If pressed to name the hottest apartment markets in the U.S. right now, Milwaukee likely would not be in your top five guesses. But you might be mistaken.

This overlooked Midwest market posted one of the nation’s top apartment performances in the past year, and the stability in Milwaukee is expected to hold for the near term as well, ranking it among bigger, more typical heavier hitters.

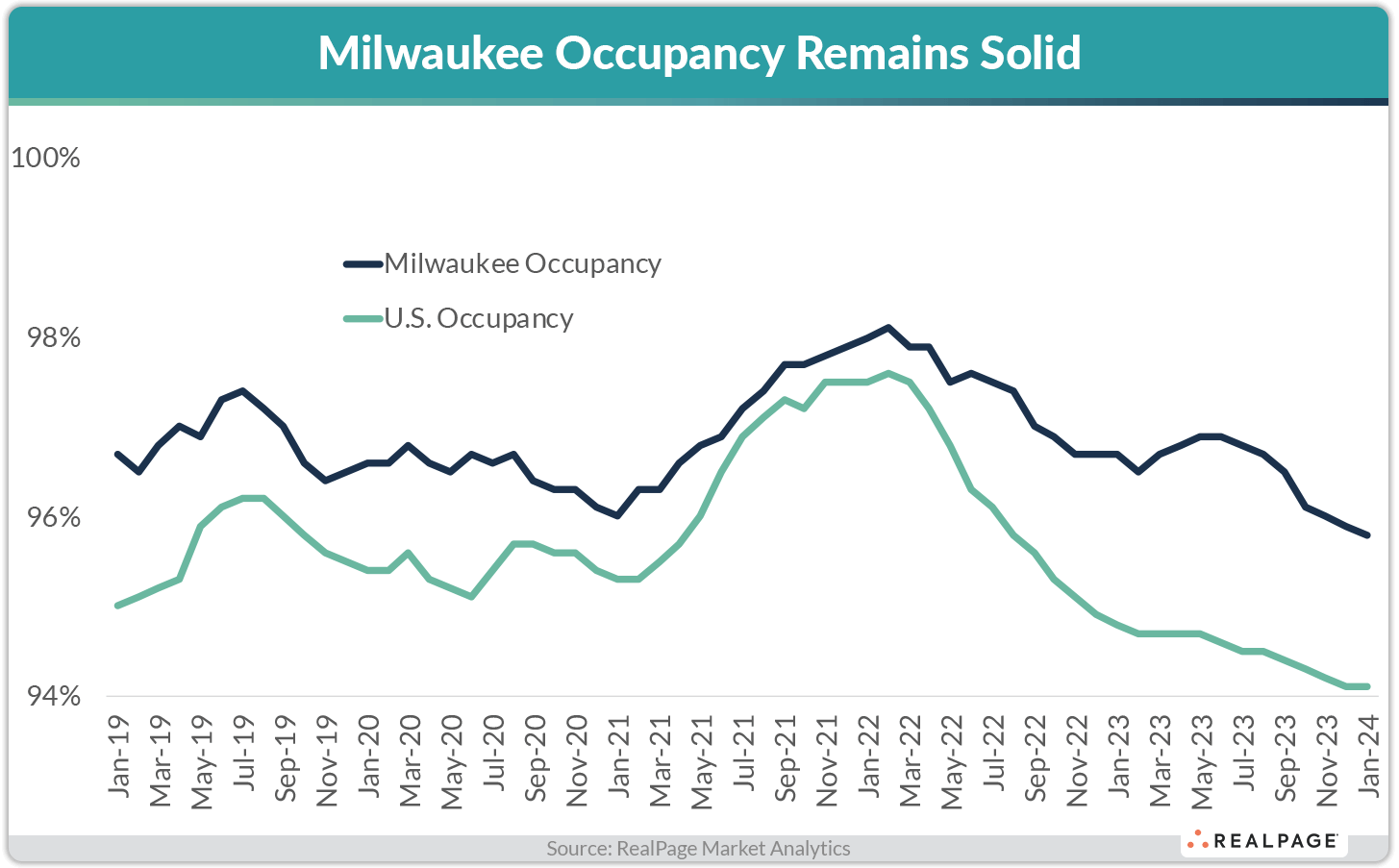

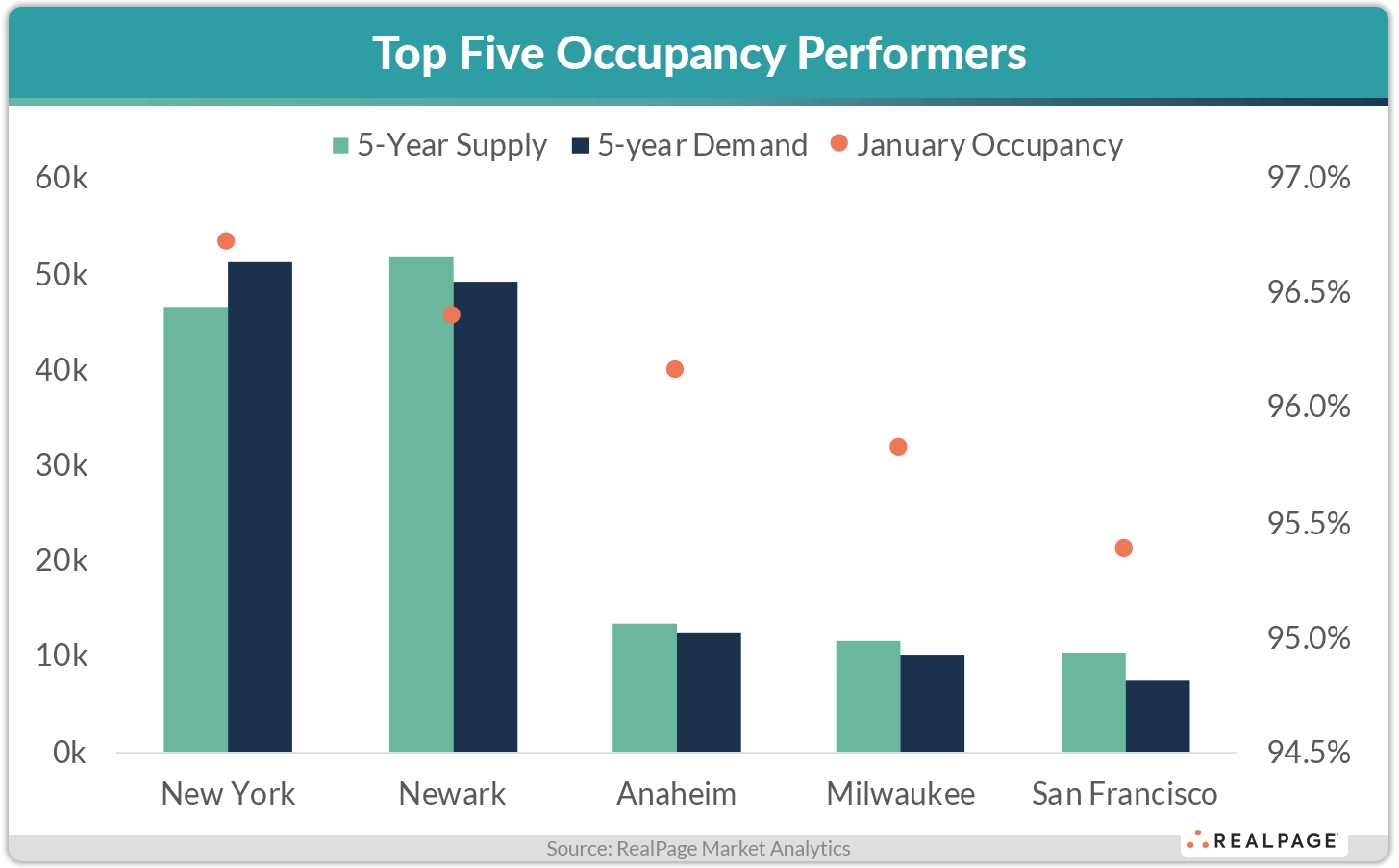

Milwaukee logged one of the best occupancy performances in the U.S. in January, with a rate of 95.8%, according to data from RealPage Market Analytics. This was the fourth-best showing among the nation’s largest 50 apartment markets. The remaining markets to rank in the top five were typical high-occupancy markets: New York, Newark, Anaheim and San Francisco.

The key to Milwaukee’s performance among the nation’s elite has been balance. Most Midwest apartment markets have displayed a stability that other markets nationwide haven’t, and that has been a key ingredient to strong apartment performance amid the uncertainty triggered by the COVID-19 pandemic. While most apartment markets across the U.S. fluctuated significantly in the past few years, the Midwest held onto constancy – not necessarily due to strong demand, but because developers haven’t built as much new product in the Midwest as they have in, say, the Sun Belt.

In Milwaukee, specifically, the inventory increased by 1.8% in 2023, well behind the U.S. average of 2.3%. In the past five years, Milwaukee’s apartment base grew by 7.6%, shy of the U.S. norm of 9.8%.

Demand drivers in Milwaukee appear fairly tepid. Job growth was below the U.S. average in the past year (up just 0.4%), and the market’s employment base contracted 2.3% in the past five years, per the Bureau of Labor Statistics. The population has also contracted a bit, according to the most recent data from the U.S. Census Bureau from 2022, shrinking by 0.2%.

When looking at the top five occupancy performers in January, strong demand wasn’t necessarily the governing factor either. While New York and Newark recorded solid demand tallies in the past five years, the absorption performances were more mild in Milwaukee, Anaheim and San Francisco. Supply followed the same pattern – five-year additions were notable in the Northeast markets, and more reasonable in the Midwest and the West Coast.

Among the top 50 markets, only a handful logged cumulative demand above or relatively in line with total supply in the past five years. Milwaukee was among those markets, ranking #5 for stability. There was only a 1,441-unit gap between five-year absorption (10,276 units) and concurrent deliveries (11,717 units). The only markets to see demand top supply in that five-year time frame were New York and Chicago. The other two markets with demand hitting very close to supply were Anaheim and West Palm Beach.

Milwaukee’s most affordable Class C apartment stock was the clear outperformer recently. Occupancy in Class C product was at a very tight 96.7% in January, while occupancy in Class B stock was also solid at 96%. The rate in Class A product was a little more reserved – but still solid – at 94.6%.

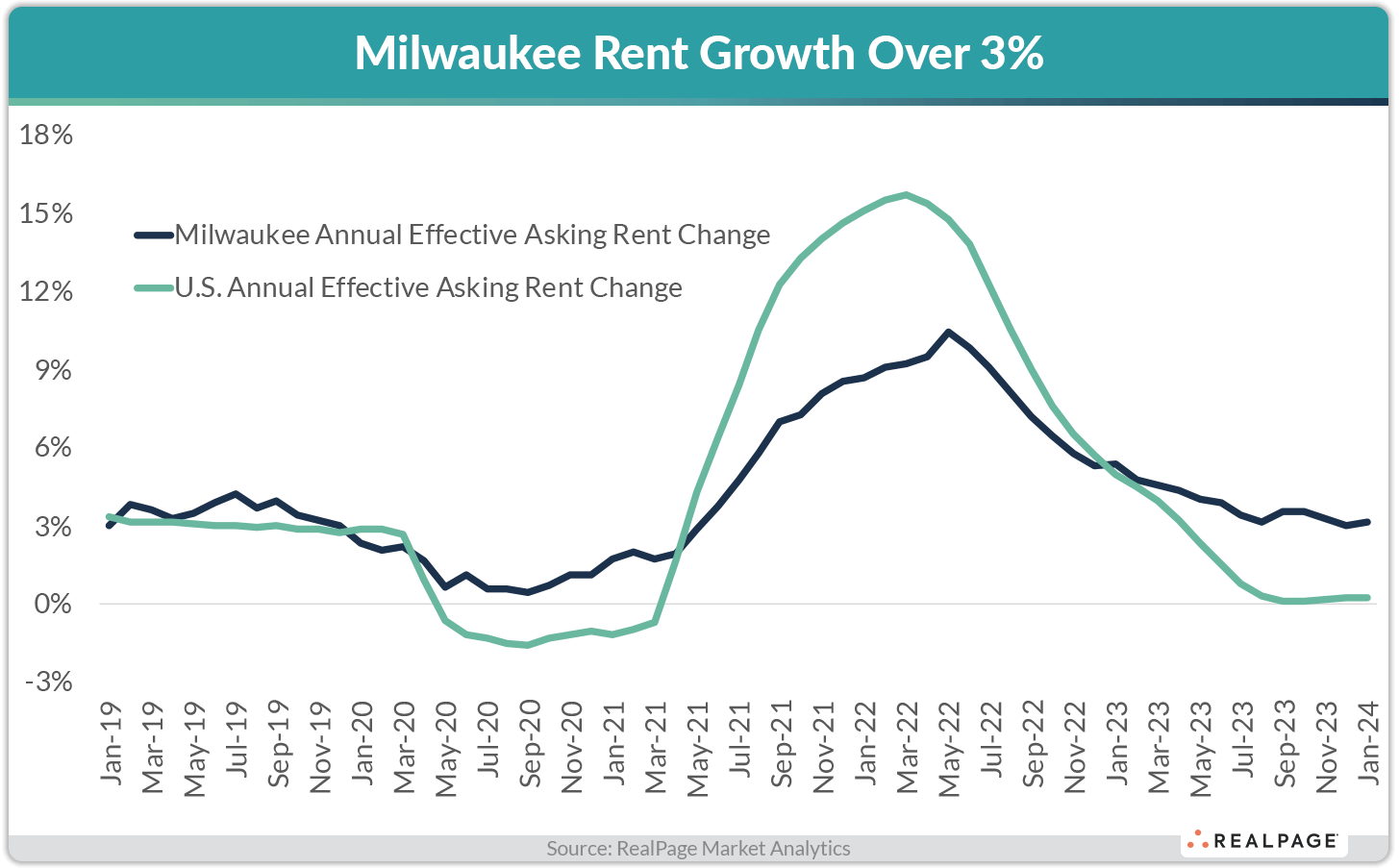

Milwaukee was also a market leader for rent growth recently. Effective asking rents increased 3.1% in the year-ending January, a #5 performance among the nation’s largest 50 apartment markets. Other markets ranking in the top 5 spots include Cincinnati, Boston, Chicago and Washington, DC.

Class A and B units logged the strongest rent growth in Milwaukee, with price increases of 3.5% each in the year-ending January. Annual rent growth in Class C stock was softer at 2%.

Among submarkets, the best occupancy performers in January were the larger submarkets to the West and South of the urban core. Waukesha County was tightest with a rate of 97.2%, while occupancy was just shy of 97% in Racine and Franklin/Oak Creek. These were also some of the market’s best rent growth performers, joined by urban core Downtown/Shorewood and urban-core adjacent Near North/West Side/Wauwatosa.

Milwaukee is forecasted to continue to see nation-leading rent growth into 2024. Occupancy is expected to remain tight, but supply is scheduled to increase a bit, which could apply a bit more pressure than the market has seen recently. Still, look for Milwaukee to continue to shine in the near term, as historic stability lifts the market into the spotlight.