Behind the curtain of the build-to-rent (BTR) space is a well-developed playbook constructed from what was once a speculative investment but now ranks as one of the fastest-growing rental segments in the multifamily space.

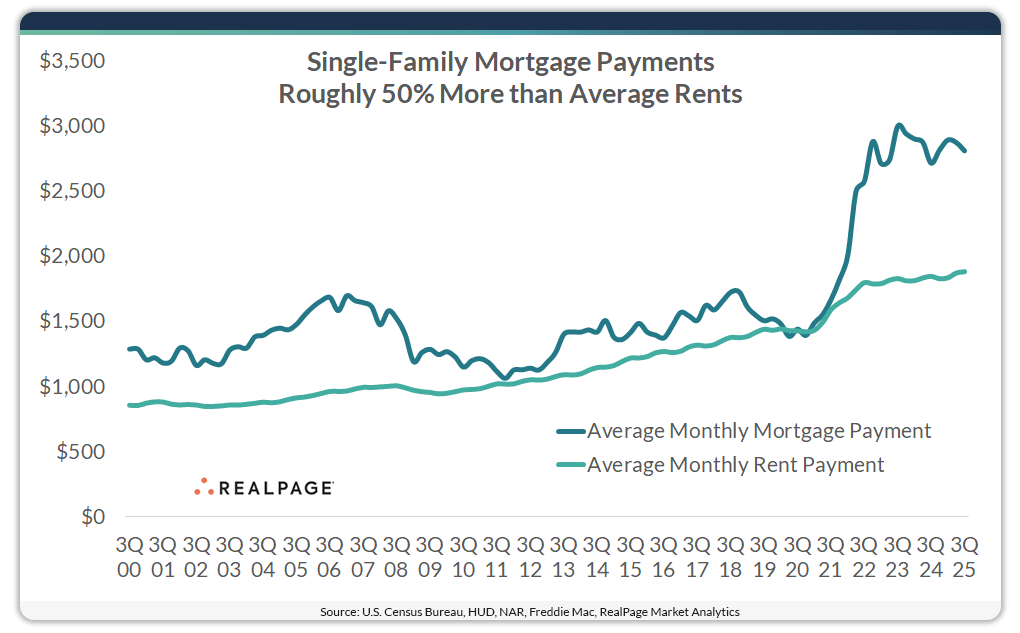

Several key factors are driving the momentum seen in the BTR space. First and foremost is the affordability gap between owning and renting, which has reached the widest gap on record. The average U.S. home surpasses median household income by more than seven times.

Additionally, single-family mortgage payments eclipse rents notably. Around 2021, mortgage costs began to climb sharply. Today, the average monthly mortgage payment is over $2,800, about 50% higher than the average monthly rent payment which averaged about $1,900 per month as of 2025.

Several factors contribute to the gap including the cost of property taxes and insurance which account for nearly one-third of the monthly mortgage payment in many markets.

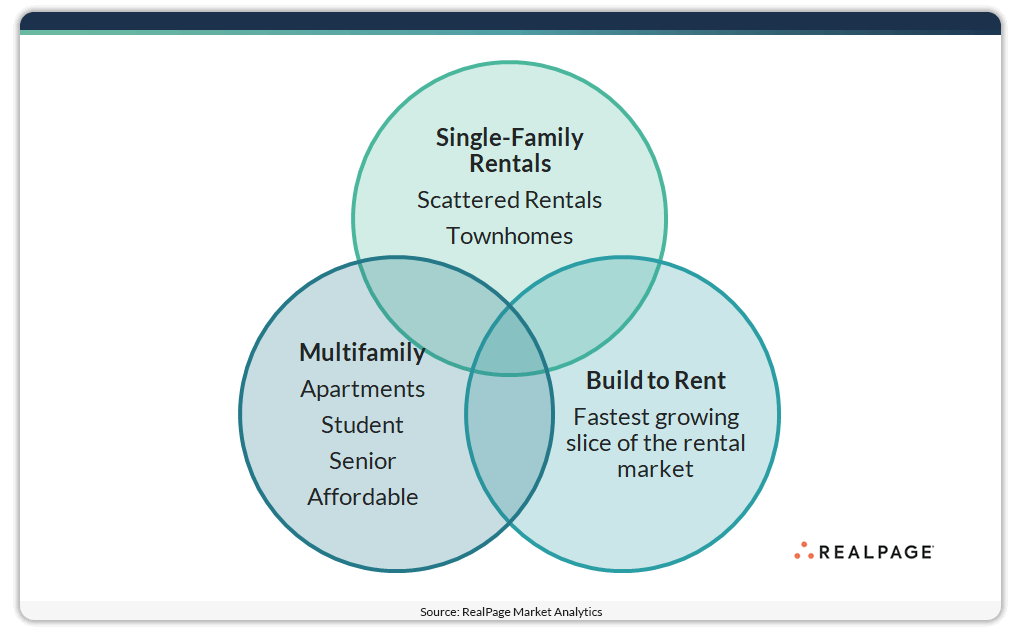

It’s important to note that BTR does not replace multifamily. Instead, it extends the choices renters, investors, developers and operators have in the rental market. Importantly, it serves a niche of renters that may remain in the rental market longer, filling a desire for space, privacy and community, some of those added benefits that accompany single-family living.

As of 2025, RealPage is tracking nearly 20.3 million conventional apartment units. The rental universe is not simply composed of multifamily units. Nearly 20 million single-family homes are leased out across the nation’s neighborhoods, often managed by individual owners.

BTR adds a third sphere to rental options filling a niche that provides residents with rental experiences similar to single-family ownership with detached homes with yards, garages and a neighborhood feel that is professionally managed, typically featuring multifamily amenities.

Digging into the numbers, BTR has deep roots in the Sun Belt. The sector emerged nationally around 2019 with Phoenix leading the way. Today, RealPage estimates more than 120,000 BTR units operating nationwide. Nearly 40,000 BTR units completed in 2024. At least 90,000 BTR units are at various stages in the pipeline.

The BTR sector reflects resilience. In the next year, look for supply, rents and occupancy to move with local cycles as operators focus on stabilizing new communities and keeping collections consistent. Over the next three years, pipeline growth is expected to deepen in the Sun Belt and Southeast regions where absorption is strongest.

For more information on the state of the BTR landscape, watch the on-demand BTR webcast: Build-to-Rent Playbook.