Record volumes of new apartment supply are giving the average U.S. renter more options from which to choose. But demand trends remain favorable in lease-up properties yet to hit stabilization.

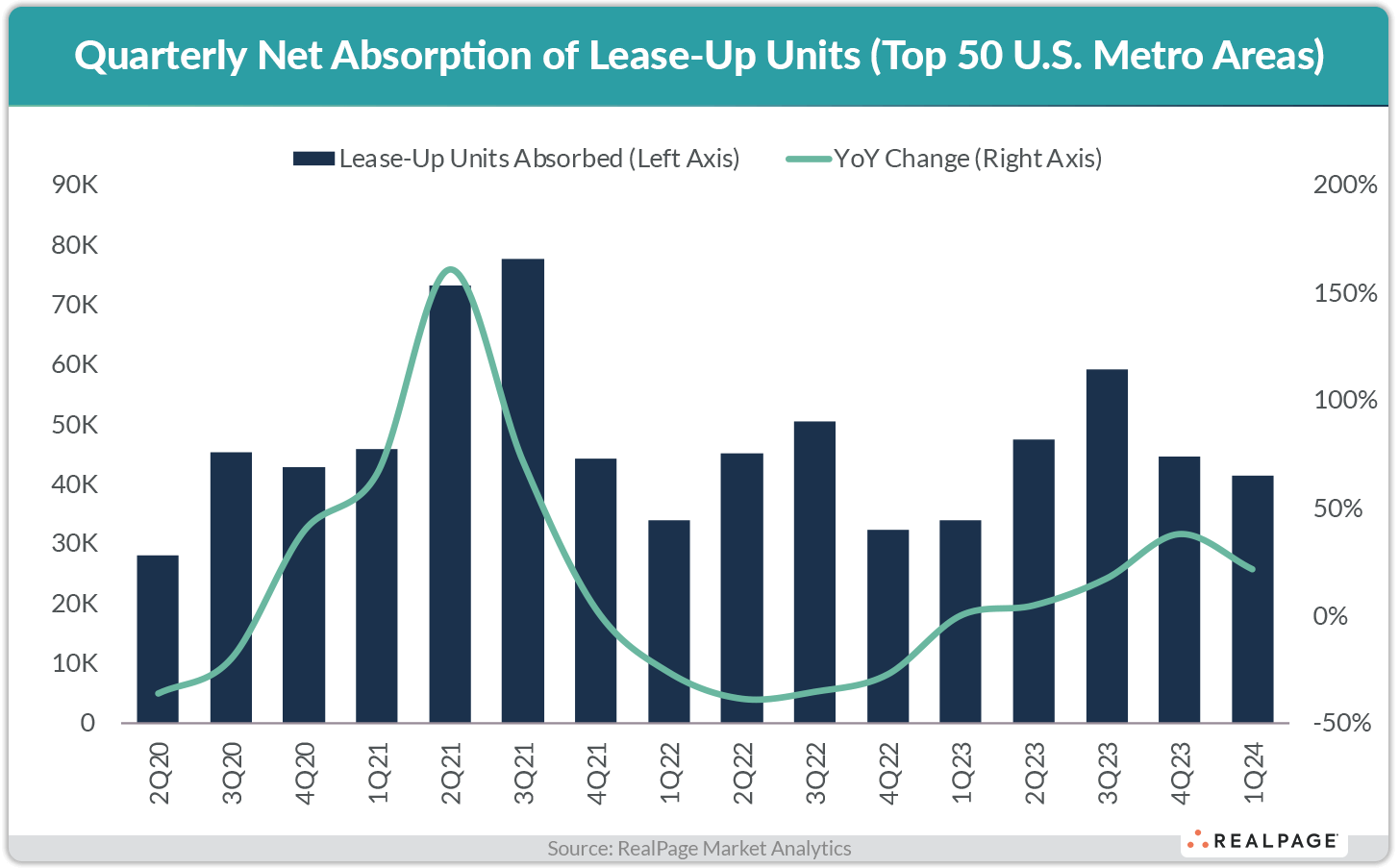

Among these assets going through the initial lease-up phase, about 40,000 units were absorbed in 1st quarter 2024. That number is up about 20% more than 1st quarter 2023 volumes.

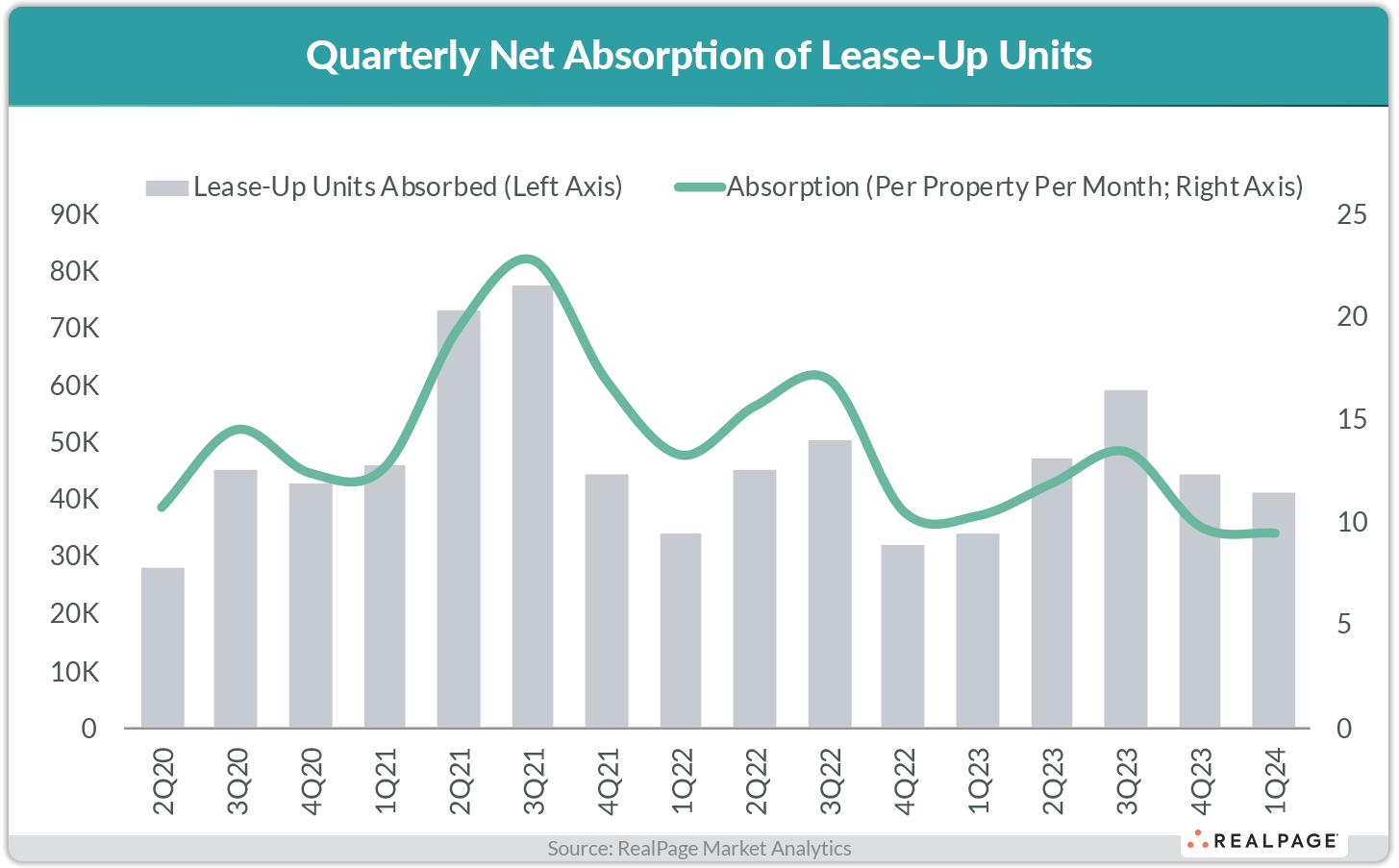

Despite this impressive data, many operators report that lease-up demand doesn’t feel strong. And they aren’t wrong. There is a disconnect between these market-level figures and property-level figures. As supply levels continue to rise, so has competition. Thus, the amount of leases filtering to each property is below what you’d expect.

The average lease-up community is executing about 10 to 11 leases per month, which is down 10% from last year, despite a 20% increase in overall absorption.

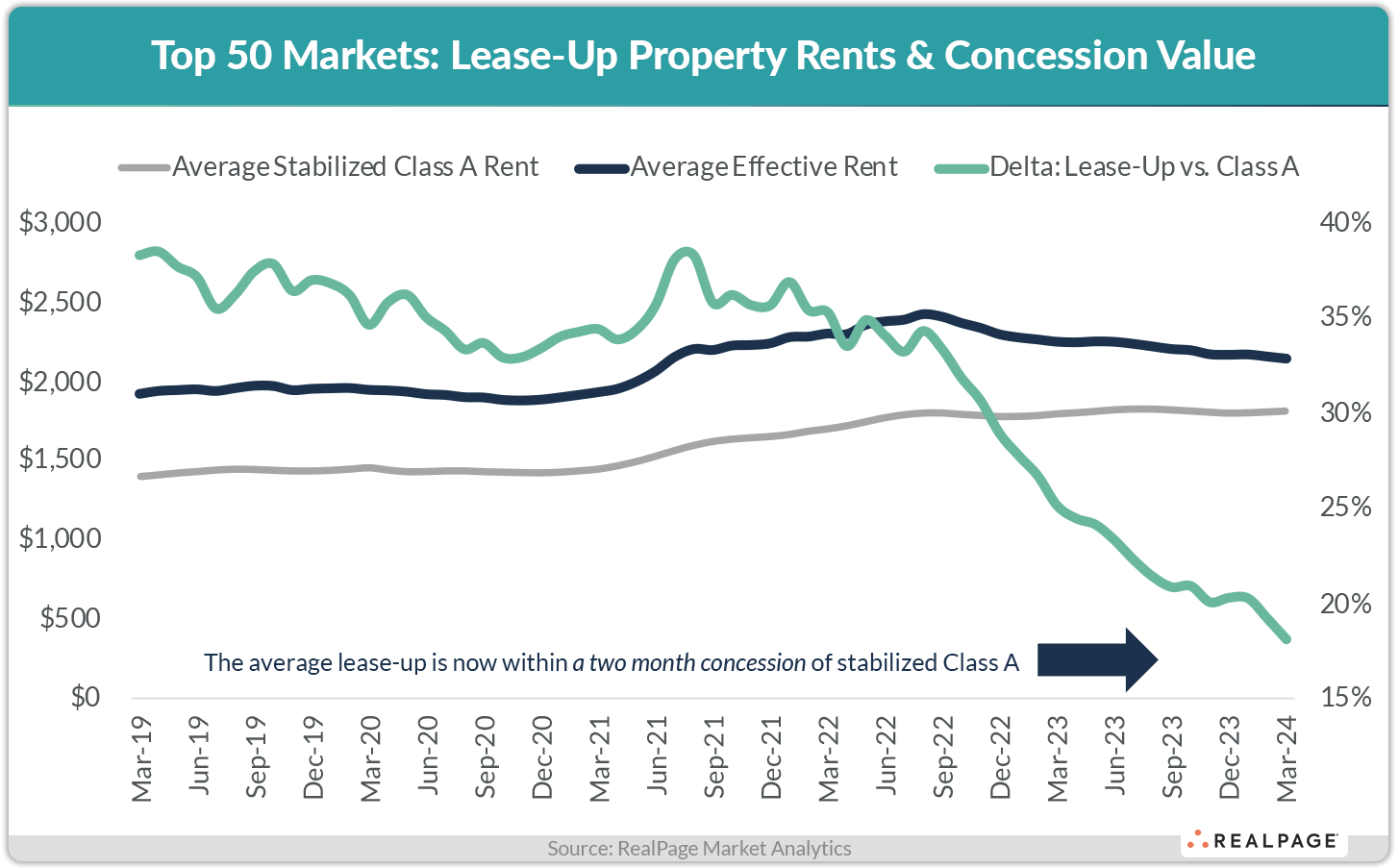

This disconnect is the reason we are seeing weaker-than-average rent growth, especially in lease-up properties where the pressure is on to fill up as quickly as possible.

While lease-up concessions haven’t gone up all that much recently, asking rents have been cut, causing a shrinking delta between Class A rents and lease-up rents. Because of that, there’s only two months worth of concessions difference between a Class A asset and a lease-up property.

As lease-up properties become more competitive, it’s not a huge leap to imagine someone choosing a lease-up unit over their current Class A property.