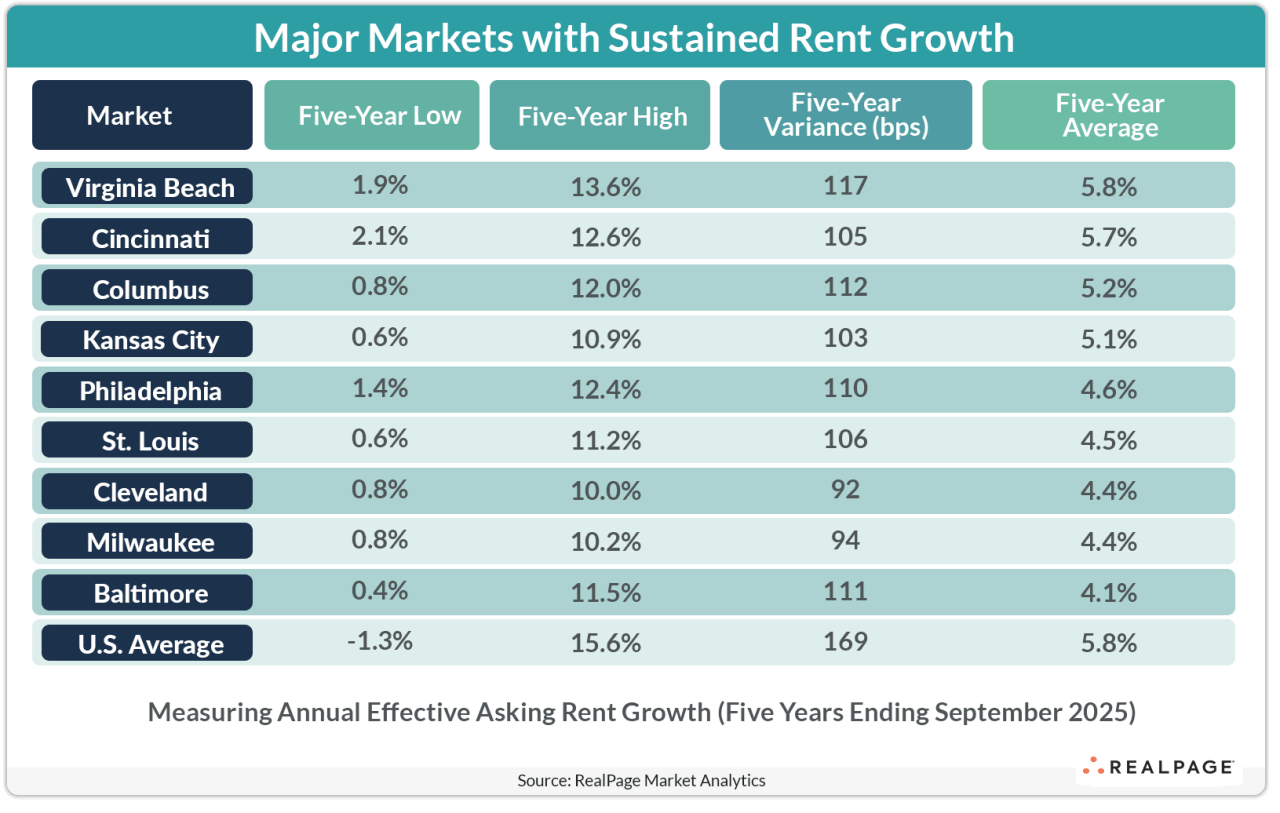

Nine Major Markets Record Sustained Annual Rent Growth for Five Years

Only nine of the nation’s 50 largest apartment markets have been able to sustain rent growth year-over-year every month for the past five years. More than half of those markets are in the Midwest. All nine of those large markets averaged annual rent growth of roughly 4% to 6% from October 2020 through September 2025, according to data from RealPage Market Analytics. Virginia Beach led with a 5.8% average annual increase during that period. The only other South region market to record sustained annual rent growth was Baltimore, with five-year average annual rent growth of 4.1%. Five Midwest markets continued to post year-over-year rent increases for five years, with the largest average annual increases in Cincinnati (5.7%), Columbus (5.2%) and Kansas City (5.1%). Philadelphia was the only market in the Northeast to make the list. For comparison, the U.S. overall averaged annual rent growth of 5.8% during that five-year period. Looking at fluctuations among those nine markets, Cleveland recorded the least variation in annual rent growth during that five-year period, with prices fluctuating just 92 basis points (bps), followed by Milwaukee (94 bps). That was much tighter than the rent change variation of 169 bps in the U.S. overall. Midwest markets are known for their stability and rank among the least volatile in the nation. A lot of that constancy has to do with limited supply. Most of the markets with sustained annual rent growth have seen expansion and vacancy rates well below the national average.