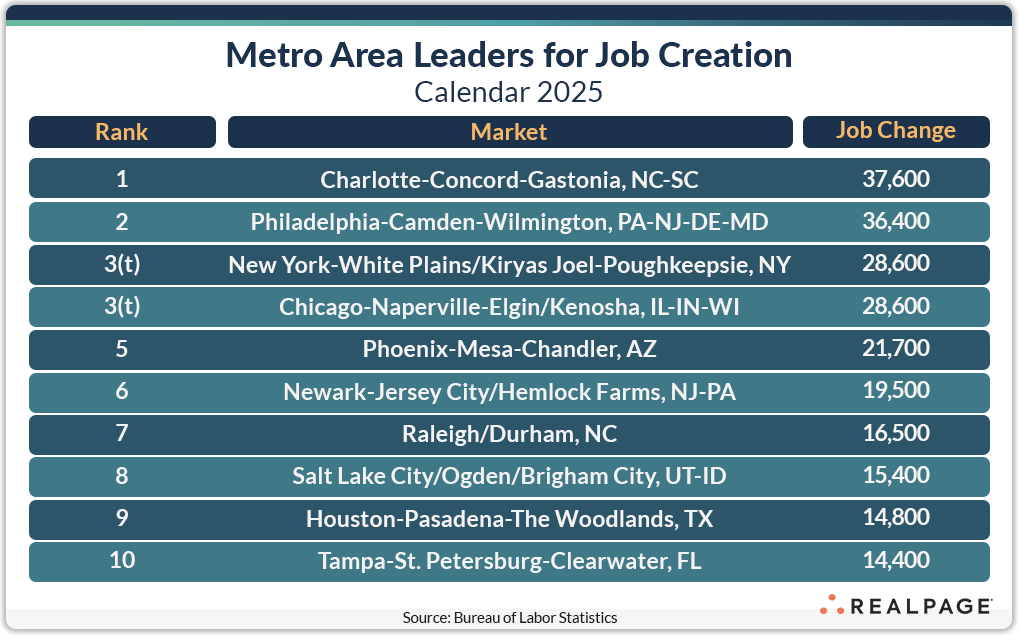

The Charlotte-Concord-Gastonia metro area led the country for job gains for 2025 with 37,600 new jobs created for the year. That was an improvement of 21,800 jobs from 2024’s total. However, the Queen City’s jump to the top was less about their gains, as it was about the falling off of other previously strong markets.

The December release of employment estimates from the Bureau of Labor Statistics (BLS) revealed that job gains have slowed sharply or are retrenching in many of the nation’s metropolitan areas compared to one year ago.

Only two of last year’s top markets for job gains returned to the top 10 list for calendar 2025. New York and Houston remained among the top markets for job gains, but their numbers were drastically reduced. Missing from the list were such typically strong markets like Washington, DC, Dallas, Austin, Atlanta and Los Angeles.

Moving up to the top 10 list in December were Philadelphia, Chicago, Raleigh/Durham, Salt Lake City, Newark/New Brunswick and Tampa.

Perennial leader – New York – saw a reduction in job creation of almost 111,000 jobs compared to last year, while Houston’s gains were down by almost 35,000 jobs. Washington, DC’s shutdown-related losses of about 56,000 jobs in 2025 swung their net job change to -118,400. The remainder of last year’s top 10 markets averaged decreases of from 30,000 to 45,000 jobs.

At the end of 2024, the top 10 job creation markets summed to 493,600 new jobs compared to this year’s top 10 total of 233,500 jobs. The current top list members created 337,500 new jobs in 2024, a reduction of about 31% or 104,300 fewer jobs.

The top 10 markets were not the only ones to see lower job creation totals, as the next 10 markets (#11 to #20) of RealPage’s top job gain markets saw their total gains decrease 23.4% from last year to 110,200 new jobs. There were no markets that gained more than 40,000 jobs in calendar 2025.

Led by Washington, DC’s federal funding-related cutbacks, a total of 49 of our top 150 markets reported annual job losses for the year in December, 18 more than in November. In addition to Washington, DC, job losses occurred along the West Coast (Bay Area, Los Angeles, Seattle, Portland), in the Midwest (Milwaukee, Kansas City, Cincinnati, Omaha) and in the Desert Southwest (Las Vegas, Tucson, El Paso) among the larger markets.

Job Growth

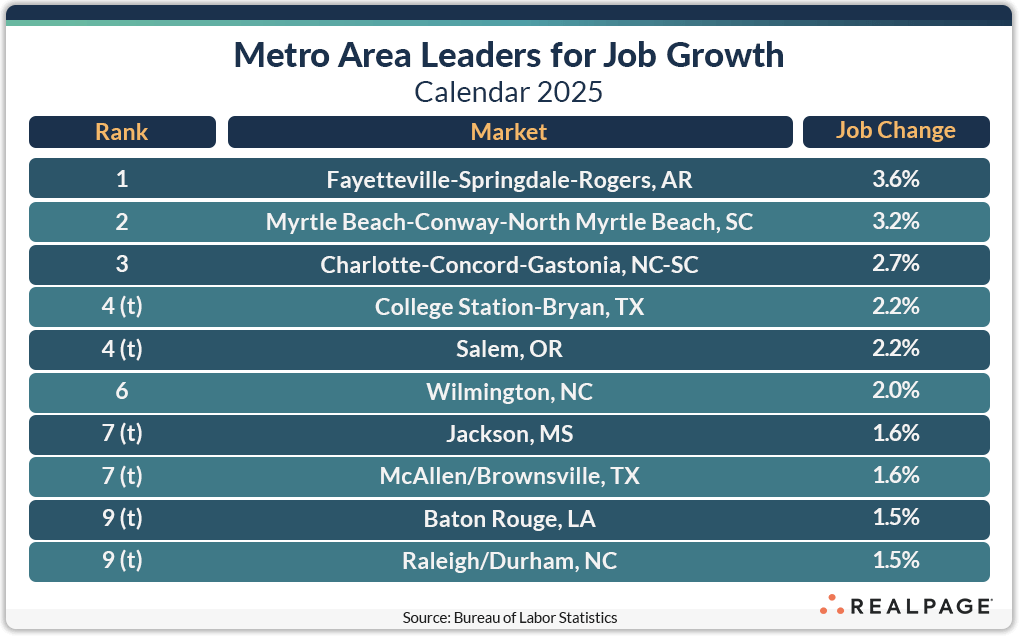

Unlike the top job gain markets, which tend to be large in population and employment, smaller markets usually dominate the top markets for annual percentage change in employment. As we typically see, state capitals, college towns and resort or tourist destination cities dominate this list. Eight of November’s top markets for job change returned to the December list.

Fayetteville-Springdale-Rogers, AR and Myrtle Beach-Conway-North Myrtle Beach, SC returned in the top two spots for job growth in calendar 2025, but the pace of growth dropped 20 and 50 basis points (bps) from last month, respectively.

Job creation leader Charlotte ranked #3 for percentage change with 2.7% growth, unchanged from November, while College Station-Bryan, TX and Salem, OR tied for #4 with 2.2% growth each.

Wilmington, NC, Jackson, MS and McAllen/Brownsville, TX also returned among the top markets for job growth as Baton Rouge, LA and Raleigh/Durham, NC joined this month’s list.

Only five of the top 10 job growth markets had greater growth rates than one year ago, led by Charlotte with a 160-bps increase. The top two – Fayetteville and Myrtle Beach – also increased their gain in employment by at least 100 bps. Outside of the top 10 growth markets, Charleston, NC, Salt Lake City, Columbus, OH and Philadelphia had employment growth rates of between 1.2% and 1.4%. Including the top 10, there were 74 markets that exceeded the national not seasonally adjusted growth rate of 0.3%.

This post is part of a series by RealPage Senior Real Estate Economist Chuck Ehmann analyzing employment data from the Bureau of Labor Statistics. For more on this data, read previous posts on Job Growth.