While apartment demand across the South region has been stout, hefty delivery volumes have continued to weigh down occupancy across the region.

Occupancy in the South tightened 170 basis points (bps) to 94.8% in the year-ending May. Still, that rate fell 80 bps below the U.S. norm (95.7%) and ranked the South as the only region with occupancy trailing the U.S.

Occupancy in the Northeast led the nation at 97.1%, roughly 220 bps above the South region average. The Midwest and West regions followed at 96.5% and 95.8%, respectively.

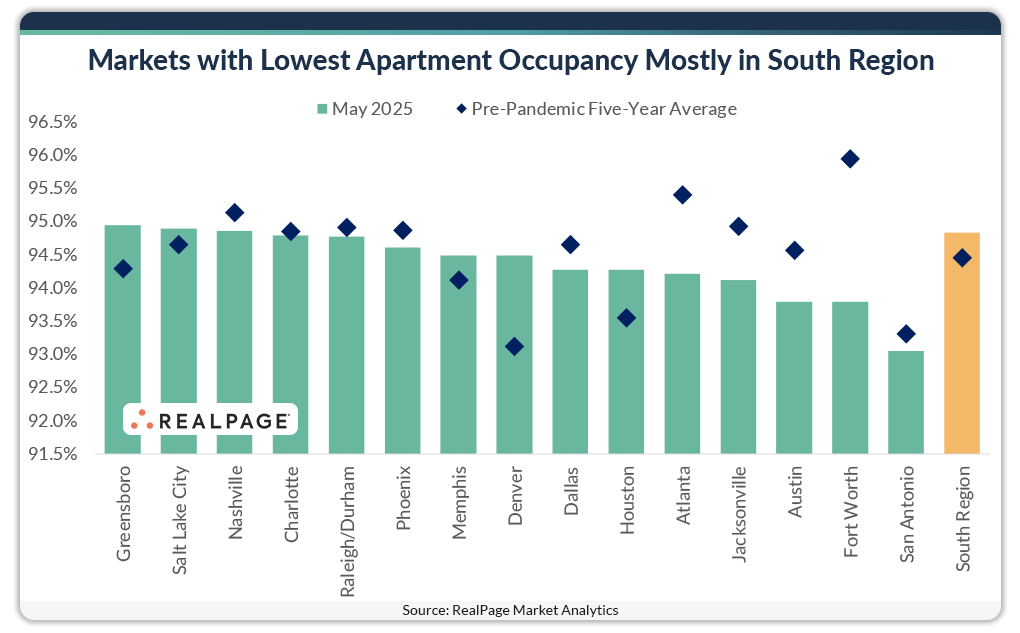

Although the South region occupancy rate in May ticked above the region’s pre-pandemic five-year average (94.5%), about 80% of South region markets lagged the national norm contributing to the region’s underperformance, according to data from RealPage Market Analytics.

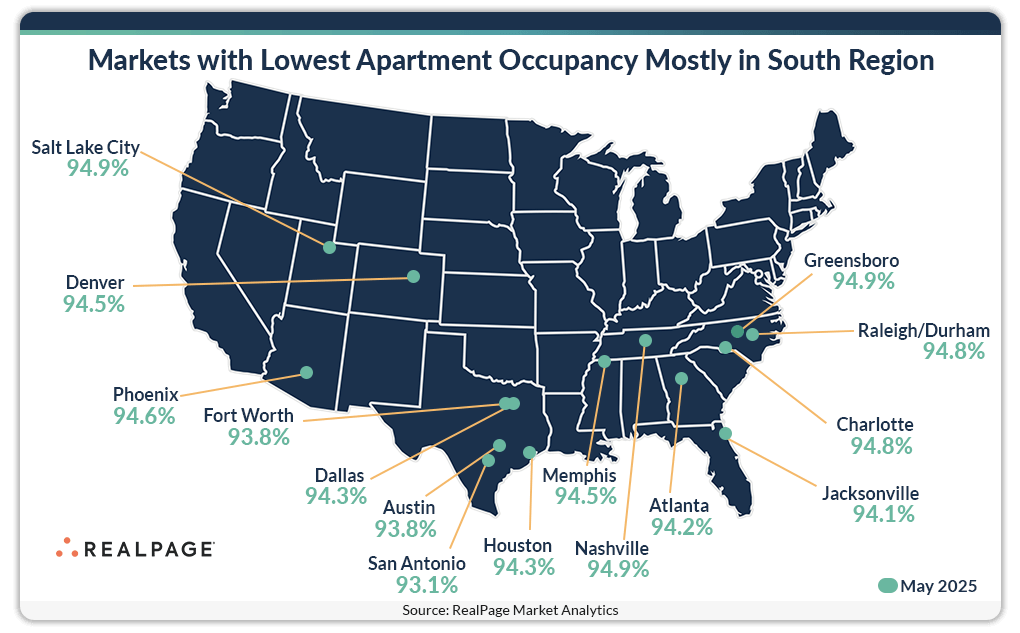

For perspective, 12 of the 15 markets with the lowest occupancy in May were in the South.

At the bottom of the list, San Antonio trailed the nation with occupancy at 93.1%. That rate straggled slightly below San Antonio’s pre-pandemic norm (93.3%). The existing unit count in San Antonio has climbed more than 35% since 2020, weighing down occupancy despite strong demand.

In a similar position, occupancy in Austin and Fort Worth slumped below 94%, both to 93.8%. That rate was more than 200 bps below the pre-pandemic five-year average for Fort Worth and an 80-bps difference for Austin.

Rounding out the bottom five performers were Jacksonville (94.1%) and Atlanta (94.2%). Occupancy in Jacksonville remains 80 bps below its pre-pandemic norm and Atlanta 120 bps.

Three other major markets registered occupancy at 94.9% or below in May: Salt Lake City (94.9%), Phoenix (94.6%) and Denver (94.5%).