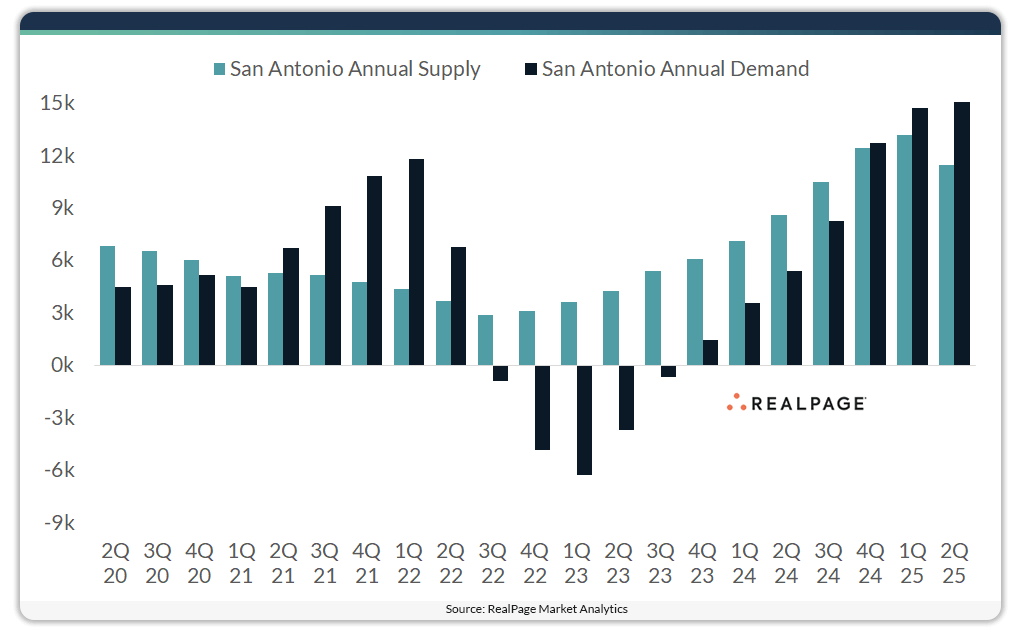

San Antonio has a solid economy anchored by government, military and health care sectors. This market also has strong demographic tailwinds such as a younger population, continued in-migration and growth in the renter age cohort. Record absorption of 15,083 apartment units during the year-ending 2nd quarter in San Antonio outpaced completions of 11,464 units, also near record highs. Those completions grew inventory 5% and were led by apartment additions in the New Braunfels/Schertz/Universal City submarket of 3,073 units. The pace of new development is slowing, as San Antonio is set to receive just 3,642 new units over the next 12 months, which is one-third the current delivery volume and about half the market’s five-year annual average. Higher renewal conversion rates (50.8%) and longer terms on both new (12.5 months) and renewal (12 months) leases helped stabilize occupancy amid elevated supply. Occupancy hit 93.2% in 2nd quarter, and rents were cut by 3.5% year-over-year, driven by deep cuts in Class C product (-6.8%). In fact, this market hasn’t seen rent growth since mid-2023 and cuts are likely to persist in the near term, with growth expected to resume again in early 2027. Median single-family home prices ($317k) in San Antonio are lower than neighboring Austin ($489k) and pose a potential shadow market for higher wage households in the region.