Apartment Rent Growth Remains Aloof in February as Occupancy Stabilizes

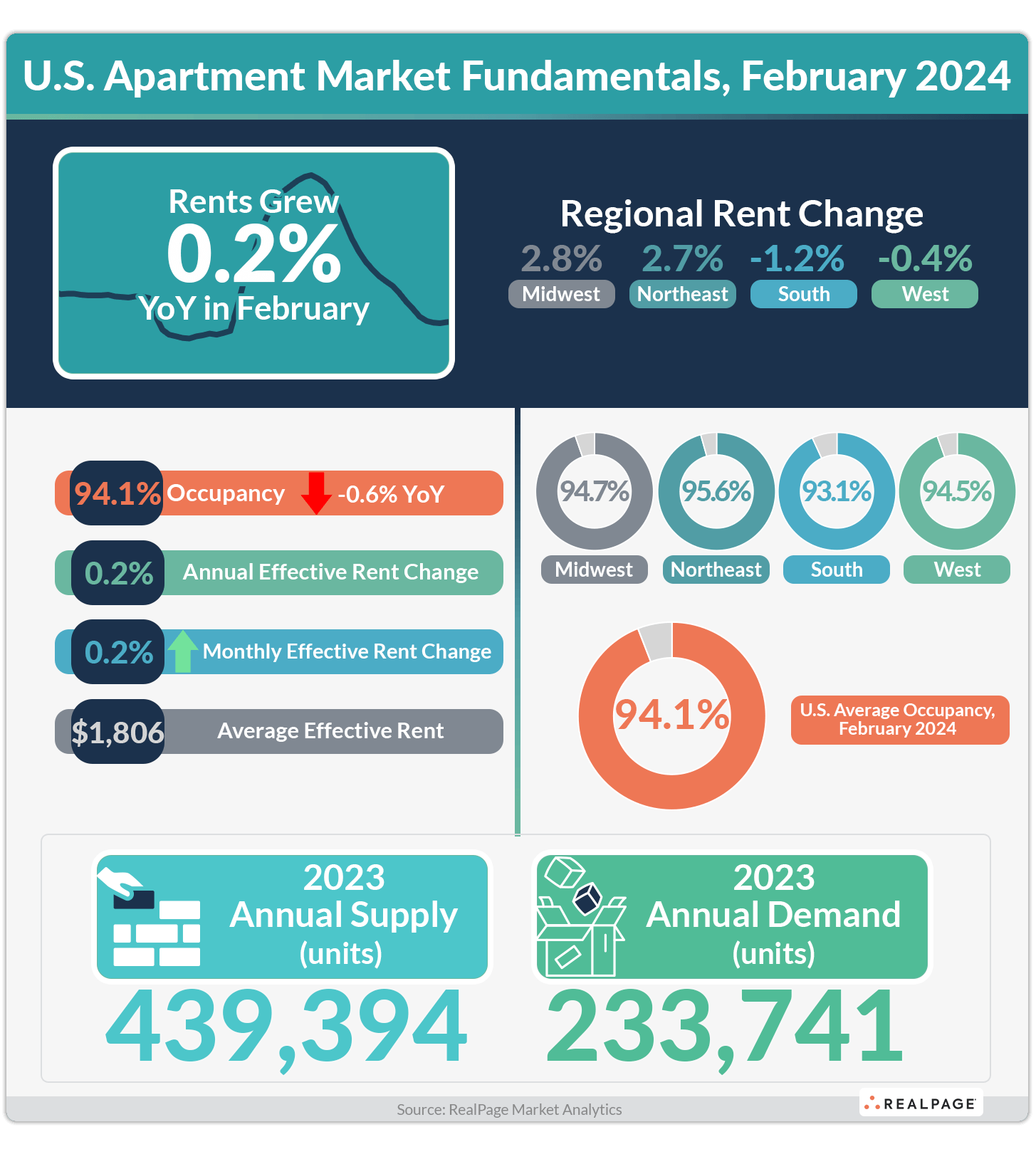

U.S. apartment rents continued to tick up on a negligible basis in February. Asking rents for professionally managed apartments inched up just 0.2% in the year-ending February 2024, with change measured on a same-store basis, according to data from RealPage Market Analytics. On a monthly basis, rents also ticked up 0.2%, indicating that monthly rent change added up to a collectively unchanged rate in the previous 11 months.

Dating back to 2010, the average monthly rent increase for February has been about 0.6%. While February 2024 saw rents increase 0.2% month-over-month, rent growth momentum remains aloof. Still, the February increase of 0.2% was the largest monthly increase dating back to June 2023 which suggests that seasonal movement in rents – though muted – appears to be following historical trends.

Muted rent growth is expected to continue throughout 2024 as supply continues to put downward pressure on rents.

Apartment occupancy held steady at 94.1% in February, the third consecutive month at that rate, which further supports the idea that apartment occupancy is reaching a stabilization point. Still, the current 50-year high in apartment construction will no doubt pose a headwind to occupancy through the remainder of 2024. Nearly 962,000 apartment units were under construction across the nation at the end of 2023, with about 672,000 of those units expected to deliver in 2024.

Construction Weighs Down Rent Growth, Causing Cuts in High-Supply Markets

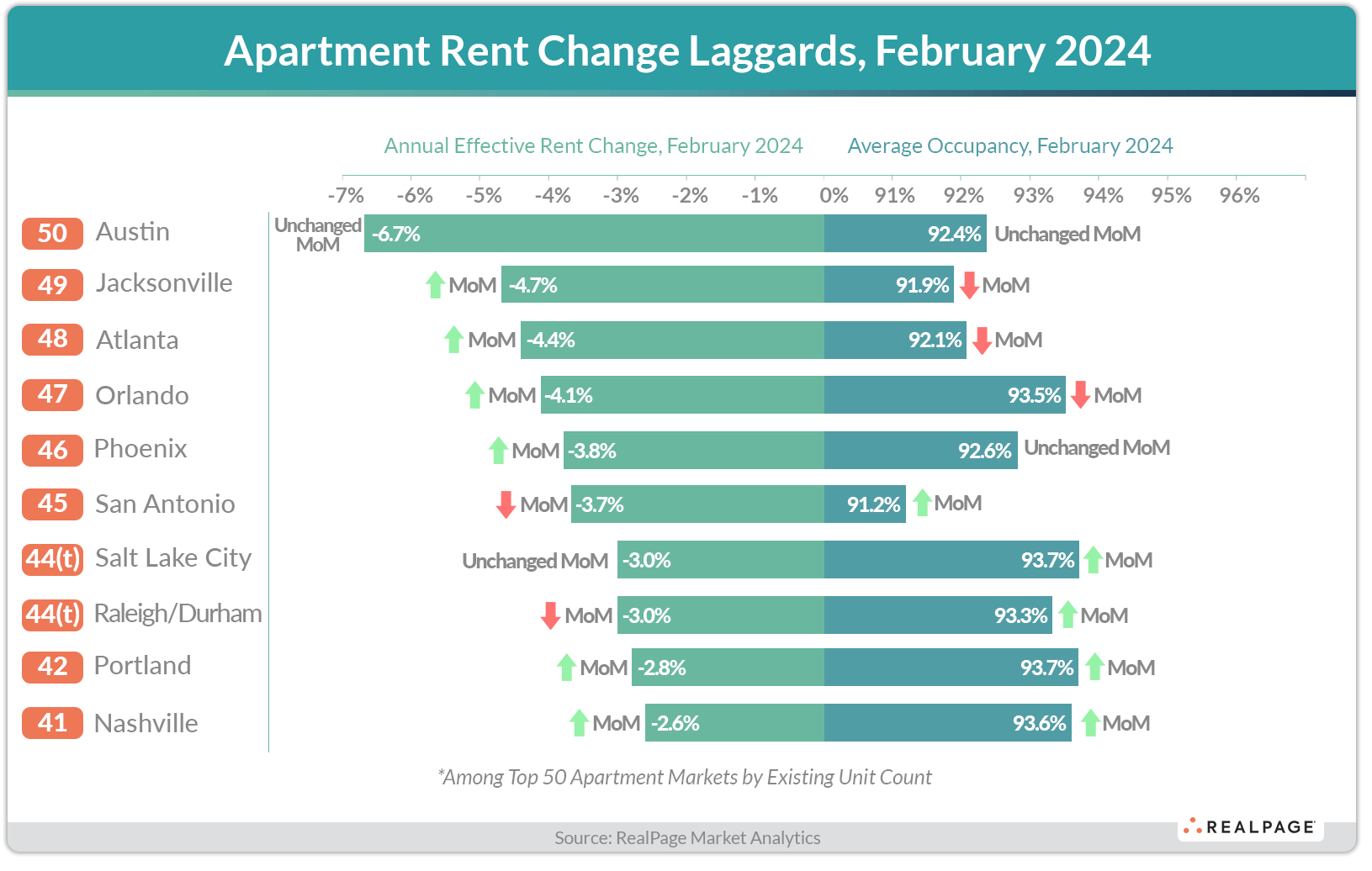

While supply weighs on the nation’s apartment fundamentals at large, several individual markets display this relationship clearly.

Supply remains the key driving force behind markets seeing the deepest rent cuts. Development hotspots such as Austin, Jacksonville, Nashville, Orlando, Phoenix, Salt Lake City and Raleigh/Durham all rank in the bottom 10 for rent change performance among major U.S. markets, as each posted deep rent cuts as of February 2024.

Austin was the national laggard for rent change in February 2024, posting annual rent cuts of 6.7%. Austin has also sustained a continuous wave of new apartment supply for several years running. In calendar 2023, over 17,000 new apartment units were delivered in Austin, growing total apartment inventory 6.0%. And another 43,000 units were underway in the Texas capital at the end of 2023. Austin is expected to grow its total apartment inventory by an enormous 11.2% in 2024.

Extremely high apartment supply has also recently delivered in other markets posting rent cuts, including Salt Lake City and Nashville, both of which grew total inventory 7% or more in 2023 alone.

Solid Rent Growth in Lower Supply Areas

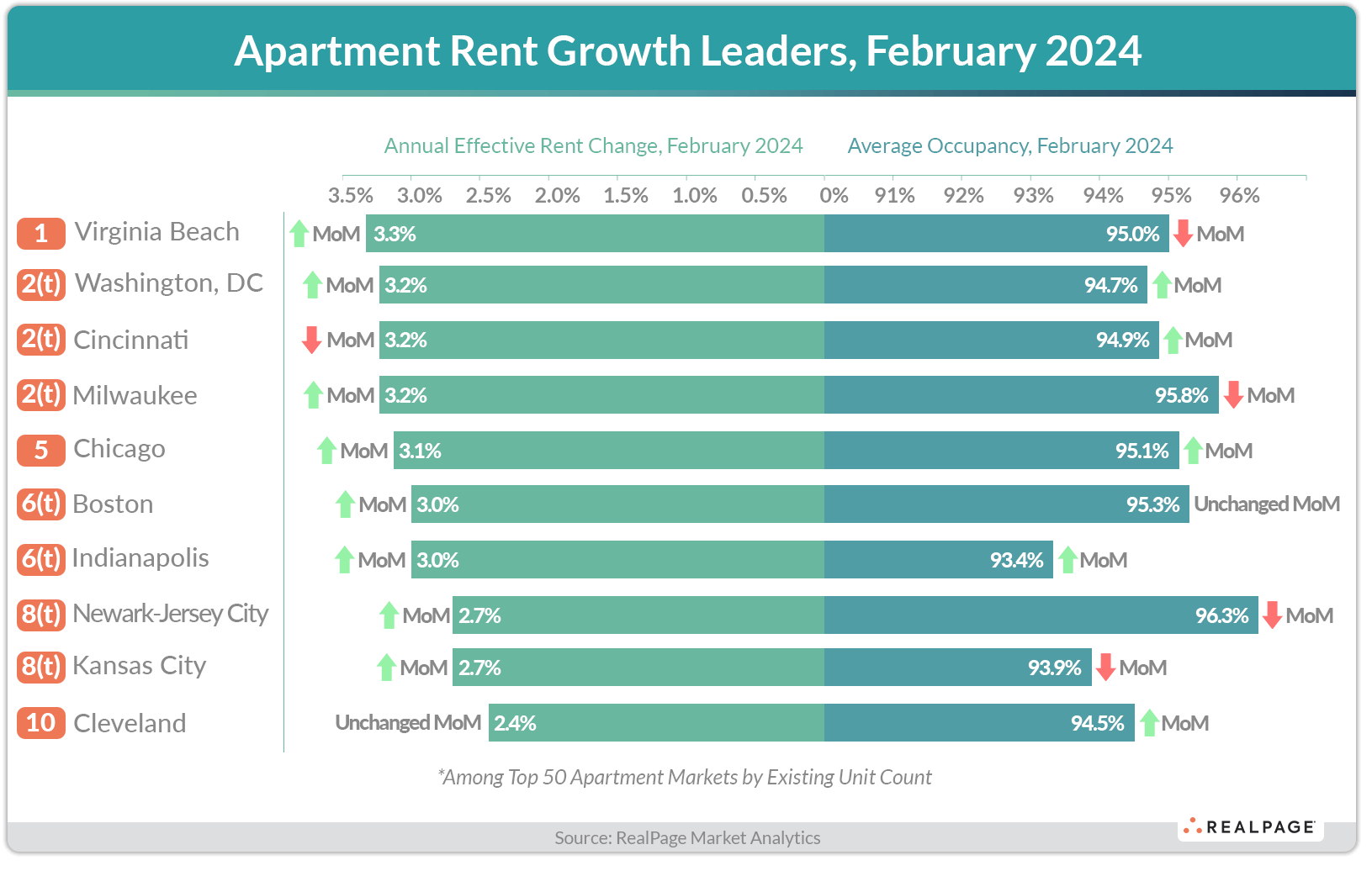

Outside the high-supply Sun Belt region and other markets with fast-growing demographic tailwinds, areas of the country with more modest apartment construction continued to post the highest rent growth in February.

The Midwest and the Northeast regions recorded effective asking rent change of 2.8% and 2.7%, respectively, in the year-ending February 2024, both easily outpacing the national norm of 0.2%.

In the Midwest and Northeast, historically normal rent growth remains in place due to limited supply and characteristically steady demand. Conversely, rents fell by 1.2% in the supply-heavy South region and by 0.4% in the demand-constrained West region.

Leading the nation for apartment rent growth as of February 2024 were Virginia Beach, Washington, DC, Cincinnati and Milwaukee – all relatively low supply markets that grew total inventory below the national norm in 2023.

Occupancy Improves in Three Markets Nationally

Though it has been exceedingly uncommon to find markets where occupancy has increased in the past 12 months, there are a few examples across the country. Three of the nation’s 50 largest markets – San Francisco, West Palm Beach and Virginia Beach – have seen local occupancy rates increase modestly year-over-year.

In San Franciso, occupancy rates remain well below pre-pandemic levels, however, so the modest increase is a signal of those markets working back toward stabilization. As of February, San Francisco apartment occupancy averaged 95.5%, a 50 basis-point (bps) increase year-over-year.

That also means that San Francisco and Virginia Beach are the only two major markets nationwide to post improvement in both rents and occupancy year-over-year in February. In San Francisco, rents grew 1.7% in the year-ending February.

West Palm Beach and Virginia Beach, meanwhile, are two markets where counter-cyclical demand drivers such as retiree-driven demand (West Palm Beach) and military-driven demand (Virginia Beach) have supported occupancy stabilization.

In West Palm Beach, occupancy inched up 40 bps in the year-ending February. And in Virginia Beach, occupancy ticked up 30 bps annually.

Of note, all three of these markets saw less relative supply growth in 2023 than the nation overall (2.3% or less).