For the first time since the pandemic recovery began, New York has fallen from the top spot for job gains among RealPage’s top 150 markets.

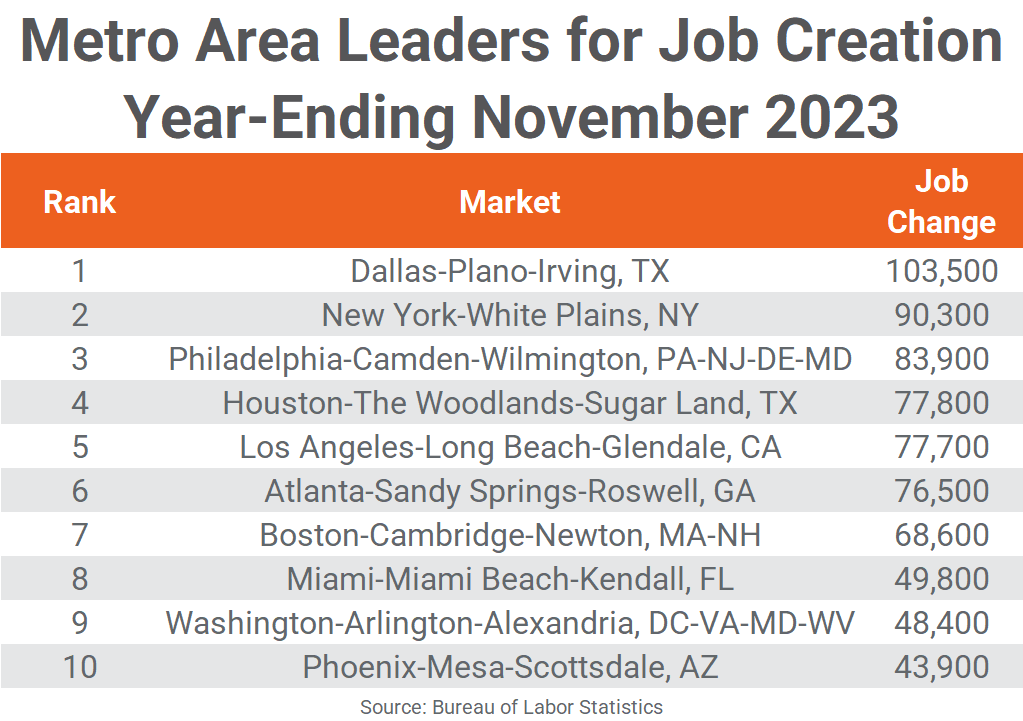

According to the latest data release from the Bureau of Labor Statistics (BLS), the Dallas-Plano-Irving metro division produced more jobs in the year-ending November than the New York-White Plains metro division (103,500 jobs versus 90,300 jobs). The combined D/FW MSA outpaced the New York-Newark-Jersey City MSA considerably, when adding the 36,200 jobs created in Fort Worth-Arlington in the past year.

The largest difference is that Dallas experienced job gains in every industry category, while New York’s strong gains in the Education and Health Services sector were partially offset by losses in the Information, Transportation/Trade and Professional Services sectors.

Nine of last month’s top 10 job gain markets returned in November with only three remaining in the same spot as in October.

Both Dallas and New York saw slowing job gains from October and the year before but New York’s decline in new jobs was triple the decline in Dallas.

Philadelphia remained in the #3 spot in November with a gain of 83,900 jobs, close to October’s total but 25,500 fewer than last year. Houston and Los Angeles also retained their positions from last month at #4 and #5, gaining a similar number of new jobs (about 77,700).

Atlanta moved up a spot to #6, gaining 76,500 jobs in the year-ending November, almost 11,000 more than in October but 28,100 less than last November. Boston was displaced one spot by Atlanta to the #7 position with 68,600 jobs gained, about 5,600 fewer than last month but only 3,700 less than last year.

Miami moved up one spot to #8, gaining 49,800 jobs for the year and adding 6,100 more jobs than in October. Washington, DC slipped one spot to #9, slowing by 13,300 jobs from October to total 48,400 new jobs in November.

Phoenix replaced Seattle at the #10 spot with 43,900 jobs gained, improving by only 2,500 jobs from October but slowing by 25,800 jobs from last year. Last month’s #10 Seattle fell to #17 with an annual gain of 31,400 jobs.

Altogether, the total number of jobs gained for the year-ending November for the top 10 markets was down 48,400 jobs from their collective total last month. However, the next 10 markets (#11-#20) saw their combined annual jobs gains increase slightly by 3,000 jobs.

With the continuing normalizing of employment gains nationally and recent slowing in New York, only Dallas exceeded 100,000 jobs gained and only six gained between 50,000 and 99,999 jobs. Nine markets reported annual job losses for the year, two more than last month as Denver, Detroit and Memphis continue to struggle.

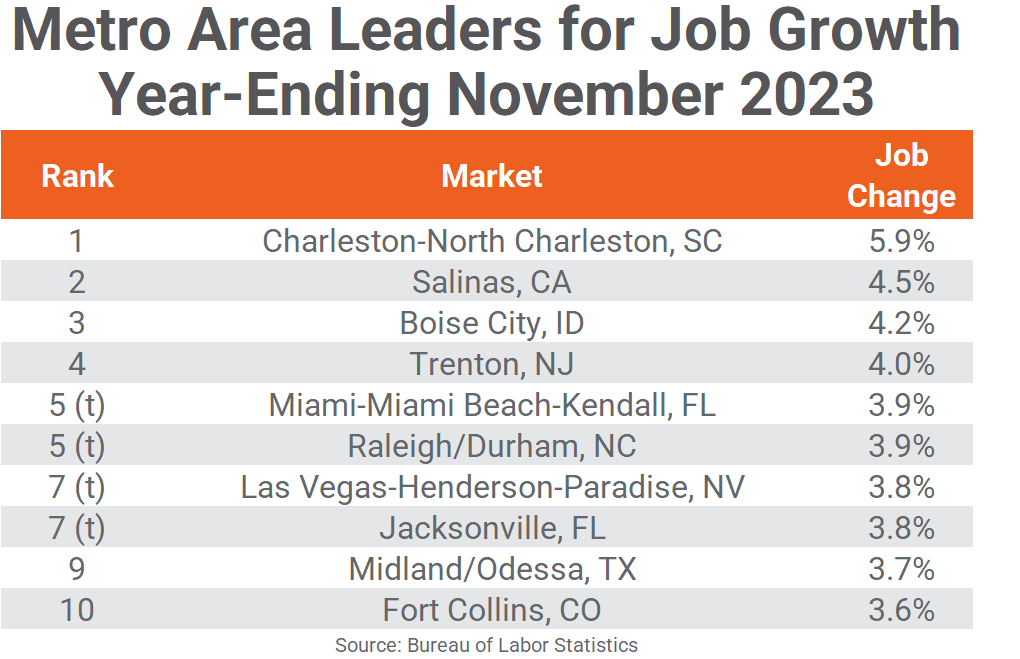

Like annual job gains, the annual percentage change in employment saw some resilience as well. The average employment percentage gain for the top 10 markets averaged 4.1% in November, almost equal to last month. Additionally, six of November’s top 10 markets had the same or higher percentage employment gains than in October.

Six markets returned to November’s top employment change list from October with Charleston, SC returning as #1 with 5.9% employment growth, 20 basis points (bps) below last month’s rate. Salinas, CA and Boise, ID changed places at the #2 and #3 spots from last month with 4.5% job growth for Salinas and 4.2% growth for Boise.

Trenton, NJ jumped onto the top 10 growth list at #4 with 4% job growth, an 80 bps increase from October. Miami and Raleigh/Durham tied for #5 with 3.9% job growth but Miami improved 40 bps from last month while Raleigh/Durham was unchanged.

Las Vegas returned to the top job growth list to tie Jacksonville at #7 with 3.8% growth, improving by 30 bps while Jacksonville slowed by 20 bps.

The small energy market of Midland/Odessa, TX fell from #4 last month to #9 in November with employment growth of 3.7%, down 40 bps from October and 580 bps from last year. Fort Collins, CO also joined the top 10 list this month, debuting at #10 with 3.6% growth, an improvement of 110 bps from October.

Compared to one year ago, Midland/Odessa slowed the most for job growth among the top 10, with the aforementioned 580 bps decline. Las Vegas fell 210 bps, while four of the remaining top 10 fell between 30 and 40 bps. Fort Collins and Salinas improved from last year by at least 200 bps and Boise jumped 90 bps from last November’s growth rate.

Outside of the top growth markets, Birmingham, AL, Santa Maria-Santa Barbara, CA, Colorado Springs and Akron, OH saw their job growth rates increase by 150 to 180 bps from last year. Meanwhile, Lansing, MI fell 580 bps from last year’s job growth to a decline of 1.7%, followed by Wilmington, NC with a 480 bps drop to job cuts of 0.6%.

Major markets with employment declines are Memphis, Denver and Detroit, while sub-1% growth markets include Des Moines, Columbus, OH, Milwaukee, Kansas City, San Francisco and Chicago. Sub-1.5% growth major markets include Omaha, San Jose, Portland, OR, West Palm Beach, New York, San Diego, Oakland, Pittsburgh and Washington, DC. Seventy-seven markets had annual job growth rates above the not seasonally adjusted national average of 1.8%, seven more than in October.