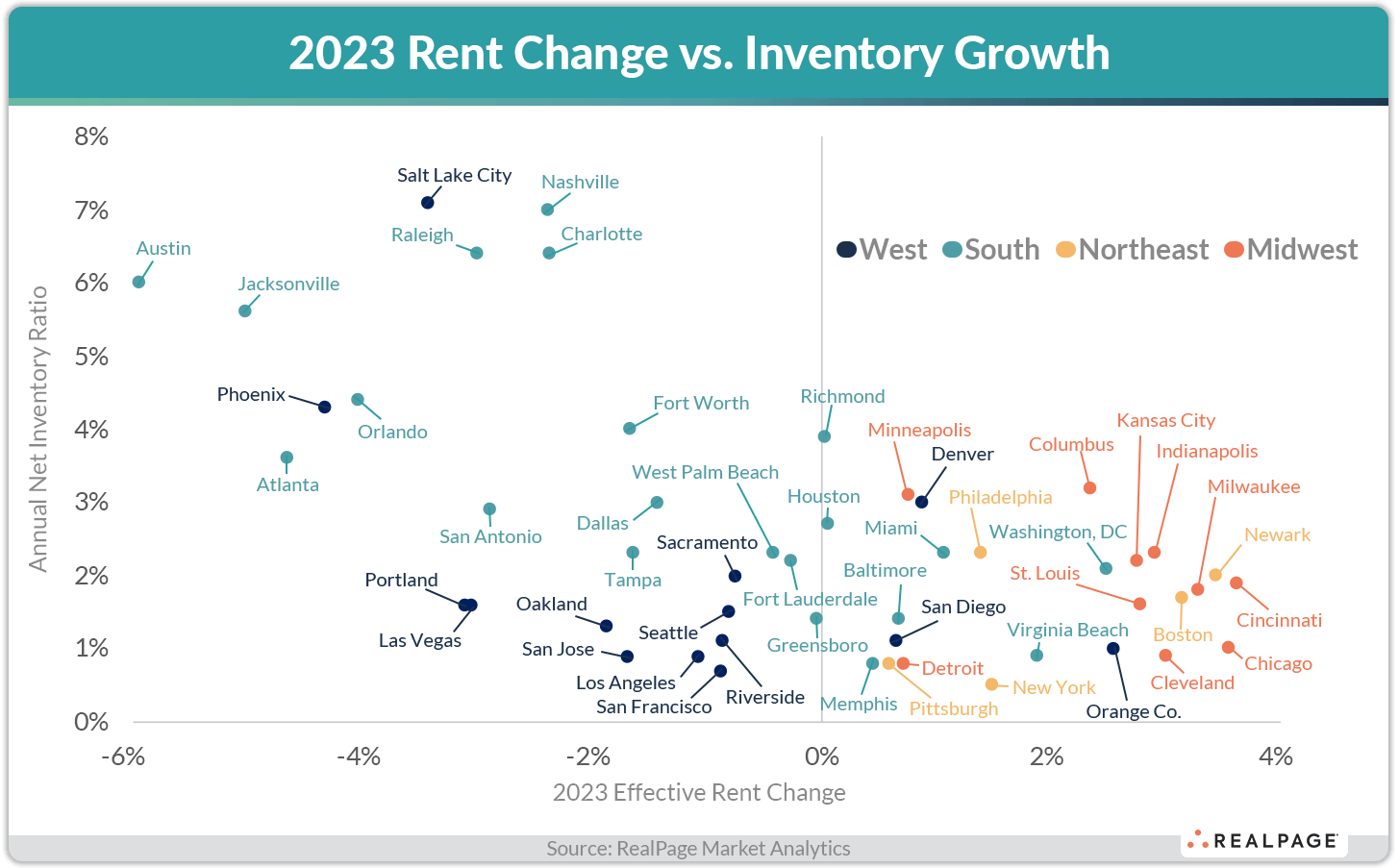

We know there is a direct inverse relationship between apartment rent growth and apartment inventory growth. The more apartment units a market builds, the more downward pressure operators face to keep prices low. The fewer apartment units a market builds, the more runway operators have to realize pricing power.

In 2023, that was on full display as developers delivered an astounding 440,000 apartment units nationwide. During calendar 2023, occupancy dipped 90 basis points (bps) under the weight of all that new supply and rents ticked up a minor 0.2%, according to data from RealPage Market Analytics.

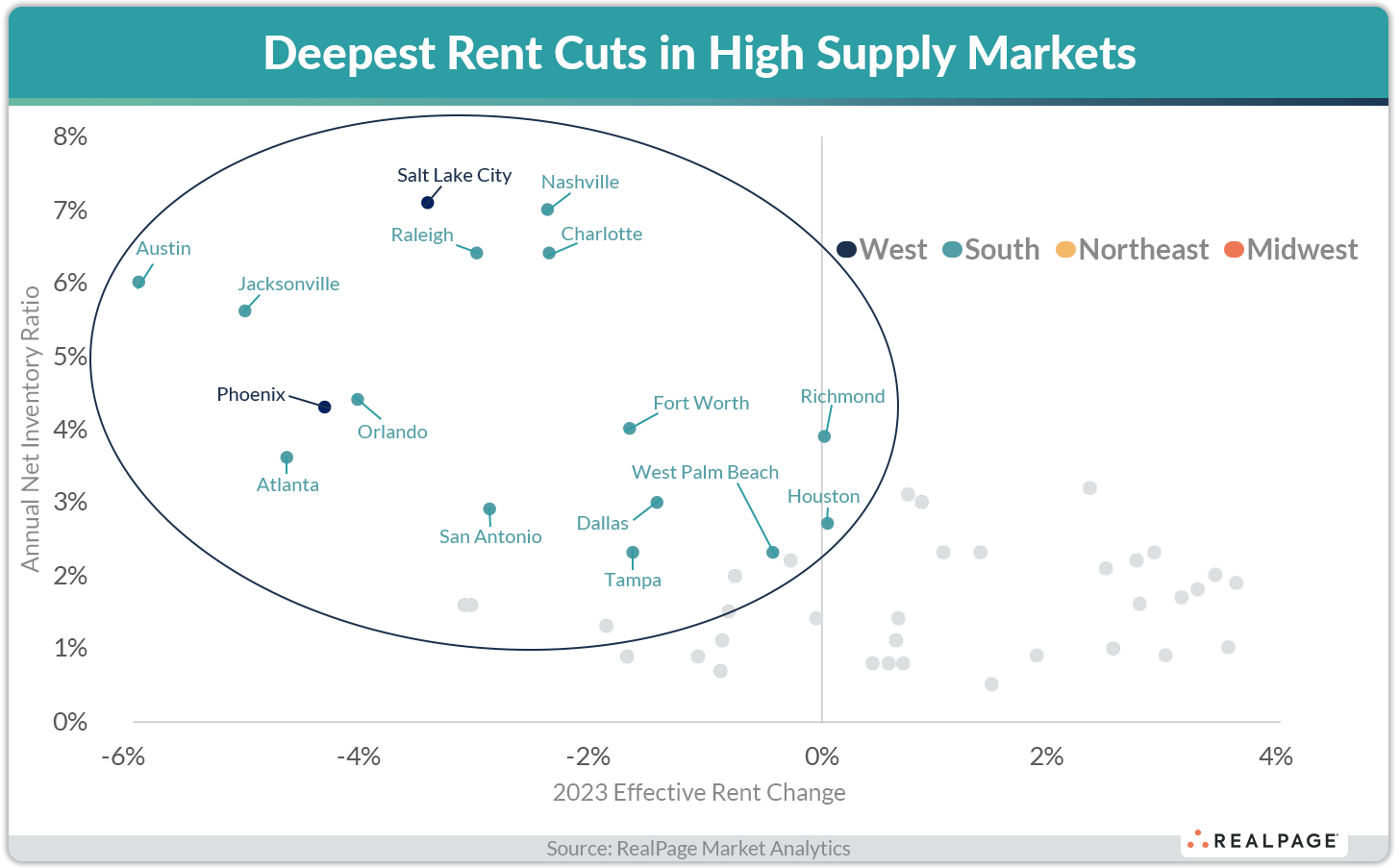

Markets with High Supply and Deep Rent Cuts

Unsurprisingly, the markets that delivered the highest ratio of new inventory also tended to cut rents at the deepest clip. Of the nation’s 50 largest apartment markets, 17 added inventory at a rate above the national average (2.8%) in 2023. Among those high supply markets, Salt Lake City and Nashville stand out as the clear supply heavyweights, both growing total inventory 7% or more in 2023 alone. Those 17 high supply markets saw effective asking rents come down by 2.2% on average in 2023, compared to marginal growth nationally. Some high supply markets posted especially deep rent cuts – such as Austin, Jacksonville and Atlanta.

Markets with Low Supply and High Rent Growth

Plenty of markets grew inventory below the national norm in 2023 and subsequently realized annual effective rent growth above the national norm. In total, 20 of the nation’s 50 largest markets posted 2023 inventory growth below 2.8% and rent growth above 0.2%. For the most part, these markets were in the Midwest, with Cincinnati, Chicago, Milwaukee and Cleveland all posting 2023 rent growth of 3% or higher. Characteristically slow-and-steady markets tended to pop up in this list as well, including Boston, Philadelphia, Baltimore and Pittsburgh. Few Sun Belt markets made this list, as that region is generally adding more inventory than anywhere else in the nation. Miami and Memphis are perhaps the only two exceptions within the Sun Belt.

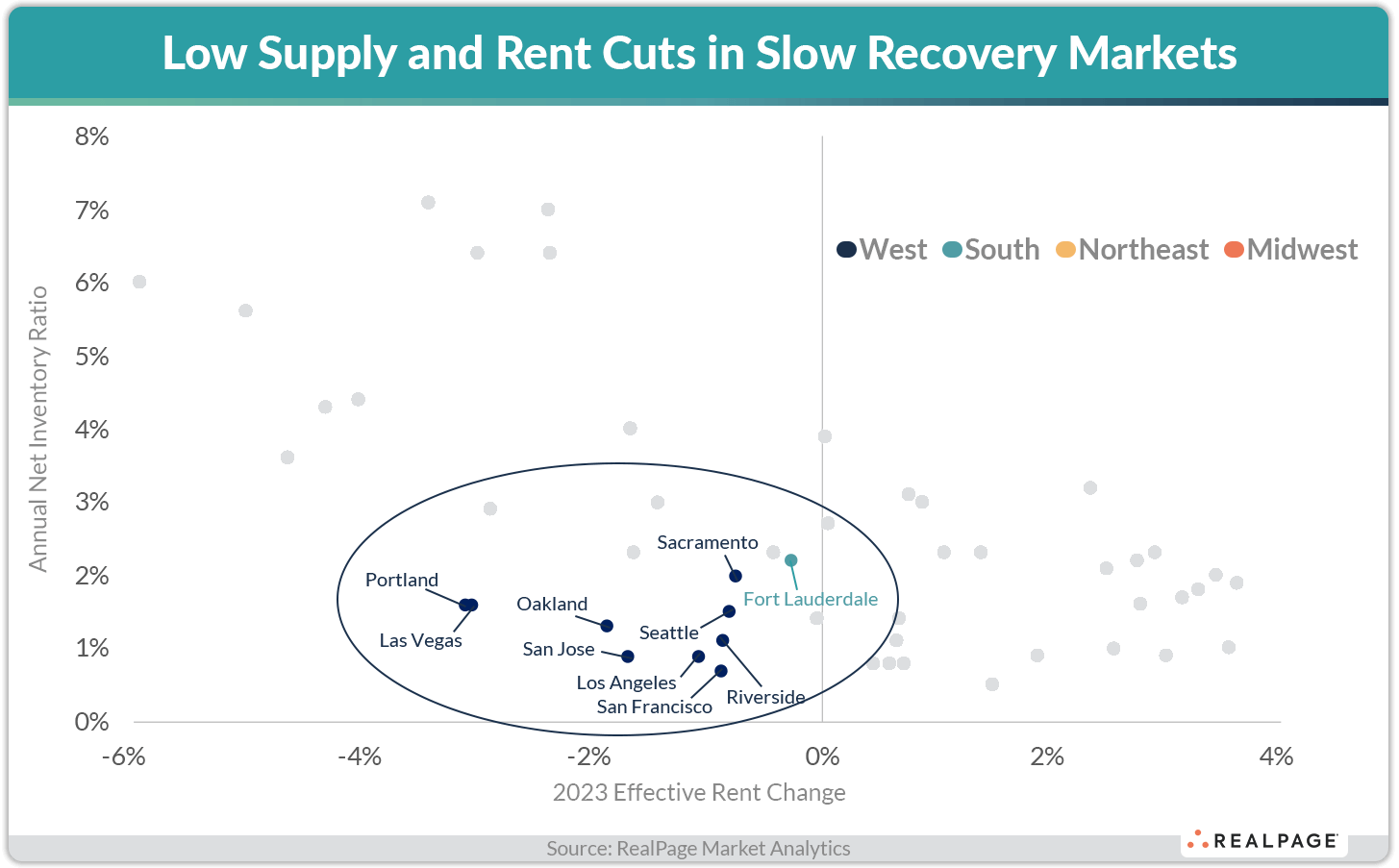

Markets with Low Supply and Rent Cuts

A smaller grouping of markets posted both low inventory growth – or at least lower inventory growth than the national norm of 2.8% – and rent cuts. These markets were overwhelmingly located in the West region of the country, with the only exception being Fort Lauderdale. Fort Lauderdale grew total inventory 2.2% in 2023, registering a marginal 10 bps below the U.S. average, so perhaps its inclusion in this list is unwarranted. Conversely, a couple of these West region markets have struggled with demand throughout the pandemic recovery period. In these demand-challenged markets, such as San Francisco, Portland and Sacramento, operators have struggled to maintain pricing power amid demographic headwinds.

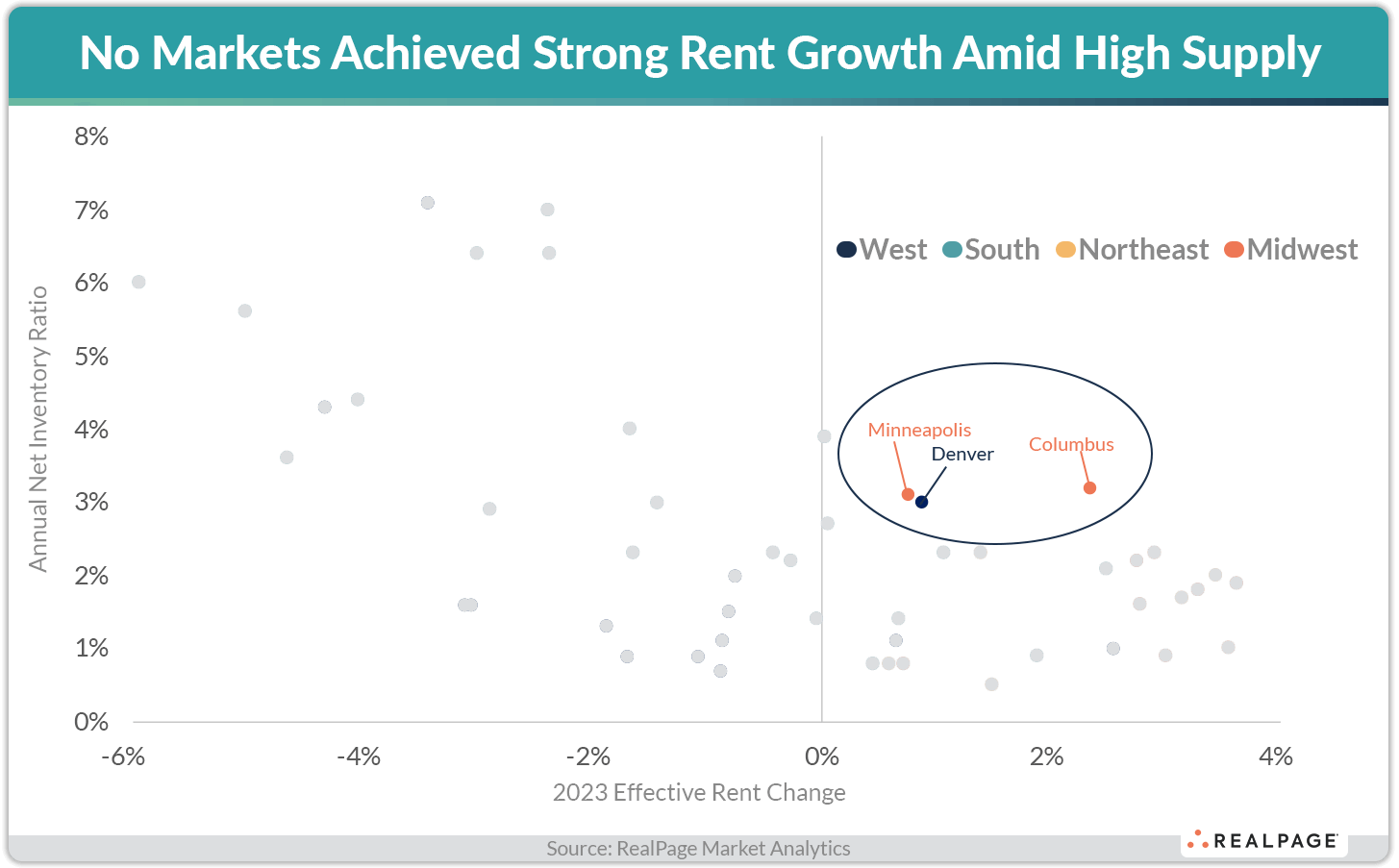

Markets with High Supply and Rent Growth

Only three major markets managed to grow inventory at a faster rate than the U.S. average and post rent growth above the near-stagnant norm nationally. Those three markets – Columbus, Minneapolis and Denver – mark notable exceptions. Still, those three markets grew total inventories between 3% and 3.2% in 2023, so within 40 bps of the national norm. Predictably, no markets posted both strong rent growth and high supply in 2023.