Purpose-Built Student Housing Rent Growth Outperforms Conventional Sector

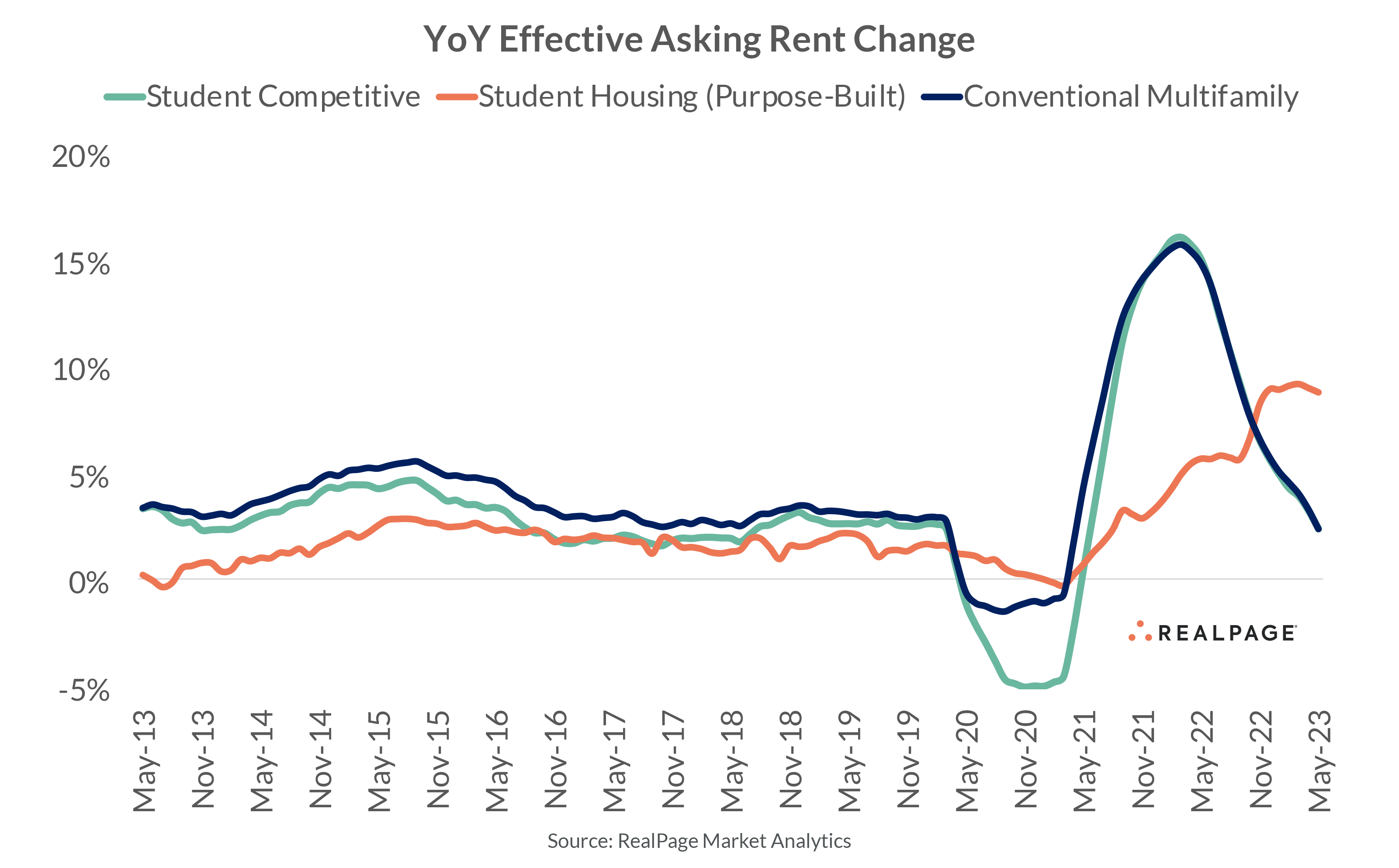

While student housing rent growth has consistently underperformed that of conventional multifamily housing over the past decade, there has been a noteworthy shift in recent months. Purpose-built student housing began to grow prices at a faster pace than the conventional sector, marking the first time in which purpose-built has outperformed conventional multifamily in a non-contractionary period.

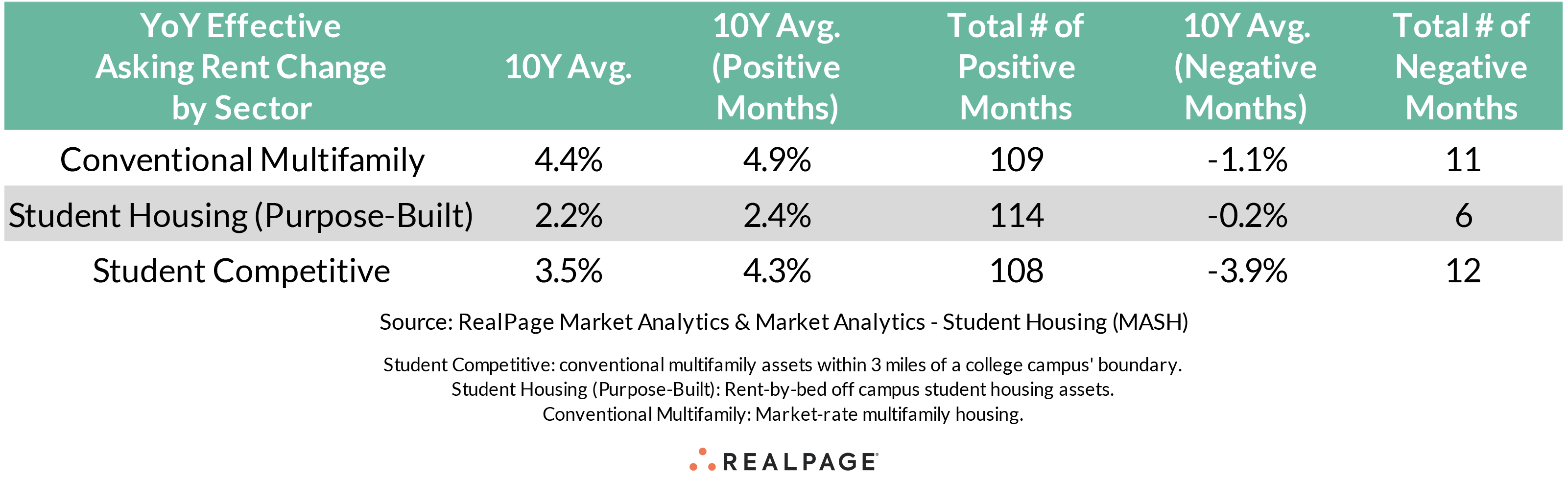

Student housing has long been touted as a stable sector. Historic data supports that idea as well. Over the past 120 observed months, annual rent change has only dipped negative for a total of six months versus a total of 12 months for conventional multifamily housing, according to data from RealPage Market Analytics. Still, fundamental economics suggests that stability comes with a price. And in the student housing space, that price has – historically speaking – been limited upside growth as well.

A comparison of 10-year average effective asking rent change for conventional multifamily housing shows the market-rate sector tends to outperform student housing by a considerable margin. That’s primarily due to growth years in which conventional multifamily housing averaged year-over-year rent growth of about 5%. Student housing meanwhile averages roughly half of the conventional space. Lastly, student competitive housing – defined as conventional market-rate housing located within three miles of a campus boundary – skews toward conventional growth rates but underperforms its larger counterpart.

But in years of contraction, purpose-built student housing holds up quite well against recessionary pressures. Months in which annualized rent change has dipped negative in the space have averaged just 0.2% contraction or effectively holding flat. Conventional meanwhile has averaged cuts of 1.1% in months where annualized rent change dipped negative (all of those months occurring in an 11-month stretch from May 2020 to March 2021.) Of note, student competitive housing took the brunt of the 2020 downturn, with a slightly longer yet much deeper period of negative rent growth, averaging nearly 4% cuts during that period.

Moving forward, it’s reasonable to expect student housing rent growth to taper off. Indeed, even the May 2023 stats show some easing from earlier peak levels. Still, the confluence of robust student demand and easing supply for student housing at large suggests that strong momentum should color much of the Fall 2024 outlook as well.

Equally important is the degree to which student housing rent growth has outperformed conventional housing in recent months. Purpose-built student housing annual rent growth has outpaced that of conventional housing for seven straight months (beginning with November 2022). And during that period, the sector has averaged annual rent change of 8.8% (versus 4.5% for conventional housing). Student competitive meanwhile has appeared to follow a strikingly similar trajectory as the conventional space.

The most peculiar asset type in this comparison is potentially the student competitive subset. Reflecting back to 2020 and early 2021, that asset appears to have been impacted by a sort of double-whammy. The introduction of remote learning caused purpose-built occupancy to plummet, resulting in little student-driven demand for the student competitive asset type. But as students were learning in a remote setting, the need for on-campus support roles was negated. In turn, that appears to have affected the non-student demand base on nearby campuses. Here more recently, student competitive appears to be marching in lockstep with the broader conventional universe – a trend that closely matches the normal expectation of the past decade.

As is typically the case with student housing, the national figure tends to wash out hyperlocal differences in performance. Though the U.S. average effective asking rent change for May 2023 came in at 8.8%, campuses achieving double digit percent rent change can be found across the country (of note, just four campuses have seen year-over-year rent cuts).

Stay tuned for campus-level performances next week.