What We Got Right - and Wrong - About the Apartment Market in 2023

Forecasting involves taking a series of data points, running them through models (both qualitative and quantitative), then sharing what is ultimately a best guess as to what a trend means and/or what a future expectation is. But it’s not an exact science. We’re just making best-informed guesses based on data and gut feeling.

That said, let’s look back at some predictions we made for 2023 and see where we got it right, where we got it wrong and where results were mixed.

In January, we forecasted that three types of markets were poised to outperform in 2023, including college towns, high job growth markets and affordable, low beta markets. Meanwhile, we also forecasted that three types of markets could be positioned to struggle in 2023, namely high-supply markets, markets where loss to lease vanished and a select few lifestyle markets. Let’s grade our 2023 predictions.

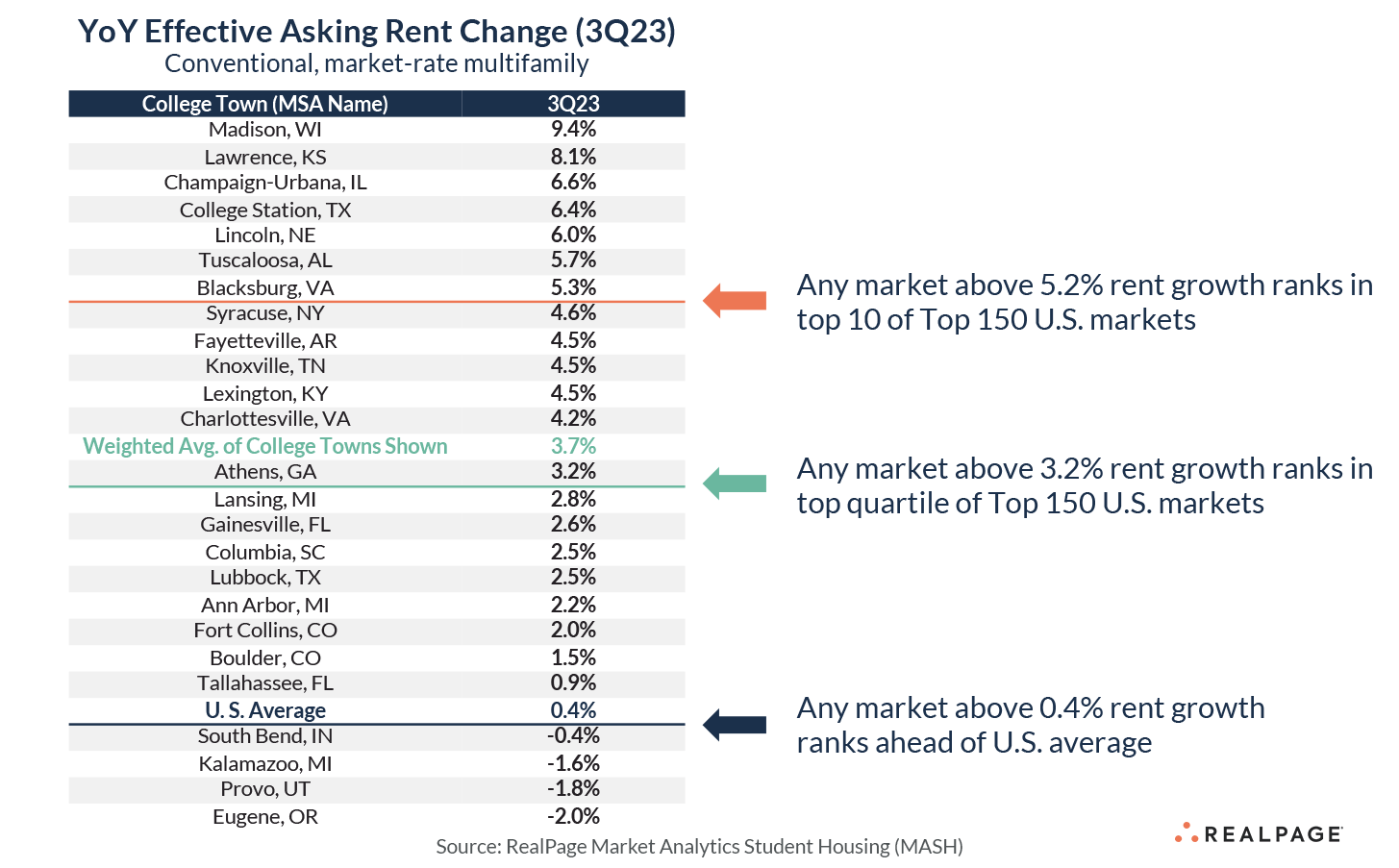

College Towns

College towns did indeed outperform this year thanks to resilient economies, improved student demand and limited supply pressure. Some good examples include Madison, WI, Lexington, KY and Lincoln, NE (#5, #6 and #7 in the country for year-over-year effective asking rent change in 2023). Champaign-Urbana, IL, College Station, TX and Knoxville, TN are other examples of really strong markets with rent growth rates around 4% in 2023.

It's probably not a stretch to think this college town profile continues to outperform well into 2024 (though we're seeing student demand normalize from the peak 2022/early 2023 period).

Affordable, Low Beta Markets

The Midwest is enjoying its moment in the sun as low supply and relative affordability provide a high floor for those local markets. Some examples of affordable, low beta markets include Wichita, KS (lowest average rent among major markets in the U.S.), Youngstown, OH, Springfield, MO, Tulsa, OK and Champaign-Urbana, IL – all averaging rents less than $1,000 per month.

Going into 2024, the Midwest will continue to see a group of outperforming markets, especially due to lack of supply pressure.

Markets with Outsized Job Growth

This wasn't exactly going out on a limb by any means. (Breaking news: “Strong economies generate housing demand" isn't going to win a Nobel Prize in economics anytime soon!). Still, this goes to show that understanding housing market fundamentals goes well beyond the headlines. We proposed Dallas/Fort Worth, Houston, Miami and Portland could outperform the U.S. overall in 2023. Instead, only Houston and Miami matched the U.S. (so a 50/50 success rate). In fact, one could argue that Portland was the most disappointing market in the country from a demand perspective in 2023.

This actually is going out on a limb, but we think Houston's rent growth will be in the top quartile of major U.S. metros in 2024. Supply isn't as aggressive here today as in previous cycles and the improvement of energy market fundamentals always helps boost Houston's economy. At very least, Houston has a good chance at being the top performing Texas market in 2024.

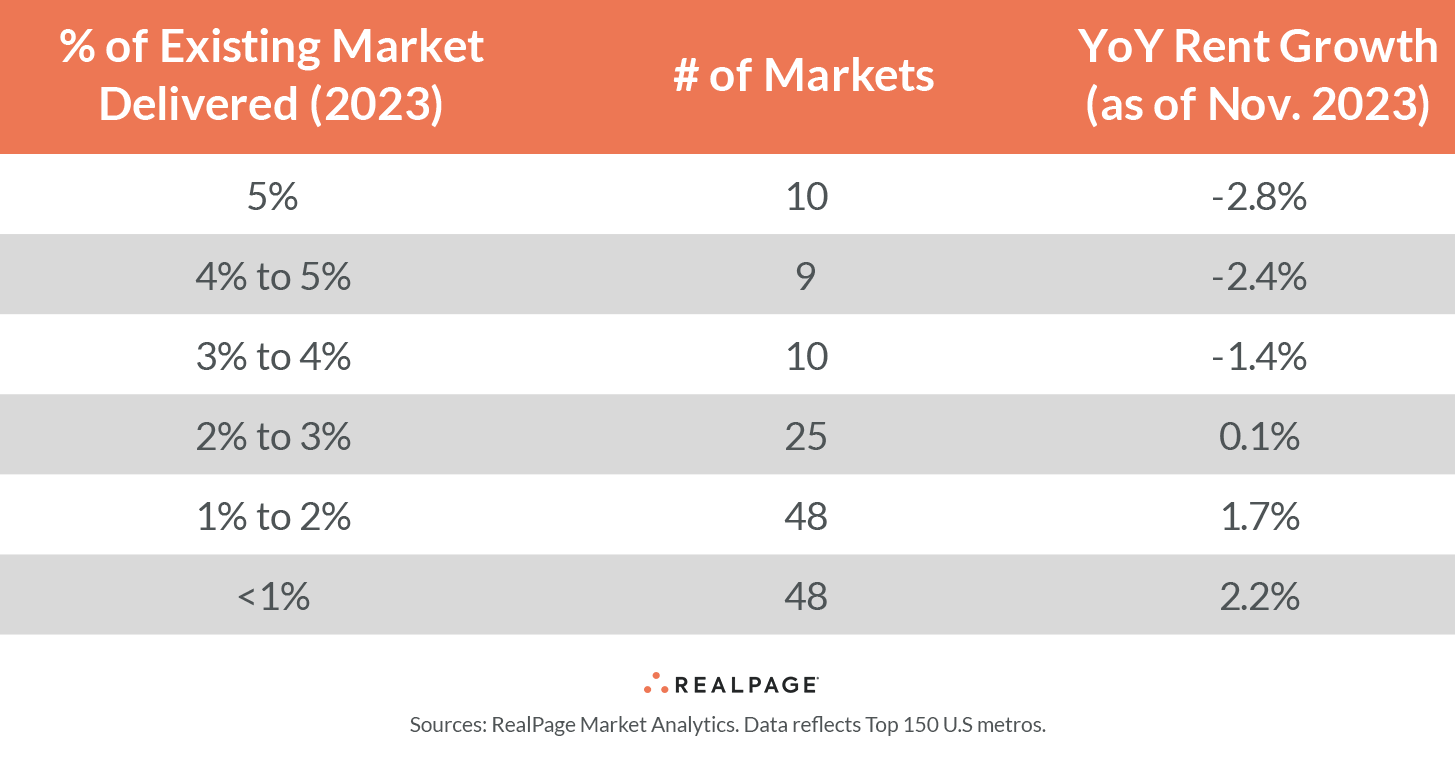

Big Inventory Growth Markets

No shocker here. Supply puts downward pressure on rents, and that's exactly what we saw in 2023. There's a direct relationship between higher supply areas seeing weaker rent growth versus lower supply areas seeing higher rent growth.

Markets where supply grew by more than 5% and rents fell year-over-year include Boise, ID, Huntsville, AL, Jacksonville, FL, Nashville, TN, Pensacola, FL, Provo, UT, Salt Lake City, UT, Sioux Falls, SD and Wilmington, NC. Only one market saw more than 5% inventory growth and was spared rent cuts. That market was Lakeland, FL though at 0.1% rent growth it's not exactly a thesis killer. We also like Lakeland's outlook for the long haul.

In fact, among the 19 markets with more than 4% inventory growth, only two (Lakeland, FL and Charleston, SC) saw year-over-year rent growth. Charleston, in particular, had some crazy strong demand as rents still grew by 2% this past year.

Markets Where Loss to Lease Has Vanished

Loss to lease was a key focal point in 2022. The narrative quickly changed in the back half of 2022, as loss to lease fell from 11% in late 2021 to about 4% at the end of 2022.

From a "grading the prediction" perspective though, this was a mixed bag of results. Let's look at it this way: the U.S. saw year-over-year rent growth slow by 6.3% from November 2022 (6.5%) to November 2023 (0.2%).

Jacksonville saw rent change slip into decline, falling 5.2% in 2023. Las Vegas is cutting rents by 3%, so that's we got that right too (especially since supply isn't a big factor). And while we like Houston in 2024, its 2023 performance does appear to have been hit by loss to lease. (Rent growth there slowed from 4.9% to 0% in 2023.)

But Cincinnati and Newark are still posting 3%+ rent growth. Meanwhile, Baltimore and Minneapolis are outperforming the U.S. today and didn't see loss to lease affect rent growth so those four are a miss.

Lifestyle Markets

We surmised that Port St. Lucie, Sarasota, Boise and Napa Valley would be candidates to underperform. Indeed, all those markets did – though we could argue for varying reasons. Boise, Port St. Lucie and Sarasota seem a supply-driven phenomenon (albeit double-hit by tapering demand). Napa Valley meanwhile seems to be a lack-of-demand driven outcome.

Check in our 2024 forecast here, including predictions on market-level leaders in supply, demand, rent change and occupancy.