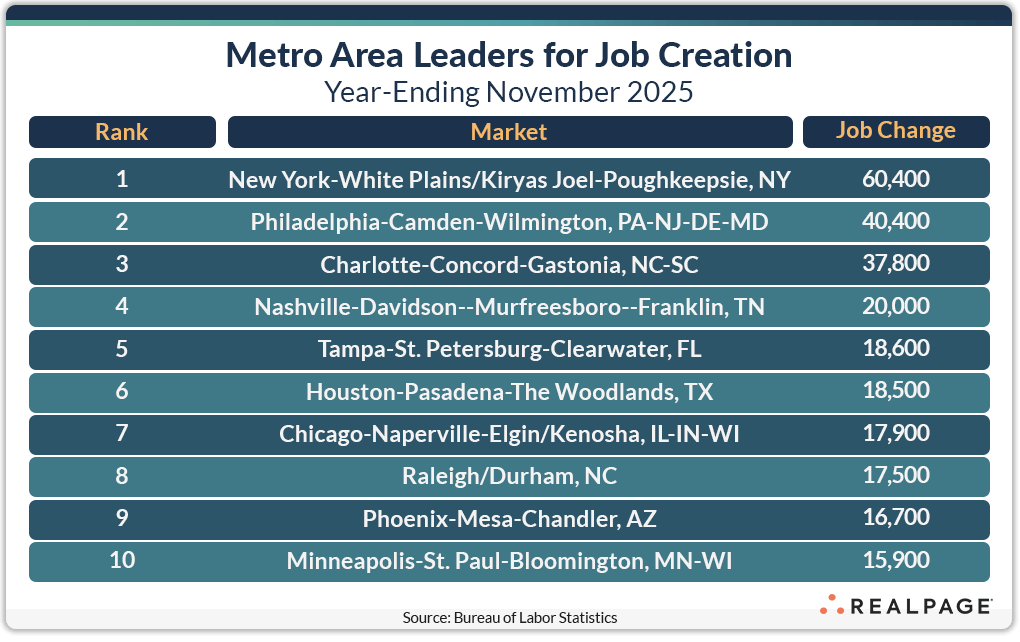

The most recent employment data from the Bureau of Labor Statistics (BLS) at the MSA level indicates that job gains in the nation’s top markets are continuing to slow.

As of November, RealPage’s list of the top 10 markets for job creation totaled 263,700 new jobs compared to 297,200 new jobs created in these same markets one year ago and 309,900 new jobs for the year-ending in October. This tracks the overall trend nationally of easing employment growth.

More importantly, the top 10 jobs market list for November looks nothing like the top 10 list one year ago. Only New York-White Plains/Kiryas Joel-Poughkeepsie, NY, Houston-Pasadena-The Woodlands, TX and Phoenix-Mesa-Chandler, AZ were among the top job creation markets in November. Missing from the November list were markets that were typically among the best in the nation for new jobs – Dallas, Washington, DC, Los Angeles, Austin and Atlanta.

In their place are markets like Philadelphia, Charlotte, Nashville, Tampa and Raleigh/Durham. Outside of New York, most of the top 10 markets gained between 25,000 to 60,000 new jobs one year ago, while November’s top 10 markets ranged from 15,000 to 40,000 new jobs (excluding the 60,400 jobs created for the year in New York, about half of last year’s total).

While New York has seen its employment gains slow by almost half from one year ago, the Big Apple still leads the nation for job creation through November. The latest top 10 list is diverse geographically, with a stronger representation in the Northeast, Mid-Atlantic and upper Midwest regions. The normally dominant Texas economy is represented by only Houston.

Some have argued that the typically strong connection between job gains and apartment demand has weakened post-COVID, but nine of the top 10 job creation markets are also among the top 20 markets for apartment absorption in 2025 (Minneapolis came in at #22 for demand). However, Dallas, Atlanta, Austin and Orlando are still among the top apartment demand markets in the past year, despite slowing job gains in those markets.

The top 10 markets were not the only ones to see modestly lower job creation totals, as the next 10 markets (#11 through #20) of RealPage’s top job gain markets saw their total gains decrease 22.1% from last year to 120,900 new jobs. There were no markets that gained at least 100,000 jobs and only New York exceeded 50,000 jobs created for the year-ending November 2025.

Led by Washington, DC’s federal funding-related cutbacks, a total of 31 of our top 150 markets reported annual job losses for the year in November, two more than in October. In addition to Washington, DC, job losses continue in the Bay Area and Portland, OR, Milwaukee, Virginia Beach and Boston, among the larger markets.

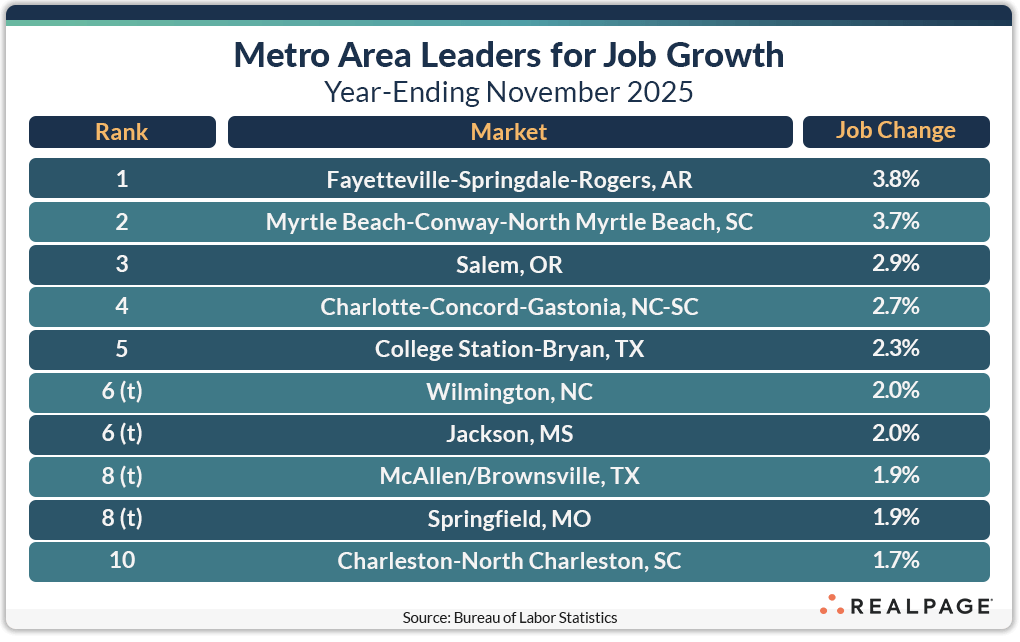

Job Growth

Unlike the top job gain markets, which tend to be large in population and overall employment, smaller markets usually dominate the top markets for annual percentage change in employment. As we typically see, state capitals, college towns and resort or tourist destination cities dominate this list. Six of August’s top markets for job change (our last published list) returned on the November list.

Although primarily thought of as a college town, top job growth leader Fayetteville-Springdale-Rogers, AR is also home to diverse employers such as Walmart, Tyson Foods, J.B. Hunt Transportation and Simmons Foods. Myrtle Beach was close behind Fayetteville with 3.7% job growth for the year.

Salem, OR and Charlotte improved growth rates by more than 100 basis points (bps) each from last year, while #5 College Station was unchanged. Wilmington, NC and Jackson, MS tied for #6 with 2% growth, while McAllen/Brownsville, TX and Springfield, IL tied with 1.9% growth each. Charleston, SC ranked #10 with 1.7% growth.

Eight of the top 10 job growth markets had greater growth rates than one year ago, led by Myrtle Beach with a 250-bps increase. Outside of the top 10 growth markets, Nashville, Honolulu, Raleigh/Durham, Boise, ID and Ashville, NC had employment growth rates between 1.5% and 1.7%. Including the top 10, there were 68 markets exceeding the national not seasonally adjusted growth rate of 0.48%.

This post is part of a series by RealPage Senior Real Estate Economist Chuck Ehmann analyzing employment data from the Bureau of Labor Statistics. For more on this data, read previous posts on Job Growth