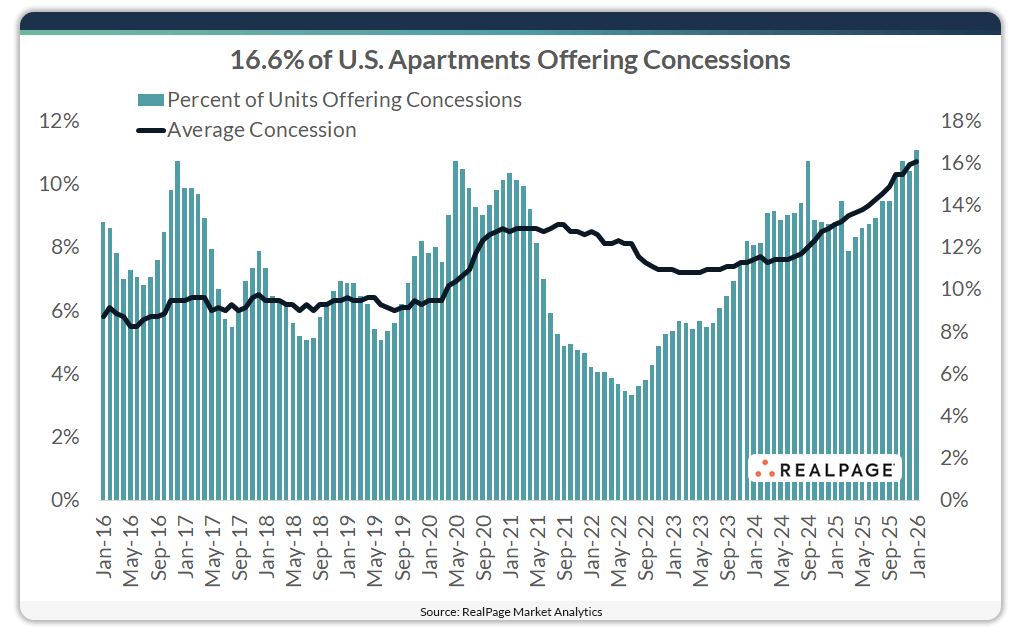

U.S. apartment concession activity climbed in January 2026, reversing course from December 2025’s modest dip. Nationwide, 16.6% of stabilized apartments offered concessions in January, according to data from RealPage Market Analytics. That was a full point above December’s rate and marks the highest monthly usage since mid-2014. The average January discount of 10.7% held essentially steady with 4th quarter 2025 yet ticked up a slight 0.4 points from October’s reading. Concession levels have trended upward over the past three years and now sit at their deepest discount rate since the post–Great Financial Crisis period (2010). Class A units posted the deepest concession discount at 11%, remaining relatively unchanged since October. However, Class B (10.3%) and Class C (10.8%) product each saw concessions deepen 0.4 points over that period. Class C properties continued to show the highest concession usage, with 23.1% offering a discount in January. By comparison, usage in Class A (12.5%) and Class B (14.6%) units was somewhat milder. Top-tier Class A product was the only segment to record a slight decrease, dipping 0.9 points month-over-month. Across floorplans, concession performance was relatively similar among one-bedroom, two-bedroom and three-bedroom units, landing close to overall U.S. averages. By contrast, efficiency units posted the weakest performance, with 19% offering discounts averaging 12.1%.