The annual benchmark revisions from the Bureau of Labor Statistics (BLS) boosted December 2022 overall employment levels in two-thirds of the top 150 markets RealPage tracks by an average of 10,000 workers. However, the annual employment gain in January 2023 was lower in 75% of those markets from their gains in January 2022.

Despite the continuing slowdown from post-pandemic rebounding employment, annual job gains in the top markets in the country continue to be relatively strong. Nationally, employment gains in January and February have exceeded most economists’ expectations but moderation throughout 2023 is still expected.

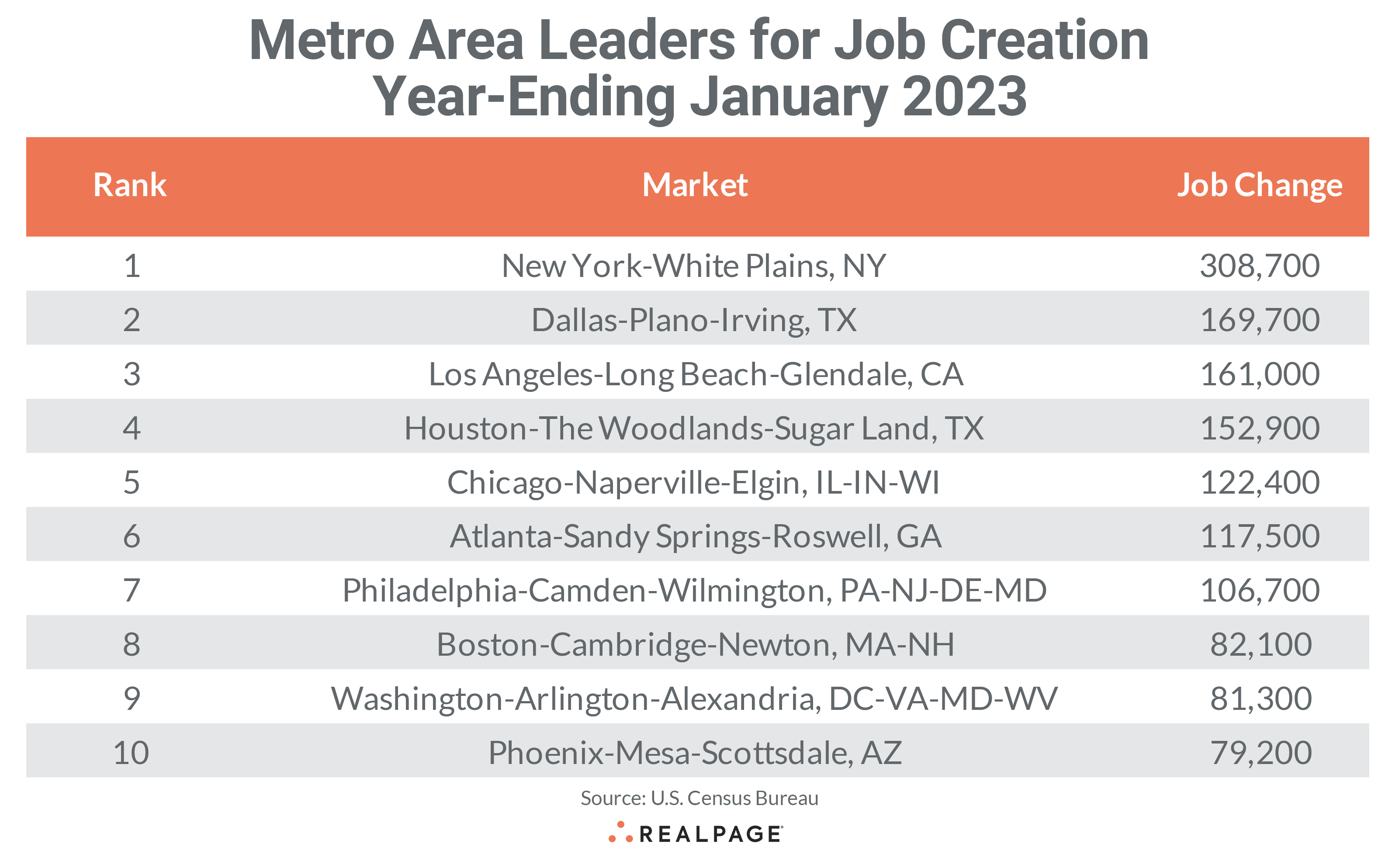

The total number of jobs gained in the top 10 markets for the year-ending January, was about 660,000 jobs less than the total for the same 10 markets in January of last year, according to the latest release from the BLS. However, the total for the top 10 markets is about 16% above last month’s revised total and all the top 10 were higher than last month.

Eight of last month’s top 10 markets returned to this month’s list and a few markets changed rankings.

New York continues to lead the nation in annual gains, but the 308,700 jobs added for the year-ending January is about 144,000 jobs fewer than last January. Dallas returned at the #2 spot with an annual gain of 169,700 jobs, roughly 10,600 jobs fewer than last year.

Los Angeles and Houston changed places from last month at #3 and #4 but while Houston’s gain of 152,900 jobs was little changed from January 2022’s total, Los Angeles’ gain of 161,000 jobs was about 203,000 fewer than the year before. Chicago and Atlanta remained in the #5 and #6 spots with gains of about 120,000 jobs, but Chicago gained almost 100,000 fewer jobs than last year, while Atlanta’s annual gain fell by 32,800 jobs.

Philadelphia (106,799 jobs) and Boston (82,100 jobs) also switched places on the top 10 list at #s 7 and 8, and both had about 46,000 fewer new jobs than in January 2022. Washington, DC and Phoenix replaced Seattle and Riverside on the top 10 list with annual jobs gains close to 80,000 each. DC added about 31,000 fewer jobs than last year while Phoenix slipped by about 39,000 jobs.

As mentioned, post-revision annual employment gains in January were stronger in all the top 10 markets when compared to December’s annual gains, with the average increase at about 20,000 jobs. However, these month-over-month comparisons of not seasonally adjusted labor data from the BLS can sometimes be misleading. In January, 113 of our top 150 markets had higher annual job gains than in the previous month compared to 46 in December and 37 in November.

Despite these ongoing job gains, the positive momentum that has helped many markets recover the jobs lost early in the pandemic recession appears to have reversed. In January, 95 of our top 150 markets had returned to or bettered their February 2020 employment level, 30 less than last month. Additionally, of the top 10 job gain markets, five remain or returned below their pre-pandemic employment levels.

However, nine of the next 10 top 150 markets ranked by January job gains have regained their pre-pandemic employment levels. Minneapolis-St. Paul had the strongest downward revision after BLS benchmarks with a decrease in December employment of about 64,000 jobs.

Seven markets had annual job gains of 100,000 or more, equal to December as job gains are slowing. Another 14 markets gained between 50,000 and 99,999 jobs, three less than last month. No markets reported an annual job loss from last January.

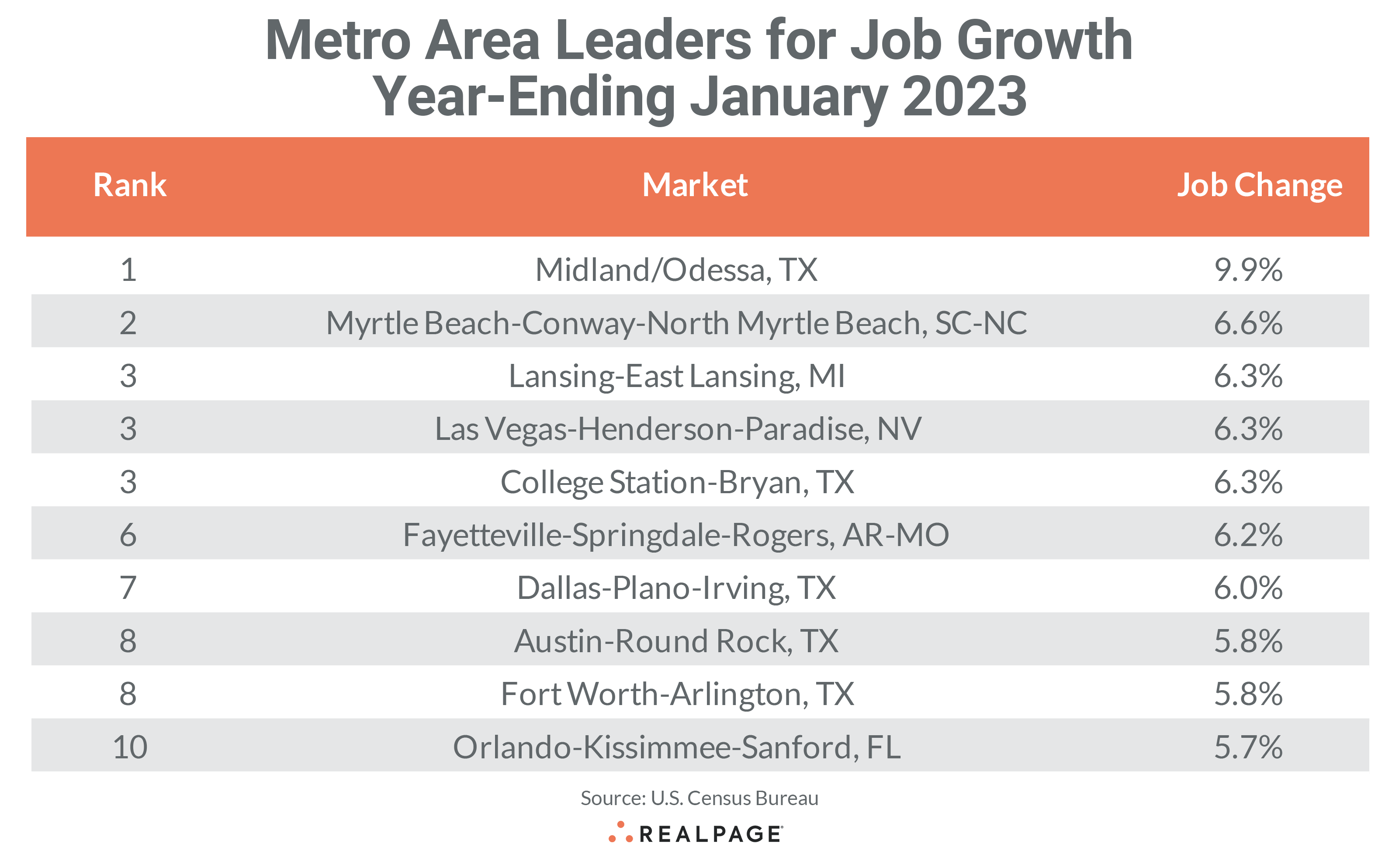

Like annual job gains, the annual percentage change in employment was strongly affected by the benchmark revisions to last year’s employment data. Only one of last month’s top 10 made the list in January as many smaller markets benefited from revisions and even small employment gains can make a larger percentage difference in these markets.

Dallas was the only market to return to the top percentage change list in January, but it fell to #7, even with a 6% gain. The energy-dependent Midland/Odessa market led for percent change in January with a 9.9% gain in employment. Myrtle Beach was #2 with a 6.6% gain for the year.

Lansing, MI, Las Vegas, and College Station, TX tied for #3 at 6.3% change, while another college town – Fayetteville, AR – ranked #6 with 6.2% employment change. After Dallas, Austin and Fort Worth tied for #8 with annual change of 5.8%, and Orlando rounded out the top 10 with 5.7% change.

Of the top 10 growth markets, Texas was well represented with five of the 10 positions. The rest were either tourist destinations (Myrtle Beach, Las Vegas, Orlando) or college towns (College Station, Fayetteville, AR). This was the pattern we saw early in the post-pandemic economic recovery.

Florida dominated the next 12 markets ranked by change in employment with six markets, and most of the non-Florida markets of that 12 were in the South (Nashville, Charleston, Wilmington, NC and Houston).

The weakest major markets for percentage growth are primarily in the industrial Midwest and mountainous West. Major markets with sub-2% growth include Milwaukee, Omaha, Akron, Baltimore, Lincoln, Eugene, Cleveland, Denver, Detroit, Provo and Colorado Springs. Seventy-five markets had annual job growth rates above the not seasonally adjusted national average of 3.3%, five more than in December.