Annual employment gains in the nation’s top markets continue to surprise economic experts, as the latest data release from the Bureau of Labor Statistics (BLS) indicates continued solid growth.

Nationally, gains approached 349,000 jobs in May while the unemployment rate jumped from 3.4% to 3.7%, a sign that job seekers are attempting to rejoin the workforce. The nation’s top markets reflect this continued growth even as the level of growth moderates.

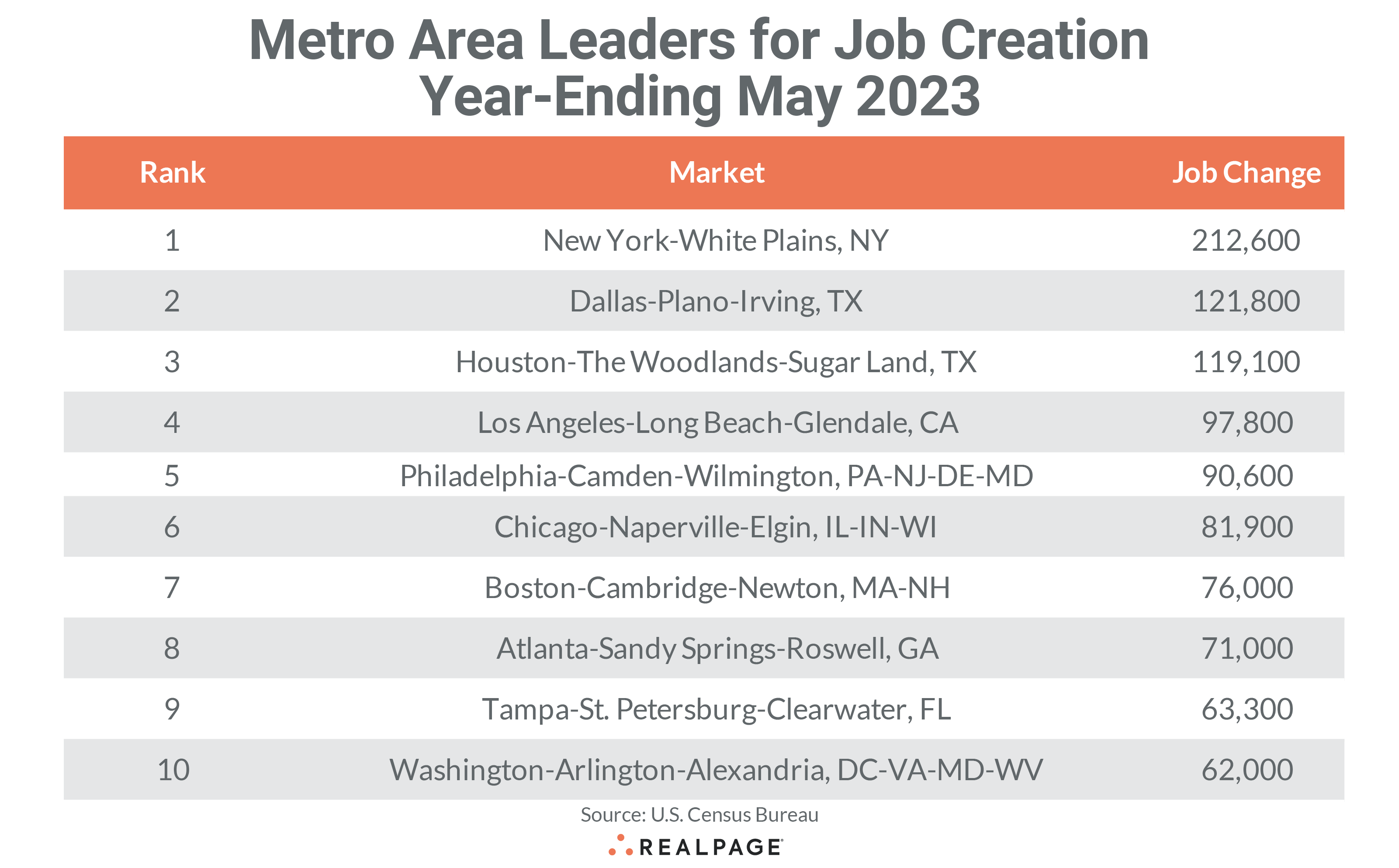

The total number of jobs gained in the top 10 markets RealPage tracks for the year-ending May, was about 13,000 jobs greater than last month (a slight increase of 1.3% from April). Additionally, only one of the top 10 markets for annual job gains in May saw a decrease in employment from April’s not seasonally adjusted levels.

Nine of last month’s top 10 markets returned to this month’s list with the first six remaining in place and a few other markets changing rankings.

New York continues to lead the nation in annual gains with 212,600 new jobs for the year-ending May, up about 3,000 jobs from last month but 266,500 less than last May. Dallas returned at the #2 spot with an annual gain of 121,800 jobs, 76,400 jobs fewer than last year and 4,900 less than April’s annual total.

Houston remained in the #3 spot, gaining 119,100 jobs for the year, down 70,600 from last May but 6,500 more than last month. Los Angeles returned in the #4 spot, adding 97,800 jobs but slowed by more than 165,900 jobs from last year and 8,400 jobs from last month. This is the first time LA fell below the 100,000-job gain level since the pandemic recovery began.

Philadelphia and Chicago remained in the #5 and #6 spots with 90,600 and 81,900 jobs gained each (an average monthly improvement of 6,800 jobs), despite slowing by 70,100 and 125,700 jobs from last year, respectively.

Boston and Atlanta switched places at #7 and #8 but while Boston’s annual gain through May of 76,000 jobs improved by 4,800 from April, Atlanta’s annual gain of 71,000 jobs was 5,800 jobs fewer than last month.

Tampa moved up one spot this month to #9 with 63,300 jobs gained for the year, only 21,500 jobs fewer than last year and 6,200 more jobs than last month’s annual gain. Washington, DC bumped Seattle out of the top 10, gaining 62,000 jobs for the year and improving by 6,600 jobs from April.

Compared to April’s annual job gain totals, only four of the next 10 markets ranked by annual job gains had more new jobs for the year than the month before as a general moderation continues. Additionally, only three markets had annual job gains of 100,000 or more, one fewer than in April. Another 13 markets gained between 50,000 and 99,999 jobs, three more than last month. Only Denver, Providence, RI, Fayetteville, NC and Eugene, OR reported an annual job loss from last May, one more market than in April.

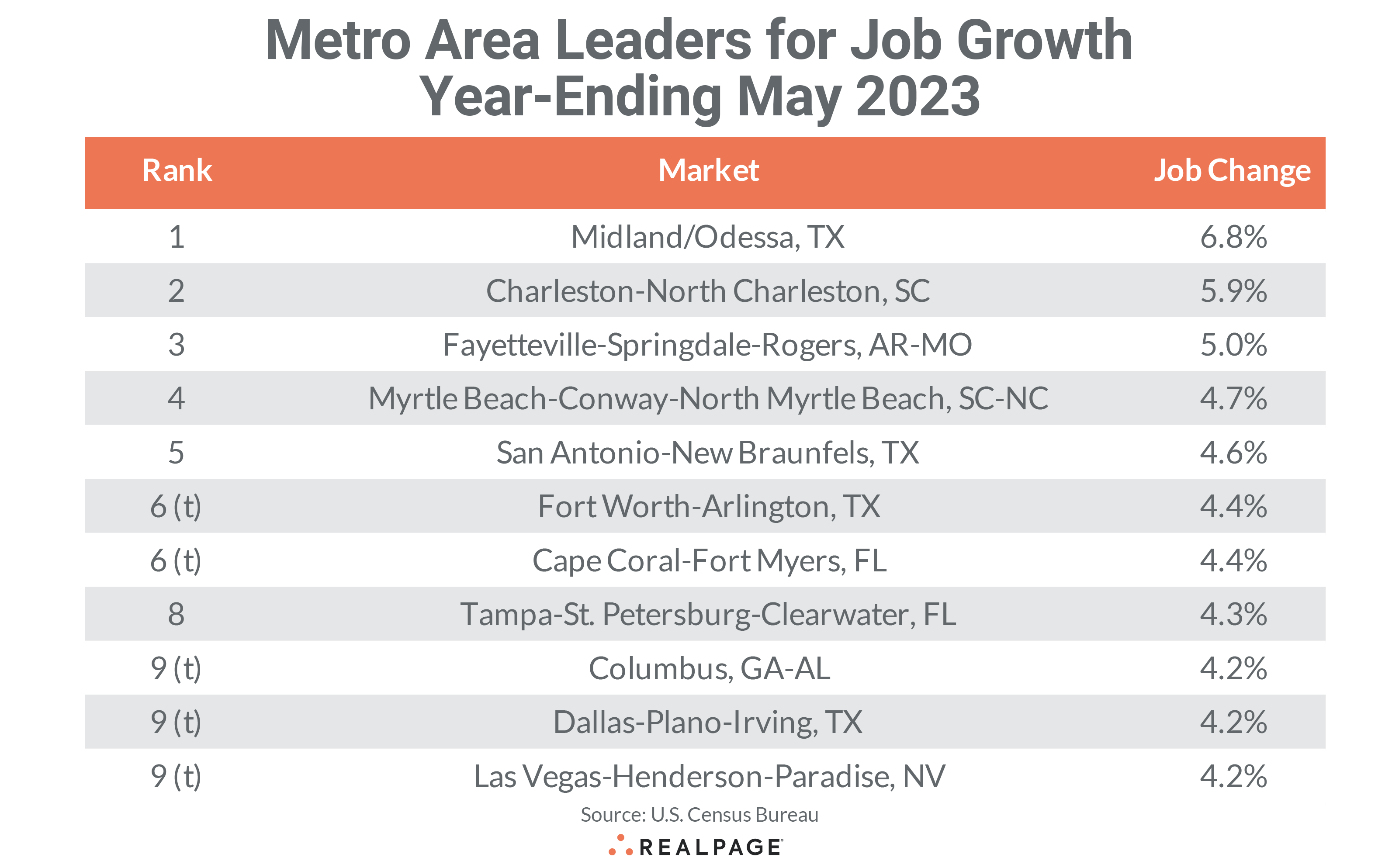

Like annual job gains, the annual percentage change in employment continues to moderate somewhat. The average employment percentage gain for the top 11 markets averaged 4.8% in May compared to 5% last month (including ties). Additionally, only four of May’s top 11 markets had higher percentage employment gains than in April.

Eight markets returned to May’s top employment change list from April with the first four in the same order. The energy-dependent market of Midland/Odessa continued to lead the nation for percentage growth at 6.8%, down 30 basis points (bps) from last month. Charleston, SC returned at #2 with 5.9% growth, down 50 bps from April.

College town Fayetteville, AR remained in the #3 spot with 5% growth, down 30 bps from last month. Myrtle Beach-Conway-North Myrtle Beach, SC-NC stayed in the #4 spot with 4.7% growth, also down 30 bps from April. San Antonio moved up to the #5 spot with 4.6% job growth, gaining 40 bps for the month.

Fort Worth slipped one spot to tie Cape Coral-Fort Myers, FL for #6 with 4.4% growth but Cowtown slipped 40 bps while the Lee Island Coast gained 60 bps from April. Tampa joined this month’s list at #8 with 4.3% employment growth, up 40 bps for the month. Dallas and Las Vegas both slipped a few spots to join Columbus, GA for a three-way tie to finish out the list with 4.2% growth.

Compared to one year ago, all but Columbus, GA (up 160 bps) and Charleston (unchanged) had lower job growth than May 2022. The largest decreases among the top 11 were in Las Vegas (-720 bps), Midland/Odessa (-320 bps) and Dallas (-310 bps).

In addition to four Texas markets, Florida and South Carolina were represented with two of the top 10 positions each. Florida had three of the next 10 markets ranked by job growth with Texas holding two and no other state having more than one of the remaining 12-21 spots.

The weakest major markets for percentage growth are still primarily in the industrial Midwest and Mountain West. Major markets with sub-1% growth include Denver, Milwaukee, Toledo, Memphis, Cleveland and Akron. Sub-1.5% growth major markets include Riverside, Tucson, Baltimore, Birmingham, Omaha, St. Louis and Columbus. Seventy markets had annual job growth rates above the not seasonally adjusted national average of 2.6%, which was 13 more than in April.