Apartment Transactions Trend Up for Third Consecutive Quarter

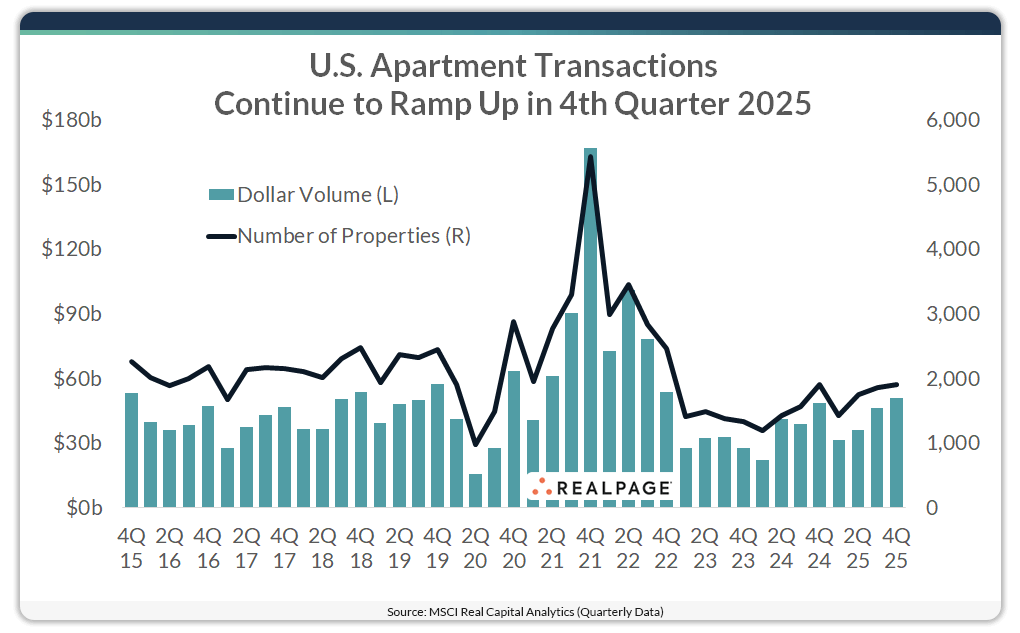

U.S. apartment transactions continued to rise during the October to December 2025 time frame. Both the number of properties traded and the dollar volume of transactions have been trending up for the past three quarters.

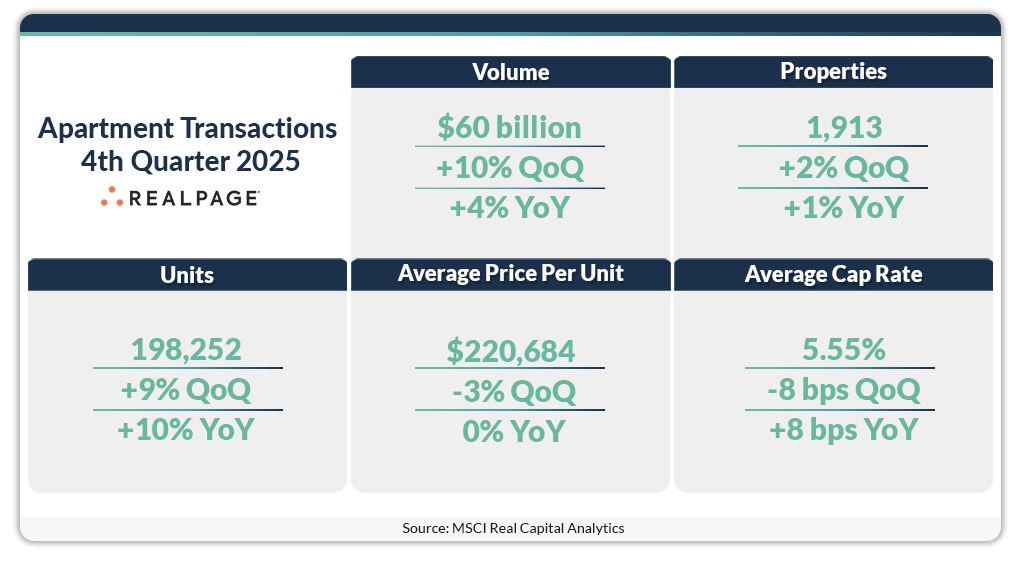

Roughly 1,910 apartment properties changed hands at a value of $60 billion during 4th quarter 2025, according to MSCI Real Capital Analytics. Overall sales volumes were up 4% year-over-year and were 10% above the 3rd quarter 2025 level when around 1,870 properties changed hands for roughly $46.5 billion. Still, recent activity was well below the $55.1 billion quarterly average from the past five years.

The average price per unit in 4th quarter remained high at $220,684, registering above $200,000 for 16 of the past 18 consecutive quarters. Prior to 2021, the per-unit pricing never exceeded that threshold and averaged roughly $151,000 from 2015 to 2019.

Meanwhile, cap rates for apartment transactions occurring in 4th quarter 2025 averaged 5.55%, well above the pandemic-era low of 4.64% from 2nd quarter 2022. Though apartment cap rates have remained above 5.5% for the past two years, they are by far the lowest among major property types, keeping the asset class an attractive commercial real estate investment.

On an annual basis, transactions in calendar 2025 totaled nearly $165.5 billion with 6,955 properties trading hands. That total sales volume was up 9% from 2024, while the number of properties sold was up 14%. Looking back over the past few years, sales dipped in calendar 2020 due to the pandemic, when about 7,300 apartment communities sold for $148.2 billion. That was well below the volume from 2019, when nearly 9,100 properties traded hands for $195 billion. In 2021, transactions jumped due to pent up demand following the onset of the pandemic, with roughly 13,500 properties trading hands at a value of roughly $359.3 billion, nearly double the 2020 level on both accounts.

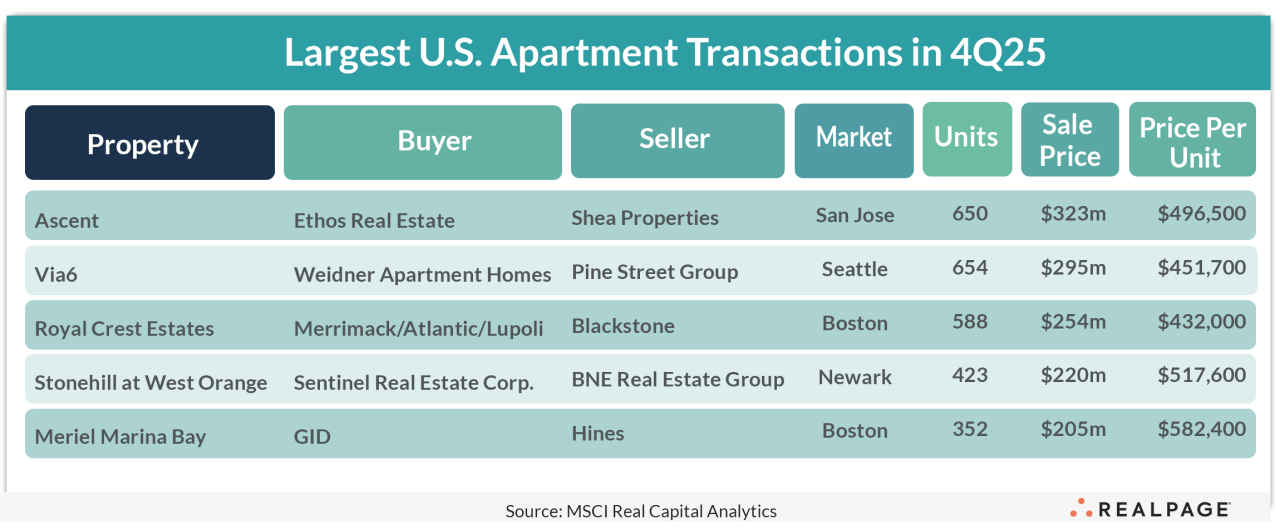

Among the five largest single-asset market-rate apartment transactions during 4th quarter 2025, all sold for more than $200 million. Of those sales, three were in the Northeast region, with two of those in the Boston market, and two were sold in the West region.

Ascent

The largest single-asset market-rate apartment transaction in the nation during 2025’s 4th quarter was in San Jose. In December, Manhattan Beach, CA-based Ethos Real Estate purchased the Ascent apartment community for nearly $323 million. South Orange County-based Shea Properties sold the 650-unit property for about $496,500 per unit. The apartment community at 5805 Charlotte Dr. within the South San Jose submarket was built in 2016. The community features a pool, resident lounge with kitchen and game room, business center, fitness center and outdoor lounge with pizza oven.

Via6

In December, the 654-unit Via6 apartment community in Seattle traded hands for about $295 million, the second-largest apartment transaction in the U.S. during 4th quarter 2025. That transaction price equated to roughly $451,700 per door. Kirkland-based Weidner Apartment Homes purchased the two-tower 24-story complex from the developer, Seattle-based Pine Street Group. The community was built in 2013 at a cost of $200 million. The development along Sixth Avenue within the Downtown Seattle submarket features a fitness center, bike shop, pet spa, chef’s kitchen and onsite retail.

Royal Crest Estates

The third-largest apartment transaction in the nation during 2025’s 4th quarter, was the sale of Royal Crest Estates in the Boston market. The 588-unit property traded for $254 million, or $432,000 per door. Merrimack College, partnering with Atlantic Management and Lupoli Cos., purchased the complex in December from New York-based Blackstone. The community is adjacent to Merrimack College’s North Andover campus in the North Essex County submarket. The community was already partially leased by the college for student housing. The 76‑acre site was previously the focus of a large mixed‑use redevelopment proposal rejected by town officials in 2021 for being too dense. Built in 1970, the three-story development has an average unit size of 1,173 square feet.

Stonehill at West Orange

In October, New York-based Sentinel Real Estate Corp. acquired Stonehill at West Orange, a newly developed 423-unit luxury apartment community in the Newark market. The development sold for approximately $220 million, or roughly $517,600 per unit, the nation’s fourth-largest apartment transaction in 2025’s 4th quarter. Completed in 2024 by Livingston, NJ-based BNE Real Estate Group, the property is a redevelopment of a former office campus off IH-280, about 16 miles west of Midtown Manhattan, on Executive Drive in West Orange within the West Essex County submarket. The three-building, four-story complex features more than 44,000 square feet of amenities, including two fitness centers, coworking spaces, lounges, coffee bars and concierge services.

Meriel Marina Bay

Ranking as the fifth-largest apartment transaction in the nation during 4th quarter was the sale of Meriel Marina Bay in the Boston market. In mid-November, Boston-based GID (General Investment and Development) acquired the 352-unit community from Houston-based Hines for $205 million, or roughly $582,400 per unit. The five-story community was built in 2017 on a nearly six-acre waterfront site at 552 Victory Rd. in Quincy. Amenities include a swimming pool, seaside lounge, fitness center, clubhouse, entertainment lounge, conference rooms, playroom, kayak storage, bicycle repair station, dog park and gas barbeque grills. There is also approximately 20,000 square feet of onsite retail. The community has been rebranded Windsor Marina Bay.

Every quarter, Real Estate Writer Charlotte Wheeler details the nation’s five largest multifamily rental transactions. Read the previous posts in the Apartment Transactions series.