Small Apartment Markets Where Supply is Holding Back Occupancy

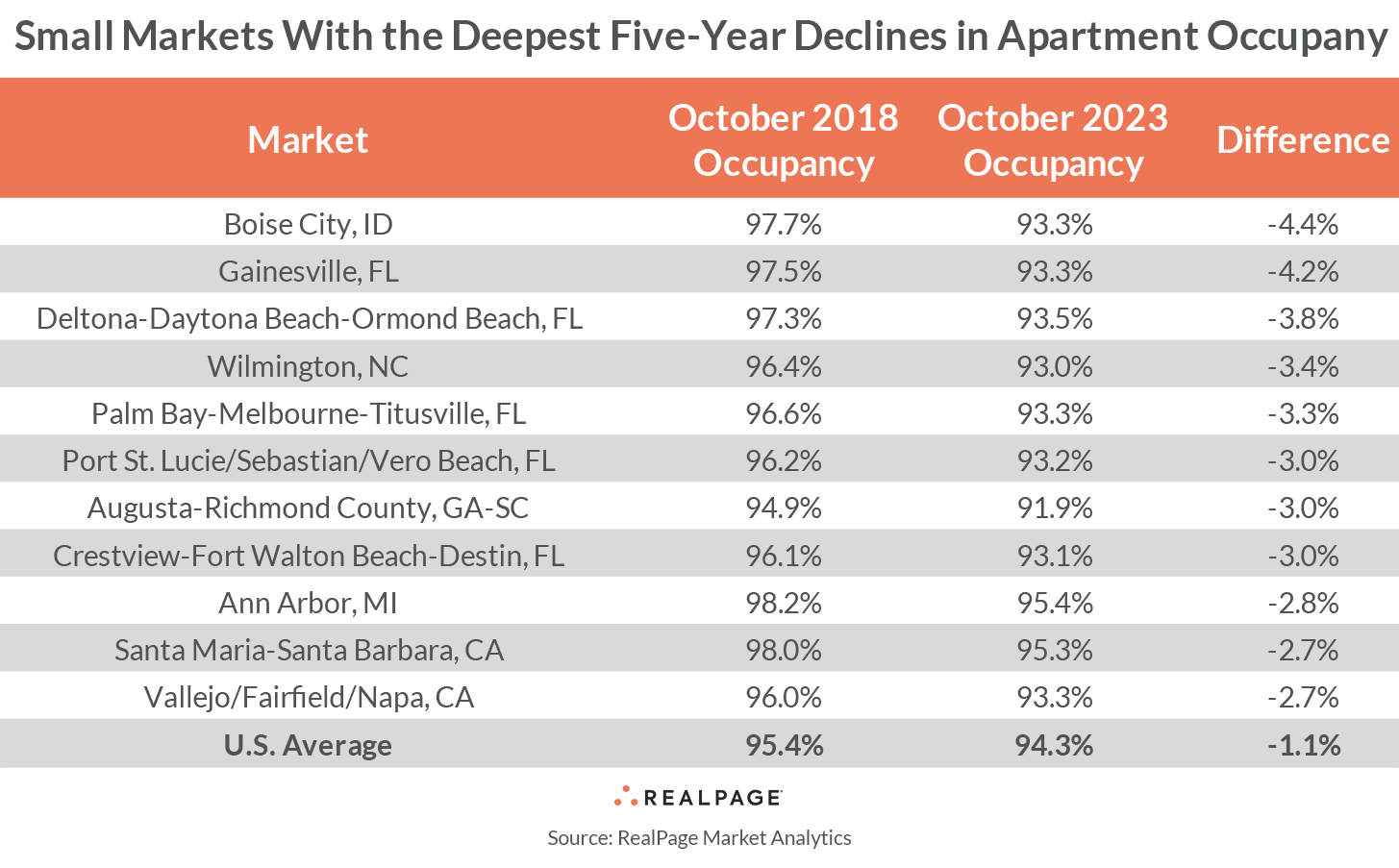

While the U.S. overall has seen moderate occupancy decline in the past five years, some small apartment markets are logging significantly worse performances.

Since 2018, occupancy nationwide has come down by 110 basis points (bps), falling to 94.3% as of October 2023. But the pace of decline is twice as deep across some small apartment markets. For the most part, these are markets that benefited from an influx of residents leaving larger, more expensive cities in the early days of the pandemic. As such, most enjoyed a solid recovery from the 2020 economic slump. When occupancy and rent growth surged, developers kicked up building efforts to a degree that these small markets – some with less than 24,000 existing units – had yet to witness. When the dust settled, these locales were left with historically high construction volumes and demand levels that fell below pre-COVID norms, causing occupancy to slip.

Boise City lost the most occupancy ground among the nation’s 150 largest apartment markets in the past five years, with a decline of 440 bps. As a result, occupancy is down to 93.3% as of October, which is one of the lowest showings this market has ever recorded. Boise City was a pandemic darling that saw jobs surge in the 2021-2022 timeframe, after the local economy became one of the fastest nationwide to recover from the COVID decline of 2020. Employment is up 18.4% since 2018, clocking in as one of the best five-year paces nationwide (only Austin beat that). But inventory growth in Boise was also one of the strongest in the U.S., swelling by 30.4% in the past five years, according to 3rd quarter data from RealPage Market Analytics. That was also a #2 performance in the U.S., beat out only by Huntsville, AL. As a result of such big construction activity, Boise City saw apartment fundamentals soften.

Small Florida markets make up nearly half this list of metros with significant occupancy declines. Inland markets Gainesville and Deltona suffered setbacks around the 400-bps mark in the past five years. Two small markets along the Atlantic coast – Palm Bay and Port St. Lucie – saw occupancy come down by about 300 bps. And Crestview, located in the panhandle, also logged a 300-bps decline. In both Gainesville and Crestview, this five-year decline was driven by significant setbacks of more than 200 bps just in the past year. Both of those markets have seen sizable inventory growth, with an increase of roughly 8% to 9% in the past five years. While Crestview’s job base grew by more than most markets nationwide during the past five years (14.7%), significant inventory growth is putting downward pressure on occupancy.

One other small Florida market – Cape Coral – saw occupancy fade by 260 bps in the past five years, just missing a spot on this list. Cape Coral is another small Florida market with nation leading job growth (14.6%) and inventory growth (25.5%) since 2018.

Two small Carolinas markets logged notably declining occupancy in the past five years: Wilmington and Augusta. Augusta is the least occupied small market on this list. Occupancy fell 300 bps in the past five years to land at just 91.9% in October. Both Wilmington and August saw sizable volumes of supply delivered in the past five years, with inventories increasing by 25.8% in Wilmington and by 13.8% in Augusta. Wilmington has also seen sizable growth in its employment base. New jobs were up 11.4% in the past five years, more than double the national average.

Ann Arbor is the only Midwest market to see occupancy dive so significantly in the past five years, with a setback of 280 bps. Out of these deep decline markets, Ann Arbor started out in October 2018 with the most solid rate of 98.2%. While job growth and supply growth have been moderate here compared to some other metros on this list, Ann Arbor is a college town with few student-based housing options, and the conventional stock serves a large portion of the student population.

And finally, two small California markets are logging occupancy well behind 2018 rates. Occupancy in both Vallejo and Santa Maria came down 270 bps in the past five years. In Santa Maria, the current occupancy rate is better than some other readings on this list, despite the decline, with an October rate of 95.3%. As a result, rents in Santa Maria have increased significantly recently. In fact, both Santa Maria and Cape Coral ranked alongside some the nation’s largest apartment markets as national leaders for rent growth in the past five years.

Only two of the nation’s largest 50 apartment markets saw occupancy decline to the degree of these small markets in the past five years. Jacksonville suffered a setback of 330 bps, while the Phoenix decline was 280 bps.