Most markets around the country have been experiencing deflating occupancy rates after the post-pandemic surge in occupancy and rents in 2021 and 2022. Consequently, rent growth has also slowed or backtracked as owners and landlords have sacrificed pricing power in order to compete for renters and maintain occupancy and cash flow. Additionally, new supply is surging around the country and is impacting market fundamentals in the markets and submarkets where it is concentrated.

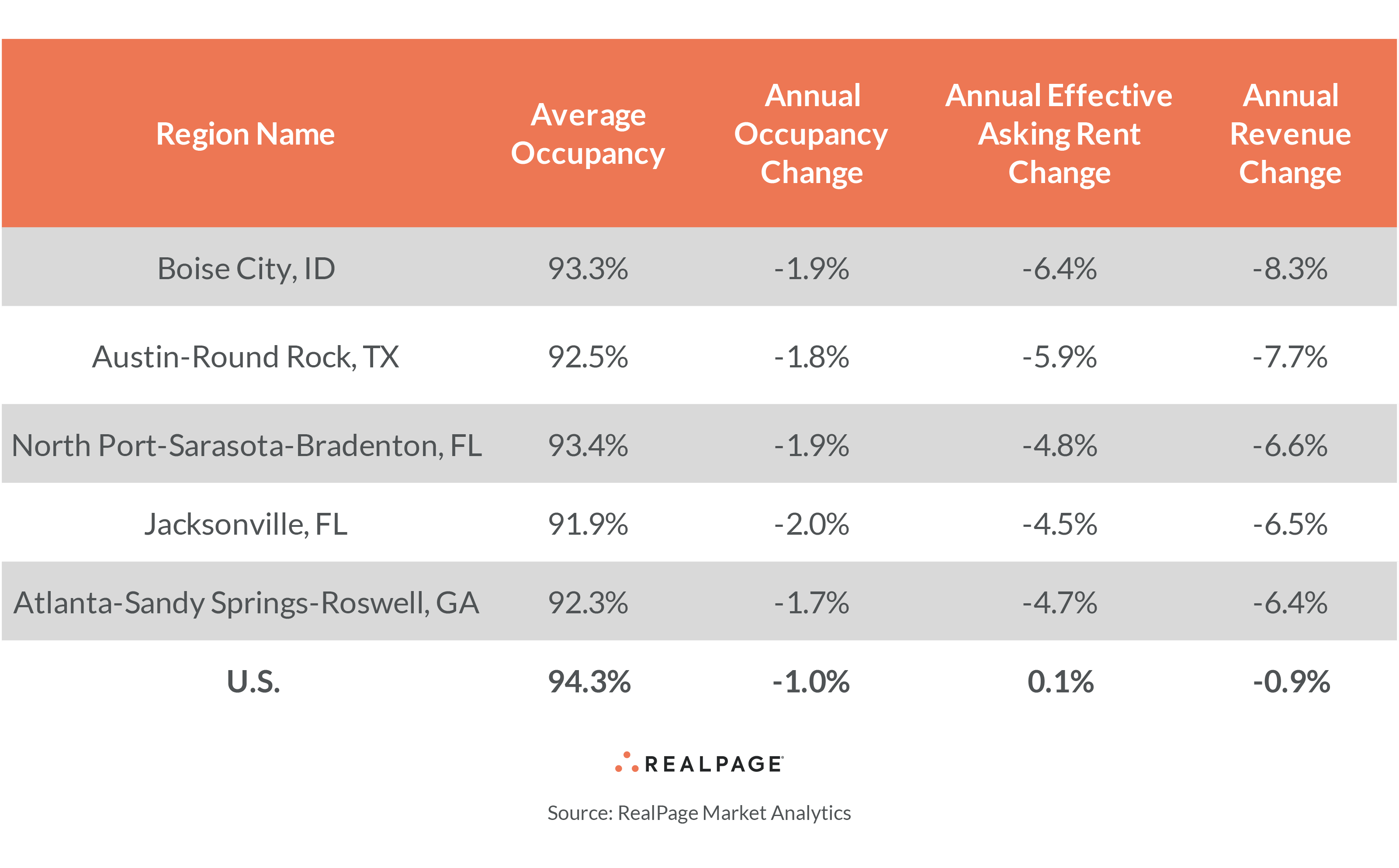

Together, declining occupancy and retreating rents have revenues falling in more than half of the top 150 markets tracked by RealPage Market Analytics. Four of the five markets with the deepest declines in revenue are in the South region. All the markets losing the most revenue were also among the 10 worst performers for annual change in effective asking rents, and most had inventory growth levels of around 5% to 5.6% in the year-ending 3rd quarter 2023 (with the exception of Atlanta at 3.4%).

The West region’s Boise City, ID saw revenues decrease by 8.3% in the year-ending October with a 6.4% decline in rents and a 1.9% decline in occupancy. Interestingly, Boise City made the top 10 markets for job growth in September with a 3.8% increase in employment from last year. Demand is not the issue, as the market absorbed nearly 800 units in the past year, but new supply has ramped up significantly in this small market. Apartment inventory increased 5.3% with 1,612 units added to local inventory in the past year and is set to increase by 7.3% in the next 12 months.

Austin’s apartment revenues decreased 7.7% in the past year, on annual rent cuts of 5.9% and a decrease in occupancy of 1.8%. Here, supply is very much the issue as inventories grew by 5.6%, or by 16,481 units for the year-ending 3rd quarter. The market will be stressed further in the next year as new supply should nearly double to 11% growth. Both Boise and Austin have seen annual rent change decrease more sharply in the past few months and both landed among the worst performance for rent change in October.

North Port-Sarasota-Bradenton, FL had the third-worst revenue loss in the year-ending October at 6.6%, primarily due to the decrease in effective asking rents of 4.8%. Although new supply in the past year increased inventory by 5.2%, this market has further to climb, as roughly 6,600 units are currently under construction in this southern neighbor to Tampa, pushing inventory growth to 5.7% by next year.

On the northern end of the state, Jacksonville, FL saw revenue drop 6.5% for the year-ending October as rent change fell 4.5% and occupancy slid 2%. New supply was the story here too as inventory growth was solid at 5.4% or a little more than 7,000 new units. Similarly, more supply is on the way with close to 9,000 new units set to deliver in the next 12 months, or 6.8% inventory growth. Like Boise, Jacksonville made the top 10 list for job growth in September at 3.9%.

Lastly, Atlanta made the bottom five list for revenue change with a decrease of 6.4%, including annual rent change of -4.7%. Both Atlanta and Jacksonville made the bottom 10 list for occupancy, but Atlanta’s 3.4% inventory growth was the lowest among the revenue loss leaders. Still, Atlanta beat Dallas for completions through the year-ending 3rd quarter 2023 by more than 1,000 units and is set to deliver nearly 23,000 units in the next 12 months for a 4.1% increase in inventory.

Although the list of markets with the weakest revenue performances in October includes several markets that are still generating new jobs or employment growth, each of the five markets above will deliver more new supply in the next year than they did this past year, challenging them to see improvement in their market fundamentals in the same time period.