Like much of the nation, the country’s largest metro areas are still producing a significant number of new jobs.

According to the latest data release from the Bureau of Labor Statistics (BLS), the top 10 of RealPage’s top 150 markets grew annual employment gains through September 2023 by 5.2% over their combined total for the 12 months ending August. The top 10’s total of 911,900 jobs gained through September accounted for almost 29% of the national total.

Although the majority of the top 150 markets saw post-COVID declines in their annual job gain totals compared to September 2022 as employment gains normalize, a significant number are still elevated above their pre-COVID average annual job gain levels.

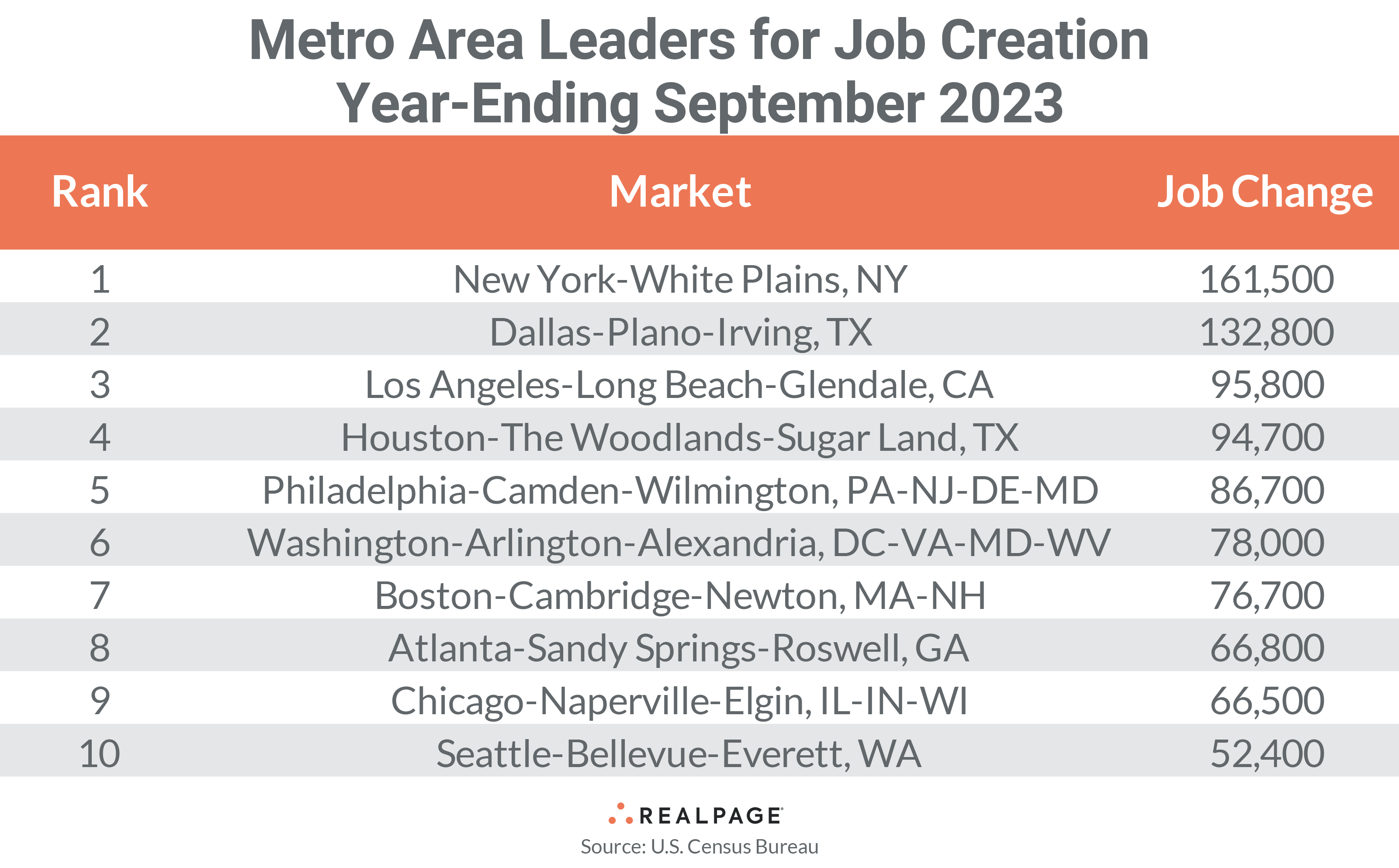

Nine of last month’s top 10 markets returned to this month’s list with just the first three remaining in place and several other markets changing rankings.

New York continues to lead the nation in annual gains with 161,500 new jobs for the year-ending September, down about 24,000 jobs from last month and 240,400 fewer jobs gained than one year ago. Dallas remained in the #2 spot with an annual gain of 132,800 jobs, about 20,000 jobs more than last month but 55,900 less than last September’s annual total.

Los Angeles’ annual job gain total was about even with August’s at 95,800 jobs but LA is down by 104,300 jobs from their annual total one year ago. Houston switched places with Philadelphia again at the #4 spot with 94,700 jobs gained, up 6,700 jobs from last month but almost 88,000 fewer than last September.

Philadelphia moved to the #5 spot with 86,700 jobs gained in the 12-months ending September, 58,000 fewer than last year and 4,100 less than in August. Washington, DC jumped onto the top 10 list at #6 with 78,000 jobs gained for the year, an increase of almost 19,000 jobs above August’s revised total. In fact, DC’s revised employment gains would have placed it in the top 10 last month.

Boston, Atlanta, Chicago and Seattle each moved down one spot from their rankings last month to round out the top 10 with Beantown at #7, decreasing their annual gain slightly from last month to 76,700 jobs. Atlanta slipped to #8 with 66,800 jobs gained, up almost 12,000 jobs from August’s total but down 81,600 jobs from last September.

Chicago also slipped one spot to #9, gaining 66,500 jobs for the year and increasing by 14,000 jobs from August’s total. Seattle also moved down one spot on this month’s top 10 list with 52,400 new jobs, up 5,200 jobs from last month but 15,300 jobs less than last year.

After the improved performance of this month’s top 10 markets, the next 10 markets ranked by annual job gains (#11 to #20) had 13,700 more new jobs for the year than the month before, an increase of 3.2%. However, only New York and Dallas had annual job gains of 100,000 or more, the same as in August. Another nine markets gained between 50,000 and 99,999 jobs, three more than last month. Only Naples-Immokalee-Marco Island, FL recorded an annual job loss in September.

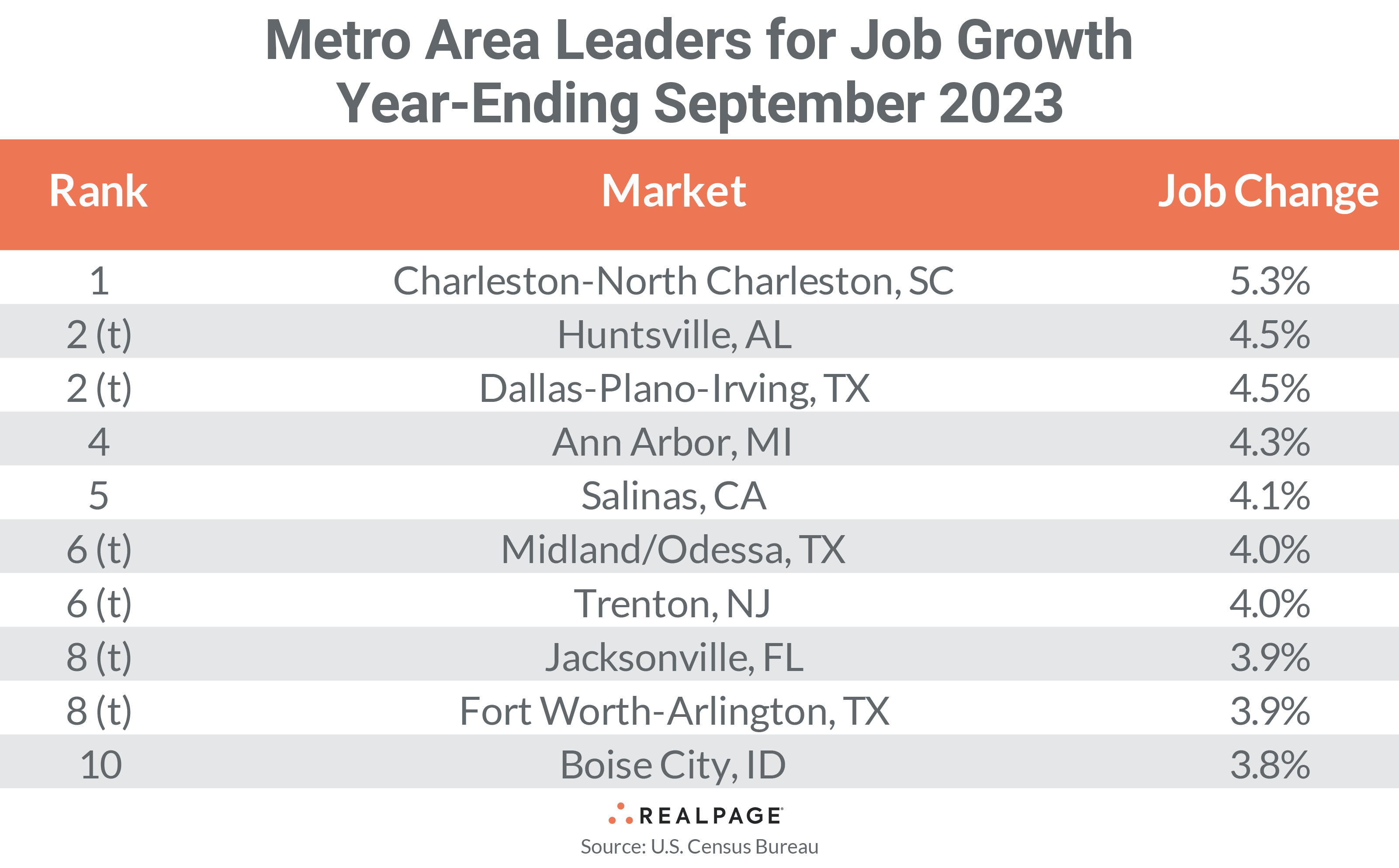

Like annual job gains, the annual percentage change in employment saw some improvement as well. The average employment percentage gain for the top 10 markets averaged 4.2% in September compared to 4.1% last month. Additionally, five of September’s top 10 markets had higher percentage employment gains than in August.

Six markets returned to September’s top employment change list from August with the none remaining in the same order. Charleston, SC led the nation for employment growth at 5.3%, and that was 70 basis points (bps) above last month’s #1 market (Huntsville, AL). Dallas tied with Huntsville for the #2 spot with 4.5% employment growth, but while Huntsville slowed their growth by 10 bps from August, Dallas improved by 70 bps.

Ann Arbor, MI came in at #4 with 4.3% annual growth and Salinas, CA ranked #5 with 4.1% growth, both down 20 bps from last month. Midland/Odessa and Trenton, NJ tied for #6 with 4% growth and both slowed by 50 bps from their August growth rates.

Jacksonville, FL and Fort Worth tied for the #8 spot with 3.9% employment growth and each improved by 30 bps from August. Boise City, ID rounded out the top 10 with 3.8% job growth, also up 30 bps for the month.

With smaller markets experiencing more volatility in their job growth rates, the spread or difference between the #1 and #10 markets on this month’s list widened compared to last month. September’s spread of 150 bps is more than twice August’s difference of 60 bps.

Compared to one year ago, Midland/Odessa slowed the most for job growth among the top 10, falling 660 bps for the year. Dallas fell 230 bps, while Charleston, SC slowed by 150 bps from last September. Outside of the top growth markets, Naples, FL fell 710 bps from last year’s job growth to -0.2%, followed by Orlando with a 610 bps drop to 2.1% growth.

The weakest major markets for percentage growth are still in the industrial Midwest, Mid-South and Mountain West. Major markets with sub-1% growth include Columbus, OH, Denver, Memphis, Detroit, Des Moines and Milwaukee, while sub-1.5% growth major markets include Omaha, Buffalo, St. Louis and Chicago. Seventy markets had annual job growth rates above the not seasonally adjusted national average of 2.2%, five fewer than in August.