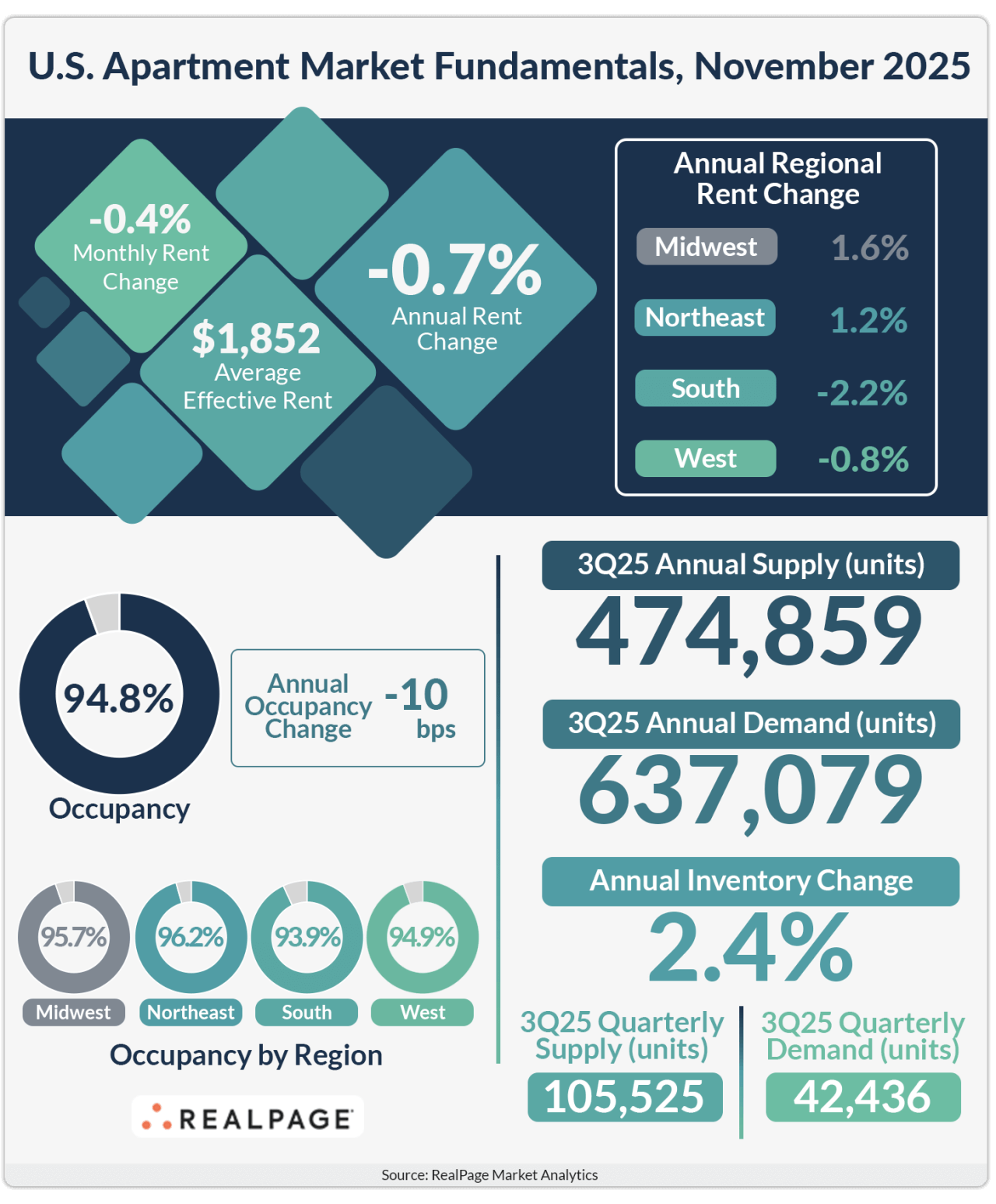

Rent Cuts Continue in the U.S. Apartment Market as Occupancy Falls Below 95%

Rent cuts persisted across the U.S. apartment market in November, as occupancy fell below the essentially full mark. But rent cuts, at least, aren’t getting any more intense.

After four consecutive months of mild decline, occupancy fell to 94.8% in November, according to data from RealPage Market Analytics. U.S. occupancy was 10 basis points (bps) below the October showing and has fallen 70 bps in the past four months. Year-over-year, occupancy was down 10 bps, marking the first annual decline the market has seen since August 2024.

As occupancy faded, effective asking rents have also fallen for four consecutive months. U.S. prices fell 0.4% in November and were down 0.7% year-over-year. However, it should be noted that, after rent cuts intensified for three months straight, the annual decline in November matched last month’s pace, marking a slowdown to the progressive decline. Still, this was the second month of annual rent declines around that level – the nation’s deepest since March 2021.

The nation’s South and West region markets continued to see the deepest rent cuts, while tech hubs are enjoying a bit of a rebound.

Rent Cuts Continue in South and West Region Markets

The surge in apartment supply volumes across the South over the past few years has inspired operators to take a more measured stance. In fact, the South has not recorded any annual rent growth since mid-2023. However, it should be noted that, after annual rent cuts intensified every month for the past seven months across the South, November rent cuts eased a bit. It wasn’t an extreme slowdown, but at least the bloodletting has been stemmed. The story is the same in the West: annual rent cuts continued in November, but at a reserved pace, marking an end to four months of progressively intensified annual cuts.

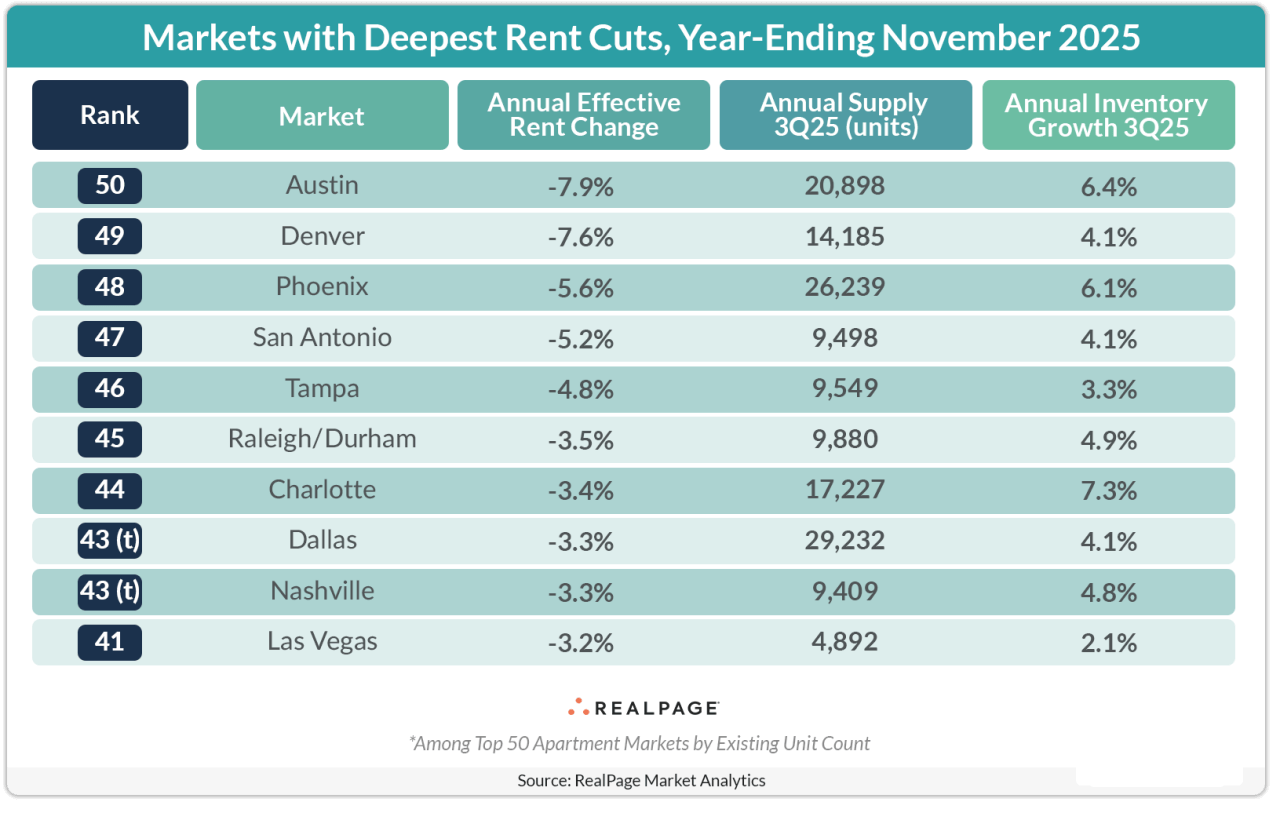

Supply-heavy areas like Austin, Denver, Phoenix and Charlotte were some of the hardest-hit, with rent cuts persisting despite solid apartment demand.

Other markets that continued to see deep rent cuts were tourism-dependent markets such as Tampa, Nashville and Las Vegas. Softness in markets that rely on tourism can be an early sign of economic weakness as consumers tighten discretionary spending on travel. Of note, Tampa and Las Vegas moved into the bottom-tier performance this month, after just missing the list in October.

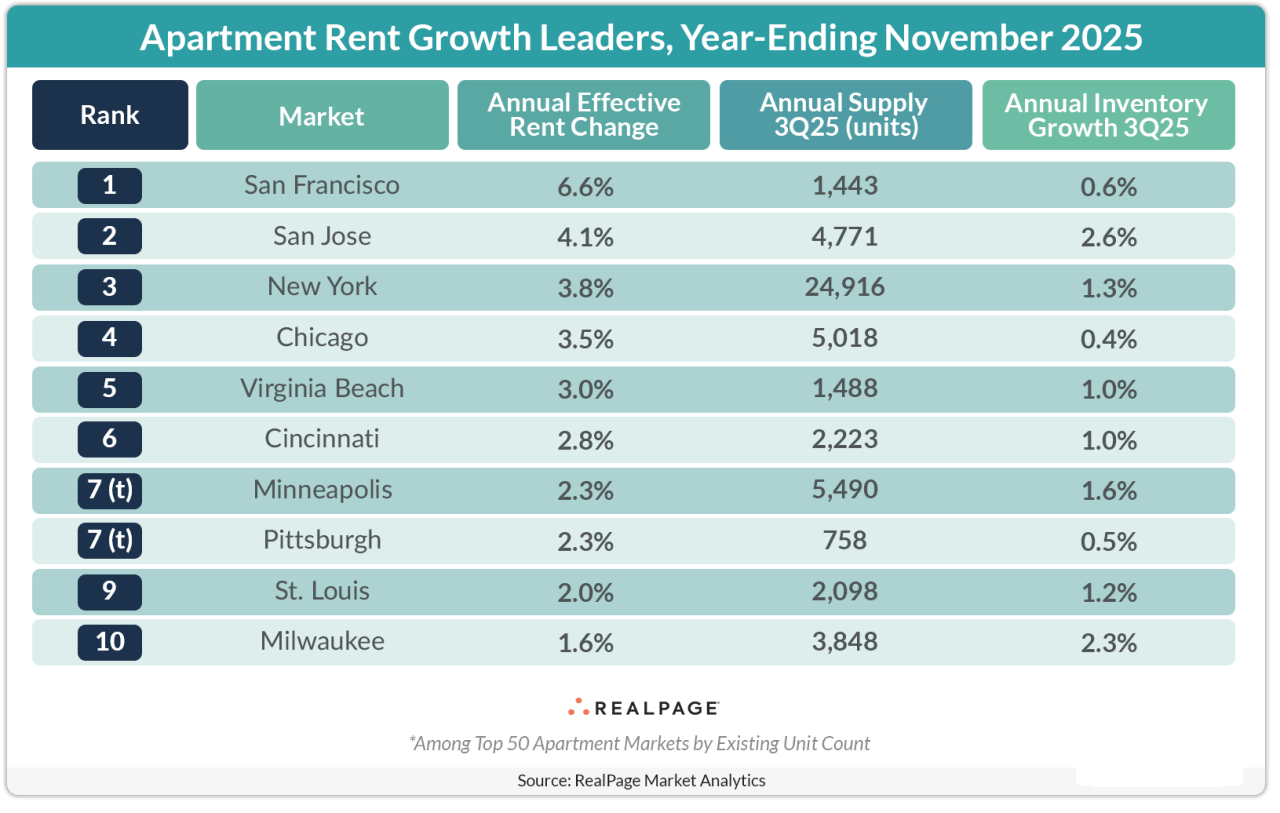

Tech Markets See Sizable Rent Growth

On the other hand, renewed apartment demand in tech-heavy coastal markets – fueled in part by optimism surrounding artificial intelligence – is boosting rent growth in San Francisco, San Jose and New York. These markets continued to rank among the largest 50 apartment markets with the most rent growth, with prices climbing roughly 4% to 7% in the year-ending November.

Other markets with big rent growth in the past year included Chicago, Virginia Beach, Cincinnati, Minneapolis and Pittsburgh. St. Louis made a big move onto the top performer list in November, which is not a typical spot for this slow-and-steady Midwest market.