New York Continues Reign as Nation’s Tightest Major Apartment Market

New York has historically been one of the nation’s most prolific apartment markets in terms of both pricing and inventory. Except for faltering in 2020 and 2021 due to the COVID-19 pandemic, apartment market fundamentals in New York generally exceed U.S. norms.

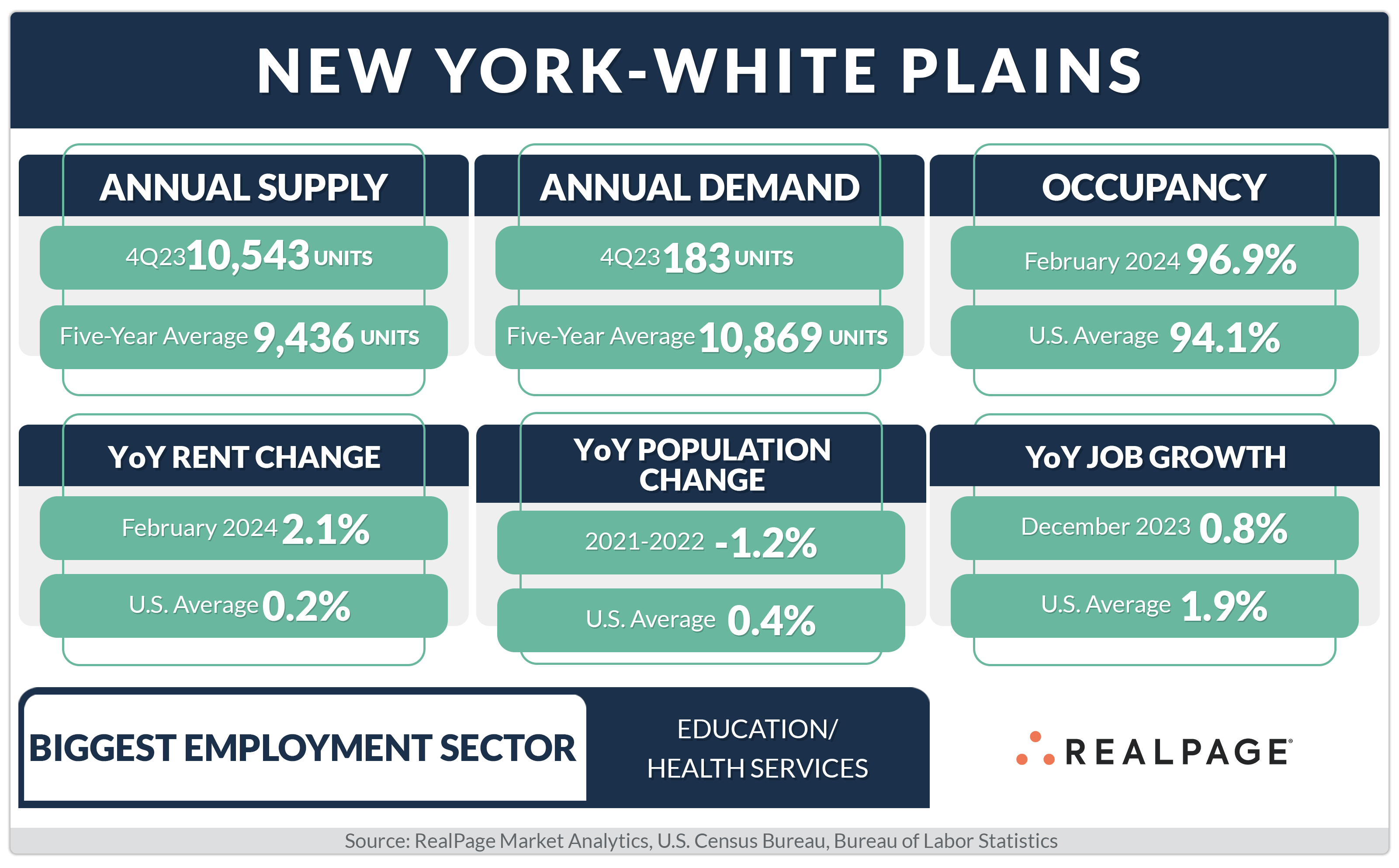

New York-White Plains has a population of nearly 10.8 million residents, the largest metropolitan area in the nation and home to the nation’s most populous city. However, the population here has fallen recently. From 2021 to 2022, the market population declined 1%, according to the latest data from the U.S. Census Bureau. Still, New York-White Plains has a high concentration of young adults – demographics critical to apartment owners – with 22.4% of the population between 20- and 34-years-old. That compares to the nationwide average of 20.4%.

The economy in the Big Apple consists of long-term structural drivers. Although considered to be the world’s preeminent financial center, the metro’s largest employment sectors include Education/Health Services, Professional/Business Services, Government and Trade. New York leads the nation with 47 Fortune 500 company headquarters, the largest (in terms of revenue) being JPMorgan Chase, Verizon Communications, Citigroup, Pfizer, PepsiCo, MetLife and Goldman Sachs Group.

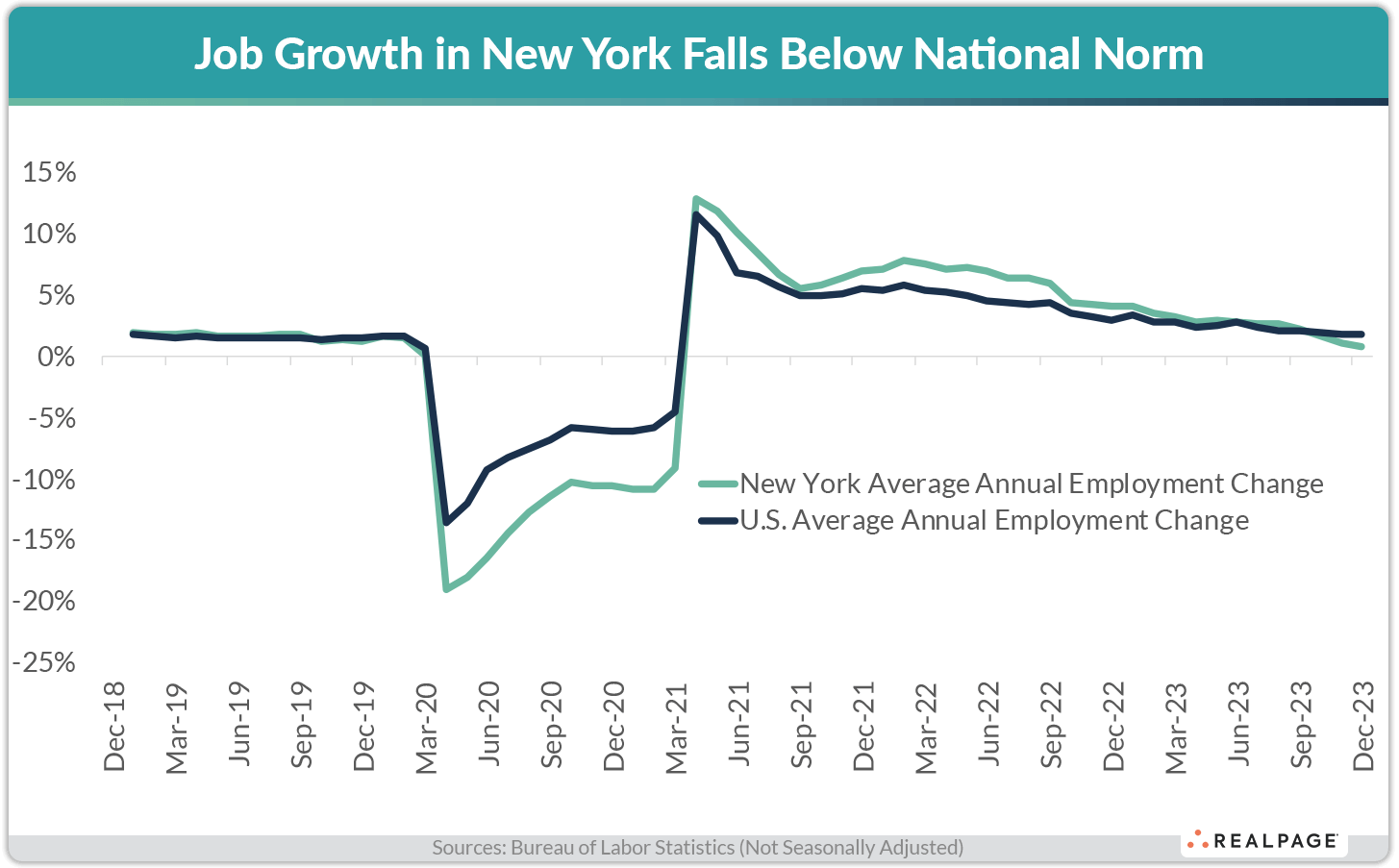

New York was hit hard not only by COVID-19 pandemic-era job cuts, but also by residents fleeing the city for less expensive rental options when employees started working from home. Some just went across the Hudson River, while others moved all across the nation as the work-from-anywhere trend took hold. However, New York has recovered all the jobs lost during the pandemic, with its current employment base now sitting roughly 179,000 jobs, or 2.5%, above the pre-pandemic level from February 2020. Most recently, the metro recorded a net gain of 61,300 jobs in 2023, about a 1% year-over-year increase. While the number of jobs added over the past year ranked seventh nationally, it was less than half of New York’s annual average job gain prior to the pandemic (2015-2019). During the past year, job gains in New York-White Plains were most pronounced in the Education/Health Services sector.

New York-White Plains also has the nation’s largest apartment market with more than 1.9 million units. New York’s apartment market is dominated by units in high-rise buildings. Most of the low-rise and mid-rise properties are in the suburban submarkets of New York Northern Suburbs and South Westchester County. New York apartment market data is not included in national results since product there is not representative of the country’s typical apartment selection and weighting results for the large volume of units that exist in New York would skew national statistics.

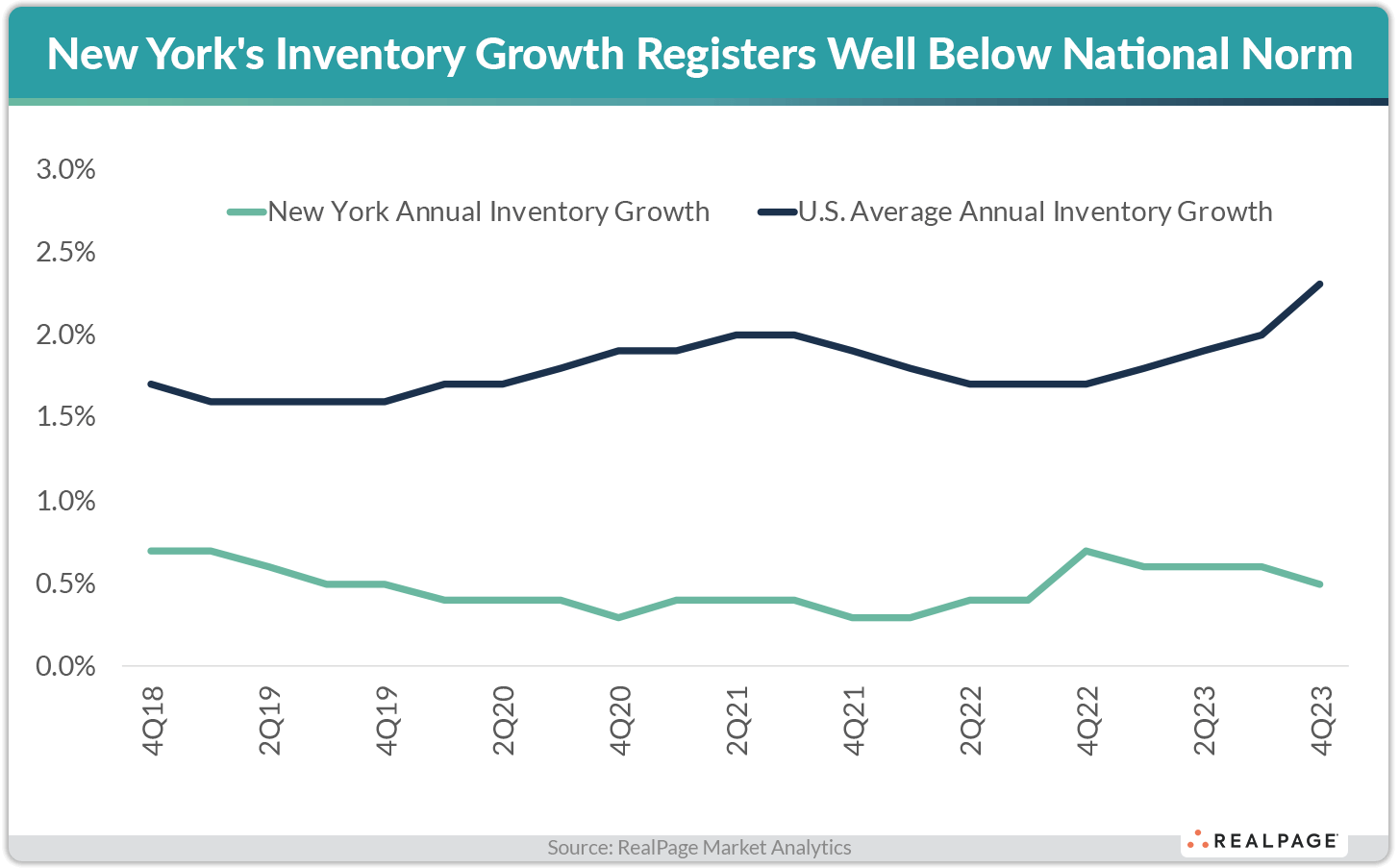

New York added nearly 47,000 new apartment units in the last five years, according to data from RealPage Market Analytics. Given New York’s high existing unit count, all those new units only increased inventory about 2%, well below the national average of 10%. More than half of New York’s completions in the last five years came online in just two submarkets: Brooklyn (14,530 units) and Queens (10,612 units). But since those are some of New York’s largest submarkets, new supply there only grew the existing unit count 3% to 4%, respectively.

In 2023, New York added 10,543 units for an annual expansion rate of just 0.5%, well below the U.S. average of 2.3%. In the past year, supply in New York was greatest in the Brooklyn (2,904 units) and Bronx (2,120 units) submarkets. At the end of 2023, there were 53,330 units under construction with 24,694 of those units scheduled to complete in 2024. If all those scheduled completions do wrap up in 2024, that would be the highest delivery volume since RealPage began tracking the market in 2008. Scheduled deliveries in the coming year are expected to be concentrated in Brooklyn (8,523 units), Queens (5,277 units) and South Westchester County (4,465 units), with those three submarkets capturing three-fourths of New York’s new supply.

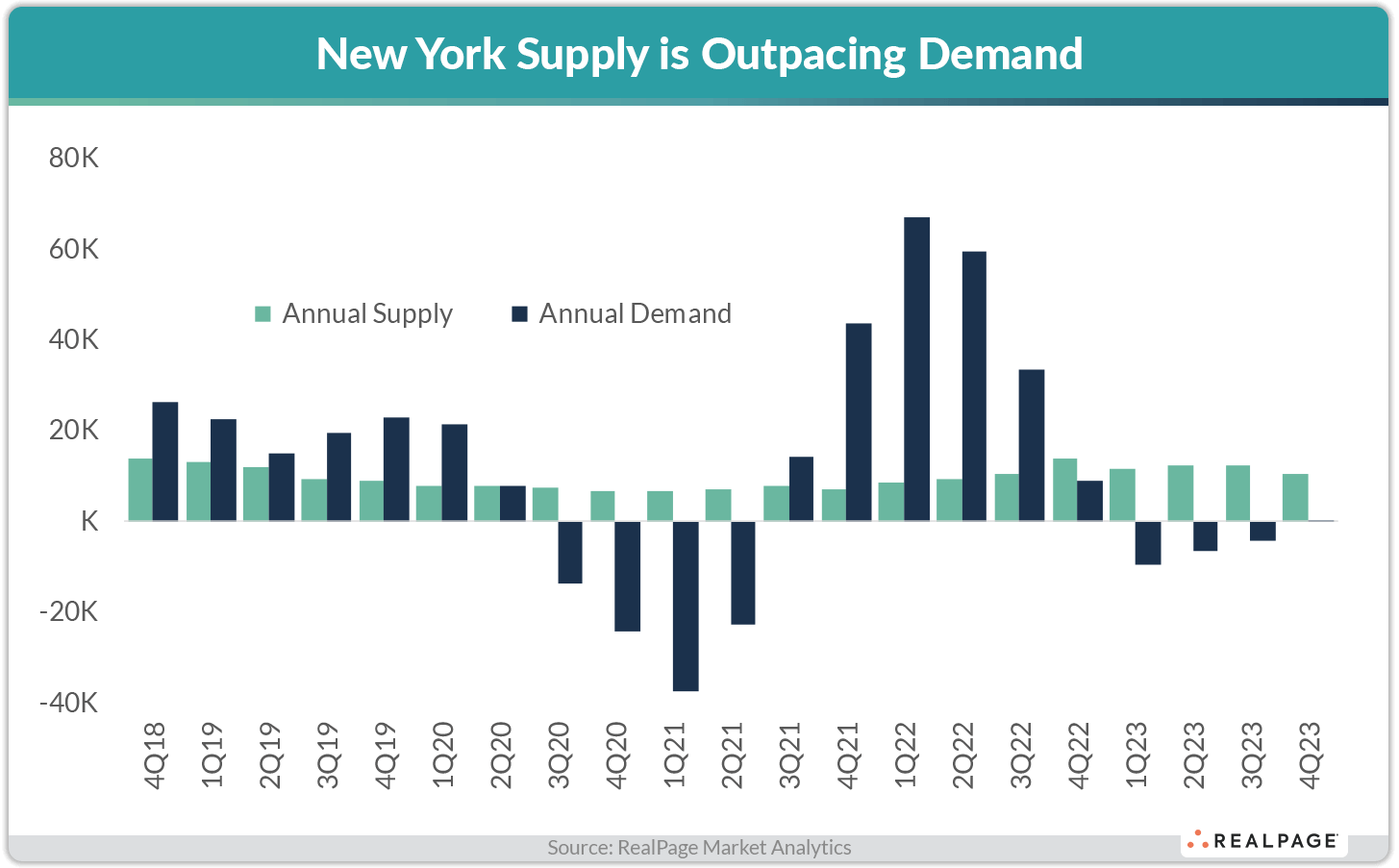

Supply in New York is currently outpacing demand, as the market recorded absorption of just 183 units in 2023. However, over the past five years, demand has exceeded new supply (51,242 units to 46,682 units). In fact, among the nation’s 50 largest apartment markets only New York and Chicago have seen five-year demand exceed five-year supply, with New York far outperforming Chicago by a wide margin. Among New York submarkets, the strongest absorption over the past five years was seen in Brooklyn (18,257 units), Queens (13,404 units) and the Bronx (9,459 units). Those areas accounted for 80% of the market’s total demand over the past five years. In the past year, demand was greatest in the Bronx (18,795 units) and to a much lesser degree the Brooklyn (2,140 units) and South Westchester County (1,918 units) submarkets.

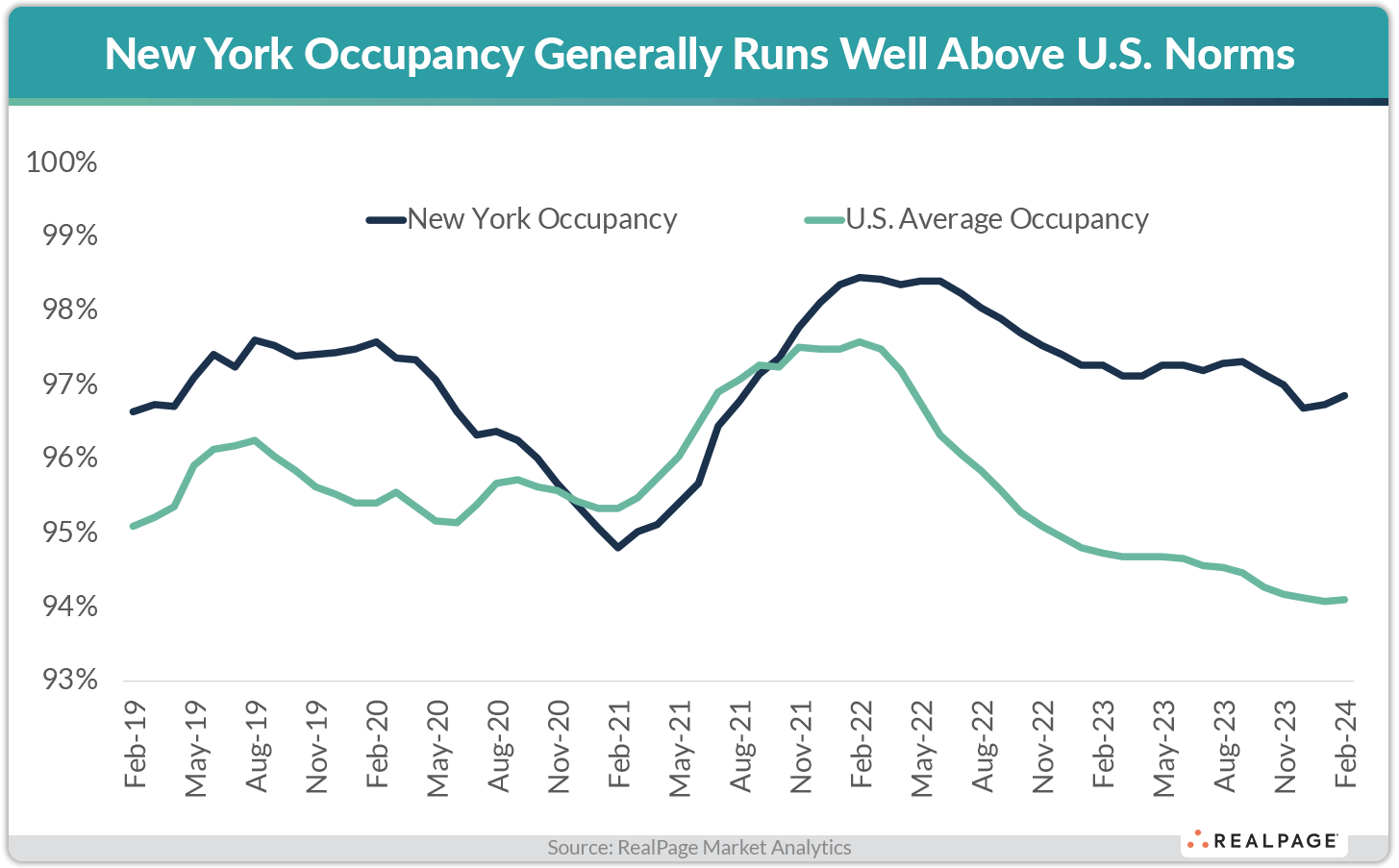

With supply outpacing demand over the past year or so, occupancy has been trending down. After reaching a decade high of 98.5% in February 2022, occupancy has contracted 160 basis points (bps) to register at 96.9% as of February 2024. Despite the backtracking, New York had the tightest February 2024 occupancy rate among the nation’s 50 largest apartment markets and came in 280 bps above the U.S. average. Except for a blip during 2021, occupancy in New York always registers well above national norms.

Most New York submarkets posted occupancy above the effectively full mark of 95% during February. Of those submarkets with sufficient sample, several recorded rates at or above 97%, with the Lower East Side topping the leaderboard at 99.3%. Among product classes in New York, February occupancy registered at 96.2% in Class A units, 98.1% in Class B stock and 94.8% in Class C units. High-rise buildings had the tightest occupancy of 97.1%, while low-rise buildings had the weakest reading of 95%. Meanwhile, mid-rise buildings were 96% occupied as of February.

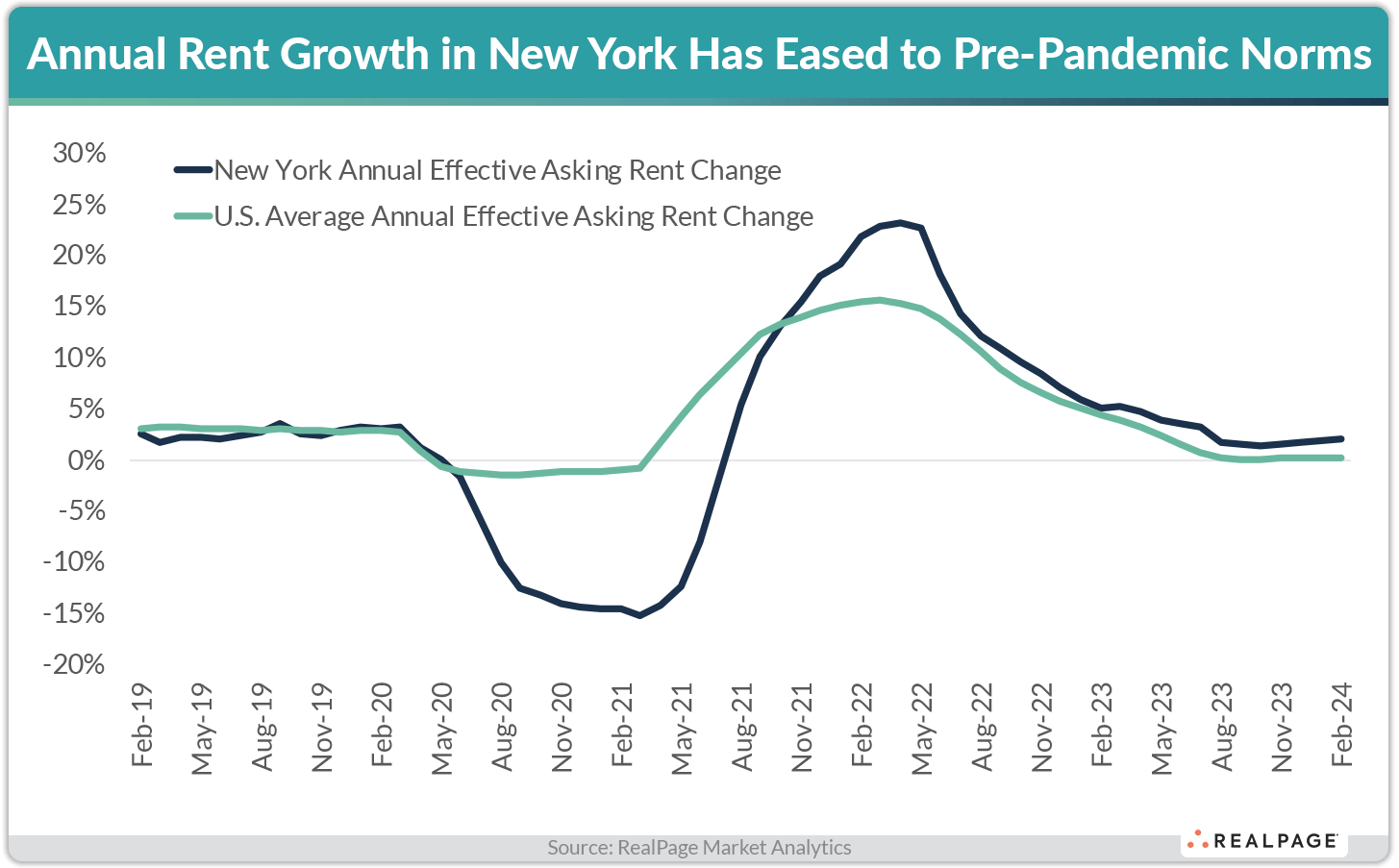

Similar to occupancy, rent growth has been trending down over the past year or so but remained above U.S. norms. In February, effective asking rents in New York rose 2.1%, well above the national average of 0.2% and ranking #14 among the 50 largest markets. Although New York’s recent rate increase was well below the market’s all-time high rent growth of 23.2% from April 2022, it registered near the pre-pandemic annual average of 1.6% from 2015 to 2019.

Every submarket in New York was able to eke out some rent growth over the past year. The strongest annual rent growth performances among submarkets with sufficient sample during the year-ending February 2024 were in the Upper East Side (4.6%) and Queens (3.7%). The weakest performances were in the Lower East Side (0.1%) and South Westchester County (0.5%). New York’s Class A units led for rent performance in February with a 2.6% year-over-year increase, while Class B and C product posted rent increases of 2% and 1.8%, respectively. Units in low-rise communities commanded the largest year-over-year price bump in February, with a 2.6% rent hike, followed by high-rise units which recorded a 2.2% rate increase. Units in mid-rise properties recorded a milder 0.8% increase.

New York claims the highest rents in the nation, averaging $4,458 per month as of February 2024. New York’s submarkets present a wide range of prices, with six submarkets exceeding the $5,000 per month threshold. The priciest submarkets were the Lower West Side ($5,559 per month) and Midtown East ($5,527 per month), while the most affordable submarket was New York Northern Suburbs ($2,266 per month).