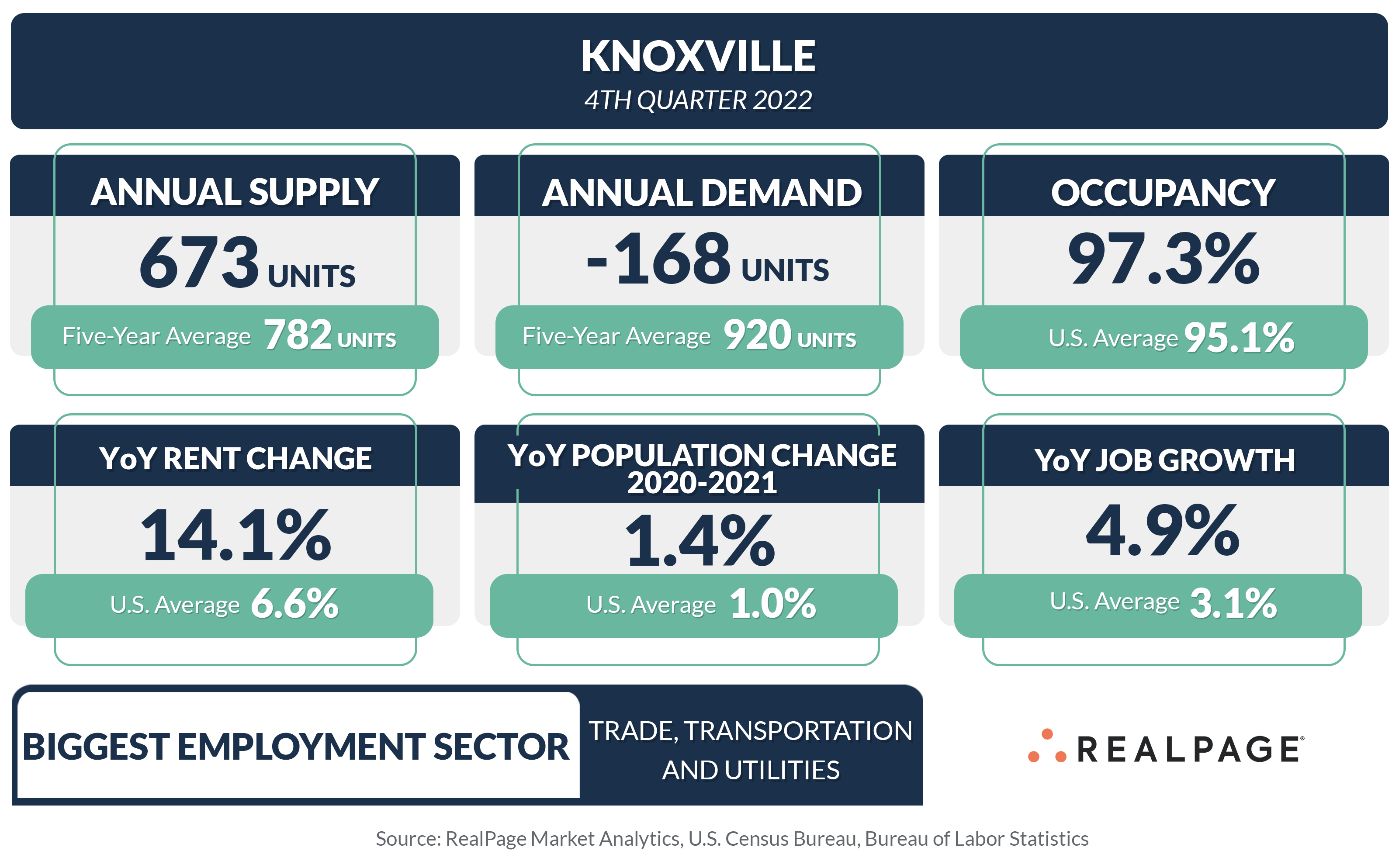

Located about 200 miles east of Nashville along the Tennessee River, Knoxville is outperforming national trends. This small apartment market with roughly 52,600 existing units has maintained tight occupancy and stellar rent growth, despite both easing of late.

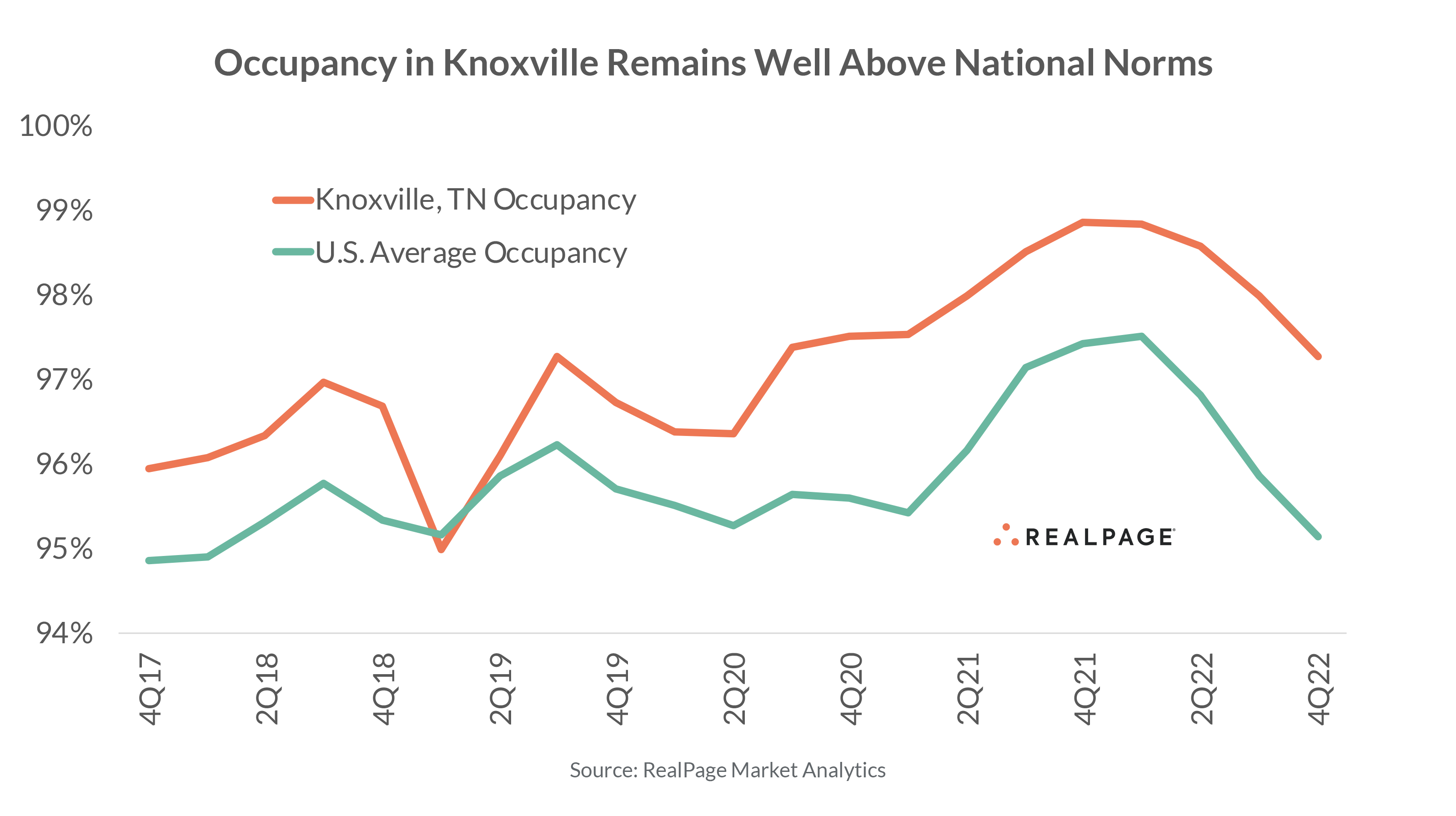

Knoxville recorded strong apartment occupancy of 97.3% in 2022’s 4th quarter, ranking #9 among the core 150 markets nationally, according to data from RealPage Market Analytics. While down 160 basis points year-over-year, that reading was well above the national norm of 95.1% and well above Knoxville’s pre-pandemic average of 95.8% from 2015 to 2019. In addition, Knoxville’s 4th quarter 2022 occupancy landed well above Nashville’s rate of 94.9%.

All of Knoxville’s product classes recorded occupancy at or above 96%, with Class C stock taking the lead at 98.4%. Meanwhile, Class B product was 97.5% occupied, while Class A product trailed with a rate of 96%. Likewise, occupancy among Knoxville’s four submarkets was tight, ranging from 96.8% in North Knoxville to a very strong 98% in Downtown/University/South Knoxville.

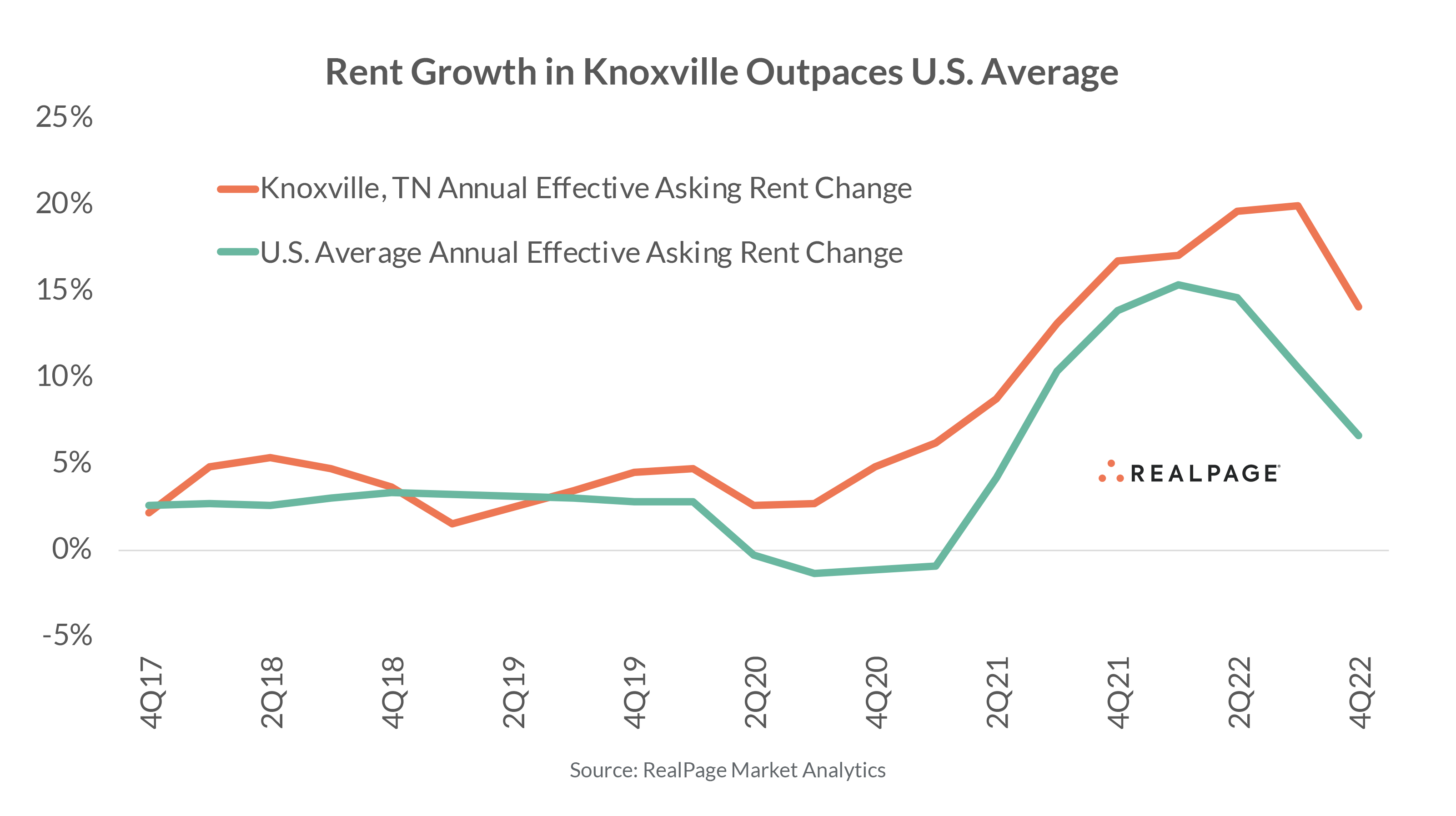

While rent growth in Knoxville has also softened recently, price increases remain solid, continuing ahead of historical norms and national averages. Same-store rents in Knoxville climbed 14.1% year-over-year in 4th quarter 2022, notably above the 6.6% increase in the U.S. overall and ranking #5 nationally. In addition, Knoxville’s annual rent growth performance was nearly double the pace set in Nashville (7.8%). While Knoxville’s recent price hike has come down from the historic peaks of nearly 20% in mid-2022, the market is still well ahead of its pre-pandemic average of 3.4% from 2015 to 2019.

Similar to occupancy, rent growth remained strong across asset types and submarkets. Knoxville’s Class A and B product posted the biggest annual rent growth of around 14.5% to 15.5%, while Class C units recorded a 6.8% increase. Across Knoxville’s submarkets, rent growth remained in double digits, ranging from a low of 12.2% in Southwest Knoxville to a high of 17.7% in Downtown/University/South Knoxville.

As of 4th quarter 2022, monthly rent in Knoxville averaged just under $1,400, below the Nashville average of roughly $1,600 and the U.S. norm of nearly $1,800.

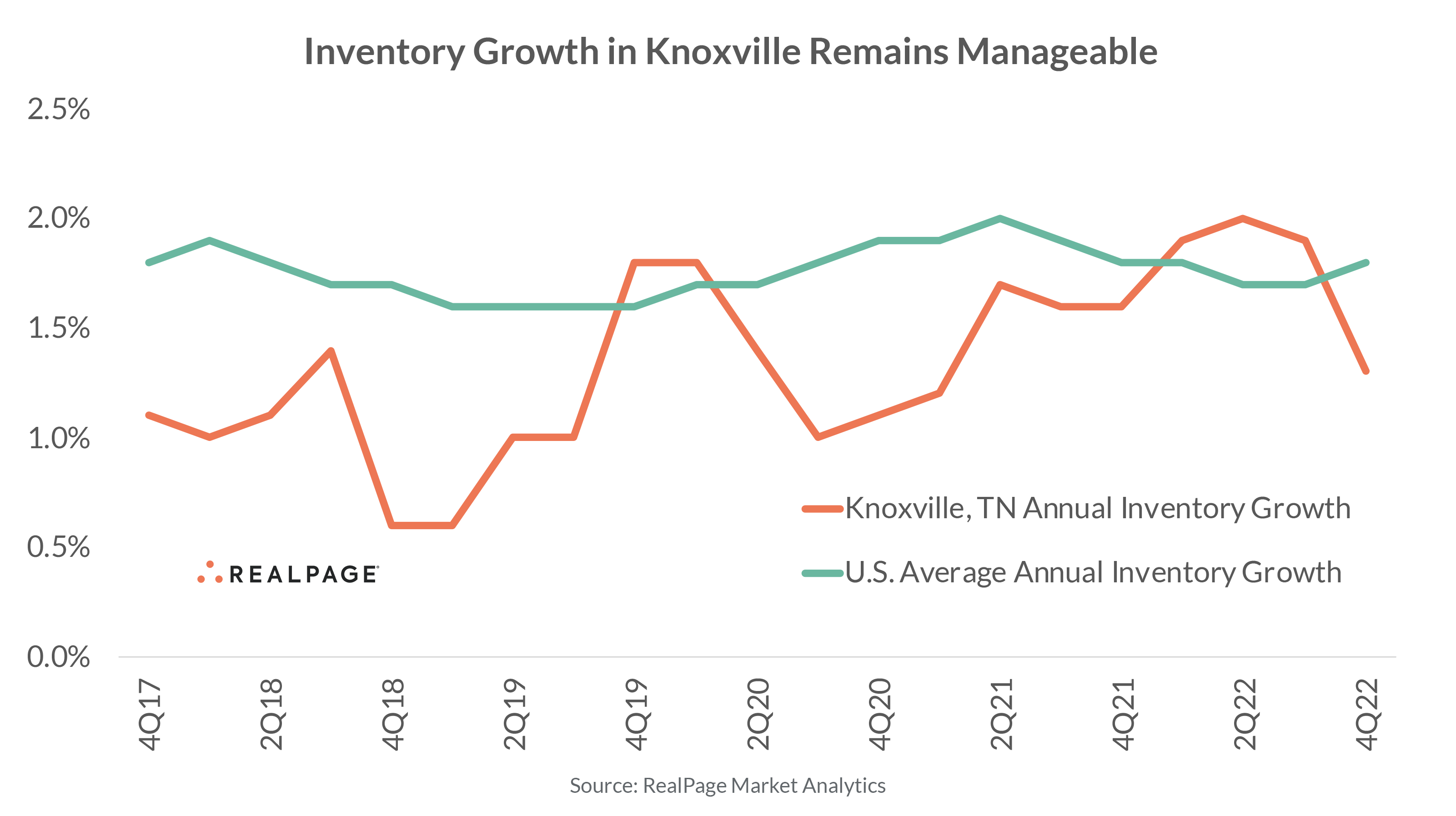

Helping Knoxville maintain strong occupancy and rent growth levels, new supply has been modest, with a pace that trailed the national average over much of the past five years. That trend continued into 2022. Knoxville added just 673 units during the calendar year, growing its existing unit count 1.3%, below the national average growth pace of 1.8%. While Knoxville saw the demand dip like the rest of the country in 2022, recording net move-outs from 168 units in 2022, the demand and supply relationship maintained a balance over the past five years, with a total of 3,811 units absorbed and 3,734 units delivered. However, Knoxville is expecting supply to surge in the coming year, which could dampen market fundamentals. In 2023, roughly 2,090 units are scheduled to come online, which is slated to grow existing inventory 4%.

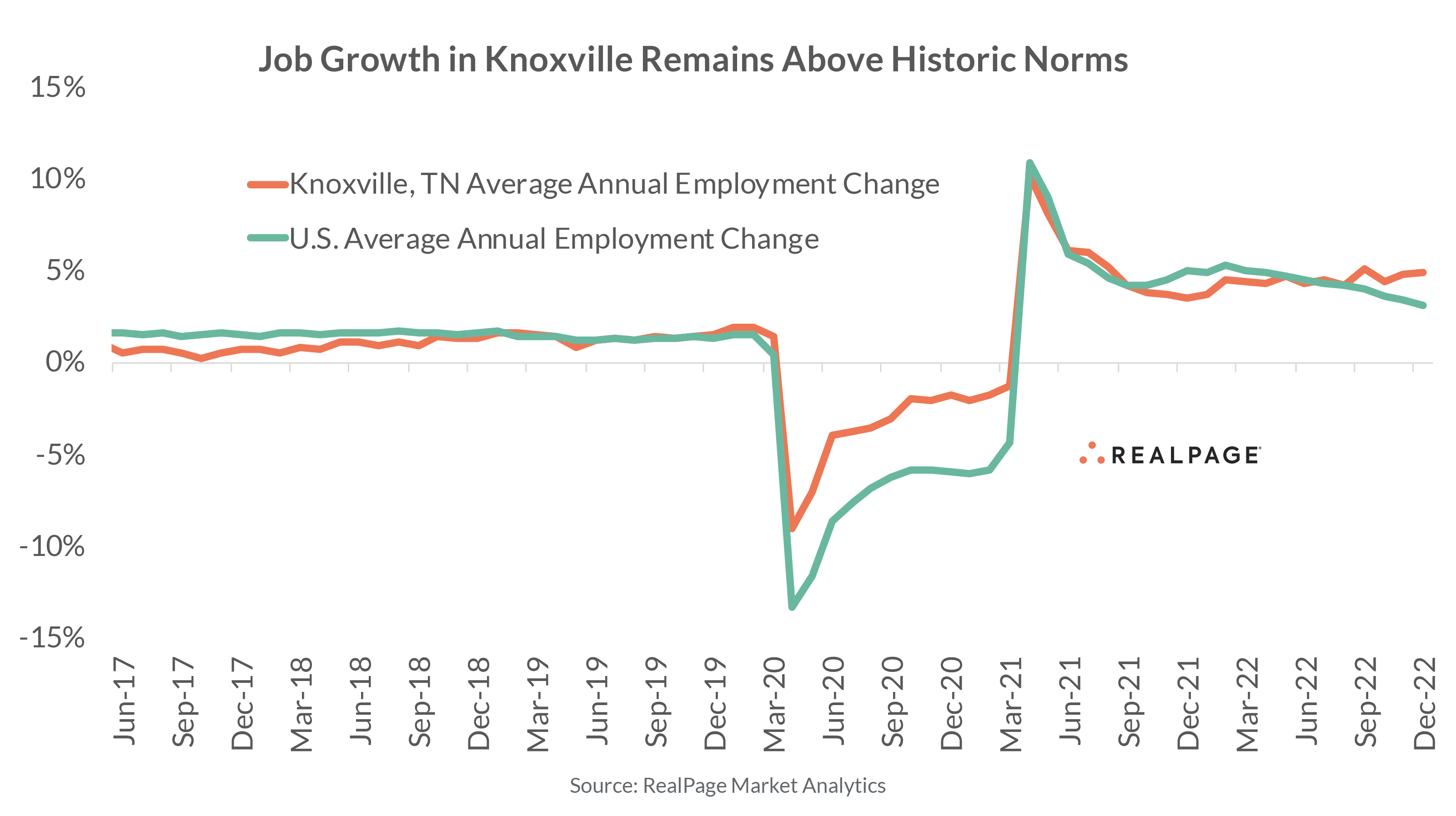

Aside from modest supply volumes, the key to Knoxville’s apartment market resilience is the local economy. Job growth in Knoxville has remained above historic norms since mid-2021. In 2022, the metro added 20,400 jobs, growing its employment base 4.9%, the eighth-fastest growth pace among the top 150 markets nationally. Outside of the 50 largest markets, only Charleston (5.9%) and Portland, ME (5%) recorded faster growth rates. For comparison, prior to the pandemic, job growth in Knoxville averaged 1.5% annually from 2015 to 2019.

Knoxville’s job market didn’t suffer as big of a job base contraction as most other markets during the onset of the pandemic and therefore didn’t have as much ground to make up. As a result, total employment in Knoxville is now significantly higher than prior to the pandemic. As of December 2022, the metro area had 30,500 jobs more jobs compared to February 2020, which was a 7.5% job base expansion and a much better performance than the U.S. norm of 2.9%. Trade/Transportation/Utilities, which makes up one-fifth of all jobs in Knoxville, contributed a good chunk of those new additions. That sector added 11,700 jobs since February 2020, increasing its employment base 14.8%.

With so many jobs tied to Trade/Transportation/Utilities, incomes in Knoxville are comparatively low. As of 2021, Knoxville’s median household income clocked in at $60,724, well below the national norm of $69,021. Homeownership in Knoxville also falls below the national average. The local homeownership rate in the Knoxville metro area averaged 63.8% in 2022, well below the U.S. average of 65.8% during that same period.