Student Housing Rent Growth in Double Digits at Key Schools

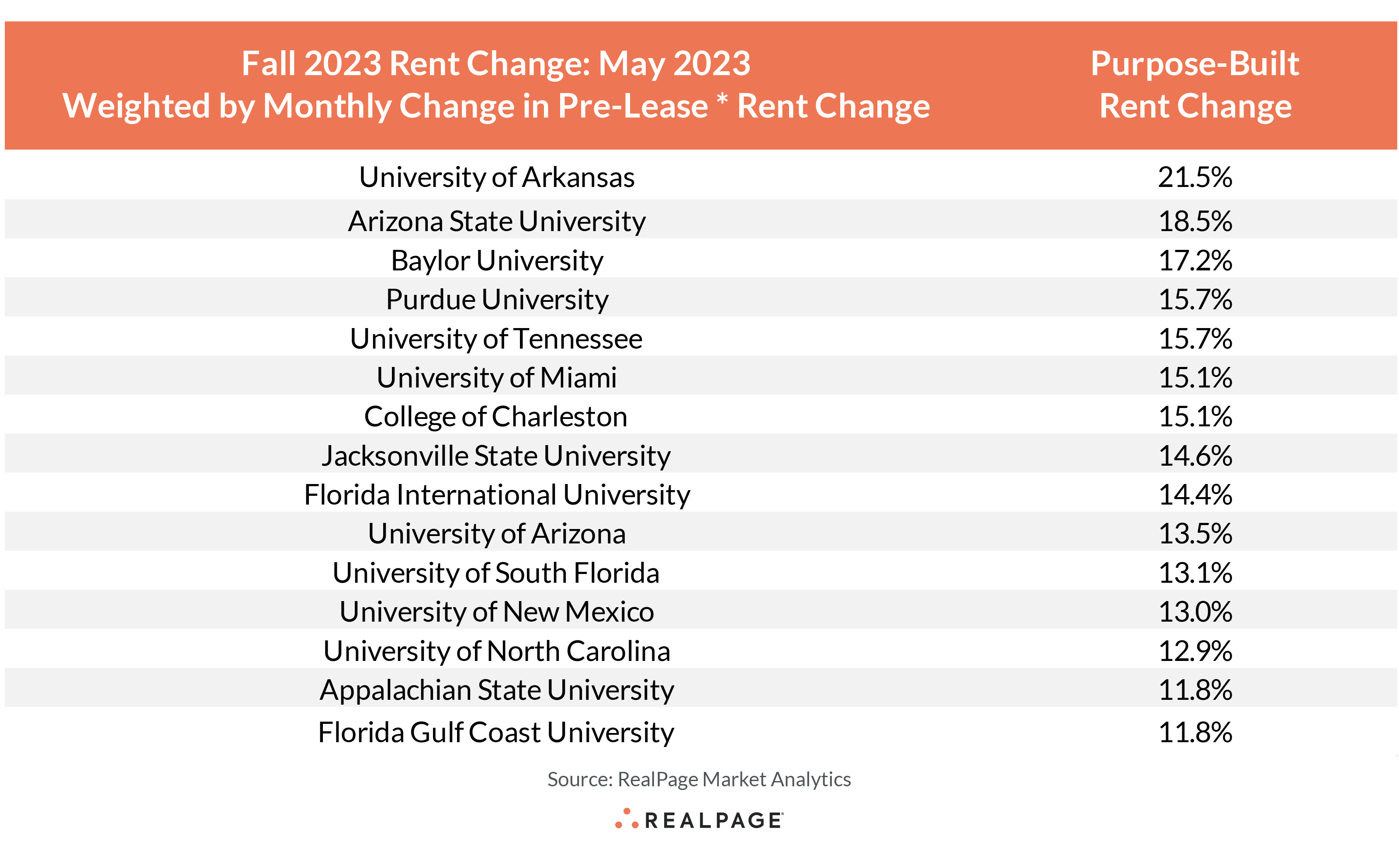

Though the U.S. average effective asking rent change for May 2023 came in at 8.8%, campuses achieving double digit percent rent change can be found across the country (of note, just four campuses have seen year-over-year rent cuts).

In addition to the top 15 campuses for Fall 2023 year-over-year rent change, an additional 16 schools are achieving growth rates of greater than 10%. And comparing the suite of RealPage175 campuses to the 10-year average annual rent change (2.2%), some 82% of the nation’s campuses are achieving Fall 2023 greater than that 10-year average.

The recent strength of the student sector has been quite impressive considering the degree to which conventional market rent growth has eased. Though annual rent change for conventional multifamily housing (2.3% as of May 2023) isn’t necessarily out of line with historic norms, it was just 12 months prior that growth rates were nearly 15%. Conversely, student housing has seen acceleration from May 2022 (5.6%) to May 2023 (8.8%).

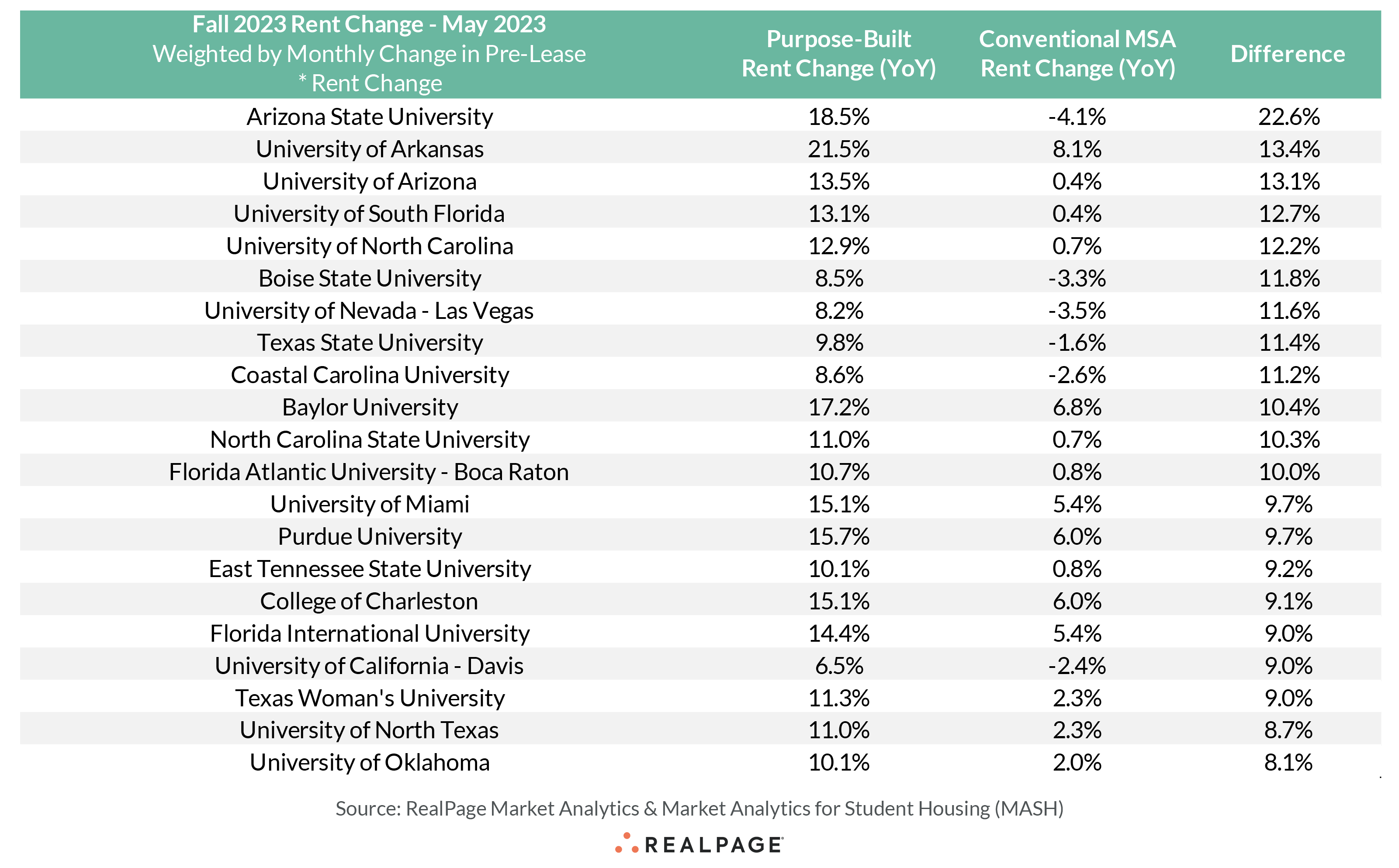

Comparing local growth rates between purpose-built student housing and conventional growth within the university home markets shows a similarly stark difference.

Across 150 qualifying campuses where their home metro had enough conventional data to report, two-thirds had purpose-built growth rates greater than that of their home metro. And only 25 campuses saw conventional growth rates trailing their home metro area’s conventional housing stock by more than 200 basis points.

In the tranche with the largest degree of outperformance (areas in which local purpose-built stock is achieving at least an 8% rent growth premium versus conventional housing in its home metro area) includes an interesting mix of campuses.

In this group of schools, we see a handful of campuses performing very well despite significant challenges within their conventional markets. Key examples include Phoenix (Arizona State, where the campus is outperforming the metro by a staggering 22.6%), Las Vegas (UNLV), and Boise (Boise State). All three of those instances see their conventional markets cutting rents by at least 3% year-over-year. Sacramento’s UC-Davis and Austin’s Texas State University are also campuses seeing strong campus growth despite negative rent change at a market level.

Markets in which rents could dip into negative territory in the coming six months include Tucson (positive year-over-year change, but monthly growth came in at 0.0% during May 2023), Tampa (less than 0.1% month-over-month growth in May 2023), and West Palm Beach (which actually saw monthly rents decline nearly 0.5% in May 2023).

But there are instances of campuses that are outpacing strong metro-level numbers still with arguably the best example being the University of Arkansas (21.5% annual rent change) in Fayetteville (8.1% growth, #6 among Top 150 US metros).

In the group with the second largest gap between conventional and student housing rent growth is a group of potentially unlikely candidates (whereas the first grouping is generally on the radars of investors and developers).

Places like Kennesaw State University and Georgia Tech in Atlanta alongside Brigham Young in Provo (both conventional markets seeing rent cuts equal to 0.3% year-over-year) are campuses that have been coveted by national student housing groups. Conversely, places like Eastern Washington, Kent State and some of the California universities have been less intense areas of focus for non-regional groups.

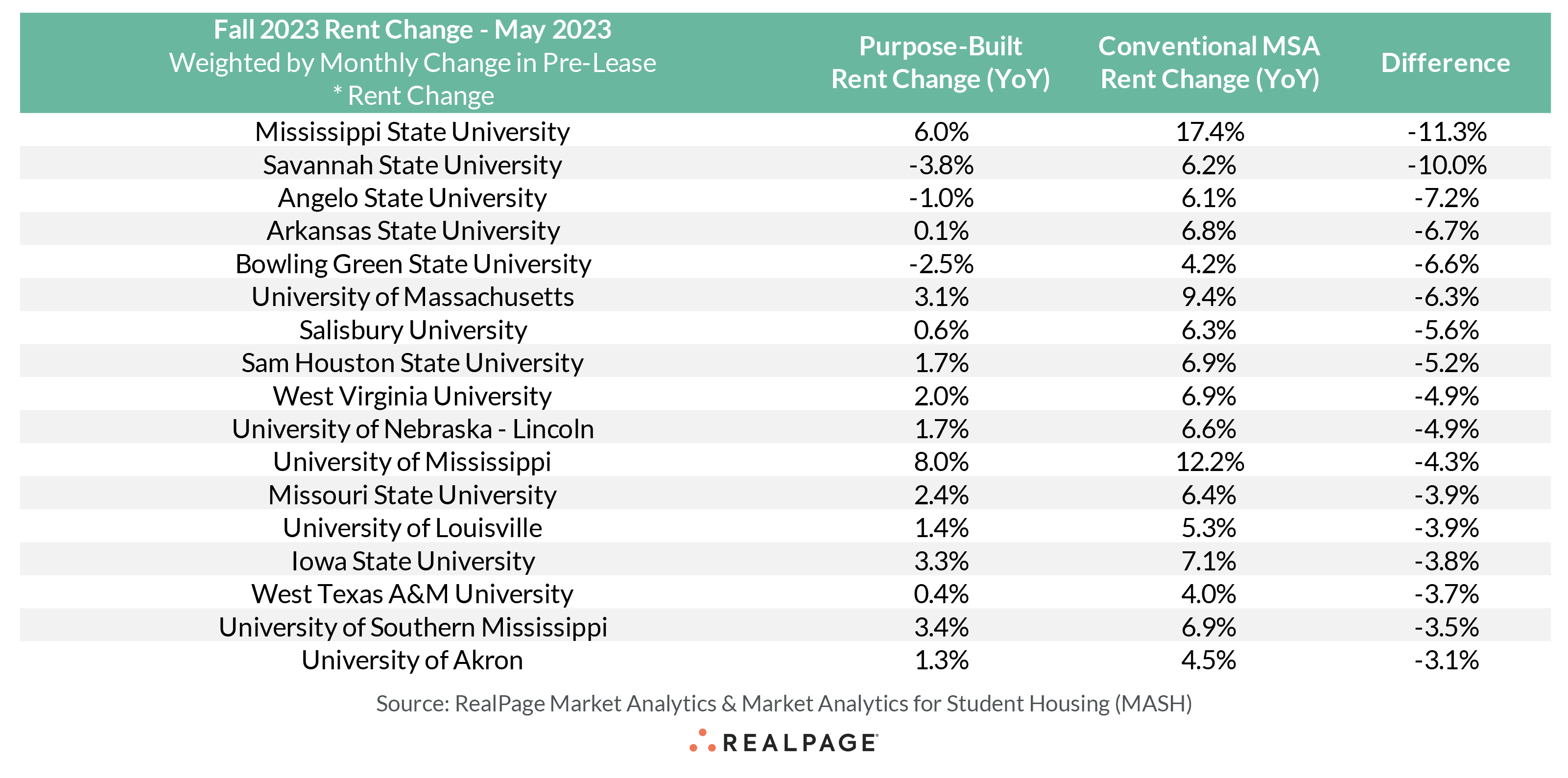

Is there a common link among schools where local conventional rent growth is outpacing student housing?

Generally speaking, yes. And there’s a simple explanation. Most campuses seeing rent growth that trails their conventional market is due to weak student housing performance. Only the University of Mississippi (8% annual rent change among student housing properties) in Oxford, MS (12.2% MSA-level rent growth) and Mississippi State University in Starkville (6% growth for the former and 17.4% growth in the latter) are seeing strong student rent change outpaced by the conventional market. Southern Mississippi in Hattiesburg; Iowa State in Ames and UMass in Amherst (the Springfield, MA MSA) are seeing decent growth by historic standards though below their market-level readings.

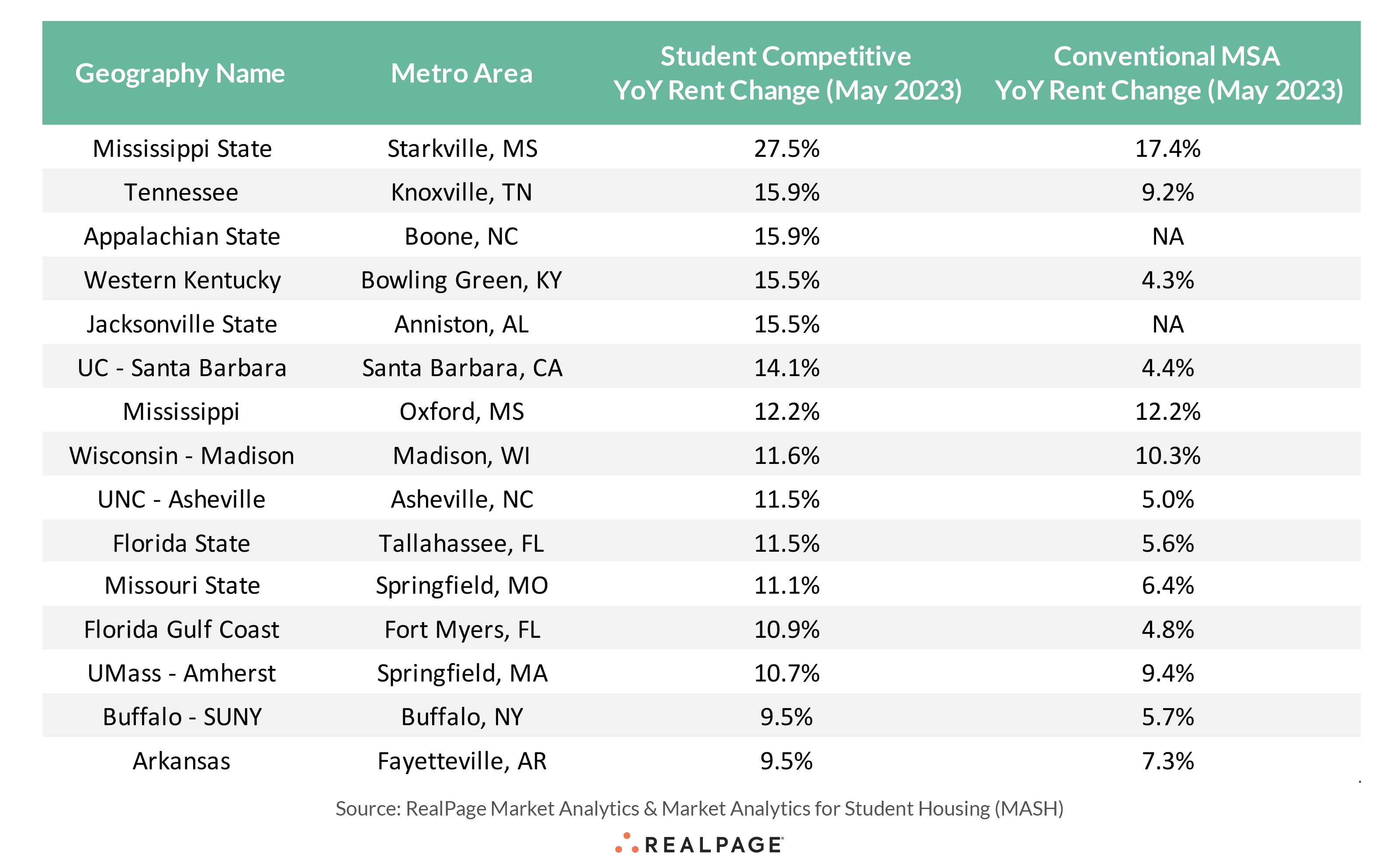

The final comparison here shows year-over-year effective asking rent change among student competitive assets. RealPage defines student competitive as a conventional multifamily housing asset within three miles of a campus boundary. The data differs, however, in that it is reflected on a per-bed basis to more closely align to the student housing standard.

There is no clear defining thing across these markets and their student competitive assets. In some instances such as the University of Tennessee and the University of Arkansas, the local student competitive product set could be benefiting from remarkably tight (if any) purpose-built student housing availability. Conversely, places like Appalachian State in Boone, NC and Jacksonville State in Anniston, AL could be seeing their student competitive assets boasting robust rent growth as their existing conventional housing stock is so limited that no substantial sample can be derived aside from the campus-adjacent set of conventional assets.

Moving froward through 2023 and into 2024, the expectation is that college town markets should perform well due to strong student demand and the stability often provided by universities during years with weaker economic growth.