Class A Rents Continue to Rise, Despite Occupancy Trailing Class B and C Assets

U.S. apartment market fundamentals have experienced some softness under continued pressure from elevated supply. But demand well above historical norms has helped to alleviate some of that strain. Despite large volumes of new supply, Class A product has held up remarkably well, with occupancy in line with pre-pandemic norms and continued rent growth.

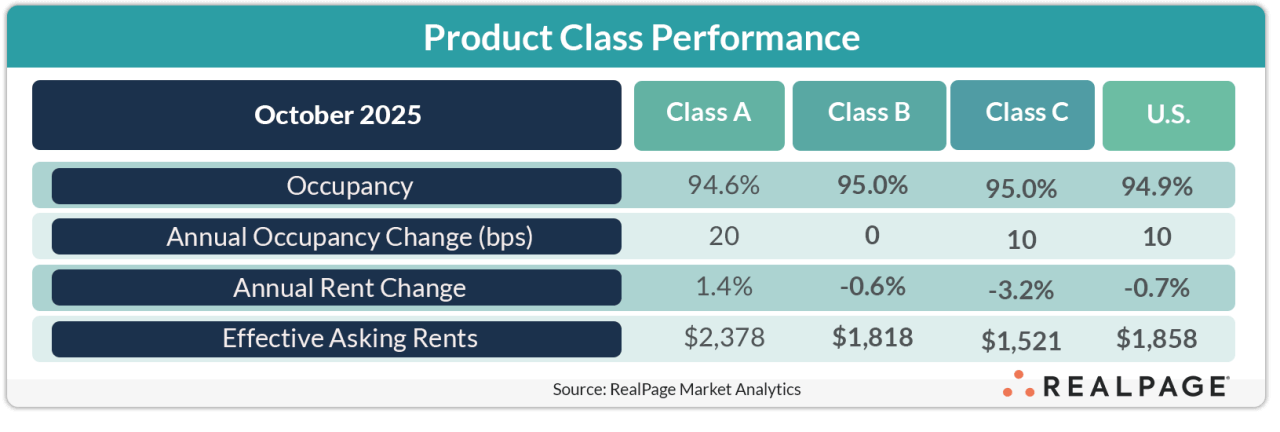

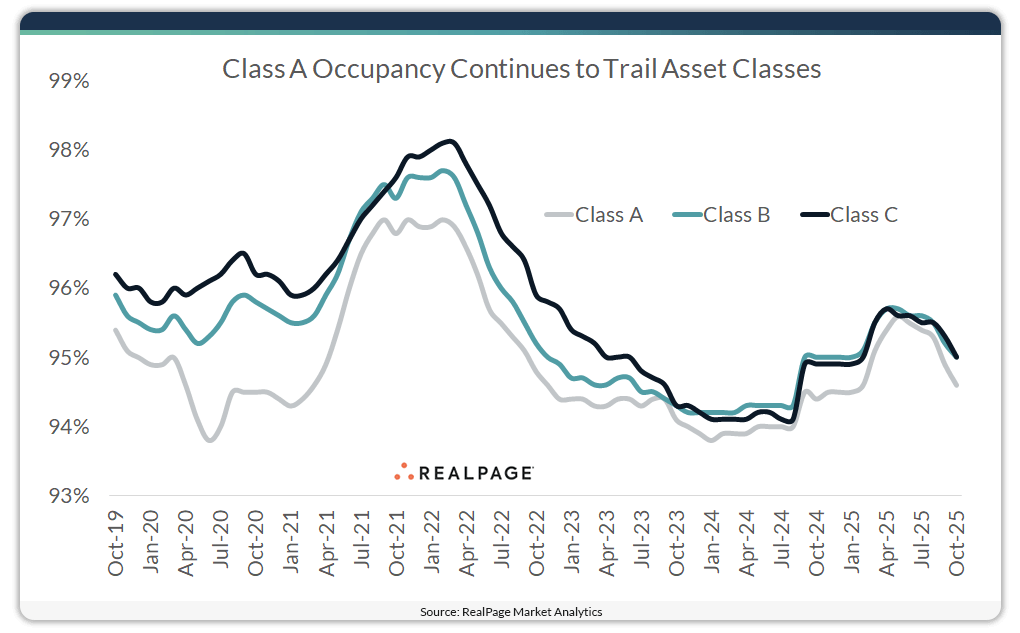

Stabilized market-rate apartments across the U.S. have captured outsized demand, but as supply has remained at historically high levels, occupancy eased in recent months. On a year-over-year basis, occupancy was still up 10 bps, according to data from RealPage Market Analytics. Class A units recorded an annual occupancy gain of 20 basis points, while occupancy in Class C units was up 10 basis points and occupancy in Class B product was unchanged.

Recent shifts took occupancy in Class B and C assets to 95% in October, rates slightly under the pre-pandemic average from 2015 to 2019 of 95.3% and 95.4%, respectively. Meanwhile, Class A units recorded an occupancy rate of 94.6% in October, in line with the pre-pandemic average (94.7%).

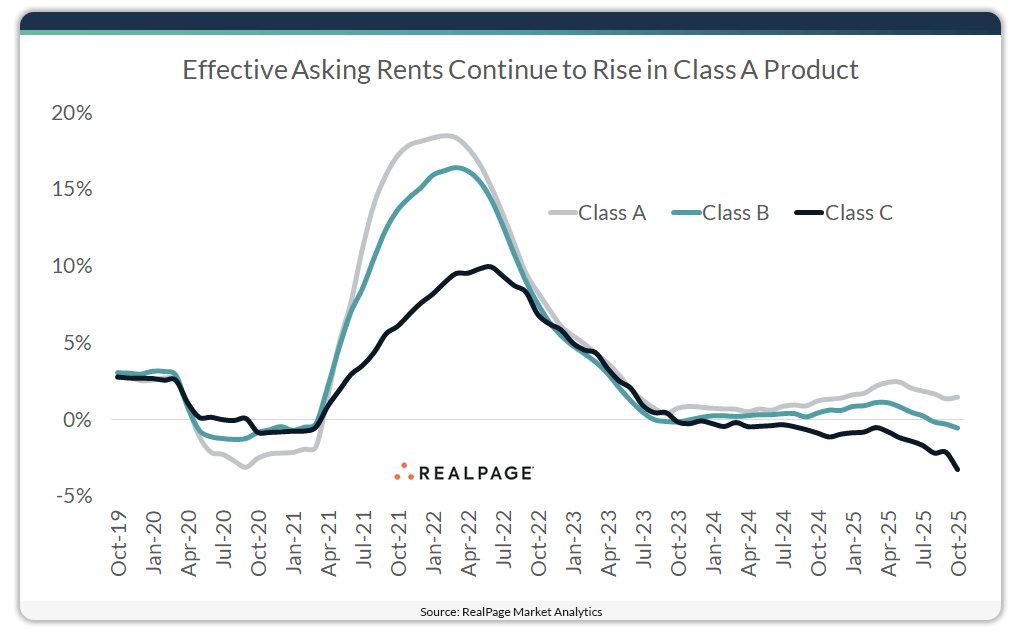

Elevated supply has put downward pressure on rent growth. During the year-ending October 2025, effective asking rents across the nation fell 0.7%, the steepest annual decline in more than four years. Class C units pulled down the national average, as effective asking rents in that asset class dropped 3.2% in the year-ending October. That was the deepest annual rent cut for that product class in nearly 14 years. Class B rents were also down, falling 0.6% year-over-year, the deepest rent cut for that segment in more than four years.

Despite the deluge of new supply, however, rents were up 1.4% on an annual basis in Class A product. While that was below that segment’s average annual increase of 3.1% during the five years leading up to the pandemic (2015-2019), it marked the 55th consecutive month of year-over-year rent gains.

As of October, effective asking rents across the nation averaged $1,858 per month. Rents in Class A product averaged $2,370 per month, $560 more than Class B product ($1,818). Monthly rent in Class C assets averaged $1,521 per month.