U.S. Apartment Occupancy Stabilizes as Rent Cuts Ease in January

The decline of occupancy in the U.S. apartment market was stemmed in January, and rent cuts eased as completion volumes fell.

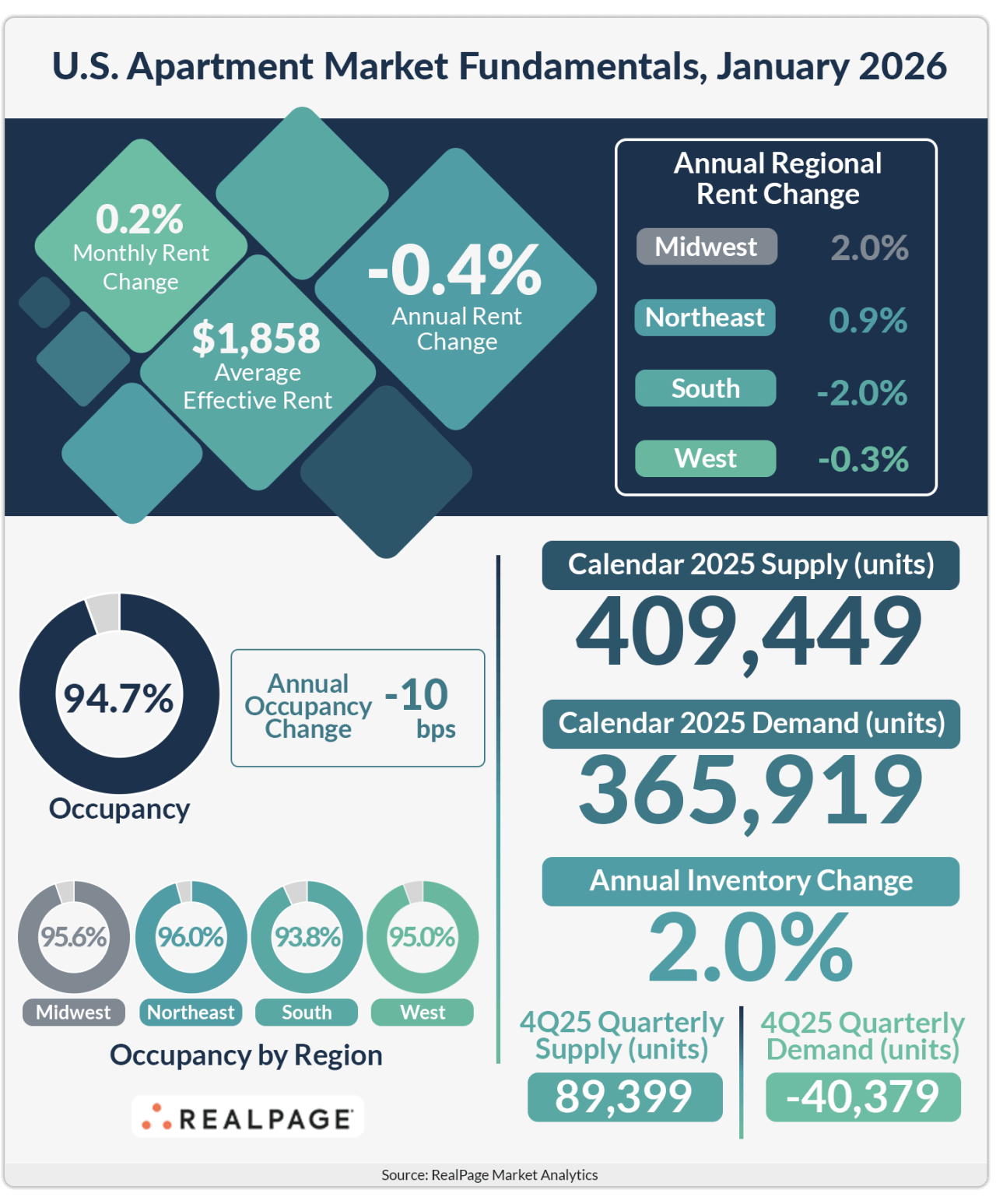

After six consecutive months of mild decline, apartment occupancy bumped up 10 basis points (bps) in January to 94.7%, according to data from RealPage Market Analytics. Still, U.S. occupancy was down 10 bps year-over-year and was 100 bps behind the recent peak from April 2025.

Effective asking rents increased in January, for the first time in seven months. U.S. prices climbed 0.2% over December rates, marking a change in performance after a long period of decline. This recent increase, however, did not completely stem the annual decline, as January rents were 0.4% below year-earlier rates.

The nation’s South and West region markets continued to see the deepest rent cuts, while East and West Coast tech hubs are enjoying a rebound.

Rent Cuts Persist Across South and West Region Markets

Rent cuts continued across the South and West regions in the past year, as operators tried to keep occupancy afloat in a high supply environment. In fact, the South has not recorded any annual rent growth since mid-2023. However, annual rent cuts in both regions are not quite as bad as they were just a few months ago.

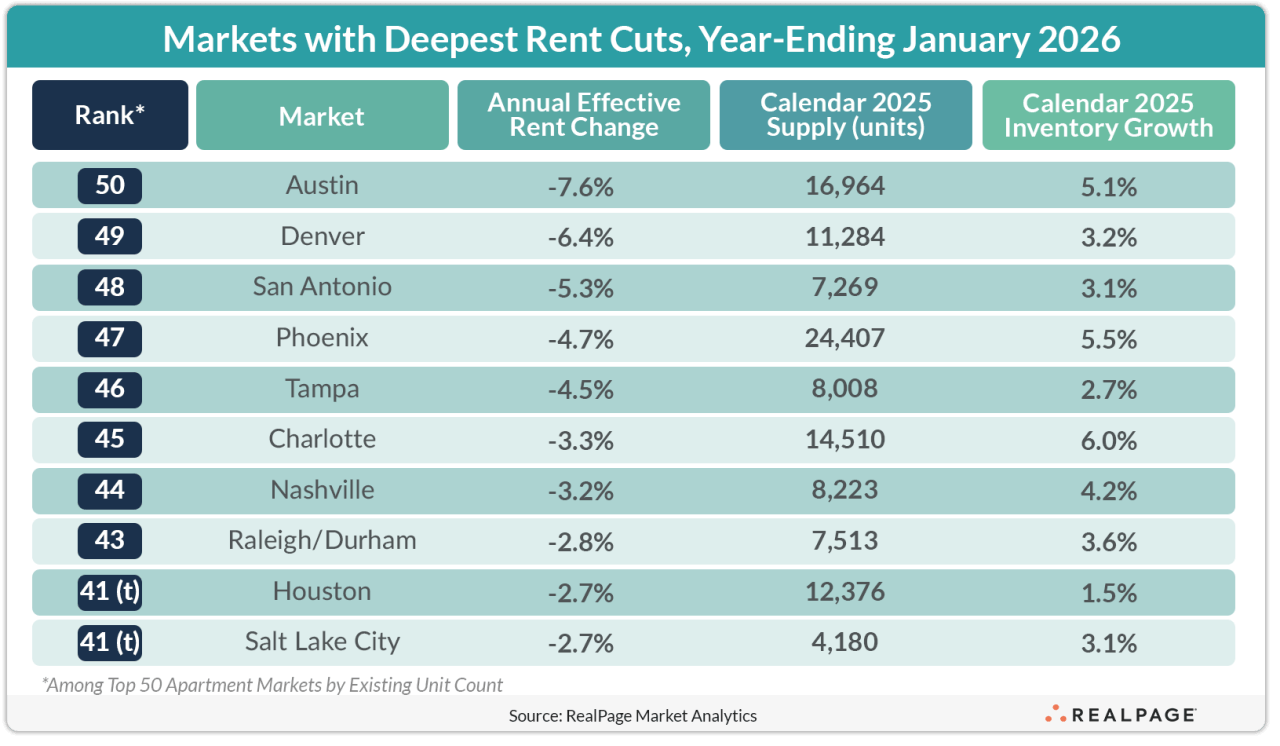

Supply-heavy areas like Austin, Denver, Phoenix and Charlotte were some of the hardest-hit, with rent cuts persisting despite solid apartment demand.

Other markets that continued to see deep rent cuts were tourism-dependent markets such as Tampa and Nashville. Softness in markets that rely on tourism can be an early sign of economic weakness as consumers tighten discretionary spending on travel.

Tech Hubs Continue to See Big Rent Growth

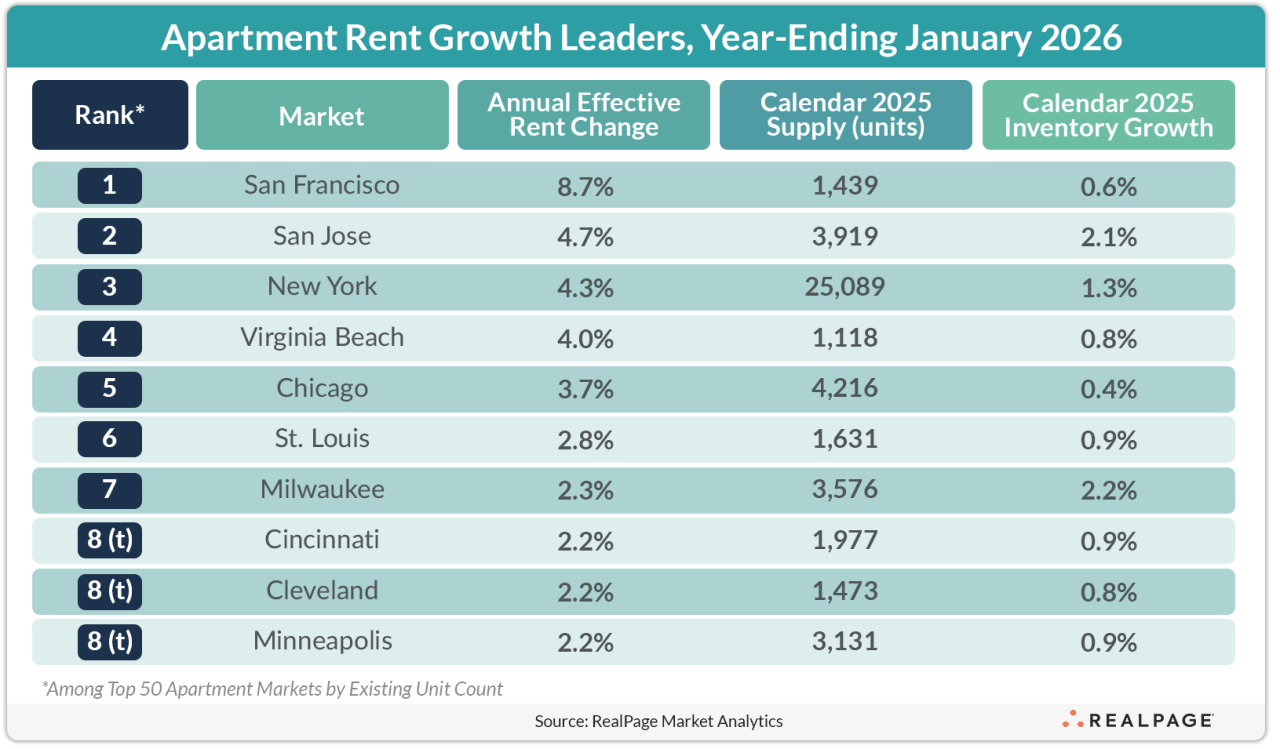

Renewed renter demand in tech‑centric coastal hubs – helped in part by growing concentration in artificial intelligence – has pushed rents higher in San Francisco, San Jose and New York. All three remained among the top 50 U.S. apartment markets for annual rent gains, with prices rising roughly 4% to 9% in the year-ending January.

Other markets with big rent growth in the past year included Virginia Beach in the South and a handful of Midwest markets: Chicago, St. Louis, Milwaukee, Cincinnati, Cleveland and Minneapolis.