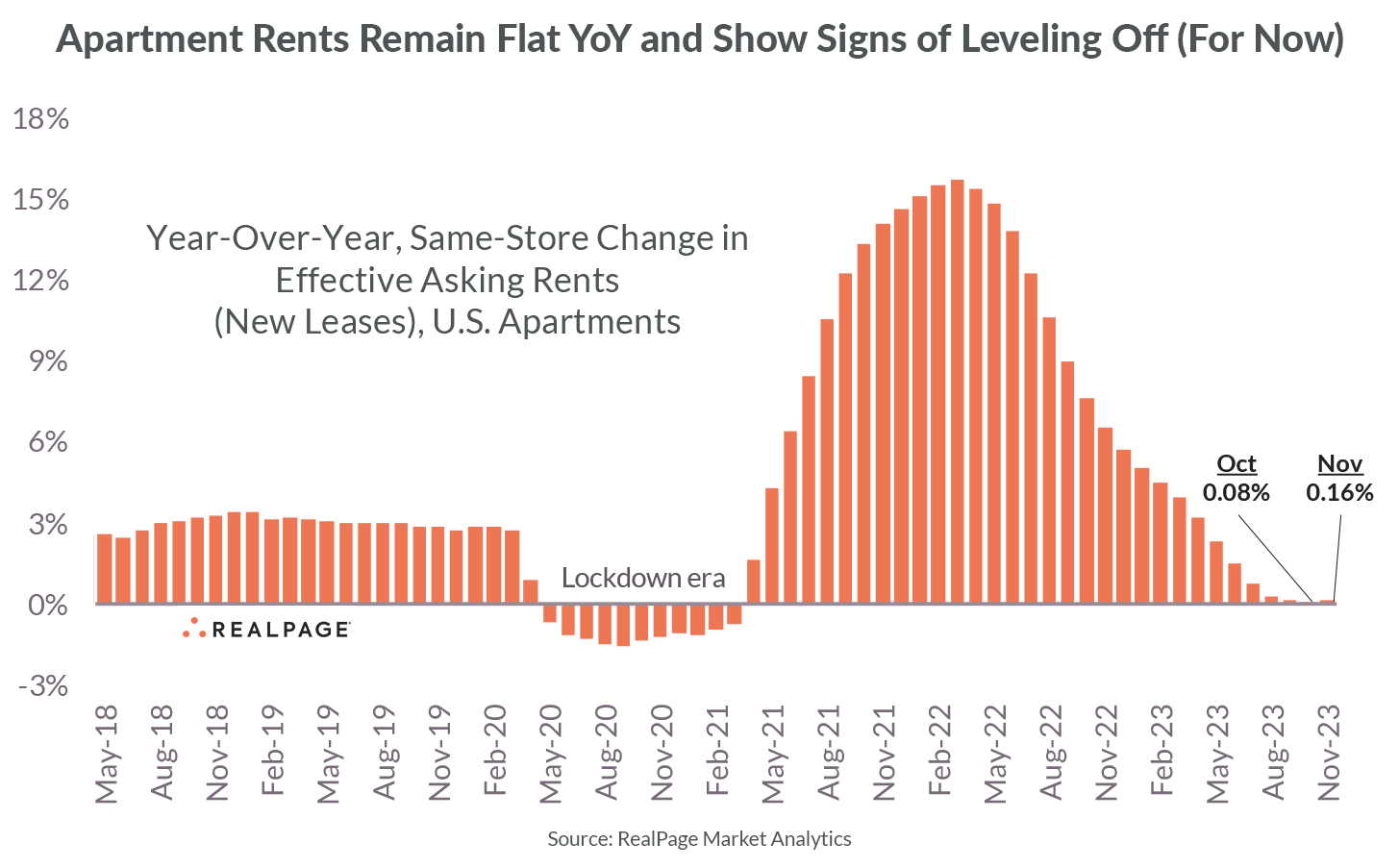

Apartment rent growth has been rapidly cooling off since peaking in March 2022. But that trend could be leveling off – at least for now.

Effective asking rents inched up 0.16% year-over-year nationally as of November 2023, compared to 0.08% in October, with change measured on a same-store basis. That marked the first time in 20 months that the pace of rent change did not decelerate. But it’s also highly unlikely to signal a meaningful re-acceleration. RealPage continues to expect rent growth to remain fairly flat through 2024, with many markets posting cuts.

Flattening rents were in line with our forecast going into the winter months due to what’s called the base effect. On a month-over-month basis, effective rents fell 0.52% in November 2023. That compared to a 0.57% cut in November 2022, according to data from RealPage Market Analytics. (Seasonal rent cuts this time of year are normal; however, these recent cuts rank as the deepest for any November since the Great Financial Crisis.)

In other words: One deep monthly cut is replacing another in the year-over-year calculation, creating the appearance of stability in the year-over-year rent metric. The base effect will likely remain at play through the winter due to bigger-than-normal cuts over the same period last year, which could keep the headline rent metric pretty flat.

The bigger question could be what happens in the first half of 2024. At that point, the base effect is less severe at the same time new supply levels will be peaking at multi-decade highs.

It’s Still All About Supply

As we noted last month, the rent slowdown has everything to do with supply and little to do with demand. There’s ample demand for apartments at today’s rent levels, but the demand story has been overshadowed by the 50-year high in construction. As a result, there’s more supply than demand, which puts downward pressure on rents.

Rents are falling most in markets adding the most supply, while the biggest rent gains continue to come in low-supply markets.

It’s no surprise, then, that occupancy continues to inch back – declining another 0.1 percentage point in November and 0.9 points year-over-year to a rate of 94.2%. For renters, that means availability is back in a normal range, which tilts the balance of power back in their favor. Supply is doing what it’s supposed to do.

Additionally, occupancy and retention remain a challenge; however, the heavy emphasis by operators appears to be paying off to some degree. In November 2023, 51.8% of apartment renters with expiring leases signed renewals. While that’s down a bit from November 2022, the pace of decline has materially softened. And 51.8% is still high for November – higher than any November in the 2010s decade prior to the pandemic. It was only in 2020-21 when retention surged to unprecedented highs, largely due to strong demand and low vacancy giving renters few attractive relocation options.

It's somewhat remarkable that retention remains above normal even amidst a multi-decade high wave in new lease-up competition.

More than 461,000 units are scheduled to complete in 2023, followed by about 670,000 units in 2024. After that, completions should drop dramatically as new starts have plunged of late. In turn, occupancy rates should rebound and rent growth pick back up – though unlikely to the degree seen in the inflationary period of 2021 and early 2022.

By comparison, completions haven’t topped 400,000 units since the 1980s, and are more typically around 300,000 units.

Rents Continue to Fall in the West and South

While the pace of rent change is flattening off across most of the country, the rent change leaderboards look similar to recent months.

But the most material shift of late has been continued deceleration in Florida markets. Demand remains strong across the Sunshine State, but not enough to keep pace with surging supply. Among the 20 markets (out of the top 150 nationally) with the deepest rent cuts, eight are located in Florida.

Effective rents (which include concessions) fell around 5-6% year-over-year in Fort Myers, Sarasota/Bradenton, Jacksonville and Daytona Beach. Rents fell 3-4% in Orlando, Palm Bay/Melbourne, Fort Walton Beach and Pensacola. Rents were also down in a number of other Florida markets, including Tampa and West Palm Beach (both around -1%).

Even the once blazing hot Miami has cooled off materially of late. Rents there remained up, but the pace of growth slowed to 0.7% year-over-year. Miami had been near the top of the national leaderboard for rent growth throughout 2021, 2022 and early 2023.

Elsewhere in the country, rent cuts toped 4% in Austin, Boise, Atlanta and Phoenix. But in all four cases, the pace of change moderated a bit (like the national trend) between October and November – signaling that cuts aren’t going deeper (at least for now).

The West Coast remains another slow region. Rents fell year-over-year in every major West Coast market with the exception of San Diego (0.6%) and Orange County (2.6%).

But rents aren’t falling everywhere. Among the nation’s top 150 metros, 41 recorded rent growth of more than 3%. Most of those markets are located in the Midwest and Northeast regions, where supply remains far more limited.

Among large markets, Chicago led the way at 3.6%, followed by Northern New Jersey, Cincinnati, Milwaukee, Cleveland, Boston, Indianapolis and St. Louis.

Wages Continue to Outpace Rents

November should almost certainly mark the 12th consecutive month where wage increases outpace rent increases – a trend that’ll likely persist through next year. That could erase all of the rent-over-wage bump of 2021 and early 2022, and in turn help further widen the demand funnel.

As mid- and upper-income renters continue to move up from older units to newer (and typically pricier) units, the affordability gains should help backfill older, moderately priced units.