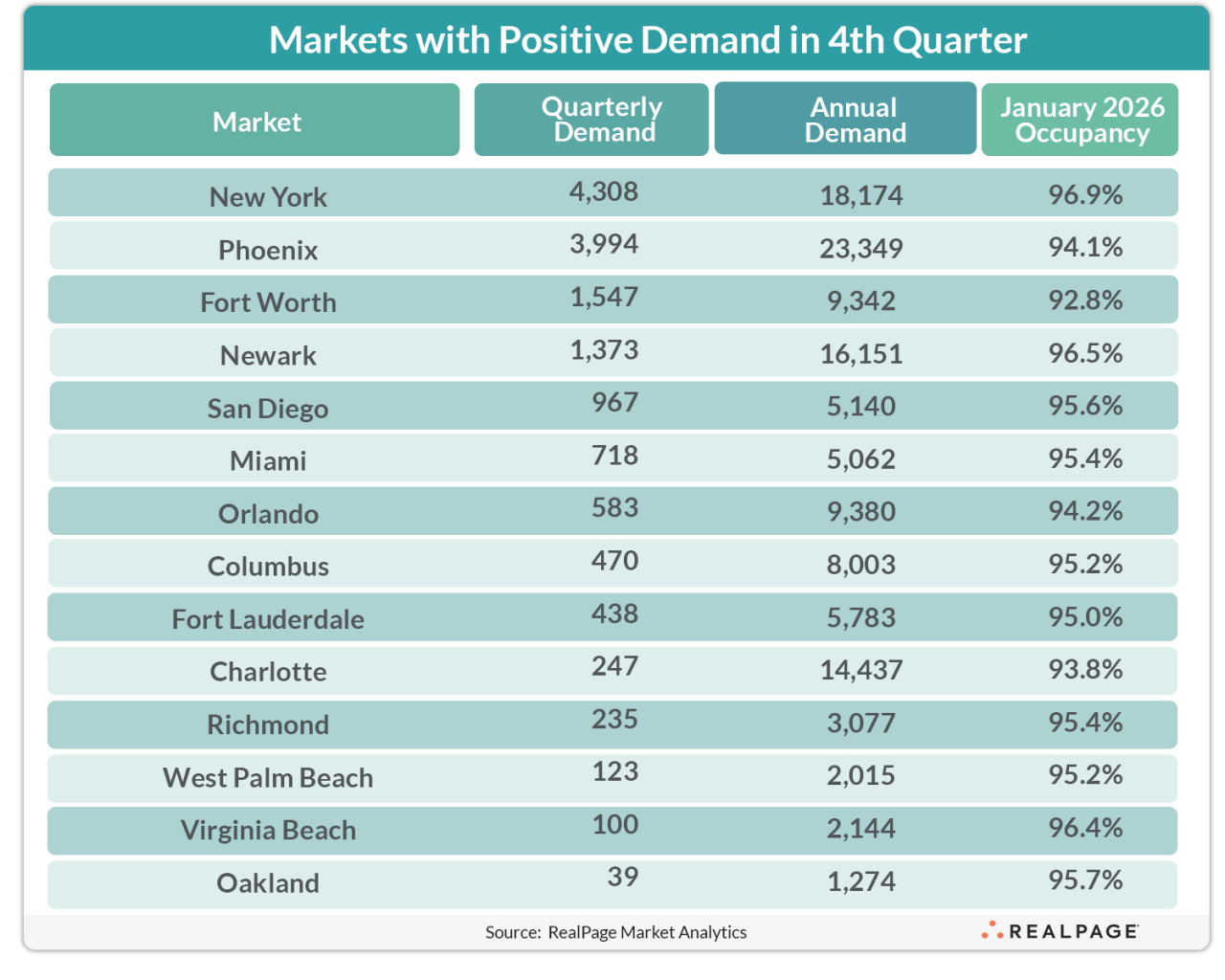

While net move-outs swept the U.S. apartment market at the end of 2025, a handful of large markets continued to see solid absorption volumes.

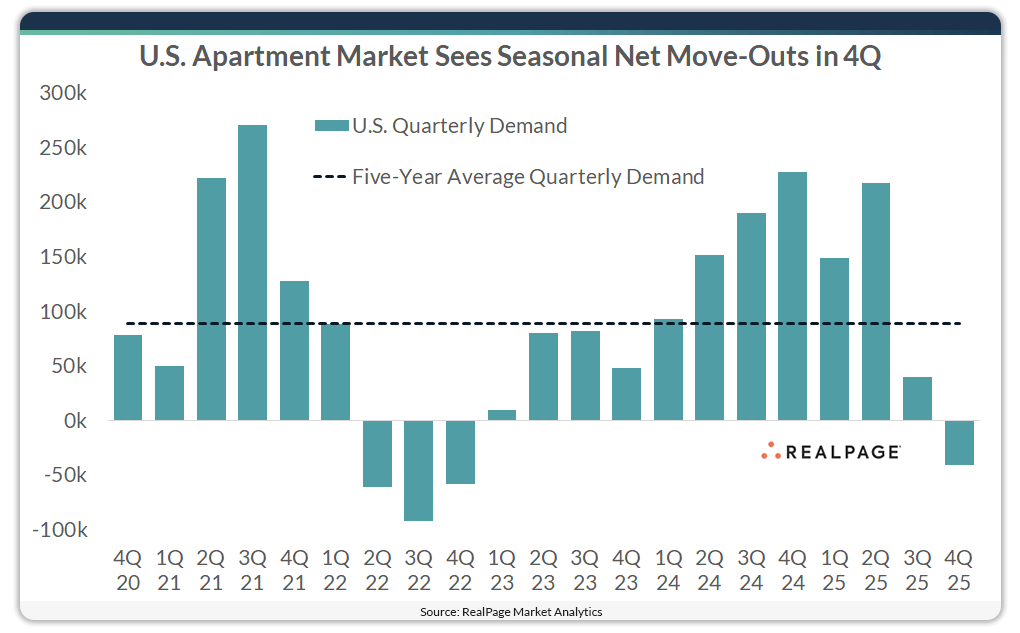

The U.S. apartment market posted seasonal net move-outs in 4th quarter 2025, for the first time in three years. This shift followed a 3rd quarter absorption cooldown and points to a broader return to pre‑pandemic normalcy after an extended period of rapid growth.

Out of the nation’s largest 50 apartment markets, only 14 continued to log positive apartment demand in 4th quarter. Of those, only four garnered more than 1,000 units of demand in the October to December time frame.

New York

The nation’s largest apartment market led the U.S. for apartment demand in 4th quarter, absorbing about 4,300 units. That was a bit ahead of the market’s five-year average for quarterly demand of about 4,600 units and marked the seventh consecutive quarter of positive absorption. Apartment occupancy in New York was the tightest among the nation’s 50 largest markets, at 96.9% in January 2026. New York occupancy started off the year strong after hovering around the 97% mark since April 2024.

Phoenix

Phoenix apartment demand came very close to New York’s, with nearly 4,000 units absorbed in 4th quarter. This marked the 8th consecutive quarter of apartment demand above or very close to the 4,000-unit mark for Phoenix. However, that volume has come down a bit after peaking in late 2024.

Only two other West region markets logged positive demand in 4th quarter. San Diego absorbed just shy of 1,000 units, while Oakland stirred up roughly 40 units in the October to December time frame.

Fort Worth

The smaller side of the Dallas/Fort Worth Metroplex was the only large Texas market to see positive apartment demand in 4th quarter. Just over 1,500 units were absorbed in Fort Worth in the October to December time frame, which was a bit behind the market’s five-year quarterly average. Despite strong demand in recent months, apartment occupancy in Fort Worth was at 92.8% at the beginning of 2026. Among the 50 largest markets, that was one of the lowest showings as of January.

Several other top 50 South region markets saw positive demand in 4th quarter, mostly in the Southeast, with Florida well represented.

Newark

Besides New York, the only other major Northeast market to log positive apartment demand in 4th quarter was Newark, where nearly 1,400 units were absorbed in the final three months of 2025. This was a decline from what the market had been absorbing recently, as the five-year average quarterly demand tally ran closer to 3,400 units. Newark apartment occupancy as of January was one of the tightest nationwide at 96.5%.

Columbus was the only top 50 Midwest region market with positive apartment demand in 4th quarter. The market absorbed nearly 500 units in the Oc