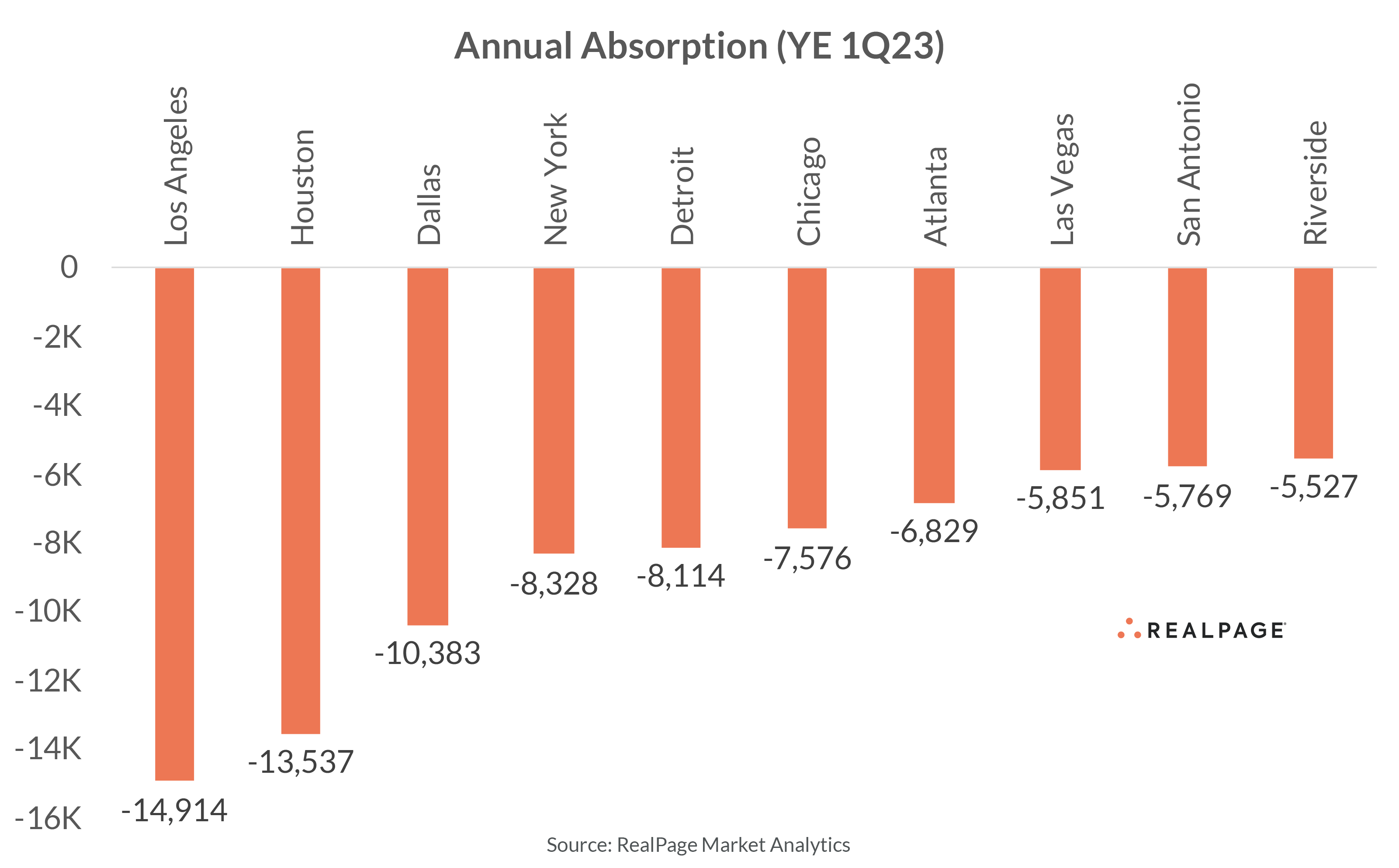

Demand slowed considerably in the back half of 2022. That story seems to have improved in the first few months of 2023 across several major U.S. apartment markets. However, a few of the largest 50 markets remain in negative territory for annual absorption. Among those, 10 markets recorded net move-outs from 5,500 units or more including heavy hitters like Los Angeles, Dallas, New York and Houston, according to data from RealPage Market Analytics.

Though the bleeding has slowed, three top 50 markets recorded net move-outs from more than 10,000 units in the year-ending 1st quarter 2023: Los Angeles (-14,914 units), Houston (-13,537 units) and Dallas (-10,383 units). The remaining seven of the 10 worst performers recorded negative absorption ranging from 5,500 units to 8,300 units: New York (-8,328 units), Detroit (-8,114 units), Chicago (-7,576 units), Atlanta (-6,829 units), Las Vegas (-5,851 units), San Antonio (-5,769 units) and Riverside (-5,527 units).

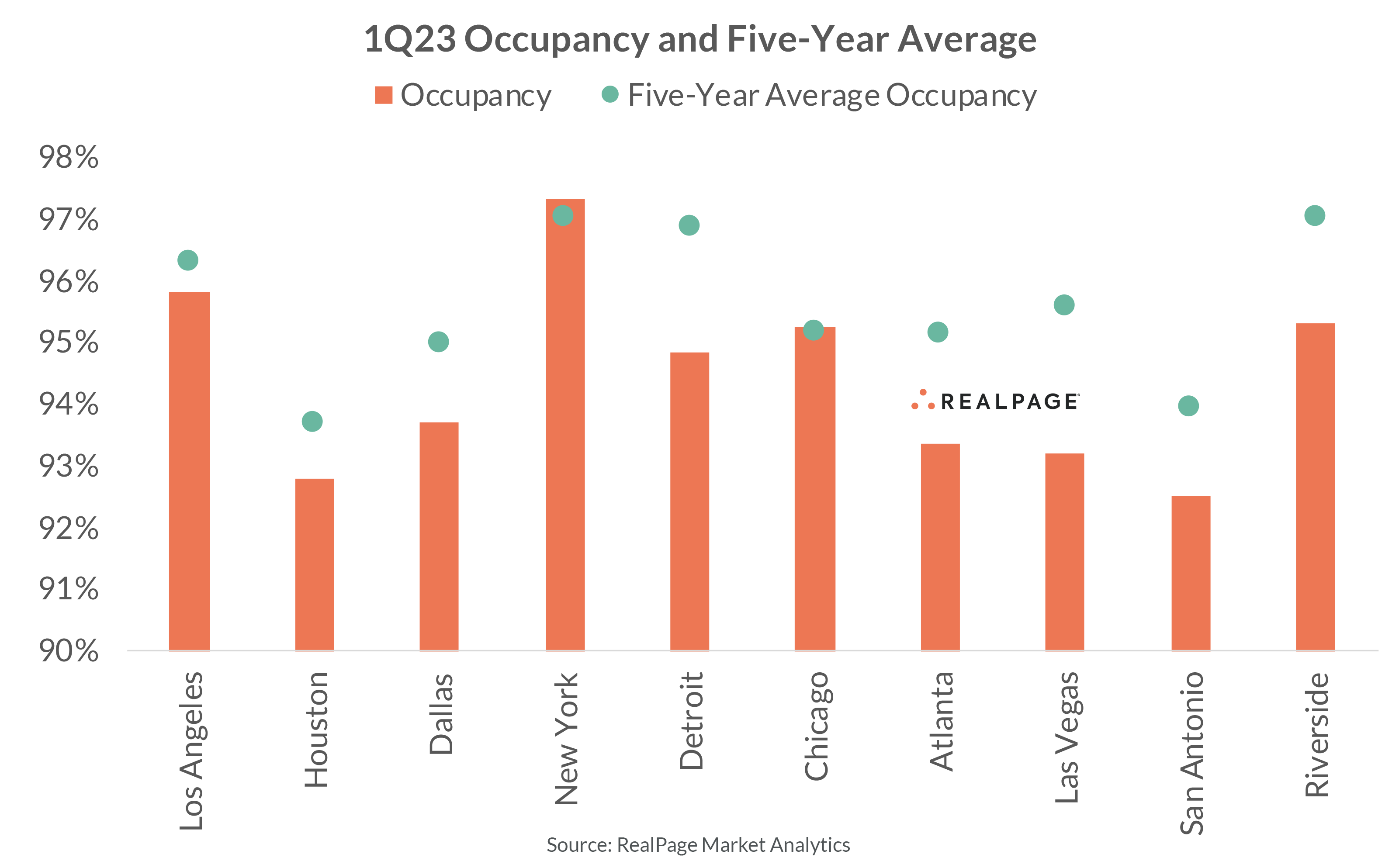

Several of these markets also saw high delivery volumes over the 12-month period, impacting occupancy, including Dallas, Atlanta, Houston, New York and Los Angeles. Occupancy in every market except New York and Chicago sat below the five-year average as of 1st quarter 2023.

Among this group of bottom performers, San Antonio realized the deepest decline in occupancy year-over-year, falling 430 basis points (bps) to 92.5%. Occupancy fell between 300 and 400 bps in six markets: Las Vegas (-390 bps), Dallas (-360 bps), Atlanta (-350 bps), Houston (-350 bps), Detroit (-340 bps) and Riverside (-310 bps). Occupancy in Los Angeles remains tight but fell 210 bps for the year to 95.8% as 1st quarter 2023. Essentially full, occupancy in the Chicago apartment market landed at 95.3% in 1st quarter, down 180 bps. Meanwhile, occupancy in the notoriously expensive New York apartment market was tight at 97.3%, a mere 100 bps below the prior year’s occupancy rate.

That said, the vacancy rate across this group of markets ranged from a manageable 2.7% to an elevated 7.5%.

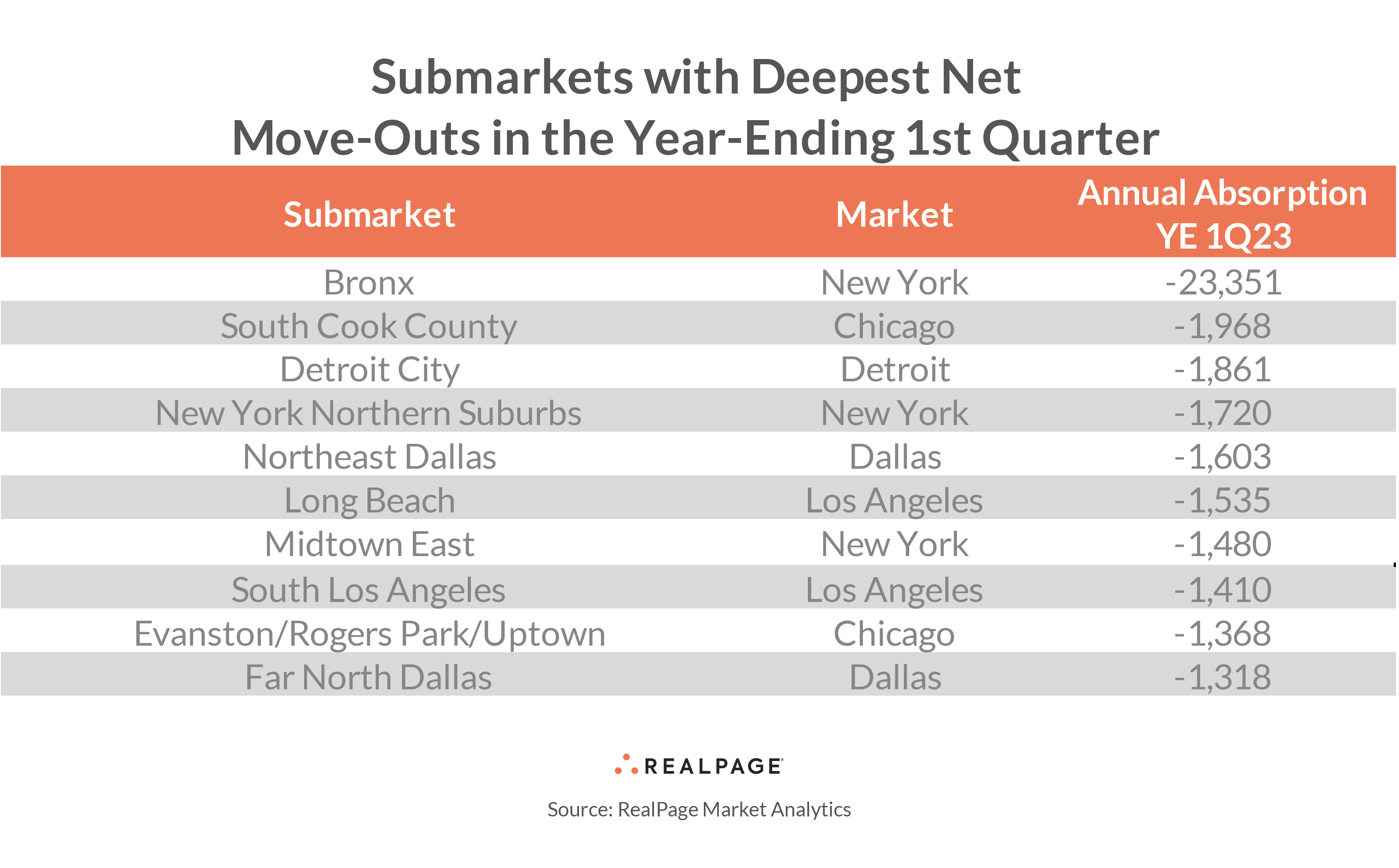

Driving vacancies across these markets were at least 10 of the 213 submarkets in the group. Submarket-level performance revealed a mixed-story – both urban and suburban. In the year-ending 1st quarter 2023, the Bronx (-23,351 units) submarket drove subpar performance in New York. Two other New York submarkets also hit the list: New York Northern Suburbs (-1,720 units) and Midtown East (-1,480 units).

Second on the list of ten submarkets with poor absorption was suburban Chicago submarket South Cook County (-1,968 units). Another Chicago submarket, suburban Evanston/Rogers Park/Uptown (-1,368 units) also ranked. In the Sun Belt, two suburban Dallas submarkets drove move-outs: Northeast Dallas (-1,603 units) and Far North Dallas (-1,318 units). Rounding out the ten worst submarket performers were Detroit City (-1,861 units), Long Beach (-1,535 units) and South Los Angeles (-1,410 units).