Rent Cuts Deepen in 4th Quarter as Demand Volumes Return to Historic Norms

The U.S. apartment market recorded seasonal net move-outs in 4th quarter for the first time in three years. After the notable slowdown in 3rd quarter, this latest performance signals a return to more normal levels after the streak of rapid growth the market has seen since the end of the COVID-19 pandemic.

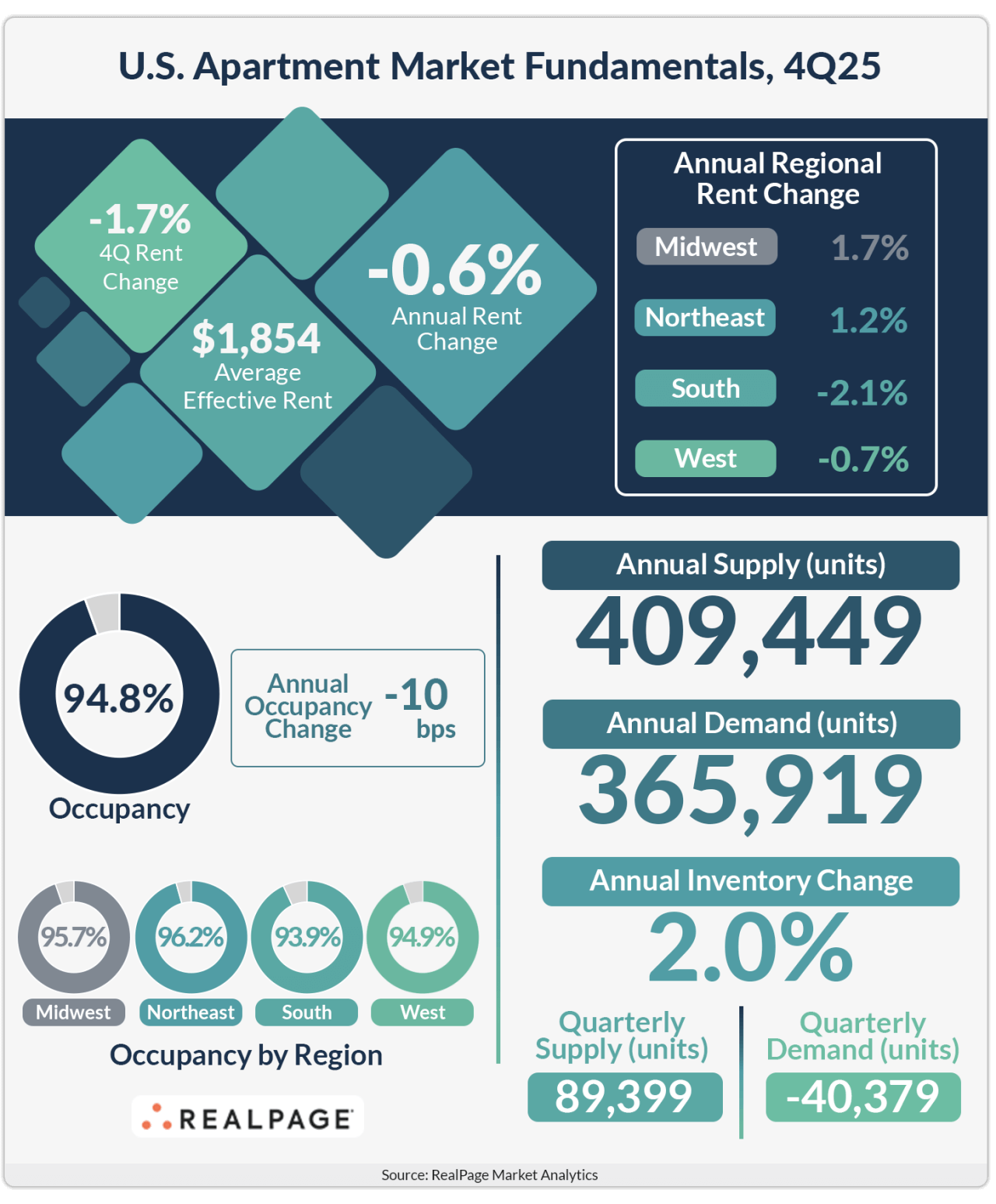

Nearly 40,400 units of net apartment demand was lost in 4th quarter 2025, cutting annual demand down to just over 365,900 units. That was the nation’s smallest annual absorption tally since 2nd quarter 2024, returning the market to a more baseline performance after the historic peaks of 2024. The latest performance ranks somewhere between the five-year average annual demand tally of 370,000 units and the 10-year norm of about 340,000 units.

Apartment supply volumes are also slowing, but not as rapidly as demand. Roughly 409,500 units wrapped up construction across the U.S. in calendar 2025, including about 89,400 units in 4th quarter alone. This marks a fourth consecutive quarter of decline after annual supply volumes peaked at over 586,100 units in 4th quarter 2024. Still, like demand, the latest round of apartment deliveries is still a bit ahead of decade norms.

As a result of falling demand volumes, U.S. apartment occupancy fell below the essentially full mark by the end of 2025. At 94.8%, 4th quarter occupancy was down 60 basis points (bps) quarter-over-quarter. It’s common to see occupancy backtrack in the seasonal downturn at the end of the year, but this decline also marks a new trend: two straight quarters of downturn after five consecutive quarters of occupancy increases.

Rent Cuts Get Deeper in 4th Quarter

Much like occupancy, effective asking rents also trended downward at the end of the year. Prices fell 1.7% in the final three months of 2025, marking two consecutive quarters of decline. While it’s common for operators to cut rents in the slower leasing season, this latest decline was roughly twice as deep as the cuts the market has seen in 4th quarters during the past five years.

In calendar 2025, rents were down 0.6%, marking a second straight quarter of annual decline. While still relatively mild, that was the market’s deepest annual price decline since early 2021.

Over 23% of apartments were offering concessions as of 4th quarter, and the average concession was 7%. As operators focus on filling units in the coming months, concession utilization could become even more prevalent, making true rent growth harder to realize until discounts burn off.

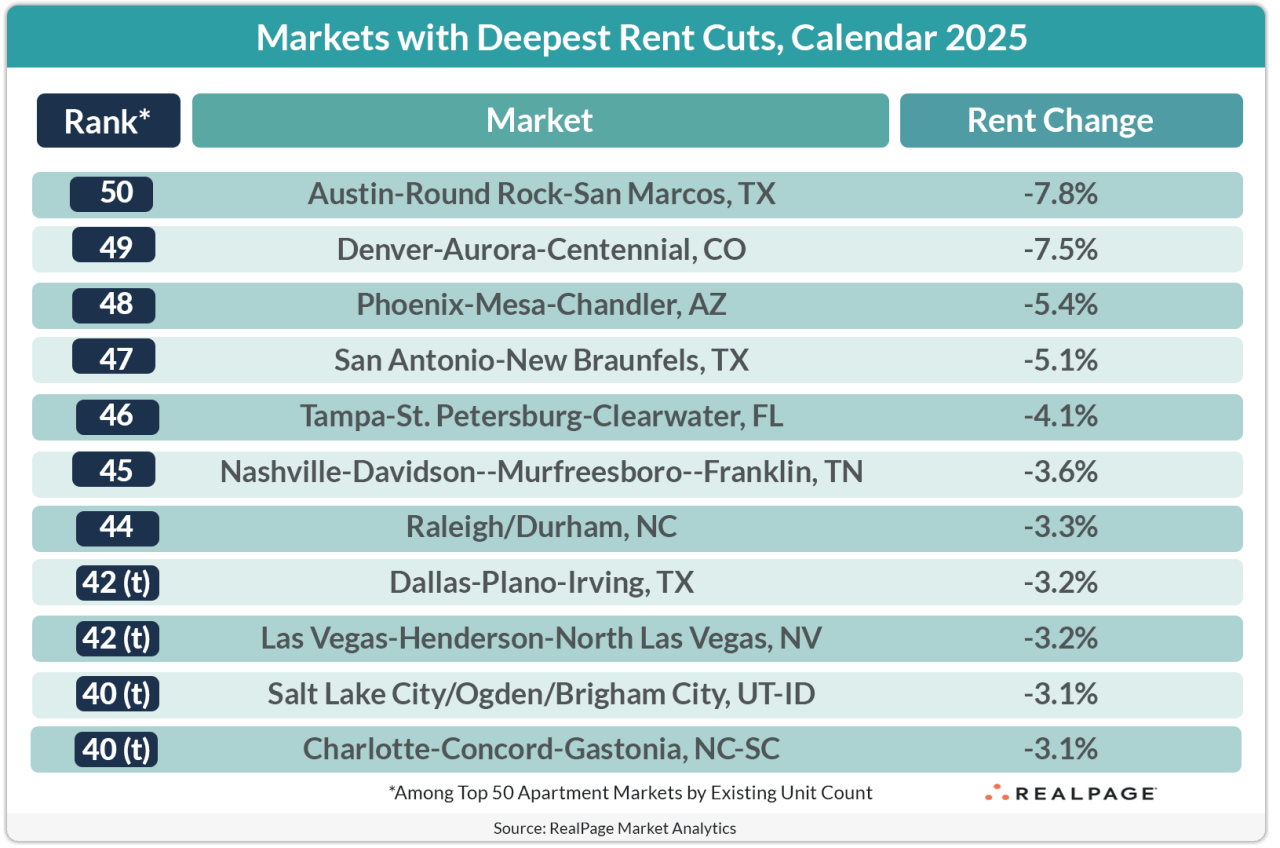

Supply-Heavy Markets and Tourism Centers See Continued Rent Cuts

Apartment construction volumes remain the primary force holding back rent growth. Supply‑heavy regions such as the South and West recorded rent declines both in 4th quarter and over the past year. In contrast, the Midwest and Northeast – where new supply has been more limited – experienced modest rent increases.

The nation’s three deepest rent cuts continued to be in supply-heavy markets that have dominated the price decline list of late. Rents were down nearly 8% in Austin and Denver, while prices were slashed by about 5% in Phoenix and San Antonio.

Meanwhile, markets that depend more on tourism, such as Tampa, Nashville and Las Vegas continued to lose momentum in 3rd quarter. Softness in tourism-dependent markets can sometimes be the first sign of economic weakness as consumers tighten discretionary spending, such as on travel and vacations.

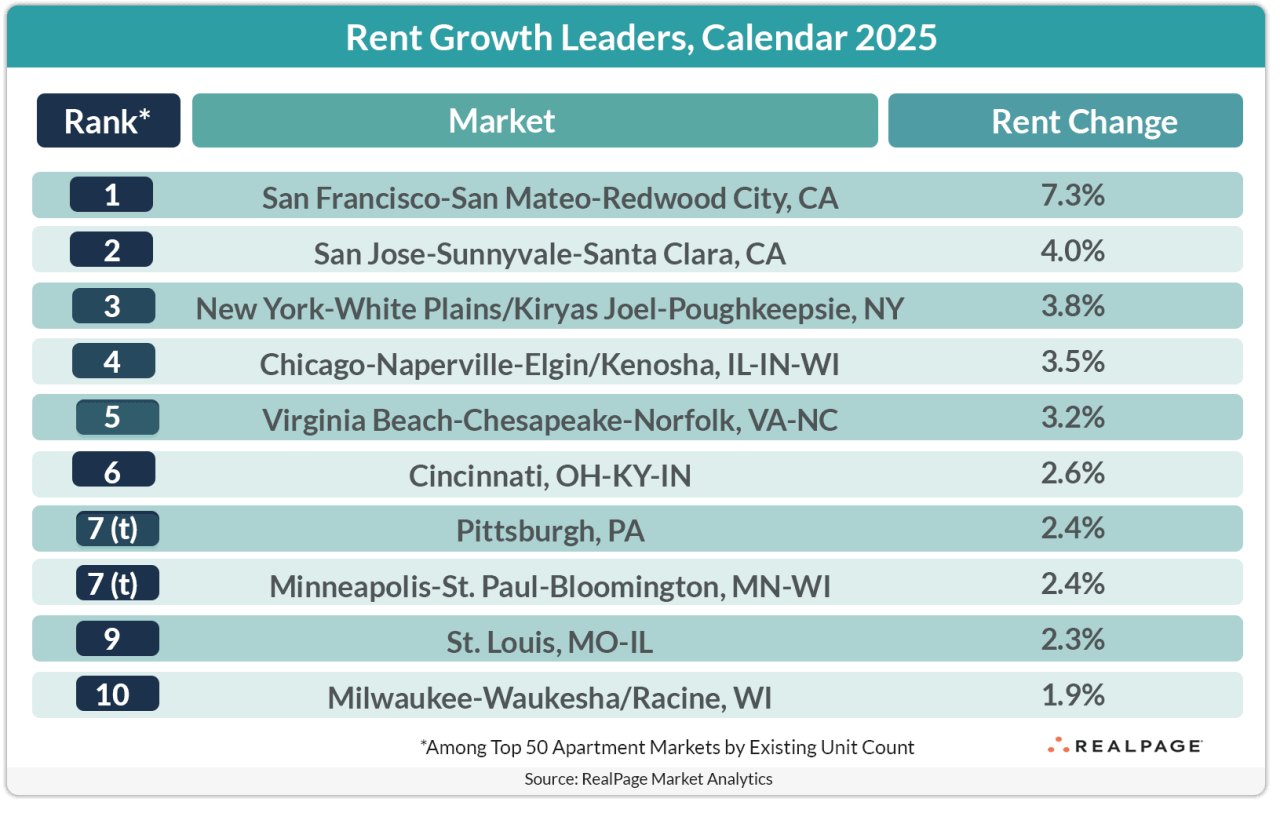

Rent Growth Continues Across Coastal Tech Markets

On the other hand, tech-heavy coastal markets like San Francisco, San Jose and New York continued to see rent growth in 4th quarter, with strength perhaps linked to return-to-office mandates, the rise in optimism surrounding artificial intelligence technology and waning supply volumes.

A handful of Midwest apartment markets with modest supply volumes were also still seeing rent growth in the past year. Chicago, Cincinnati, Minneapolis, St. Louis and Milwaukee all logged growth between roughly 2% and 4% in 2025.