After Rapid Cooldown, Apartment Rents Plateau (For Now)

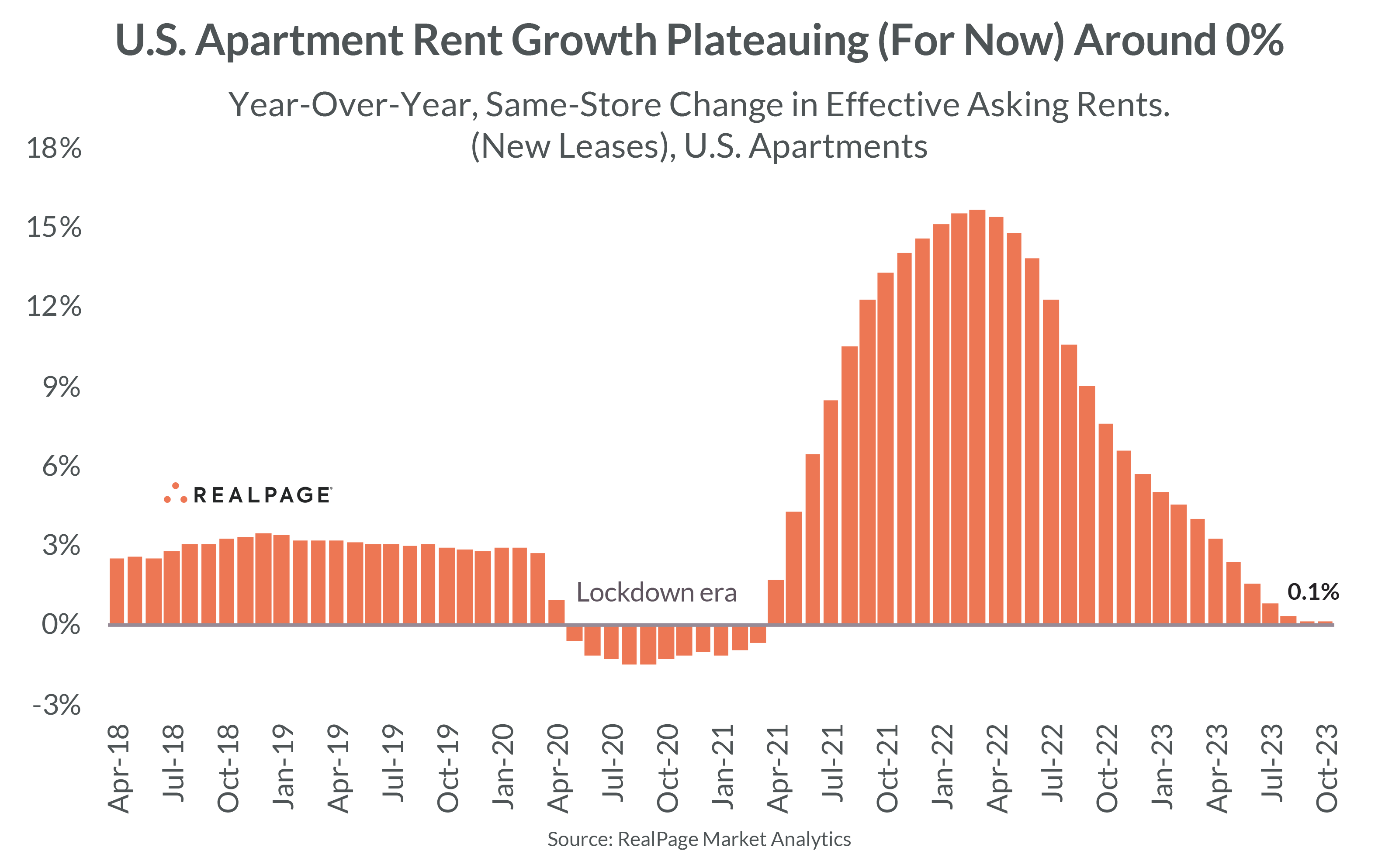

For the first time in three years, the year-over-year apartment rent growth trendline isn’t moving like a roller coaster. National rent growth held steady at a flat 0.1% annually for a second consecutive month in October – pushing the pause button on what had been 18 straight months of cooling that followed a similar stretch of increases.

But beneath the headline number, it’s a bit more complicated story around what’s called the base effect. On a month-over-month basis, effective rents fell 0.56% in October 2023. That compared to a 0.54% cut in October 2022, according to data from RealPage Market Analytics. Those cuts rank as the deepest for any October since the Great Financial Crisis.

In other words: One deep monthly cut is replacing another in the year-over-year calculation, creating the appearance of stability in the year-over-year rent metric.

The base effect will likely remain at play through the winter due to bigger-than-normal cuts over the same period last year, which could keep the headline rent metric pretty flat.

The bigger question could be what happens in the first half of 2024. At that point, the base effect is less severe at the same time new supply levels will be peaking at multi-decade highs.

It’s All About Supply

As a reminder: It’s still all about supply. There’s still a lot of demand for apartments in 2023. Just not enough to keep pace with the nation’s biggest apartment construction spree in 50+ years. That wave came as a result of big rent growth and low vacancy of 2021 and early 2022.

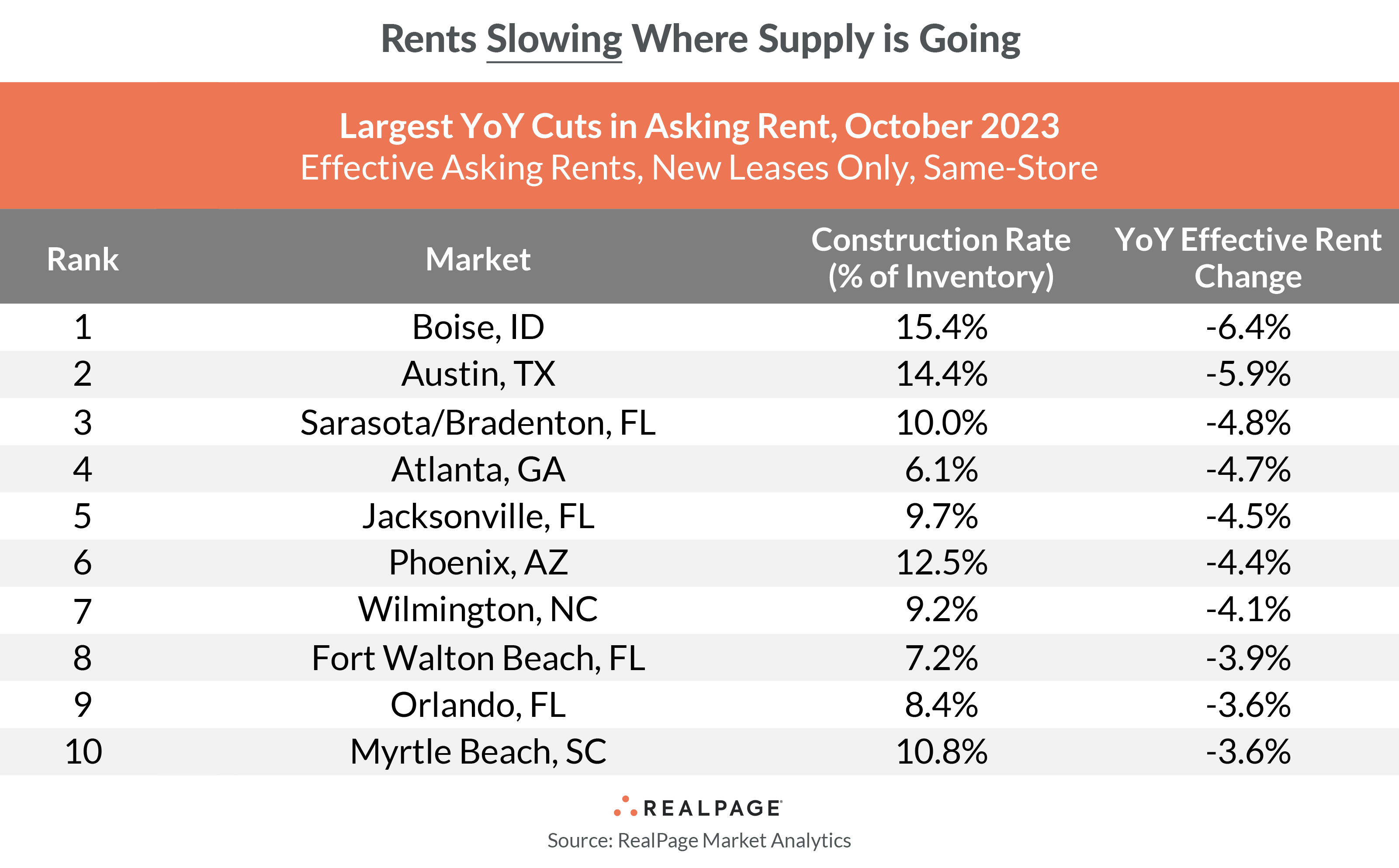

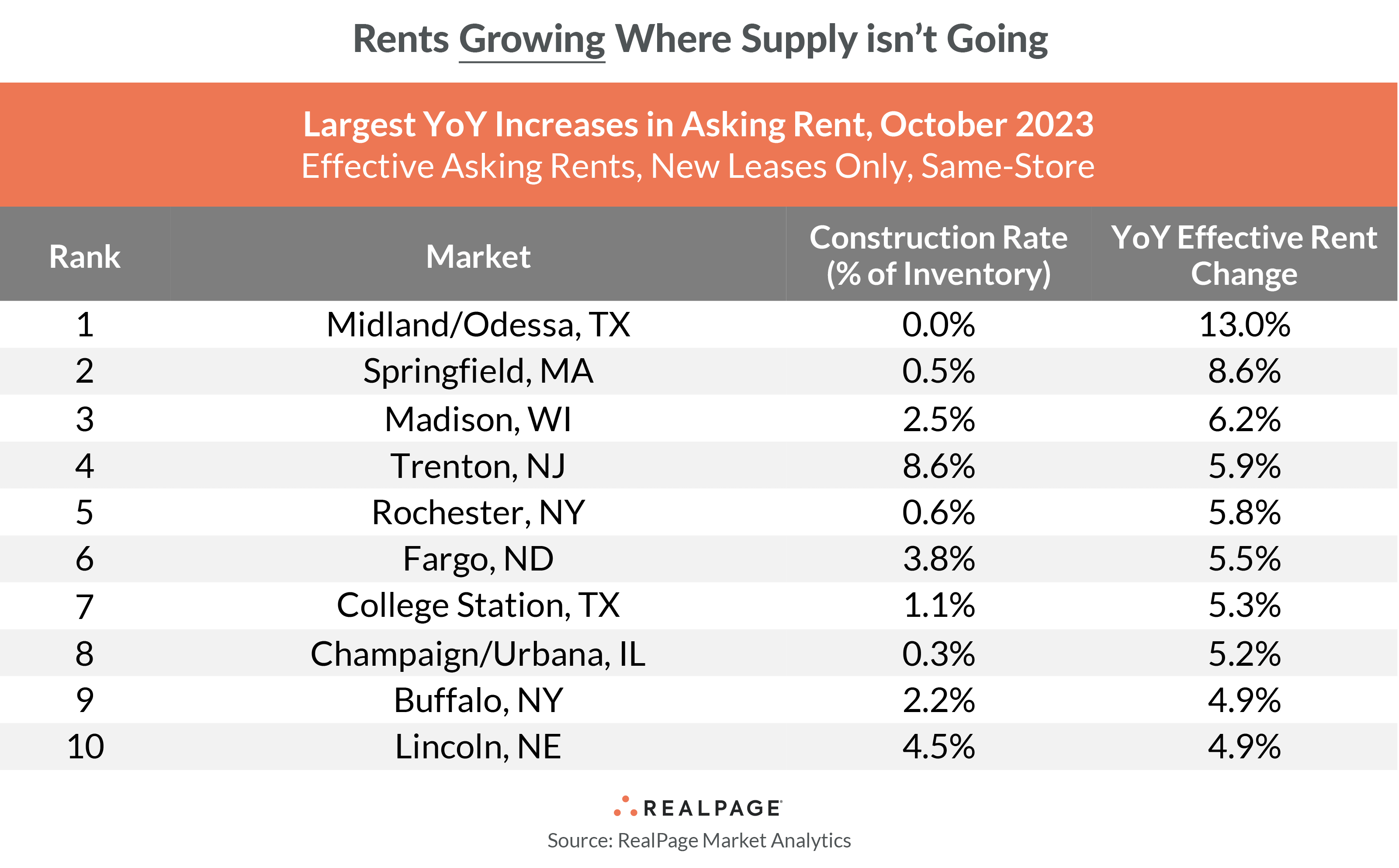

More specifically: Supply is creating a tale of two markets – those with and those without. Rents are cooling fastest where supply is growing fastest.

Among the markets still seeing sizable rent growth, nearly all are adding new supply at below-average rates. In fact, of the 21 markets with rent growth at or above 4% annually, all but one had a construction rate (total units under way as a share of total existing inventory) below the U.S. average.

And among markets cutting rents the most, nearly all are adding new supply at above-average rates.

In fact, of the 10 markets cutting rents by more than 3.5%, all 10 had construction rates well above the national norm. Rents fell deepest in Boise (6.4%) and Austin (5.9%) – two markets with strong renter demand, yet rents slowed by construction rates nearly three times the national average.

In the high-supply areas, lease-ups are having a bigger-than-expected impact on even lower-priced apartments. Occupancy has declined in all asset classes, and in turn, rents have fallen. That pattern appears likely to continue through 2024. “Heads in beds” is the industry manta these days, which means operators give on rents in order to protect occupancy.

But in lower-supply markets, it appears rent growth is leveling off and likely to remain moderately positive. That’ll be especially true in the Northeast and Midwest regions, where supply is limited.

Wage Growth Outpacing Rents

On the plus side: October will almost certainly mark the 11th consecutive month where wage increases outpace rent increases – a trend that’ll likely persist through next year. That could erase all of the rent-over-wage bump of 2021 and early 2022, and in turn help further widen the demand funnel.

As mid- and upper-income renters continue to move up from older units to newer (and typically pricier) units, the affordability gains should help backfill older, moderately priced units.

The current supply wave extends into early 2025. After that, supply will drop off precipitously due to rapidly slowing construction starts this year. In turn, occupancy rates should rebound and rent growth pick back up – though unlikely to the degree seen in the inflationary period of 2021 and early 2022.