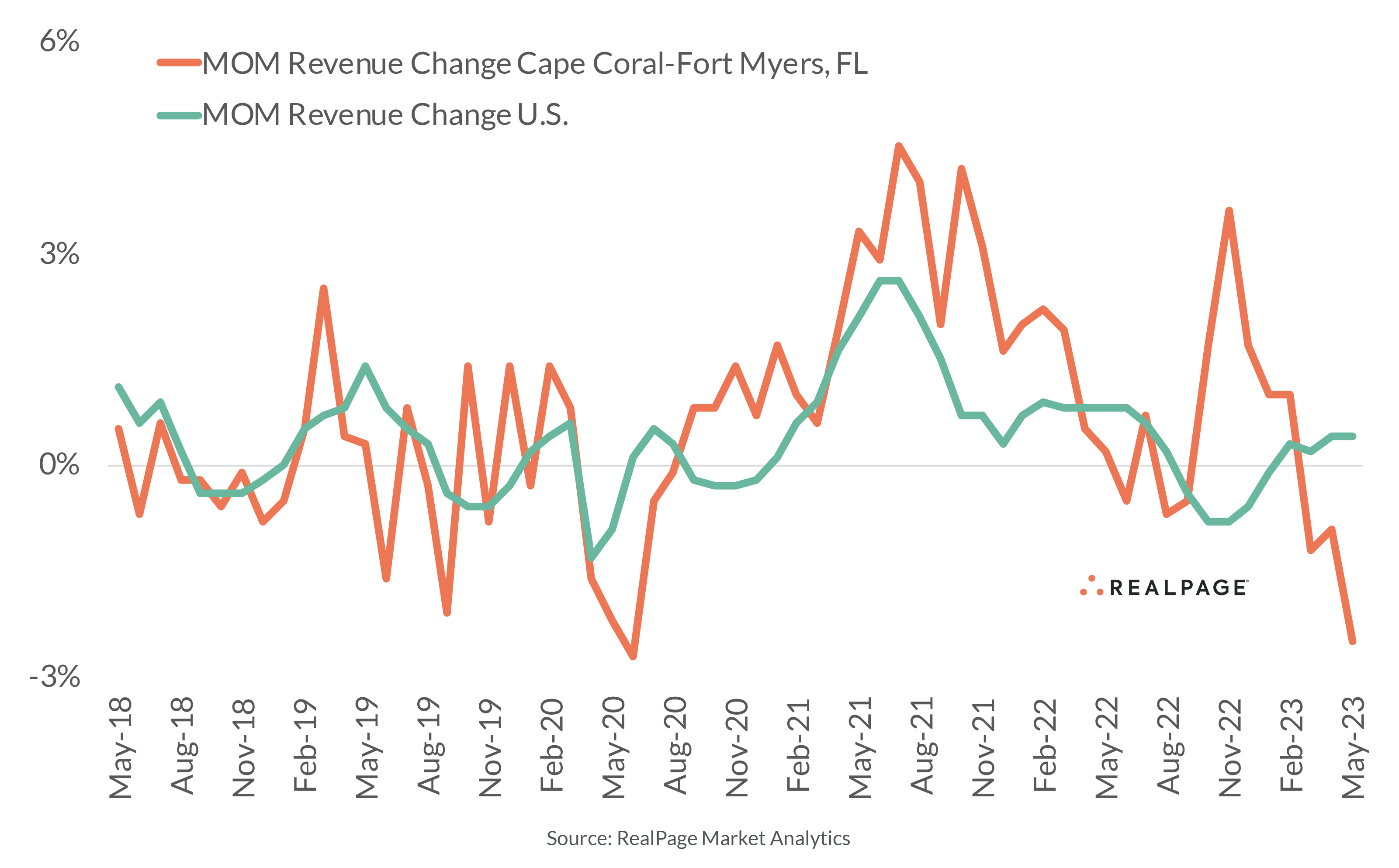

Cape Coral-Fort Myers Suffers Nation’s Worst Revenue Decline in May

After logging some of the strongest fundamentals nationwide just a couple years ago, the small apartment market of Cape Coral-Fort Myers is now seeing revenues decline. While revenues are still up year-over-year, monthly declines have become a regular pattern since March in this Gulf Coast market with a little over 50,000 units in existing stock. In the month of May, revenues came down by 2.5%, the worst decline among the largest 150 apartment markets nationwide, according to data from RealPage Market Analytics. The recent decline hasn’t been able to completely wipe out previous progress, however, as revenues in Cape Coral/Fort Myers are still up 1.9% on an annual basis, a pace that remains well ahead of the U.S. norm of 0.2%. Driving the most recent decline, effective asking rents were down 1.6% during the month of May, though prices remain at historic highs above $2,000. On the occupancy side of revenues, rates were down 90 basis points in May, taking occupancy to 93.5%. Nearby markets are also seeing decline in monthly revenues. Naples-Immokalee-Marco Island saw the nation’s second worst decrease at 1.9%, while North Port-Sarasota-Bradenton lost 1.1% for the month.