Apartment Market Comparison: Baltimore vs. Washington, DC

Baltimore is an important U.S. seaport. Washington, DC is the nation’s capital city. Located just an hour drive from each other, these neighboring multifamily markets are similar in demographic makeup but very different in some other respects.

Over the next several weeks, RealPage Market Analytics will be exploring the similarities and differences of neighboring apartment markets.

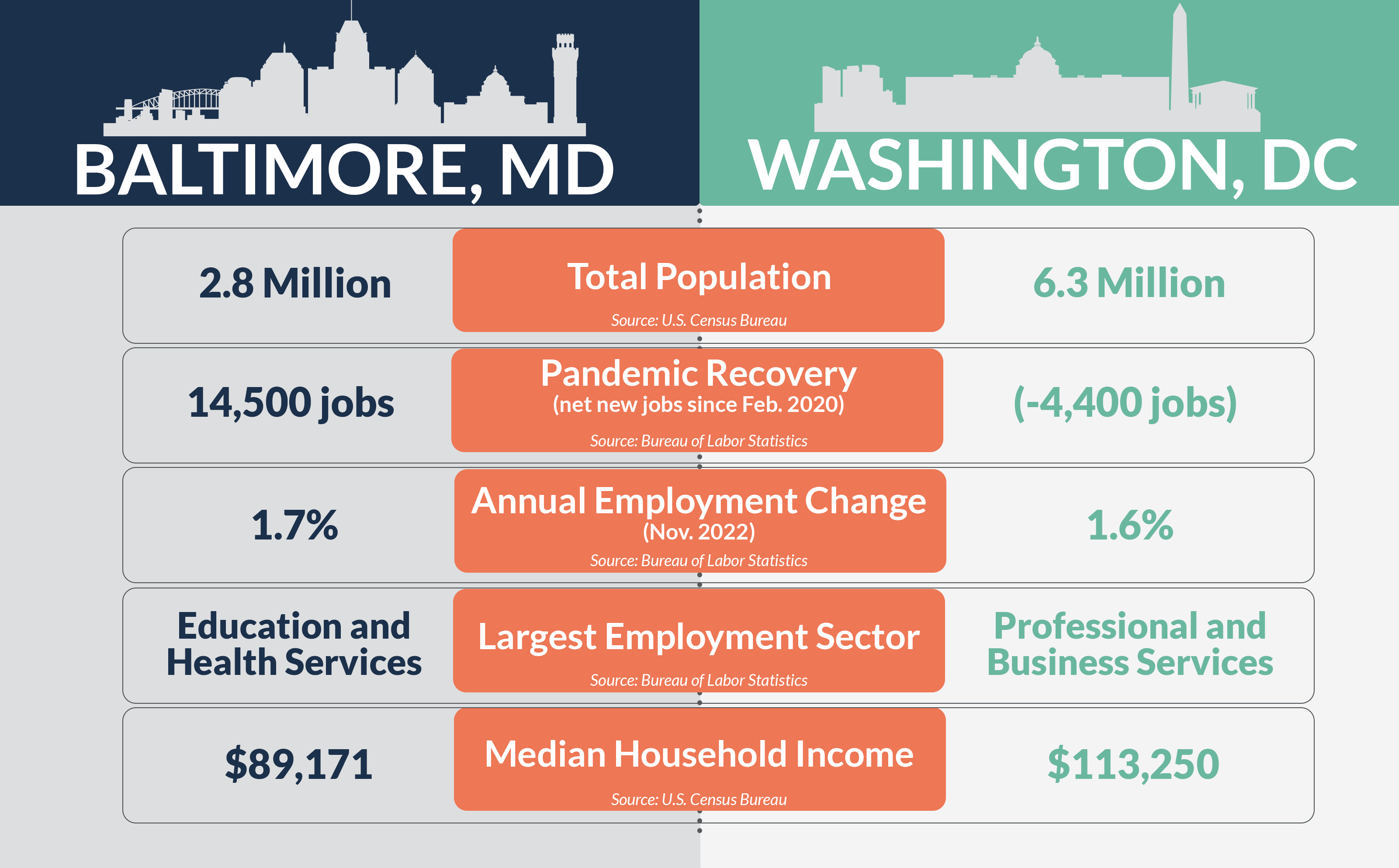

One of the big differences between Baltimore and Washington, DC is population. The nation’s capital is one of the most populous cities in the U.S., boasting 6.3 million residents, according to data from the U.S. Census Bureau. Baltimore is less than half that size, with an estimated 2.8 million people.

Washington, DC saw one of the nation’s biggest international migration patterns in 2021. Almost 12,600 people migrated to the city from outside of the country. Only New York and Miami saw more in-migration internationally. That volume, however, was muted somewhat by the 66,800 or so people who moved out of DC to other U.S. cities during the year. In Baltimore, loss to domestic migration (-5,560 residents) outweighed international in-migration (1,990 residents).

Both markets have struggled to recover from the pandemic-induced recession. Baltimore has regained the most jobs lost, and the total employment base sits 14,500 jobs ahead of pre-pandemic norms, according to data from the Bureau of Labor Statistics. Washington, DC, on the other hand, is still shy of February 2020 totals by 4,400 jobs. Among the nation’s largest 50 apartment markets, only a handful are still in the red in employment count. In addition to Washington, DC, other markets yet to fully recover are Milwaukee, Pittsburgh, San Francisco, Richmond and Cleveland.

However, in the past year, specifically, job growth in both markets is right in line with the national average of 1.6%.

Baltimore’s big two employment centers are Education and Health Services and Trade, Transportation and Utilities. Surprisingly, Washington, DC’s largest employment sector is Business and Professional Services, though Government employment is not far behind.

The median household income across both markets is notably ahead of the national average of roughly $69,000, according to five-year estimates from the U.S. Census Bureau. The share of residents with bachelor’s degrees in these two metros is also notably ahead of national norms. Washington, DC – which has the biggest population of residents with bachelor’s degrees at 52.5% – has the largest median income of about $113,250. While Baltimore comes in a bit lower at about $89,170, that income still tops the U.S. average by about $20,000.

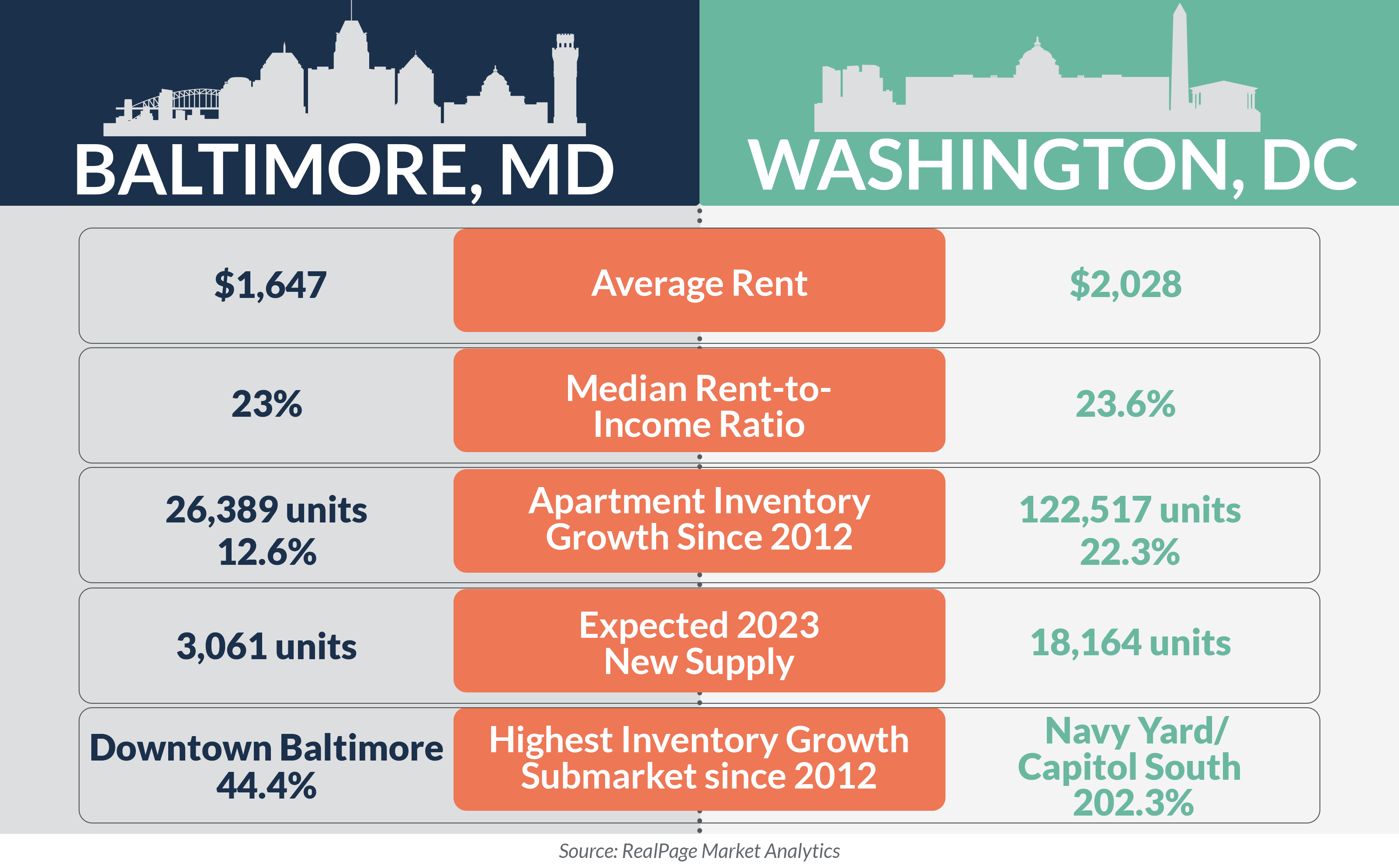

Rent-to-income ratios in Baltimore are roughly in line with the national norm of 23%, according to the latest data from RealPage Market Analytics. Rent-to-income ratios are just a bit higher in Washington, DC (23.6%). Effective asking rental rates in these markets were some of the priciest in the South region. Washington, DC commands rates of about $2,030, roughly $250 ahead of the national average. Baltimore is a bit more affordable at roughly $1,650, about $130 below the U.S. norm.

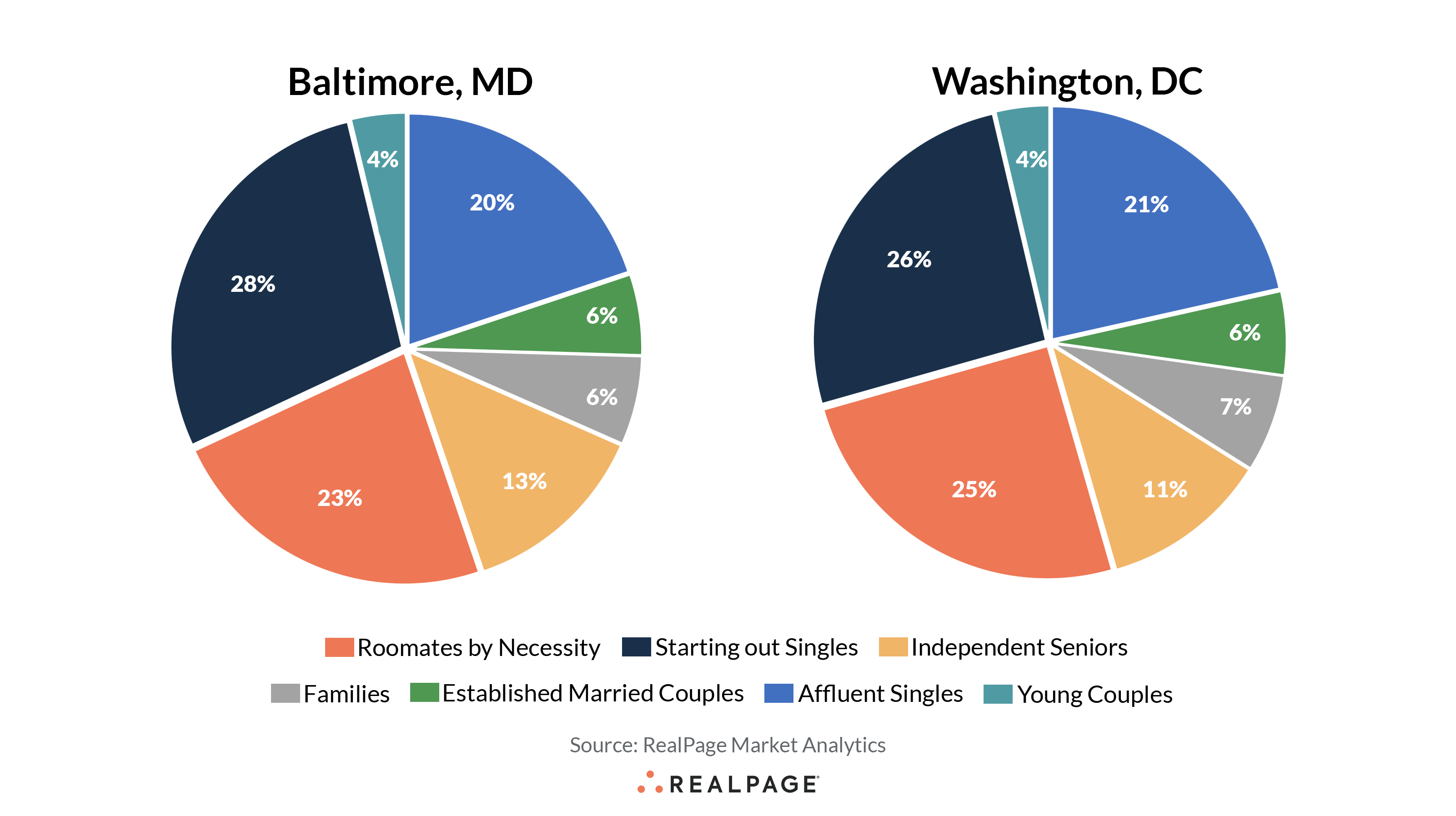

When looking at the makeup of the resident base in these markets, two big renter cohorts stand out. Starting Out Singles is the largest segment of the renter base in both Baltimore and Washington, DC, accounting for about 26% to 28%. Roommates by Necessity is another big slice, with 23% to 25% of the local population hitting in that category.

Apartment supply is another area where these two markets diverge. Washington, DC is one of the nation’s biggest development markets, with over 122,500 units built in the past ten years, increasing the existing stock by 22.3%. New supply totaled nearly a much smaller 16,400 units in Baltimore in the past decade, resulting in inventory growth of 12.6%.

The apartment market in the Navy Yard/Capitol South and Northeast DC submarkets more than doubled in the past 10 years. Meanwhile, in Baltimore, notable growth of about 40% or more was logged in Downtown Baltimore and Northwest Anne Arundel County.

Washington, DC should is expected to see notable deliveries in 2023, with 18,160 or so units scheduled to complete. Baltimore should see supply volumes kick up notably, with over 3,000 units slated to complete in 2023 – well ahead of 2022’s 900 new units and above this market’s five-year average.

Next, explore the similarities and differences of neighboring apartment markets in California’s Bay Area.