While Concessions Ticked Up in 4Q, Discounts Remain Limited

With record supply on the way in 2023 and fears that 2022’s demand slowdown may carry forward into the peak summer months, groups are once again asking about concessions.

The discussion of whether concessions are an effective management practice is polarizing. But putting aside their effectiveness (or ineffectiveness, perspective depending) it’s safe to say that concession utilization has become far less common in recent years.

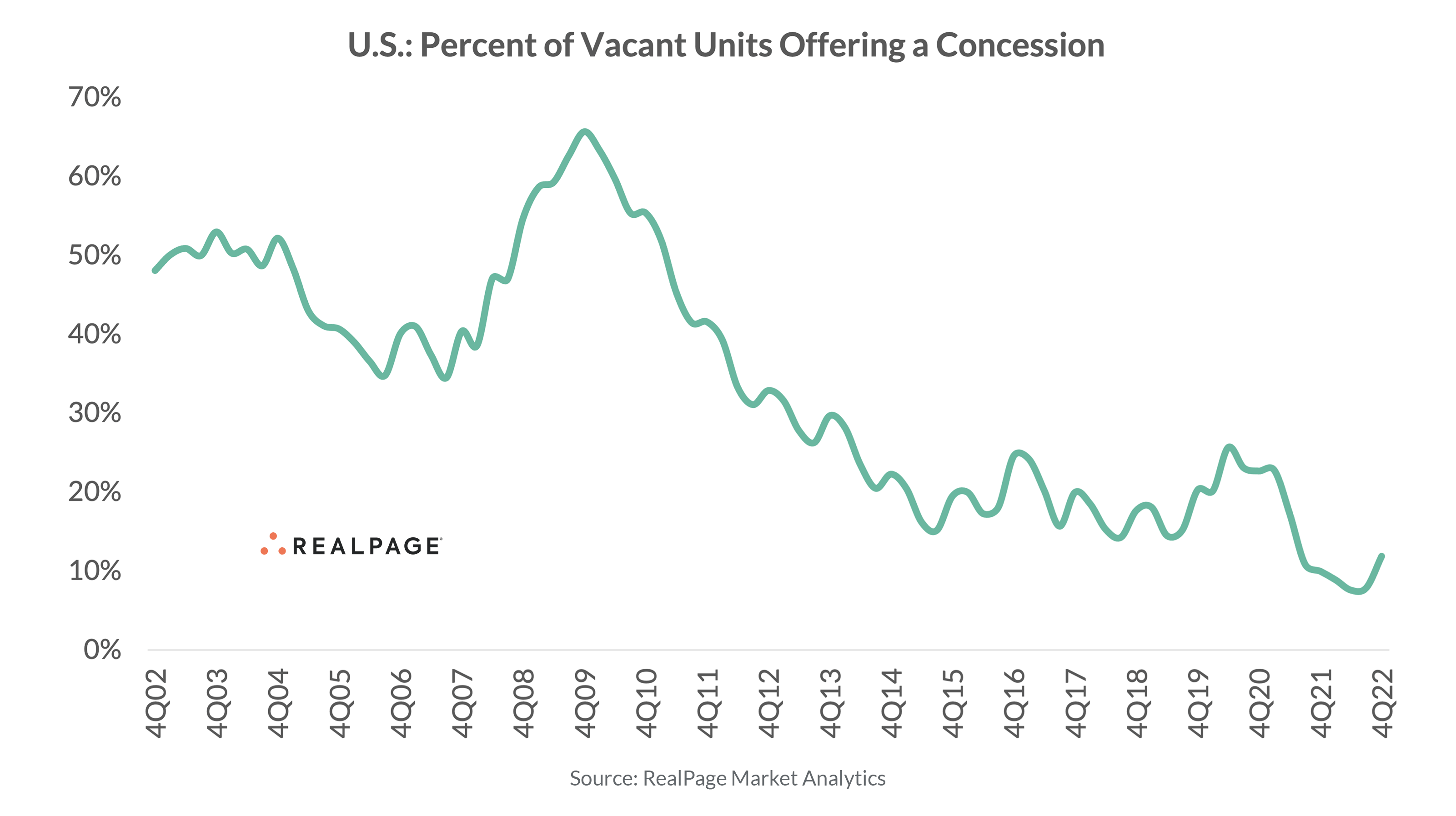

Over the past 20 years, an average of about 30% of stabilized vacant units have offered a concession, according to data from RealPage Market Analytics. During the throes of the Great Recession, concessions were approaching nearly 7 out of every 10 vacant units. But in the past five years, that figure has been just half of the 20-year average (coming in at 16%).

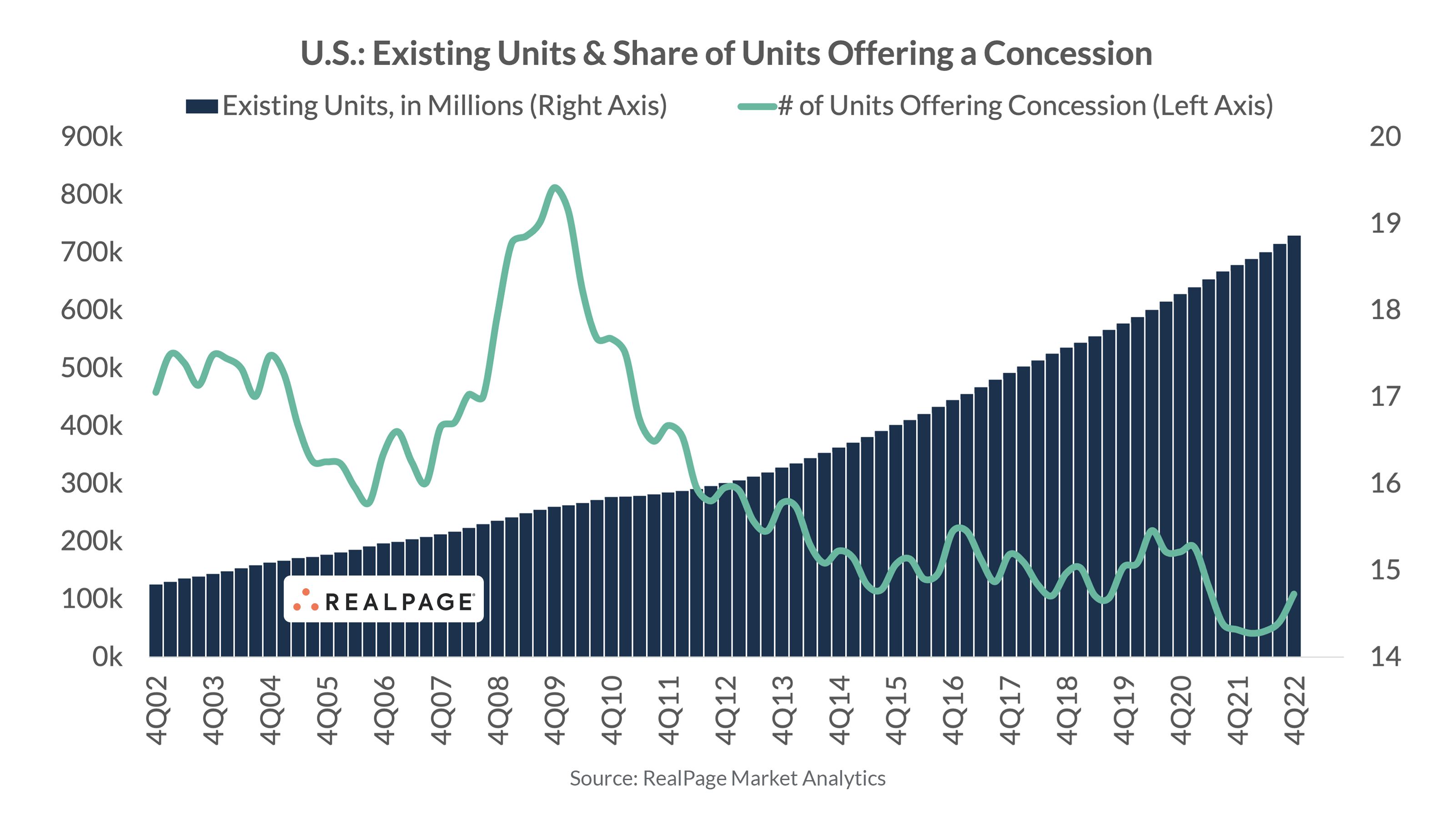

From that perspective, even the recent increase in concession utilization seems modest in comparison. Even more so when you consider the scale of units offering in absolute figures. Despite adding some 4.1 million additional units between 2002 and 2022, today’s total number of units offering a concession sits just above 100,000 units.

While that is up from its all time low (41,000 units in early 2022), the simple math shows concessions are significantly more limited than years past.

All considered, today’s concessions leverage seems sparse when zoomed out to a long-term view. But by that same token, market fundamentals are often a hyperlocal phenomenon. And even though the national storyline shows limited concessions, there are pockets of the country where concessions are beginning to factor into the equation.

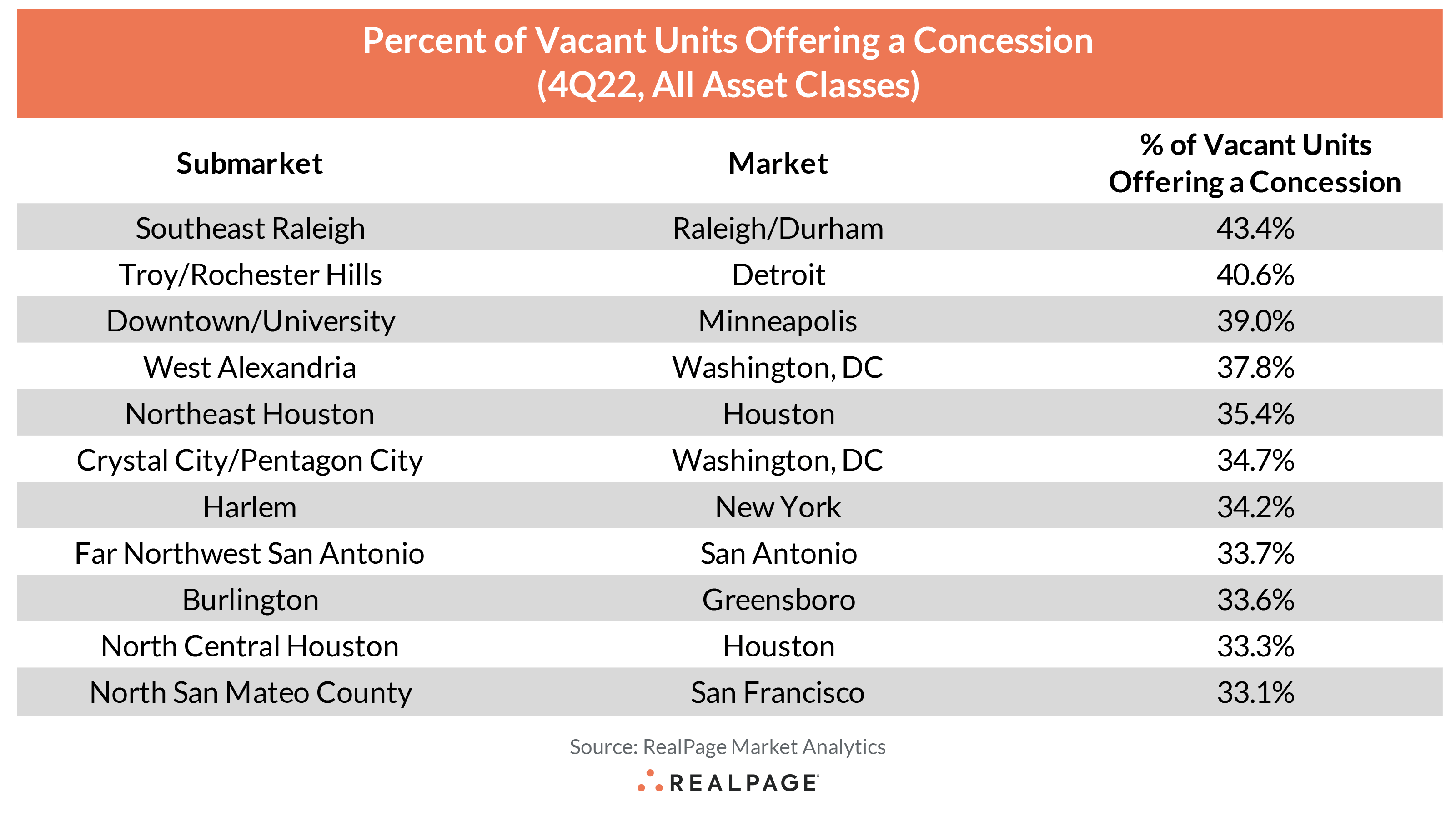

The following table shows all major U.S. submarkets where at least one-third of vacant units are offering a concession. Only 11 out of 700-plus major metro submarkets fall into this table.

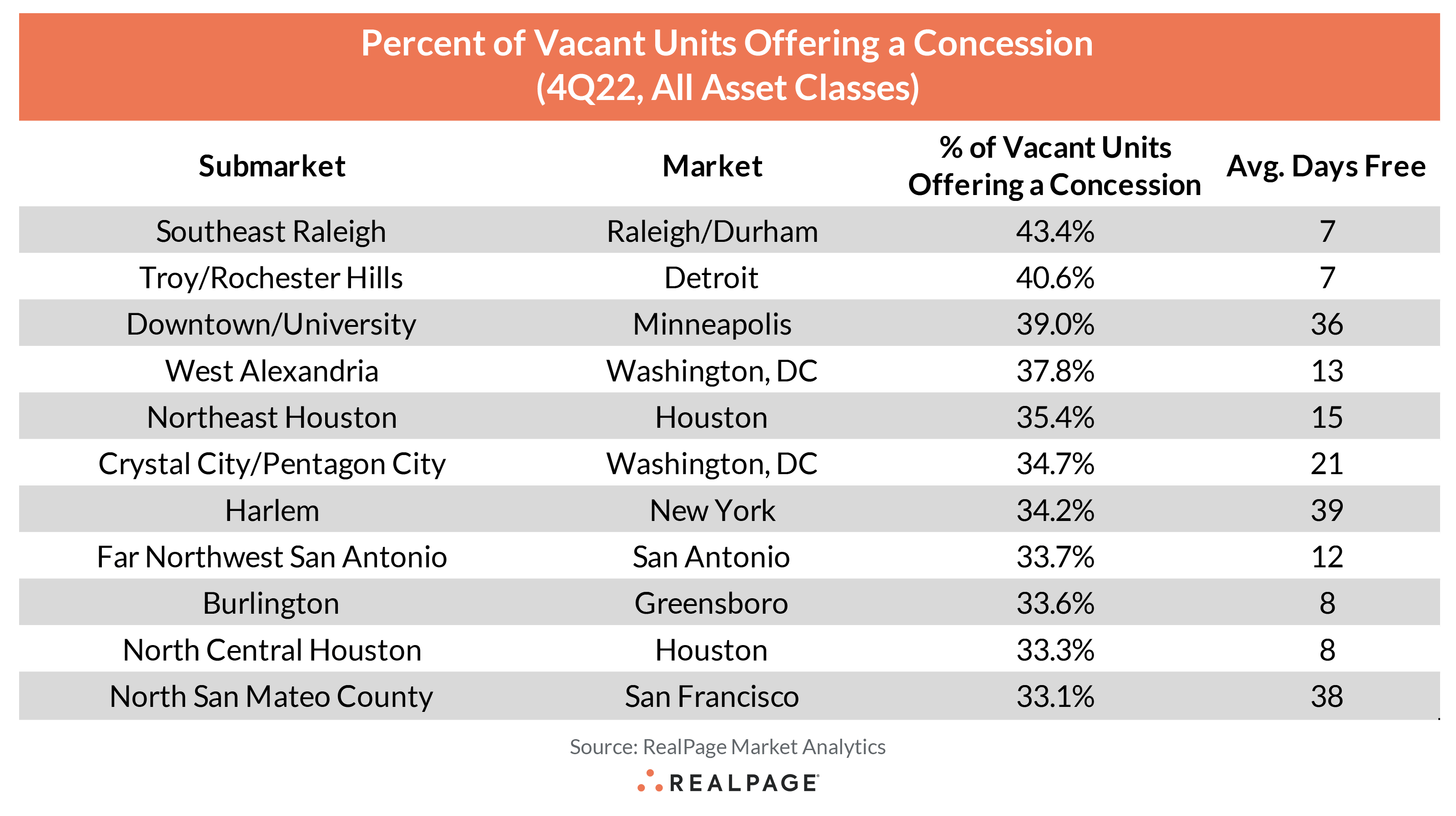

For those locales, concessions might feel like they’re quite common. But even then, the average concession being leveraged isn’t all that significant in most of these areas. Only three instances show localities where the average concession is equal to or greater than one month free. In just as many instances the average concessions runs only one week free or so.

Once more, the general takeaway with concessions is that location, location, location really matters. And that’s especially true in the nation’s urban core submarkets where a far more homogenous product style exists. In other words, the similarity in the price point of new deliveries relative to stabilized assets typically lends itself to higher competition and in some instances, deeper and more common concessions. That’s especially true in periods of significant deliveries, which inherently are more geographically clustered in urban core submarkets.

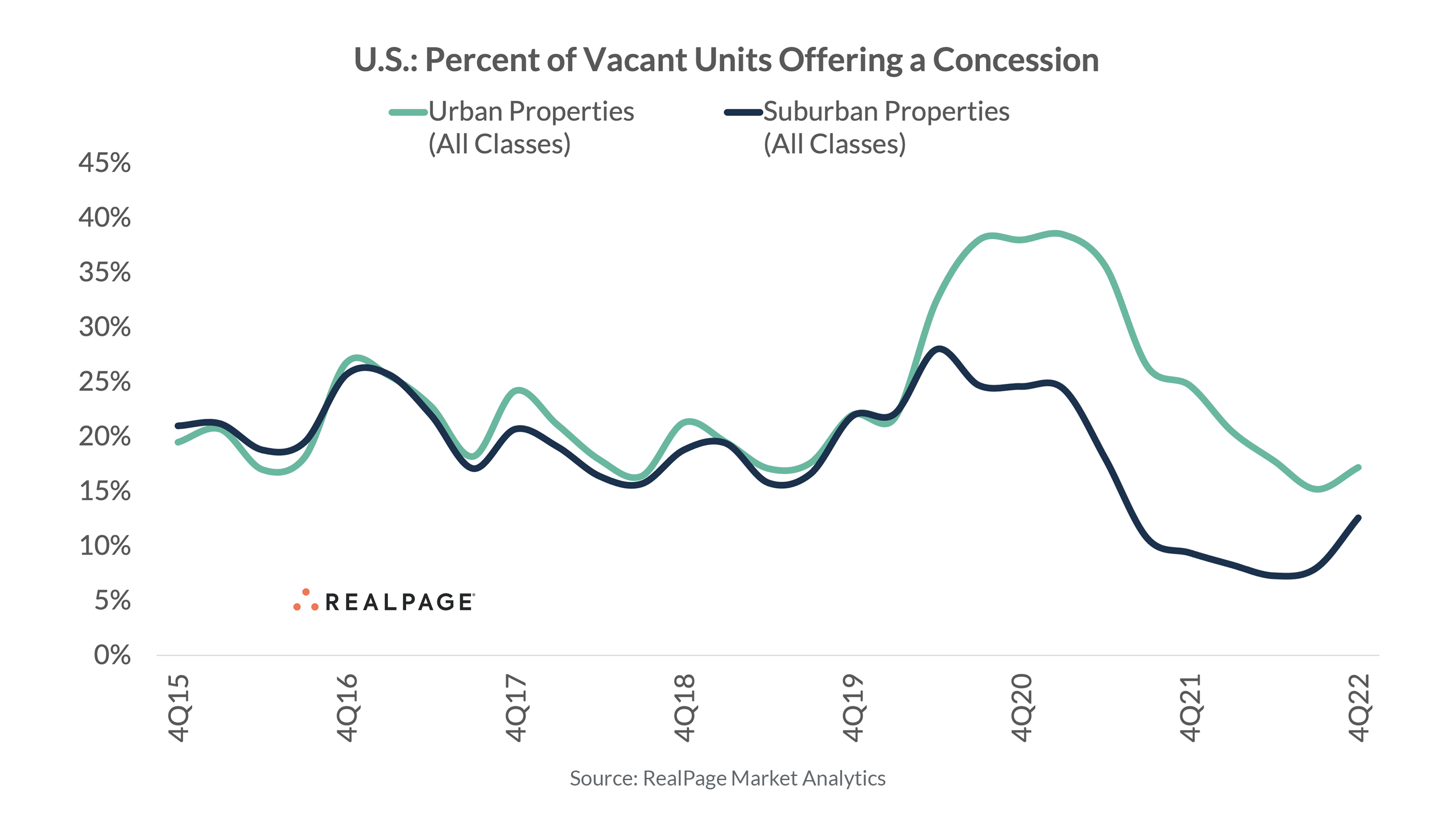

At the end of the 2022 calendar year, concessions started to show an uptick with about 17% of vacant urban units offering a concession. While suburban concessions showed a larger quarter-over-quarter increase, their rate remains well below urban submarkets.

With record supply expected in 2023, it’s likely that urban core concessions will continue to increase. We will have to wait and see whether that increase makes it back to the five-year average (about 25%, though the pandemic increased those peak 2020/2021 number considerably). But it’s certainly not impossible to find pockets of the nation where concession utilization is factoring into the local operational discourse.

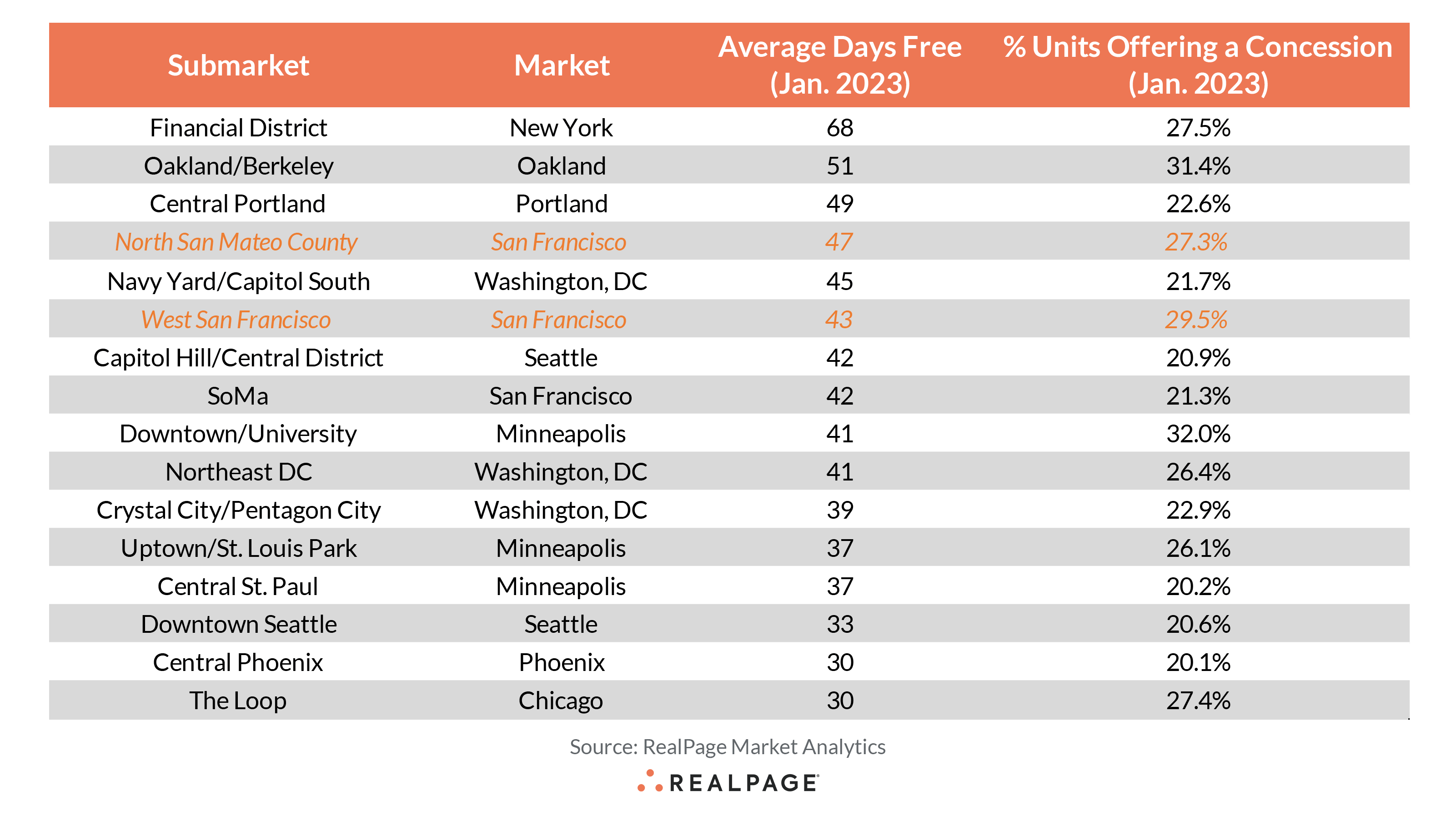

The following table highlights the few parts of the U.S. where two criteria were met: 1) at least 20% of vacant units are offering a concession and 2) those concessions average at least one month free.

The table shows an overwhelmingly large skew towards urban core submarkets – especially those in the coastal markets. Minneapolis may be a striking exception in that regard, but that local market has struggled to regain much positive momentum in recent years. Lastly, the only two suburban submarkets – both in San Francisco – aren’t necessarily the expected ‘normal’ suburban makeup as San Francisco’s geographic layout is unique in that regard.

All considered then, it’s probably fair to assume that concessions become more common than the past year or two where demand was at all time highs. Demand is expected to rebound to much more palatable levels in 2023 than the 2022 doldrums showed. In that event, it’s likely that concessions will remain highly local and highly concentrated to specific asset classes or high supply neighborhoods.