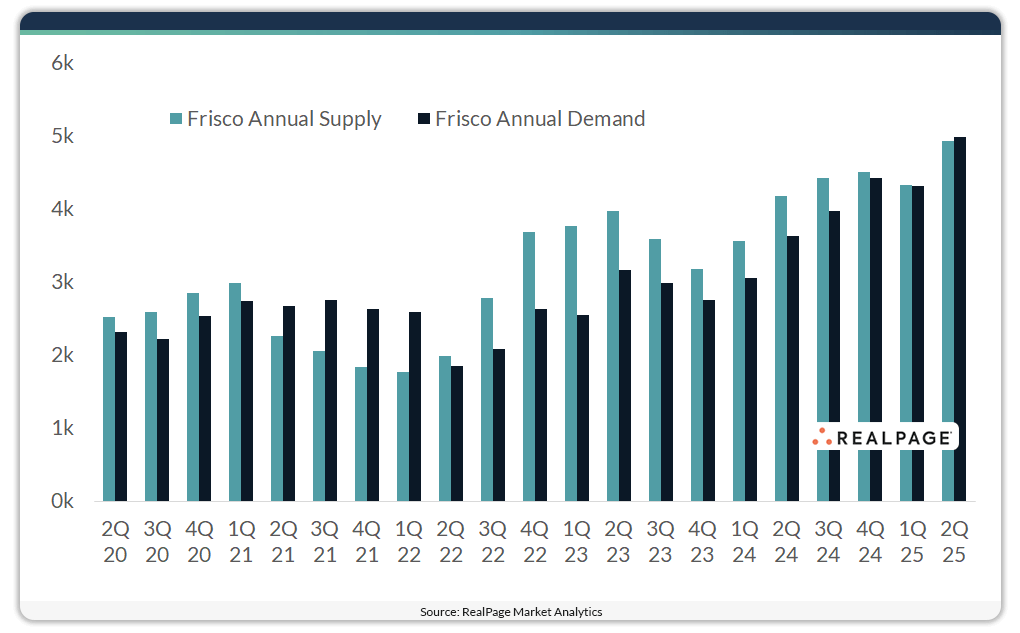

Annual demand in Frisco - a northern suburban submarket of Dallas - reached a record high of 4,992 units in 2nd quarter, a rate that was nearly double the submarket’s 10-year average. At the same time, Frisco saw record deliveries of 4,936 units in the year-ending 2nd quarter, with this stock growing existing inventory by 13.6%. But completions in Frisco are rapidly slowing. Deliveries in the coming year (2,225 units) are scheduled to drop by more than half the current level. Meanwhile, higher new (12.6 months) and renewal (11.9 months) lease terms could help prevent “back door” renter loss. Effective rents have declined on an annual basis since mid-2023, with the decline in the year-ending 2nd quarter at 3.2%. Class B (-2.8%) and C (-6.6%) units lagged performance relative to Class A assets (1.3%). In the coming year, the Dallas market will continue to see most of its new product built in the northern suburban crescent of Allen/McKinney, Denton and Frisco. The close proximity of these submarkets to each other could present increased competition for renters. Over the next 12 months, demand in Frisco is forecasted to slow alongside new supply, with occupancy ticking down and rent cuts persisting.