The Second-Largest Renter Cohort: Roommates by Necessity

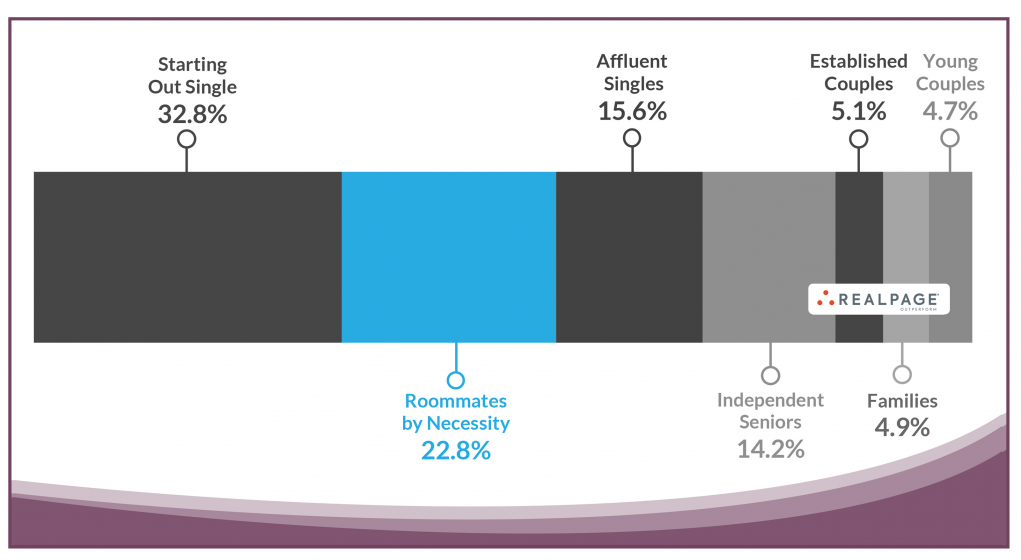

Roommates by Necessity is the nation’s second largest renter cohort, making up nearly one quarter of apartment renter households in the U.S.

RealPage performed a massive study of more than 11 million individual apartment leases to create an industry-leading cluster analysis of U.S. apartment renters. Those 11+ million leases were analyzed by our team of data scientists who crunched the numbers and identified the most powerful and explanatory variables. Then, with their help, RealPage’s team of data and market analysts combined that intel into seven individual renter cohorts based on a suite of demographic variables, including renter income, age, marital status, kids, pets and cars. Apartment product selection criteria were also included, such as property age, class, location, number of occupants, lease term, effective rent, rent-to-income ratio, length of stay and propensity to renew.

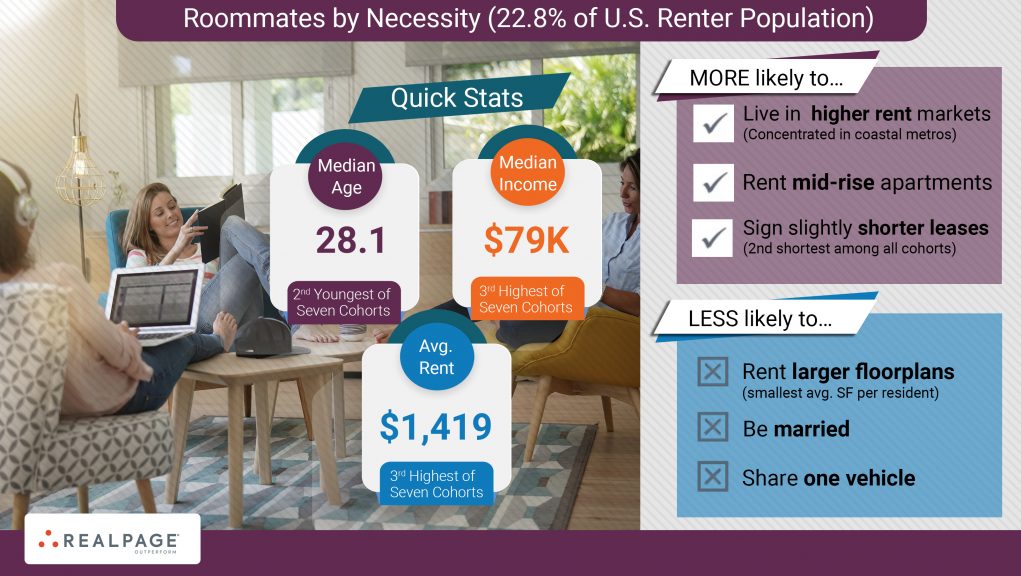

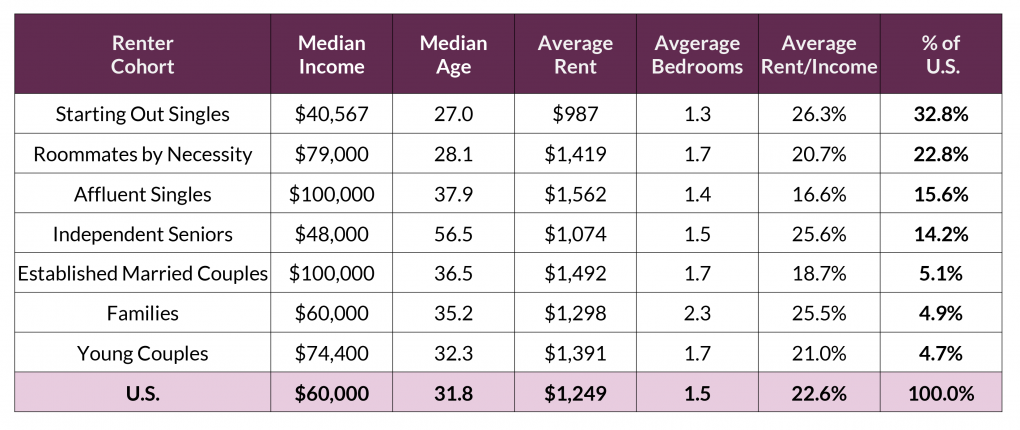

Roommates by Necessity make up about 23% of the U.S. renter population. At 28.1 years old, this is the second youngest of all seven cohorts. For comparison, the U.S. renter average is 31.8 years old.

This is a young group of renters, but this particular group is doing pretty well in terms of typical salary levels. With a median income of nearly $80,000, this group ranked3rd highest among the nation’s renter base, after Affluent Singles and Established Married Couples.

Meanwhile with an average rent of $1,419, these renters tend to live in coastal locales, in more expensive housing markets. That’s the 3rd highest among all seven renter groups. Despite the higher monthly rents, however, Roommates by Choice still spend a relatively smaller portion of their income on rent. The rent to income ratio of 20.7% was the 3rd lowest of all cohorts at the time of the analysis.

This analysis does lead to the question: If earning nearly $80,000 per year, why would this group rent with roommates out of necessity?

The answer lies in where those renters live. This group tends to live in higher rent metros, so their higher incomes are counterbalanced by the higher cost of living. This group also tends to rent Class A and upper-tier Class B properties, indicating they’re also probably clustered in higher-end submarkets.

Lastly, it’s probably safe to assume that based on their income levels and their home markets that they probably work in technology jobs, or other higher wage industries such as professional and business services.

Because this group of renters lives in higher cost-of-living markets, they tend to rent two- or three-bedroom properties with a roommate out of necessity rather than by choice.

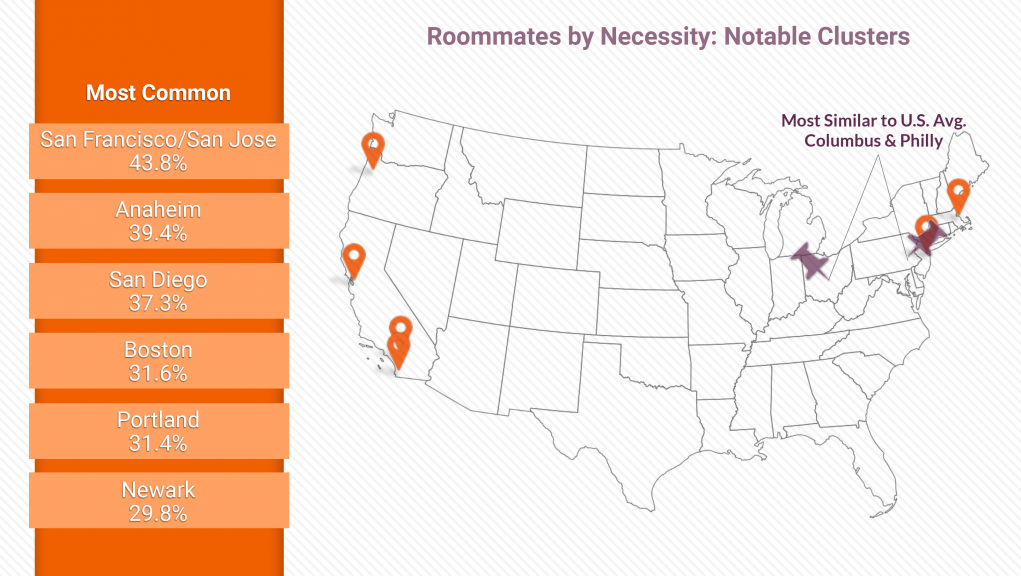

In the Bay Area, nearly 44% of all renters are classified as Roommates by Necessity. Two Southern California markets – Anaheim and San Diego – also follow suit. Another high share of roommates by necessity pops up out east in Boston and Newark.

Not far off this list of leading markets is a trio of markets that many view in a similar light. Salt Lake City, Denver, and Seattle all have about 26% to 28% of their renters that fit into this Roommate by Necessity tranche as well.

Conversely, you’re not likely to find nearly as many renters that fit this profile in more affordable, less tech-driven markets. Places like Fort Worth and Houston are two Texas markets where the Information sector makes up a small portion of the local job base. Meanwhile, Detroit, Cleveland and Memphis see hardly any Roommates by Necessity.

Renter profiles of “sister cities” can be quite different from one another. For example, the differences between Fort Worth and Dallas (with a Roommates by Necessity profile closer to 20%) present an interesting departure from conventional wisdom which tends to look at the greater metroplex as a whole. Despite their geographic proximity to one another, Dallas and Fort Worth have much different renter cohort profiles, reflective of their own unique cultural and economic characteristics.

The two markets where the percentage of Roommates by Necessity renters essentially match the same share of the U.S. overall (roughly 23%) were Columbus and Philadelphia.

Learn more about renter segmentation by following along with our weekly renter cohort series, where we discuss each individual category of renter in the U.S. apartment market, pinpointing key trends and providing insights into business decisions, now and in the year to come.