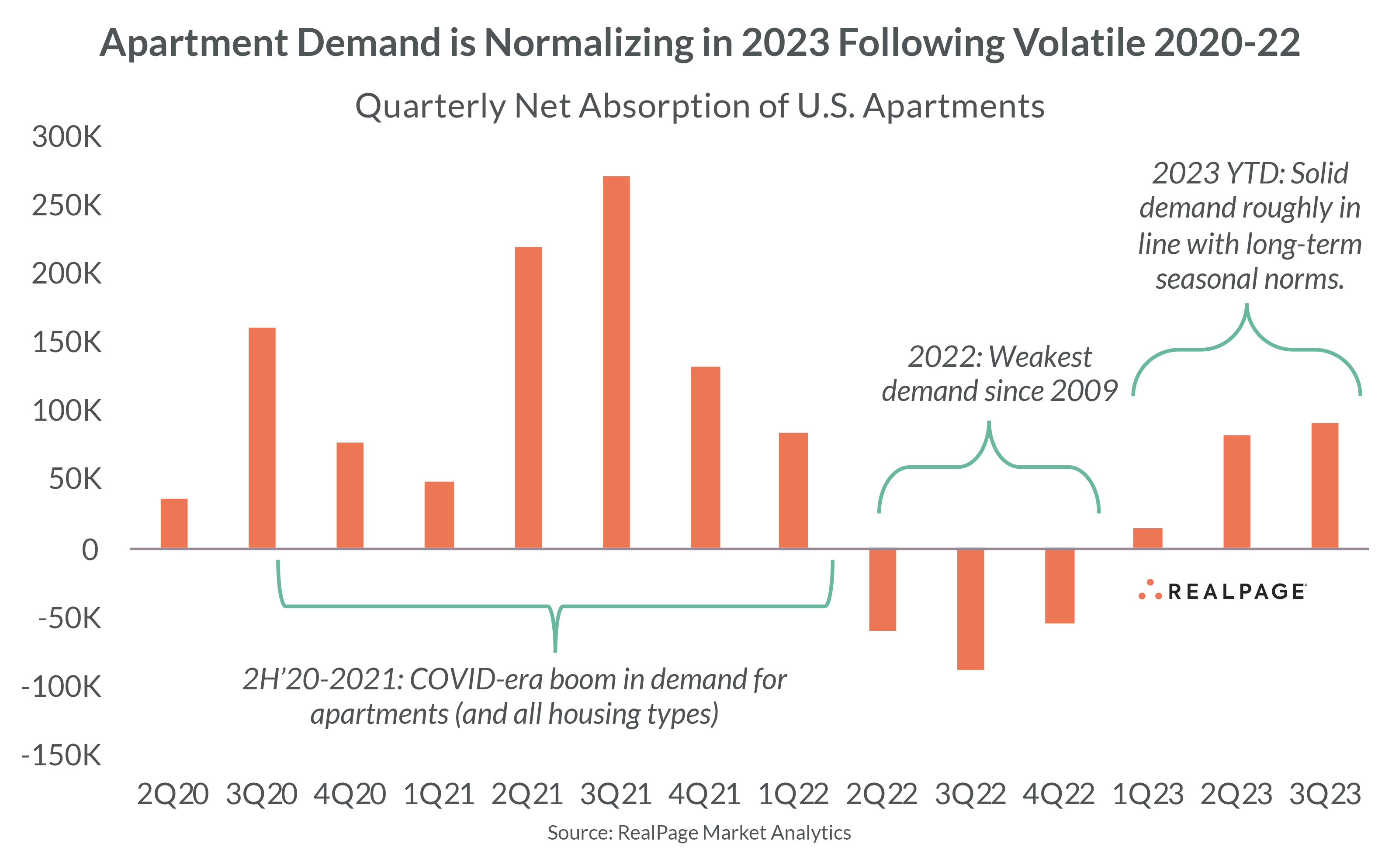

Apartment demand continues to rebound in 2023, even as rent growth flattens. In other words: It’s rent disinflation without demand destruction. Why? Supply, supply, supply. Apartment completions in 3rd quarter soared to the highest levels since the 1980s.

It’s a good reminder that the challenges facing the apartment sector today have nothing to do with demand fundamentals, and everything to do with a 50-year high in apartment construction combined with expense pressures and the rapid spike in interest rates upending the financing market.

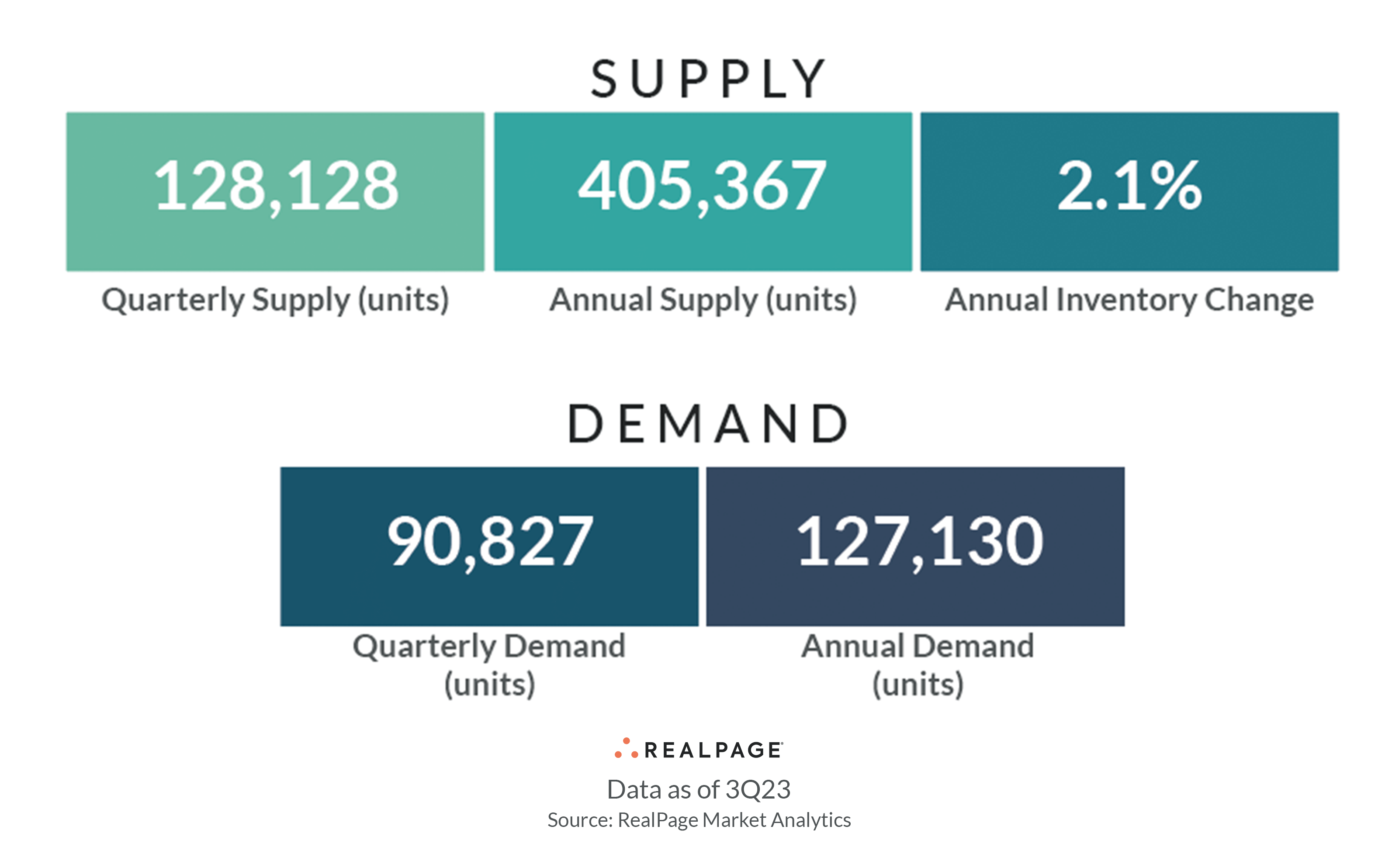

The U.S. apartment market absorbed 90,827 units in 3rd quarter 2023, according to RealPage Market Analytics. That doesn’t compare to historically robust demand of 2021, but it’s still the largest quarterly tally in nearly two years and it’s roughly in line with the long-term seasonal norms.

Don’t give high mortgage rates all the credit, either, as the correlation has been weak. Apartment demand was strongest in 2021 when mortgage rates were lower and more homes were selling. Apartment demand then evaporated in 2022 when rates initially jumped and sales slowed. Rather, it appears slowing inflation and a still-strong job market are boosting consumer confidence and, in turn, spurring household formation among young adults most likely to rent apartments.

One contributing factor: The influx of new supply has rapidly shifted the balance of power in the rental market back to renters. New apartment completions jumped to the highest level in 30+ years, with more than 128,000 units coming online nationally.

Simply put: Renters today have a lot more options thanks to all the new supply. Occupancy inched back another 10 bps in September, landing right around the long-term average at 94.4% at the end of 3rd quarter. And generally speaking: Demand is primarily going where supply is going – especially to the Sun Belt, although several Northeast markets also saw strong demand in 3rd quarter.

Falling rents in many markets despite solid demand reflects many operators prioritizing occupancy over pricing in order to protect cashflow.

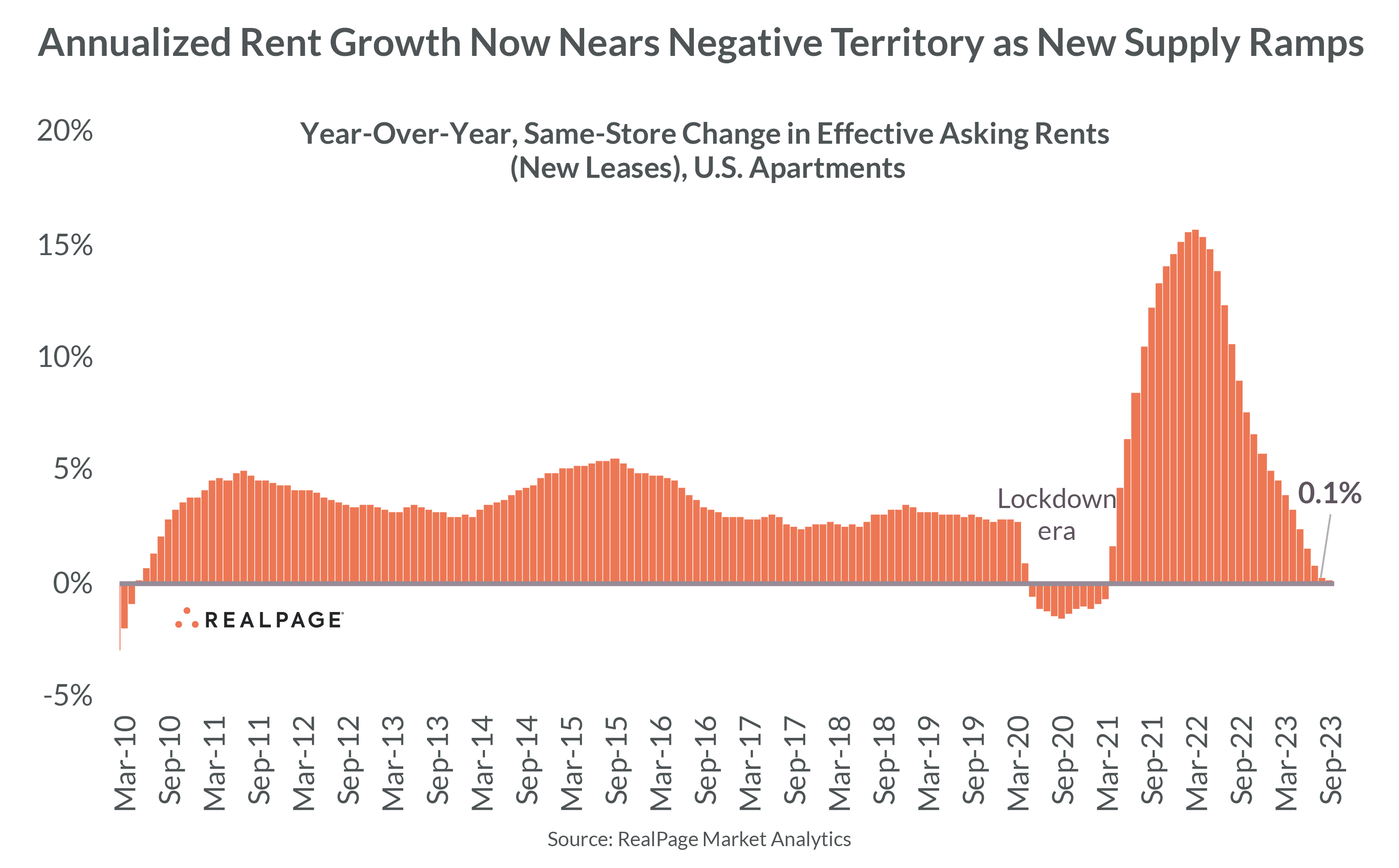

As Supply Rises, Rents Flatten

High supply has flipped the rental market narrative over the last 18 months from record-low vacancy and record-high rent growth to now normalized vacancy and flat-to-falling rents.

Nationally, effective asking rents fell 0.3% in September. That cut brought year-over-year rent growth down to just 0.1%, compared to 9.0% just one year ago. On an annual basis as of September, rent cuts are already common across the West region of the country (-1.1%) and the South (-0.8%), while rents continue to grow moderately in the lesser-supplied Northeast (+3.1%) and Midwest (+2.5%).

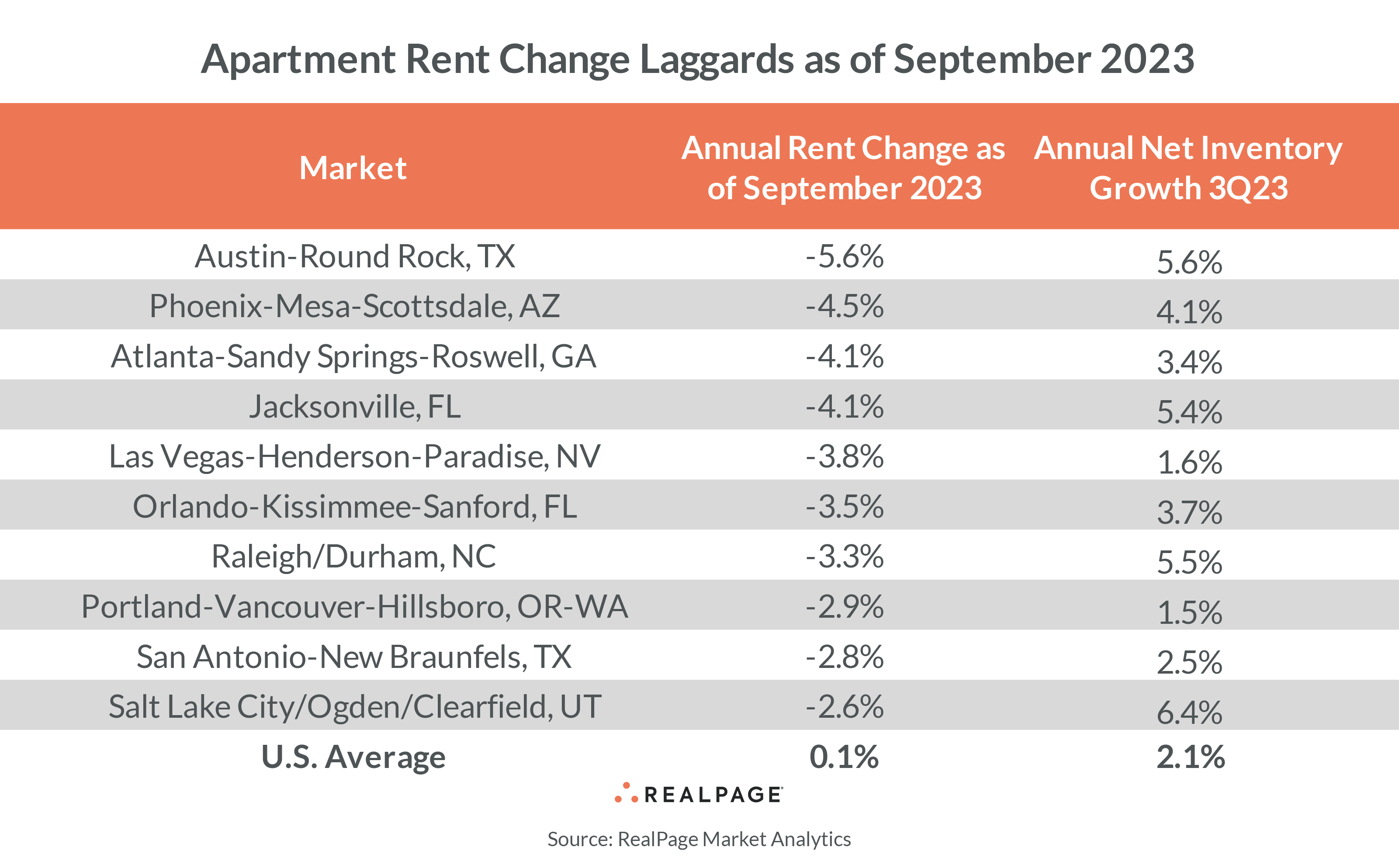

Rents declined over the last year in 26 of the nation’s 50 largest metro areas. Rent cuts topped 4% in four once-hot markets: Austin, Phoenix, Las Vegas and Jacksonville.

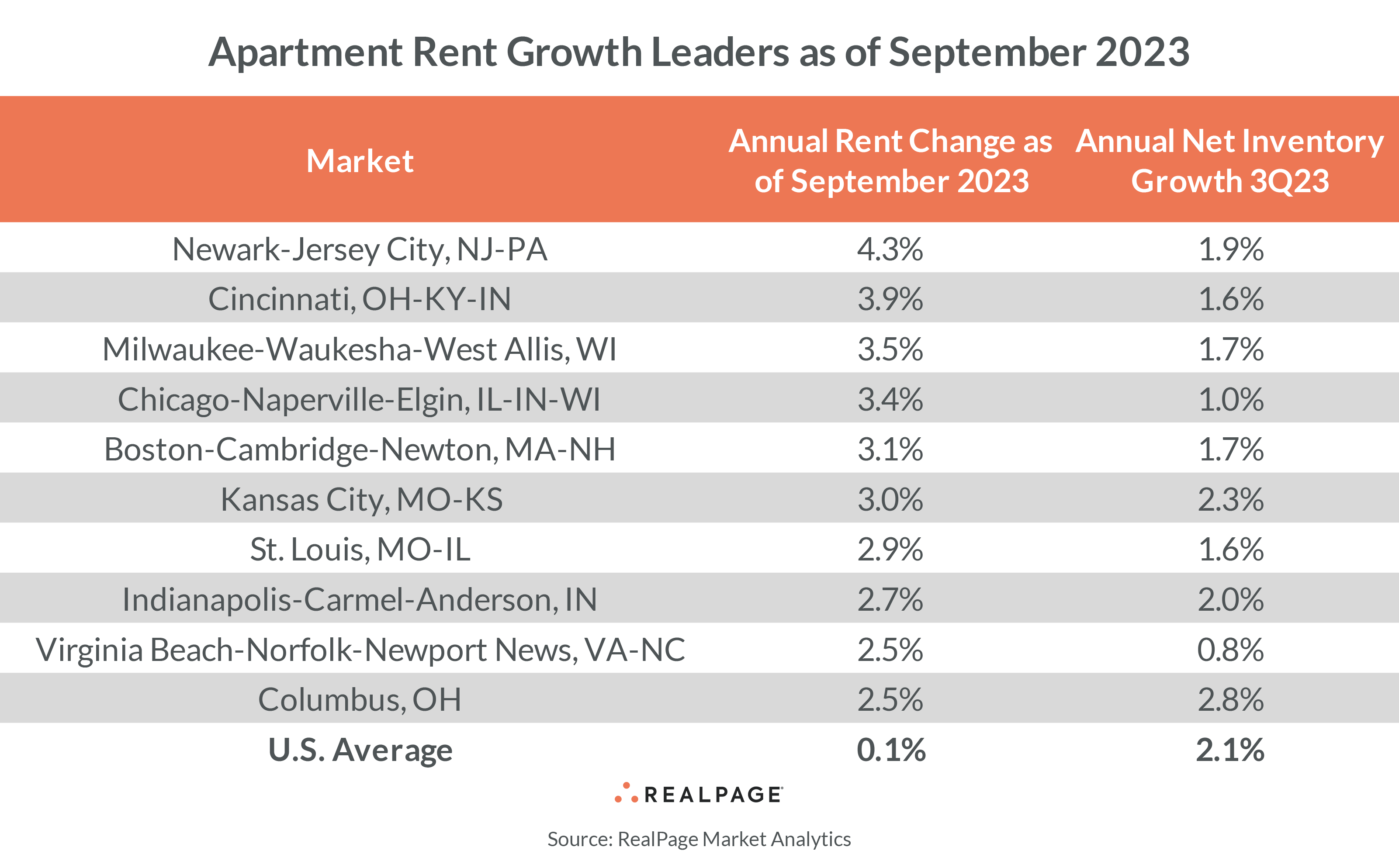

On the flip side, only six large metros recorded rent increases above 3%, led by Newark-Jersey City, NJ, at 4.3%, followed by Cincinnati, Milwaukee, Chicago, Boston and Kansas City. Not coincidentally, the rate of supply expansion trailed the U.S. average in all six with the exception of Kansas City, which came in a tick above.

There’s a remarkably clear relationship between supply levels and rent growth. In the 10 large metro areas with the deepest rent cuts, the average rate of apartment supply expansion was nearly double the U.S. average. In the markets with largest rent increases, on the other hand, the average rate of supply expansion came in below the national average. The relationship is even clearer on a submarket level.

West Coast is Lagging the East Coast

There are a few exceptions to the relationship between rent slowdown and high supply, particularly on the West Coast. The major West Coast markets generally have somewhat lesser supply, but are still seeing rent cuts due to moderate supply and lackluster demand. Rents fell in every large West Coast metro with the exception of San Diego and Orange County.

Recent quarters have highlighted a widening gap between Gateway markets on the West Coast (generally soft) versus the East Coast (generally strong). Every Gateway market on the East Coast produced rent growth over the last year, led by Boston at 3.1%. Additionally, four major Northeast or Mid-Atlantic markets absorbed more than 1,000 units in 3rd quarter, while no West Coast markets hit that mark.