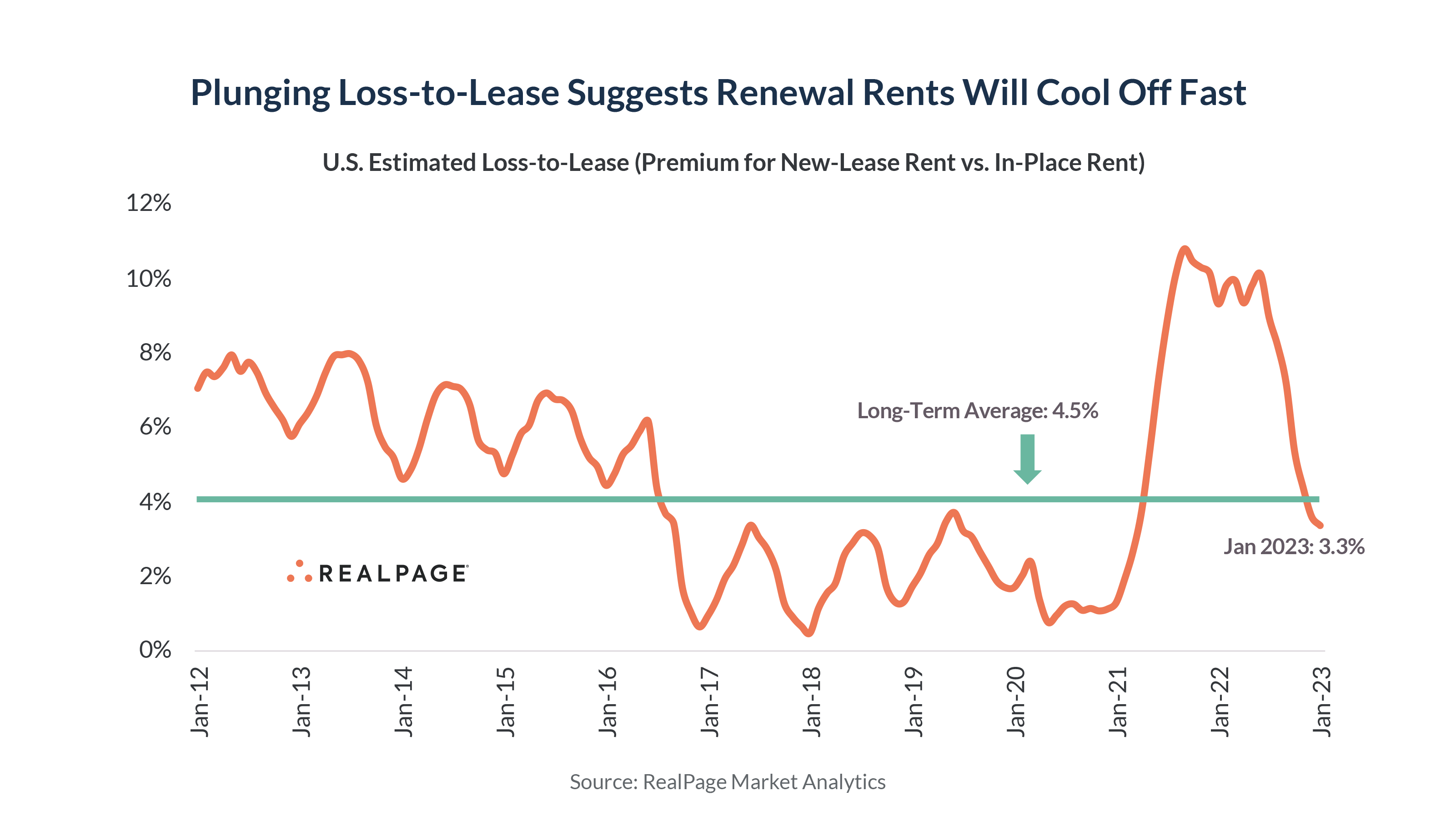

Our expectation is that renewal rent pricing will come down quickly as the gap between new-lease rents and in-place rents has shrunk remarkably quickly. Loss-to-lease (the premium paid by a new renter compared to what a current in-place renter pays) has shrunk precipitously – from 10.1% in June 2022 to 3.3% in January 2023 – and now comes in below the 10-year average of 4.5%.

Renters renewing a lease in January paid an average increase of 8.3% compared to their previous lease. That’s still sizable but well below the peak of 11.5% last year.

Renewals are often signed two or three months in advance, so renewal rent pricing tends to be a lagging indicator. But loss-to-lease is a critical forward indicator. Loss-to-lease spiked before renewal rents jumped, and loss-to-lease is dropping now before renewal rents likely follow.

All that means, as we’ve been saying for a while now, is that the balance of power in the rental market has shifted back in favor of renters.