East Coast Gateway Apartment Markets Outperforming West Coast

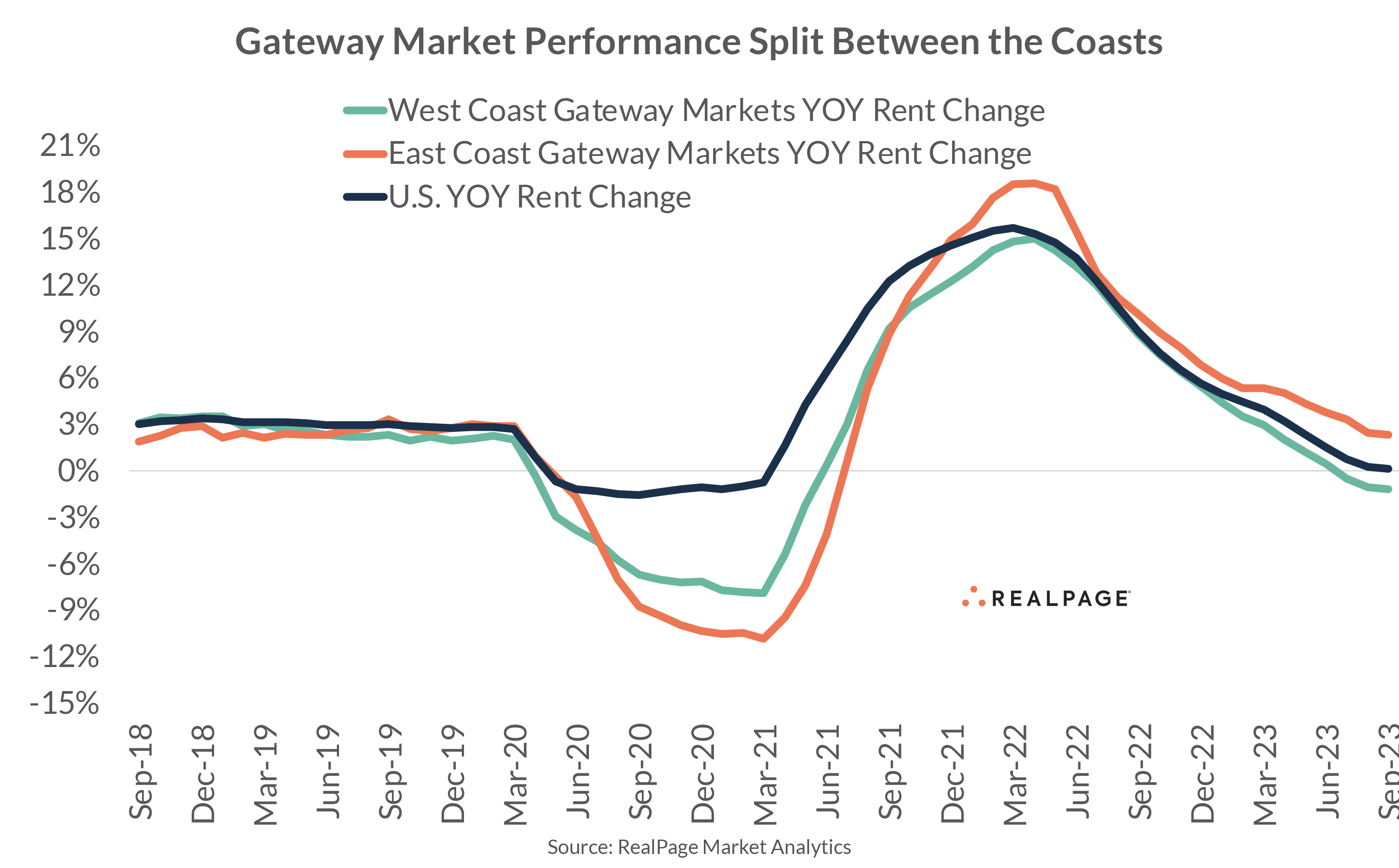

The nation’s large gateway markets have seen a widening split in apartment market fundamentals in recent quarters.

East Coast gateway markets* are exhibiting strength in the face of increased apartment supply volumes, while West Coast gateway metros** are softening, despite less significant completion levels.

Nationwide, previously healthy rent growth has flattened due to heavy supply. But apartment operators in East Coast gateway markets aren’t sweating completion volumes. In fact, rent growth was roughly 2% or better across every gateway market along the East Coast in the year-ending September. That’s much better than the essentially flat 0.1% average in the U.S. overall.

Newark was the rent growth leader among the nation’s 50 largest apartment markets, with a price increase of 4.3% in the past year. Boston’s annual increase was also solid at 3.1%, while Washington, DC and New York logged growth of 1.9% and 1.7%, respectively.

Big rent growth is not just exclusive to gateway market in the Northeast. It’s a common theme among most Northeast apartment markets recently, as rent growth in this region has taken an historic lead over the national norm. This is not just about solid price increases in the Northeast, but it’s also a likely product of operators preserving occupancy amid so much new supply allowing renters more options.

In fact, among the West coast gateway markets, only Anaheim posted rent growth ahead of the U.S. average, with an increase of 1.3% in the year-ending September. All other West coast gateway markets suffered rent cuts in the past year. The deepest declines were seen in the Bay Area metros of San Jose (-2.5%), Oakland (-2.4%) and San Francisco (-2.3%).

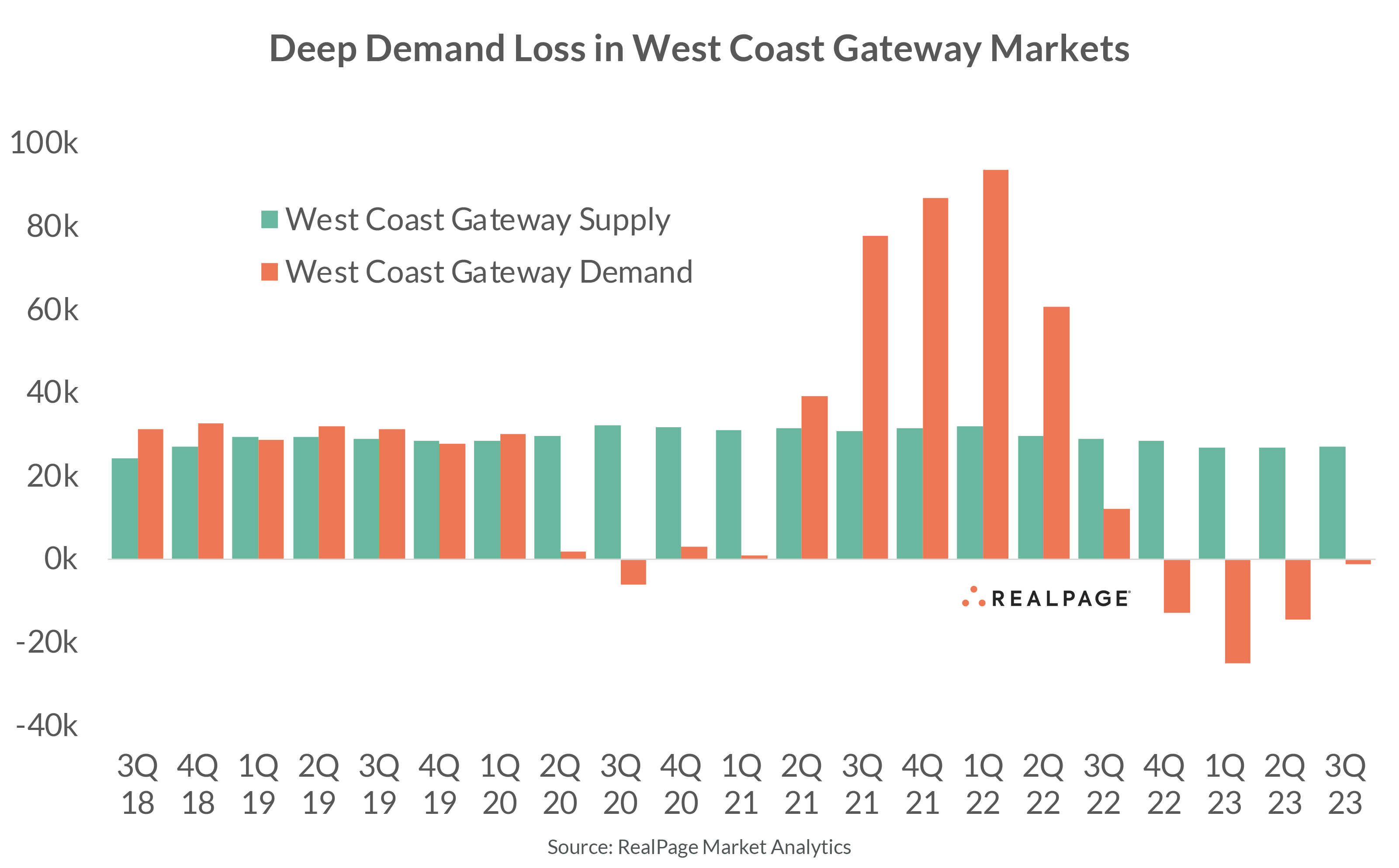

This division between coasts is inspired by apartment demand distribution. West Coast gateway markets have suffered significant demand loss in recent quarters. Annual net move-outs got as deep as 25,000 units in 1st quarter, before easing a bit in the last six months. Unlike in some areas of the country apartment supply volumes are not terrible in West Coast gateway markets. At roughly 27,000 units, completions in the year-ending 3rd quarter are a shade below recent highs from 2020-2022.

Los Angeles is the reigning leader for new apartment supply among West Coast gateway markets. Roughly 10,300 units wrapped up in LA in the past year, while net move-outs were quite a blow here, with the loss of roughly 5,200 units.

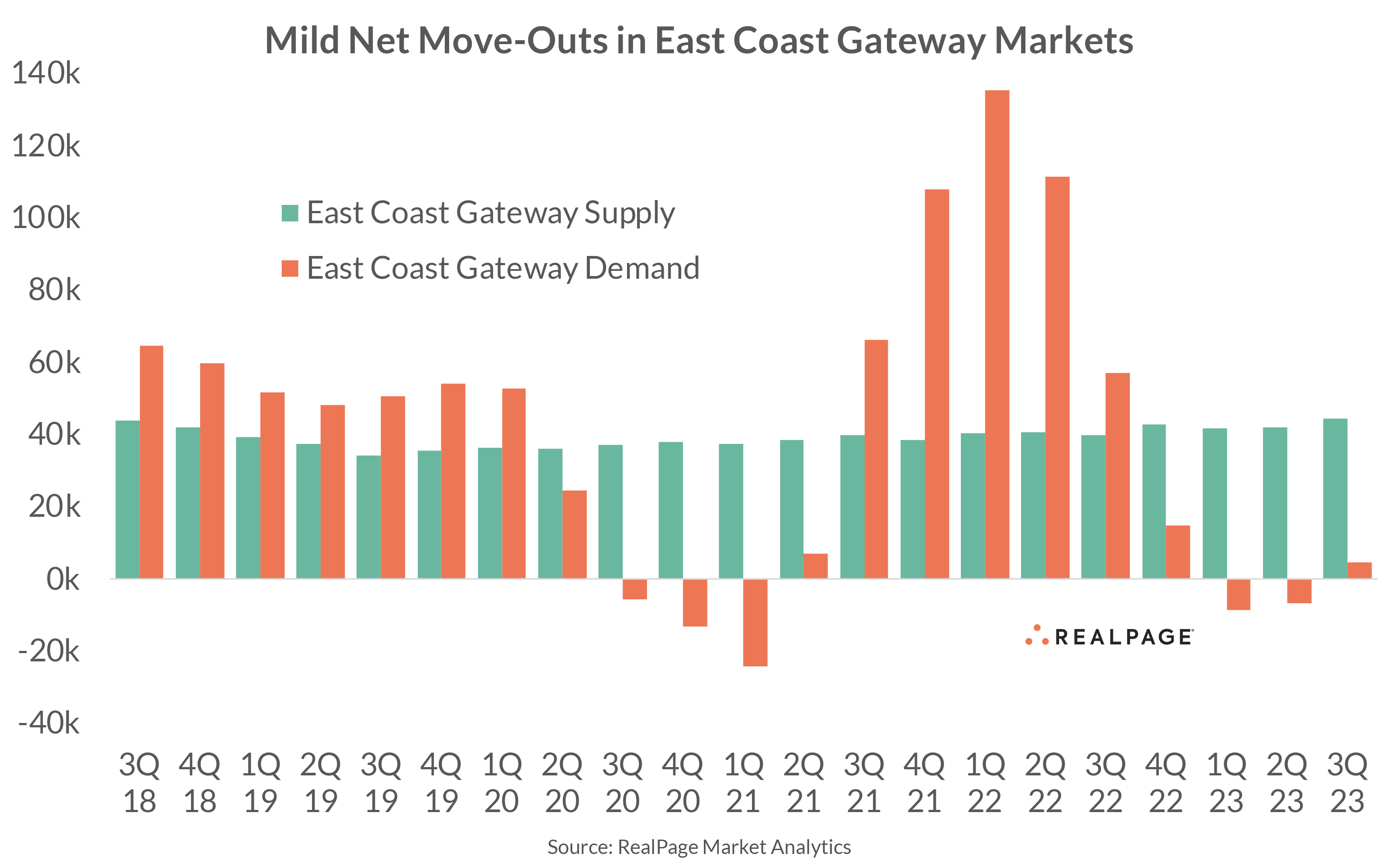

In East Coast gateway markets, net move-outs have been much milder. Roughly 9,000 units were lost at the bottom point in the year-ending 1st quarter 2023, which was not the worst showing these markets have seen in recent years. (That belongs to the nearly 25,000 net move-outs recorded in the year-ending 1st quarter 2021.) And in the year-ending 3rd quarter, positive demand returned at a mild 4,600 units or so. Meanwhile, supply has been significant. About 44,500 units were completed in the past year in the East Coast gateway markets, which was a recent peak.

Washington, DC was the supply leader among East Coast markets, with 14,500 units wrapped up in the year-ending 3rd quarter. New York and Newark weren’t far behind, however, with roughly 11,000 to 12,000 units completed. DC logged sizable concurrent apartment demand, absorbing 8,200 units. New York was the demand patsy of the U.S., suffering net move-outs from 10,600 units in the past year.

In general, demand volumes have been stronger across the rest of the Northeast as well, while the West region has seen just a trickle of apartment absorption activity. None of this, however, compared to the sizable demand recognized across the Sun Belt and Mountain regions of the U.S. in recent years.

*East Coast gateway markets are defined as New York, Washington, DC, Newark and Boston.

**West Coast gateway markets are defined as Los Angeles, Seattle, Anaheim, San Francisco, Oakland and San Jose.