While the big story for the U.S. apartment market for calendar 2023 has been record-breaking new apartment supply, calendar 2024 is poised to see an even bigger volume of deliveries.

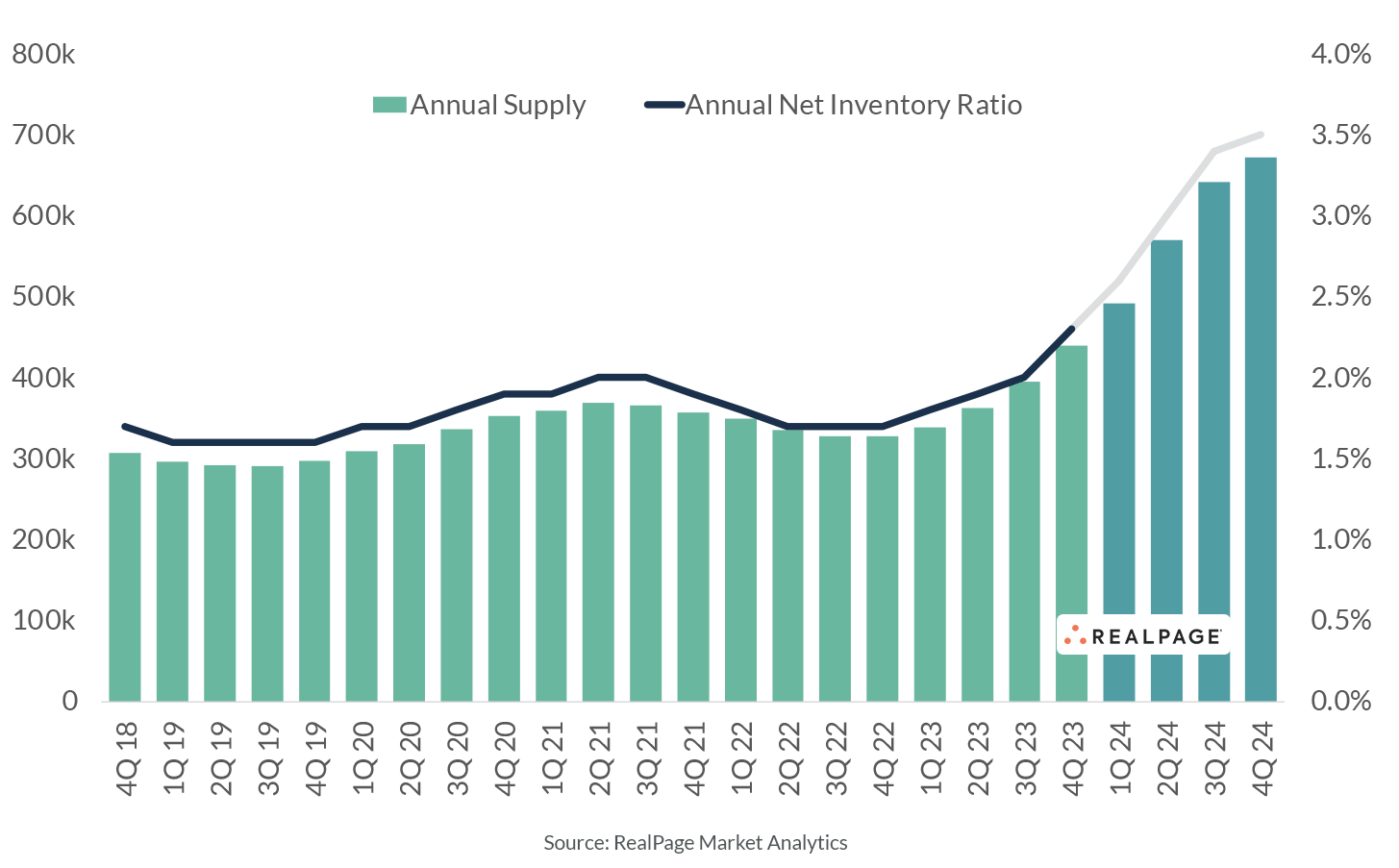

Back when apartment occupancy and rent growth were hitting record highs across the nation in 2021 and 2022, we saw a surge in multifamily permitting activity. As a result, 2023 logged a big increase in deliveries, with nearly 440,000 apartment units completed throughout the year, a 36-year high for the market. For 2024, scheduled completions in the U.S. total another 670,000 or so apartments, which blows past that record volume by about 50%.

The leasing environment operators were in when all those units were approved is looking very different now, with occupancy and rent growth at much more regulated levels, and demand just getting back on track after falling off notably.

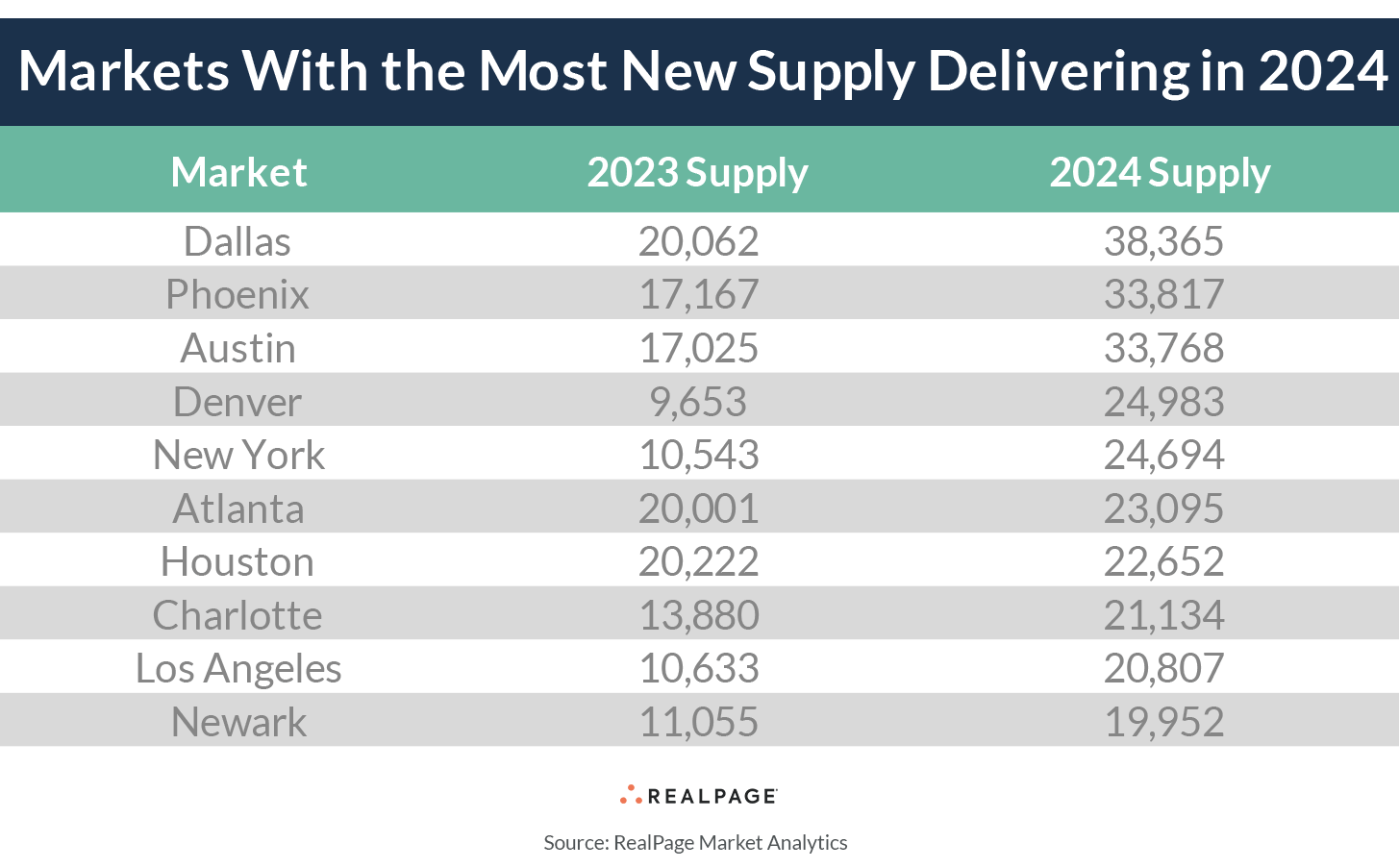

A big portion of the apartments delivered in 2023 came online in the South region of the U.S., and the stock set to deliver in 2024 is similarly targeted. Roughly 53% of the completions scheduled for 2024 are slated for the South, with more than 358,000 under way. Most of the big winners here are located specifically in Texas. South region markets with more than 20,000 units of supply set to deliver next year are Dallas (38,400 units), Austin (33,800 units), Atlanta (23,100 units), Houston (22,700 units) and Charlotte (21,100 units). All of these markets were also among the top 10 for deliveries in 2023.

The West region of the U.S. is expected to gain another 183,000 or so units, making up 27% of national apartment supply in 2024. West region markets expected to get big portions of supply in 2024 include Phoenix (33,800 units), Denver (24,900 units), Los Angeles (20,800 units) and Seattle (18,800 units).

The Midwest and Northeast are scheduled to see smaller volumes, with roughly 62,000 to 67,000 units under way, roughly 9% to 10% of expected completions.

In the Northeast, these big volumes are focused mostly on big-hitting markets like New York (24,700 units) and Newark (19,900 units). Those 2024 volumes are roughly twice the pace these markets logged in deliveries in 2023. These are some of the biggest apartment markets nationwide, each with more than 1 million units, and the pace of supply actually dropped off a bit in 2023 but should pick back up again in 2024.

In the Midwest, on the other hand, not a single apartment market ranks in the top 10 for supply deliveries in 2024. Rather, several of these slow-and-steady markets add up to the regional tally. The biggest volumes of new supply are being built in Minneapolis (8,700 units) and Chicago (8,100 units) in 2024, but those are relatively mild tallies compared to the other big performers on this list.