Student Housing Rent Growth Softens as Pre-Leasing Chugs On in June

U.S. student housing pre-leasing continues to increase at a seasonally normal rate in Fall 2024, and remains above pre-pandemic trends even though momentum has slowed from the previous two years.

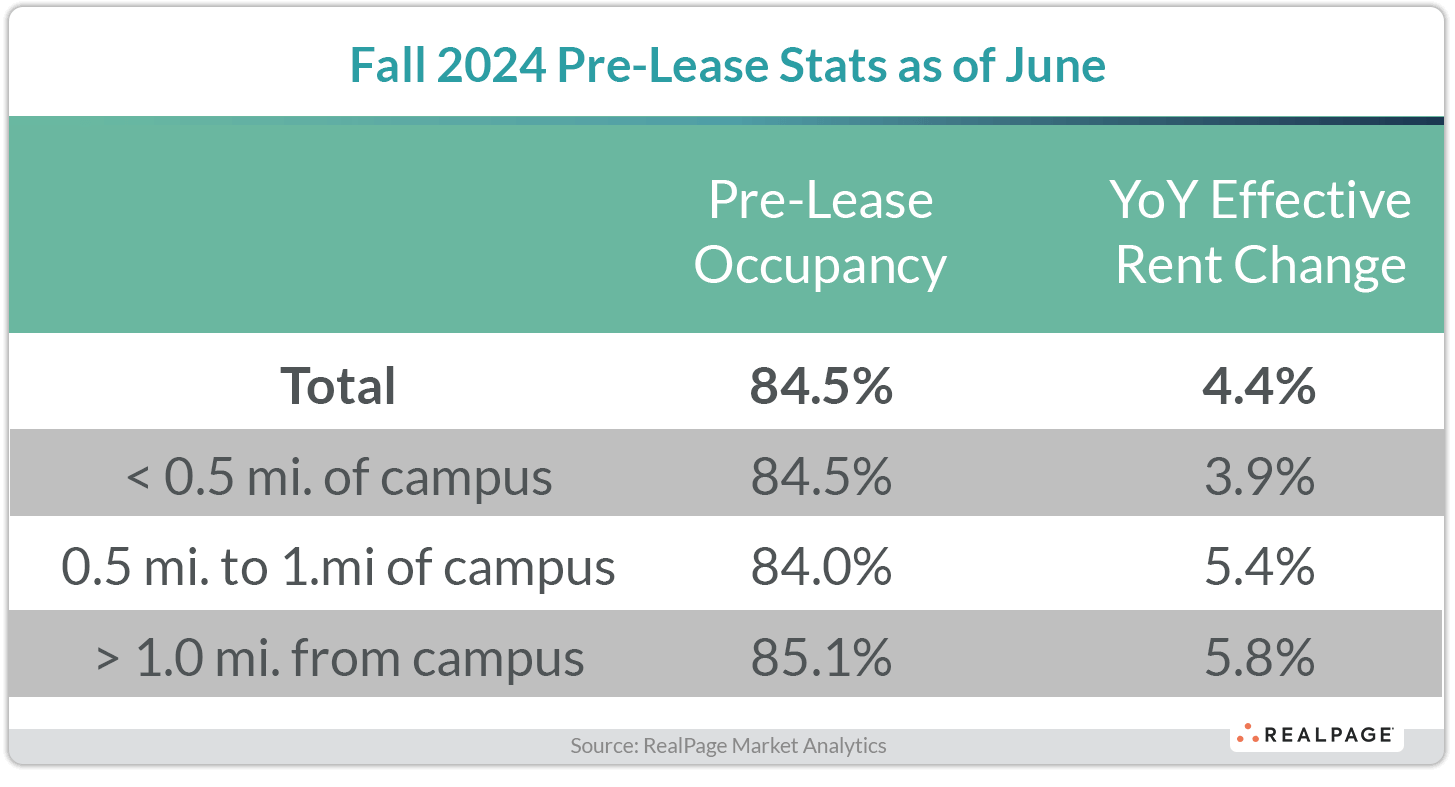

As of June, roughly 84.5% of beds at the core 175 universities tracked by RealPage have been leased for Fall 2024, compared to a rate of 85.8% one year ago. June’s pre-lease rate also falls below the June 2022 pre-lease rate for Fall 2023 of 86.2%.

Pre-lease momentum did climb notably in June, up 6% since May. This was above average, as leasing generally slows in the summer months when students leave campus. In comparison, the May to June increase in 2023 was milder at 5.5%. The next few months of the pre-lease season could see approximately a 5% jump in pre-lease momentum month-over-month, if the last two summers are any indication.

Across distances from campus, properties farthest from campus reported the tightest pre-lease occupancy as of June at just above 85%. Properties within a half mile of campus (84.5%) matched the RealPage 175 average, while properties within a half mile to one mile of campus garnered the lowest (but still historically strong) pre-lease occupancy of 84% as of June.

Across the RealPage 175, annual effective rent growth softened to 4.4% in June, which was the lowest rate seen so far this pre-lease season. Properties more than one mile from campus continued to report the strongest rent growth at nearly 6% as of June, followed by slightly softer readings at properties closer to campus.