Did Multifamily Starts Really Hit a 36-Year High in May? Probably Not.

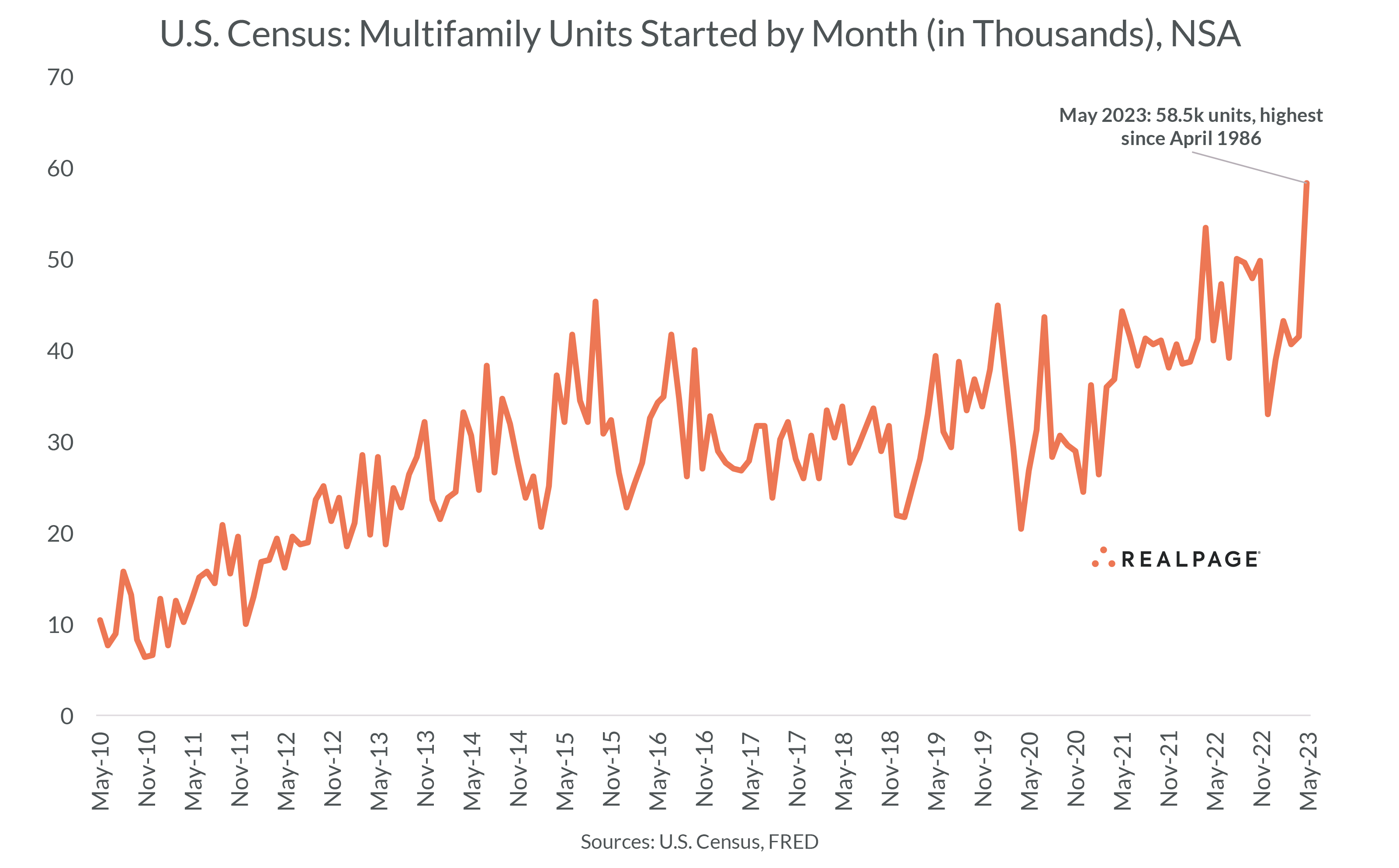

The latest U.S. Census Bureau numbers on multifamily construction starts delivered a major surprise: Multifamily starts hit a 36-year high in May 2023 at 58,500 units, up 41% from April. That’s a shocking spike. But is it true? Probably not.

Here are five reasons to question the May numbers from the Census.

1. Construction delays are accelerating due to financing issues.

Anecdotally, we’re hearing more stories of stalled apartment projects than at any point since the Great Financial Crisis. Not just delayed due to supply chain or labor issues. But stalled altogether due to difficulty securing construction financing and/or equity.

The National Multifamily Housing Council’s quarterly construction survey backs this up. In March 2023 (the latest period available), respondents said 40% of delays were due to availability of construction financing. That was up from 15% one year earlier, before rates started their rapid ascent.

2. Banks are pulling back on construction loans.

The first reason directly ties to our second reason: Banks are pulling back on lending. The Federal Reserve’s most recent senior loan officer survey showed roughly 75% of respondents reported tightening loan standards for commercial real estate construction and development (which includes multifamily). Outside of the pandemic lockdown period, that was easily the most rapid tightening seen since the Great Financial Crisis.

Many banks are either fully allocated to the sector or pulling back to preserve cash due to regulatory pressure. The cost of debt is high, and loan-to-cost ratios have plunged. That means that even if you find willing lenders, you still need to raise a lot more equity – which is no easy task in 2023.

3. The Census methodology is notoriously thin and volatile.

The Census estimates construction starts by extrapolating data from a small survey of permit holders. That creates considerable volatility. As one article pointed out: “Economists consider the Census statistics on housing starts to be highly volatile and prone to significant revisions.”

The Census, by its own admission in methodology documentation, admits that it “does not have a large enough sample size to make state or local area estimates” on starts.

4. Private sector sources tell a very different story.

Private sector sources (which show slowing) with more granular data are far superior sources. And it’s not just RealPage seeing a slowdown in multifamily starts this year.

Dodge Construction Network, as one example, reported that “the mostly private sectors of the building market like offices, multifamily and retail are struggling under the weight of higher interest rates, tightening lending standards and declining demand.”

The American Institute of Architects, which tracks billings for architectural services, noted “business conditions softened further at firms with a multifamily residential specialization in May, falling to the lowest level in two years.” Multifamily billings declined for an 11th consecutive month – essentially guaranteeing a drop in starts.

5. Could the Census data be lagged?

One possibility is that the Census starts numbers are just lagged. RealPage and other private-sector data providers have tracked more ongoing apartment construction nationally in the past couple years than what the Census has reported for multifamily overall – which suggests the Census has missed projects or that its modeling assumptions aren’t holding up as well in this cycle. Perhaps there’s some catch-up occurring where the May data reflects starts that occurred much earlier.

We do know that multifamily construction is likely peaking, but most of today’s ongoing projects broke ground in 2022 or very early 2023 with financing locked in prior to the pullback.

What’s next for apartment development?

We’re still betting that actual multifamily starts drop 30%+ in 2023 versus 2022 – regardless of what the Census reports. It’s just too difficult an environment today to maintain 2022’s blistering pace.

The drop-off will almost certainly accelerate in the second half of the year. Much of what broke ground already in 2023 were deals that were largely worked in 2022 before the fall of Silicon Valley Bank and Signature Bank put pressure on even healthy banks to curtail lending. Plus, developers have the added challenge of trying to find equity and debt at the same time supply hits 30-year highs and rent growth drops off. Completions are on track to peak in the second half of 2023 through 2024.

All told, it’s an environment that will stall or kill many new development projects. But not all. Developers with great projects and strong lender relationships will still be able to push through, just not at 2022 volumes. That suggests a material slowdown in completions by 2025, which in turn, creates opportunity for those with a longer-term view.