The Only Apartment Markets to Survive 2022 and 2023 Without Net Move-Outs

Now that apartment demand appears to have rebounded to a fairly normal pace, we can look back at how various markets fared over the extreme demand swings in the last two years.

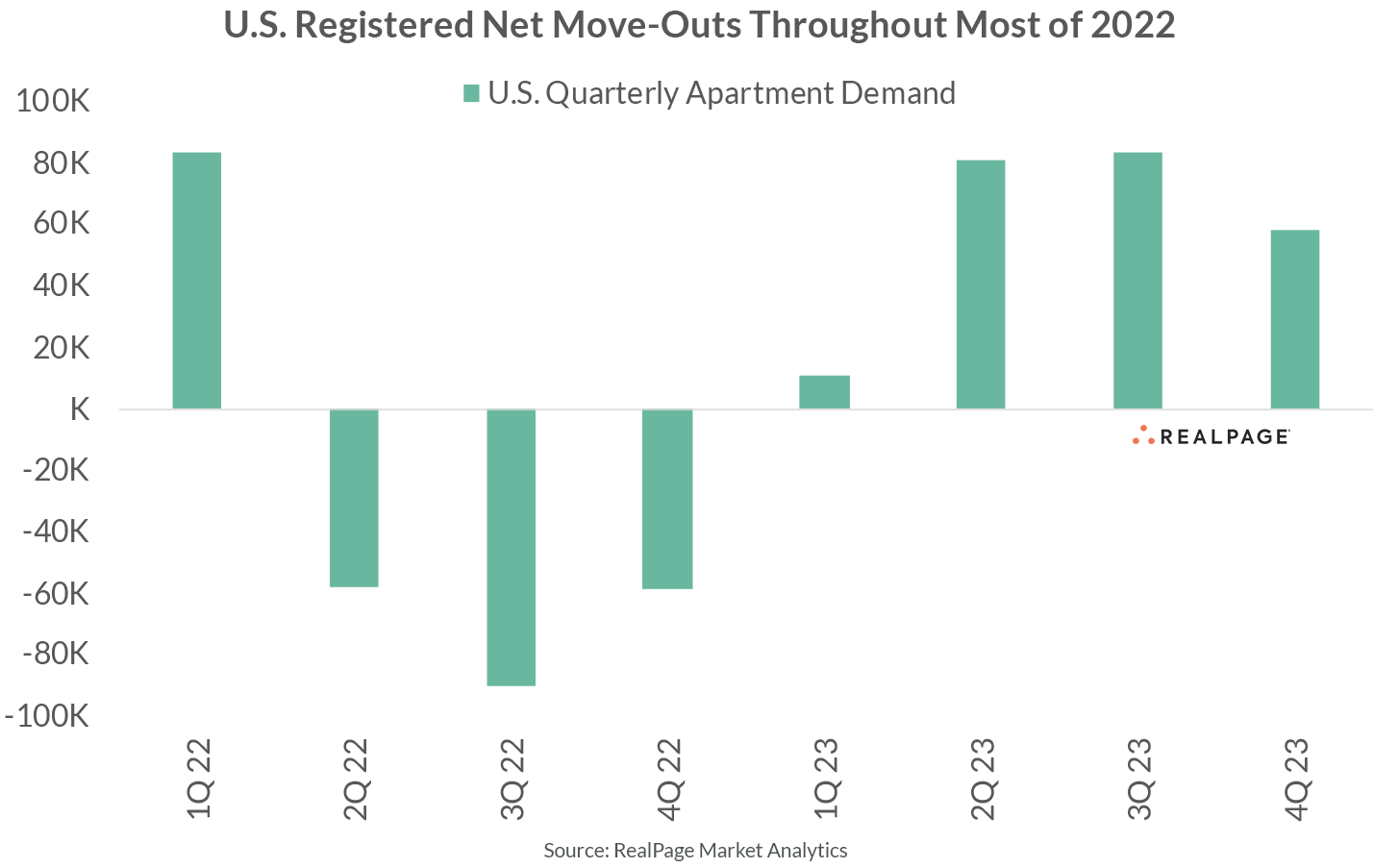

The nation at large posted net move-outs for three consecutive quarters beginning in 2nd quarter 2022, followed by barely positive absorption in 1st quarter 2023. The trough of poor demand came in 3rd quarter 2022 when the U.S. recorded net move-outs from just over 90,000 apartment units in the July to September quarter, according to data from RealPage Market Analytics.

During that time, most of the nation’s major markets were also plagued with net-move outs, though there were inevitably demand leaders and laggards. Of the nation’s 150 largest apartment markets, virtually all recorded net move-outs in at least one quarter throughout 2022 and 2023.

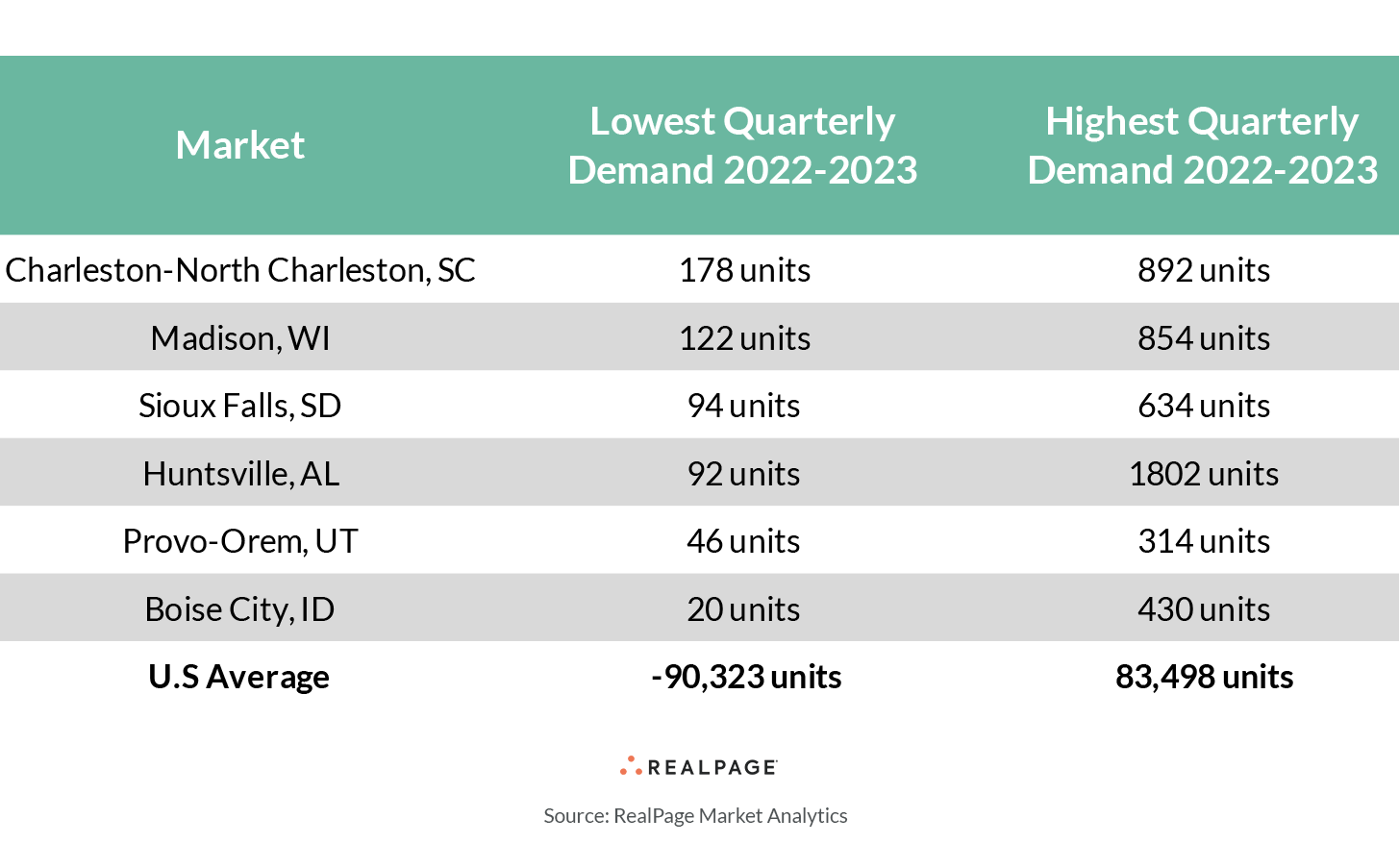

Six markets nationwide, however, managed to survive 2022 and 2023 without ever recording net move-outs. While demand underwhelmed at times in these markets, they far outperformed the rest of the nation when considering any demand at all a metric for success.

These markets include several pandemic darlings that captured, not only apartment demand, but the demographics to support it following the work-from-anywhere phenomenon in 2020 and beyond.

In Charleston, demographics have been more homegrown, rather than influenced by remote workers. Charleston led the nation in job growth on a relative basis, growing its workforce 5.9% in the year-ending November 2023. Even the no. 2 market of Salinas, CA didn’t come close to Charleston’s stellar job growth during that time. Apartment construction has been elevated for several years running in Charleston, peaking in early 2022 but still running historically high.

Madison likely relied more on its slow-and-steady reputation rather than stellar demographics to evade net move-outs in 2022 and 2023. Moderate supply in Madison (hovering below 4% annual inventory growth since 1st quarter 2022) has likely inspired some demand.

Sioux Falls and Huntsville have predominantly made headlines in the recent past for their nearly unbelievable apartment construction pipelines. Huntsville’s apartment inventory grew 15.6% in 2023 alone. Sioux Falls’ inventory growth rate was nearly as prolific, growing 10.2% in 2023.

Provo-Orem has benefited majorly from a growing population, particularly in the young adult segment, anchored in part by the twin campuses of Utah Valley University and Brigham Young University.

Boise City captured both remote workers and plenty of job growth over the last couple years. Much like Charleston, job gains in Boise City led the nation in the last year. The employment base here grew at the third-fastest relative rate, swelling 4.2% in the year-ending November 2023.